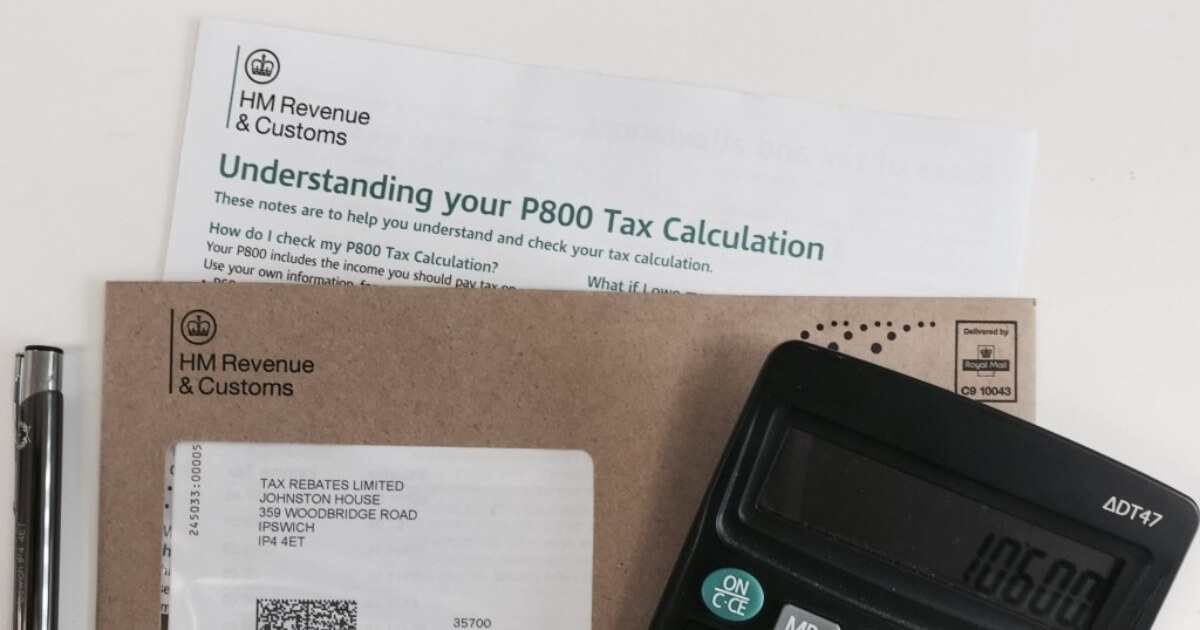

P800 Mail In Rebate A P800 is a letter issued by HMRC to quote the amount of refund based on a unique tax code which allows you to claim money back from HMRC It indicates

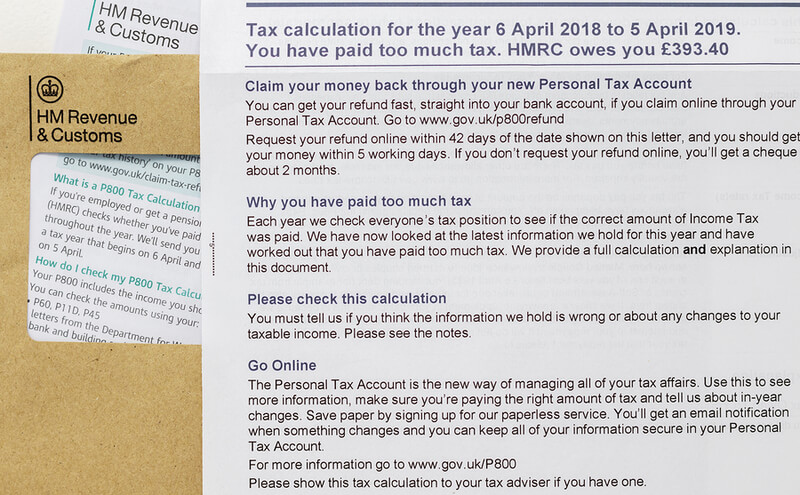

Guidance Check if a letter you ve received from HMRC is genuine English Cymraeg Check a list of recent letters from HMRC to help you decide if a letter you ve If you are due a repayment your P800 should tell you whether you can claim your refund online using a Gateway Account or whether HMRC will send you a cheque in the post Those that claim

P800 Mail In Rebate

P800 Mail In Rebate

https://www.taxbanana.com/wp-content/uploads/2019/10/are-tax-rebates-automatic.jpg

P800 Refund Are You Due A Tax Refund Tax Forms

https://www.riftrefunds.co.uk/media/2853/p800-tax-refund-calculation.jpg

Osita Mba On Twitter 16 It Was Only After HMRC Sent The Claimants

https://pbs.twimg.com/media/FUor-IJWAAIaY-m?format=jpg&name=900x900

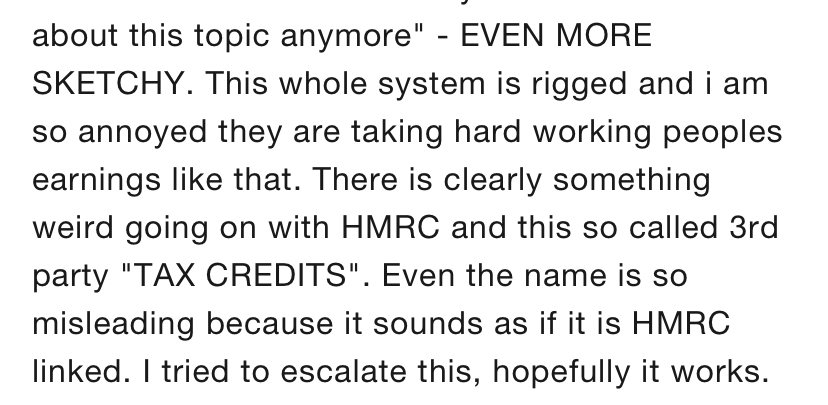

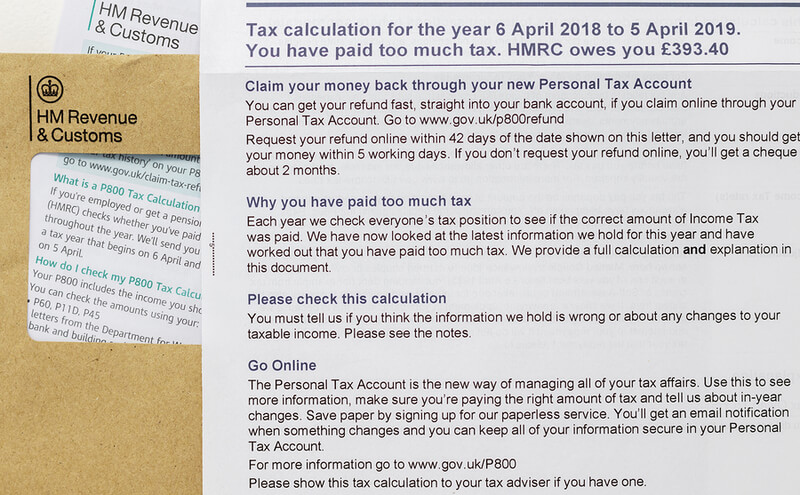

How does the P800 tax refund process work If you ve overpaid tax HMRC sends you a P800 tax form with instructions on how to claim your refund If you ve underpaid the A P800 letter is sent to individuals who are owed a tax rebate or need to make a tax payment of up to 3 000 The letter includes a P800 tax calculation so HMRC can explain how they have

A P800 is a type of tax calculation performed by HMRC to ensure we re all paying the right amount of tax If they calculate that you ve under or overpaid you ll To claim an online tax rebate you ll need to Go to the HMRC website Sign in to your Personal Tax Account using your Government Gateway User ID Follow the

Download P800 Mail In Rebate

More picture related to P800 Mail In Rebate

P800 Tax Overpayments Underpayments QuickRebates

https://www.quickrebates.co.uk/fileadmin/_processed_/c/8/csm_hmrc-deadline_aeded8c3ff.jpg

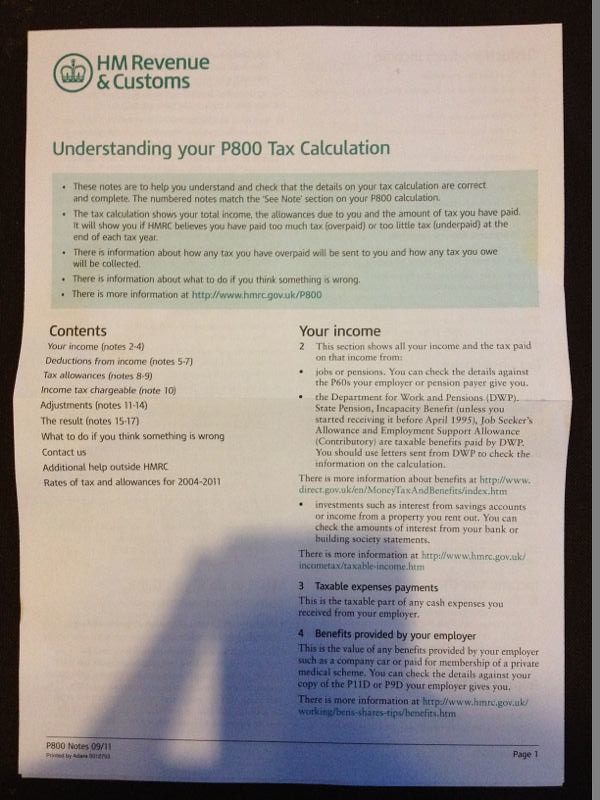

Understanding Your P800 Tax Calculation TaxRebates co uk

https://www.taxrebates.co.uk/wp-content/uploads/P800-tax-calculation-result.png?x98471

P800 Tax Letter Info Sheet Carol Bassi Nee McLaughlin Flickr

https://c2.staticflickr.com/6/5561/14447850389_16d7940fd4_b.jpg

Started getting a pension at work left a job started a new one and were paid by both employers in the same month receive certain benefits like Jobseeker s Allowance The email or text call will promise a tax rebate and often ask for personal information such as your name address date of birth bank and credit card details

How DoNotPay Can Quickly Get You Any Epson Printer Rebate Filing mail in rebates can be inconvenient for many consumers especially if they miss any steps in the process At the end of each tax year HMRC send customers an End of Year Tax Calculation P800 if they have under or overpaid their taxes This personalised letter indicates whether the

Understanding Your P800 Tax Calculation Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/p800-tax-calculation.jpeg

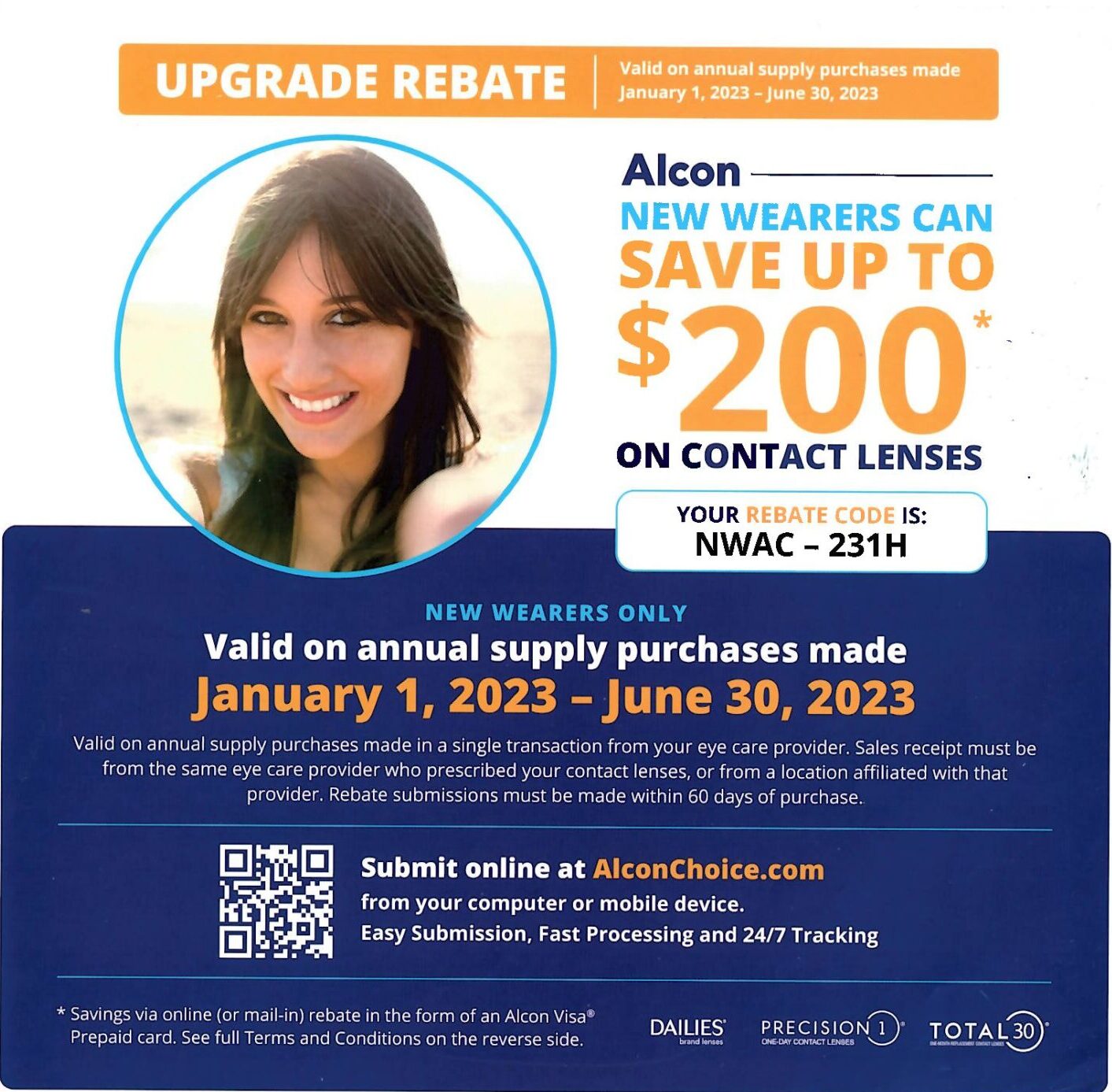

Mail In Rebate Forms For 1800 Contacts

https://content.demandreport.com/1c3d9547-effb-4947-aede-892e9525b980/b4f43d39-b763-4d76-b90f-0f83159b5b07/2019/08/22/lcaiTSh1Md.Screen Shot 2019-08-21 at 10.05.51 PM.png

https://www.debitam.com/what-is-a-p800-refund

A P800 is a letter issued by HMRC to quote the amount of refund based on a unique tax code which allows you to claim money back from HMRC It indicates

https://www.gov.uk/guidance/check-if-a-letter...

Guidance Check if a letter you ve received from HMRC is genuine English Cymraeg Check a list of recent letters from HMRC to help you decide if a letter you ve

20 00 Budweiser Mail in Rebate 5 49 For A Case Of Beer

Understanding Your P800 Tax Calculation Tax Rebates

Contact Lens Rebates Eye Consultants Of Atlanta

Are Mail In Rebates Really Such A Great Deal Buildapcsales

Mail in Rebates Newegg Knowledge Base

Foxy Roxy Canadian Couponer Mail In Rebate Free Finish Quantrum

Foxy Roxy Canadian Couponer Mail In Rebate Free Finish Quantrum

Mail in Rebates Lordco Auto Parts

10 Mail In Rebate Strategies Every Couponer Should Know The Krazy

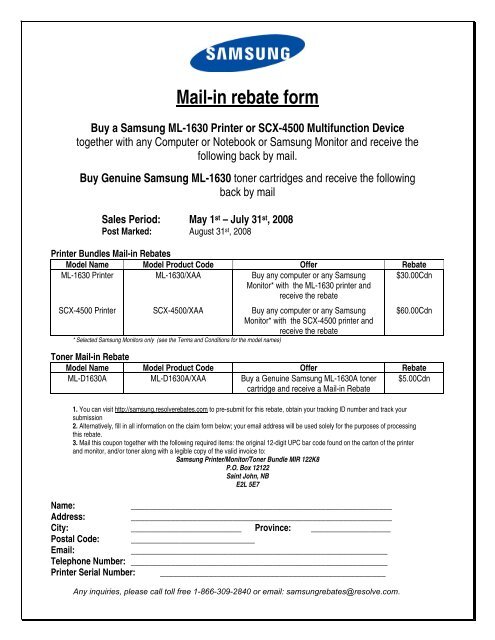

Mail in Rebate Form

P800 Mail In Rebate - To claim an online tax rebate you ll need to Go to the HMRC website Sign in to your Personal Tax Account using your Government Gateway User ID Follow the