Pa Home Tax Rebate Web First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to 45 000 a

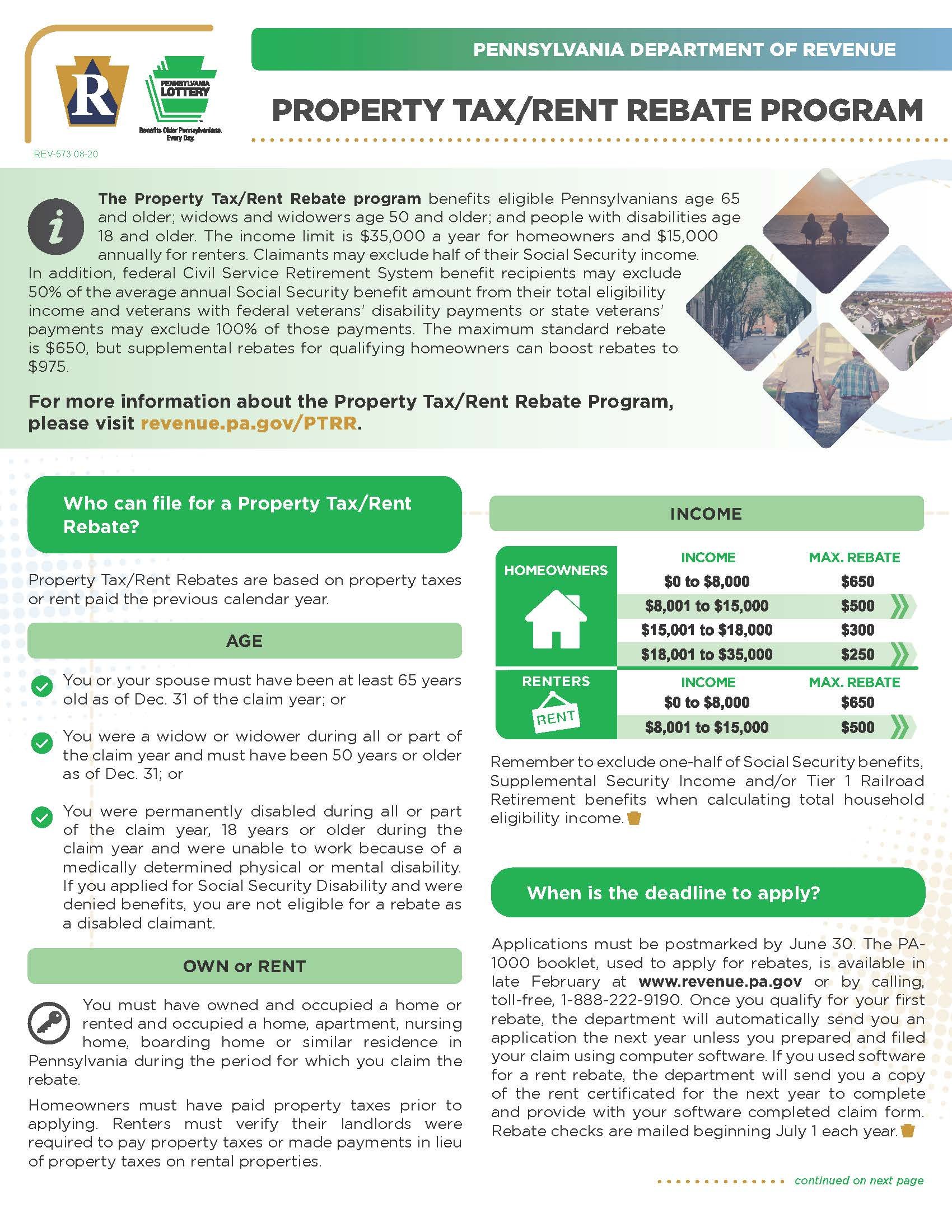

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to Web Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More

Pa Home Tax Rebate

Pa Home Tax Rebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/form-pa-1000-download-fillable-pdf-or-fill-online-property-tax-or-rent-32.png?fit=500%2C640&ssl=1

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Web Learn more about the new online filing features for the Property Tax Rent Rebate Program by visiting myPATH Visit the Property Tax Rent Rebate Program page on the Web 3 juil 2023 nbsp 0183 32 Under the Governor s proposal the maximum standard rebate would increase from 650 to 1 000 Meanwhile the income limits for renters and homeowners would be

Web 4 ao 251 t 2023 nbsp 0183 32 The lowest income households will be eligible for rebates of 1 000 up from 650 the previous maximum The law also resolves the mismatch between state Web 27 avr 2009 nbsp 0183 32 Here is the link where you can check on the status of your Property Tax Rent Rebate Property Tax Rent Rebate Status Please wait 8 10 weeks from the date you

Download Pa Home Tax Rebate

More picture related to Pa Home Tax Rebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

2022 Pa Property Tax Rebate Forms PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/return-to-claim-notice-4.jpg

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

Web 23 juin 2023 nbsp 0183 32 Online application https mypath pa gov Link RebateApply Download or request a paper application Deadline to apply Sunday Dec 31 2023 Resources on the PA Dept of Revenue website Property Web 10 ao 251 t 2023 nbsp 0183 32 Thousands more older and disabled Pennsylvanians will qualify for help from a landmark state property tax rebate program after Democratic Gov Josh Shapiro

Web 19 janv 2023 nbsp 0183 32 The income limit is 35 000 a year for homeowners and 15 000 annually for renters and half of Social Security income is excluded The maximum standard rebate is Web 28 sept 2022 nbsp 0183 32 Yes In July state lawmakers approved a one time increase to this year s rebates so recipients will get their usual amount plus 70 So if you normally get 650

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-792x1024.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to 45 000 a

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/P…

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to

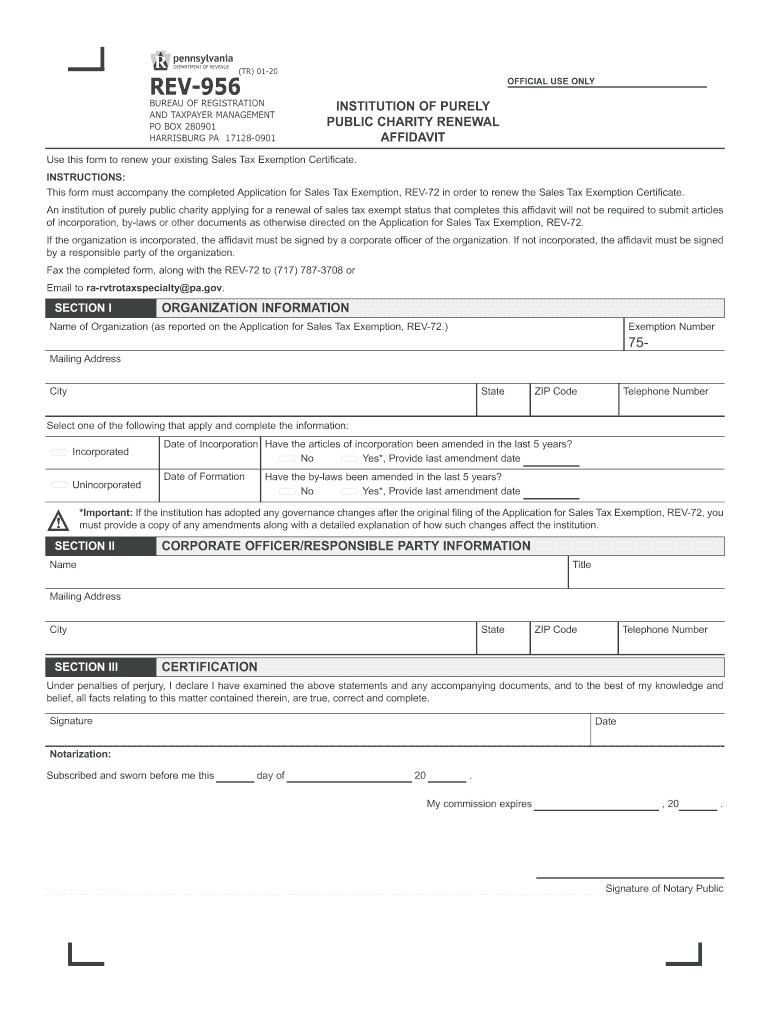

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

PA Property Tax Rent Rebate Apply By 12 31 2022 New 1 time Bonus

Fillable Pa 40 Fill Out Sign Online DocHub

Microfinance Loan Application Form

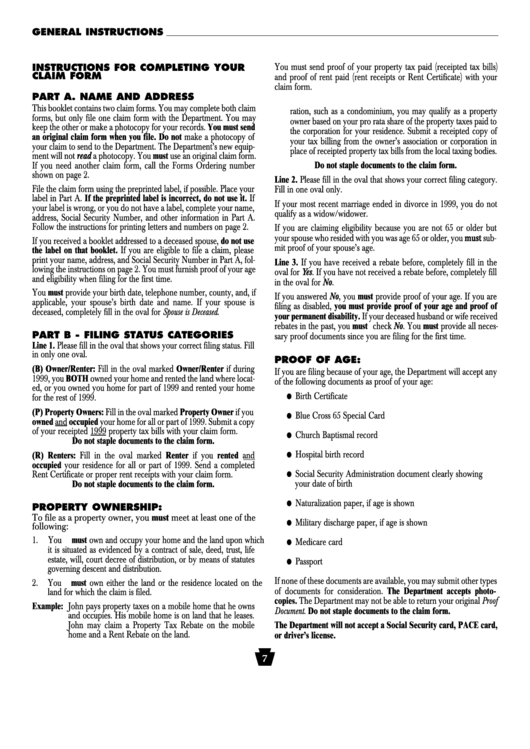

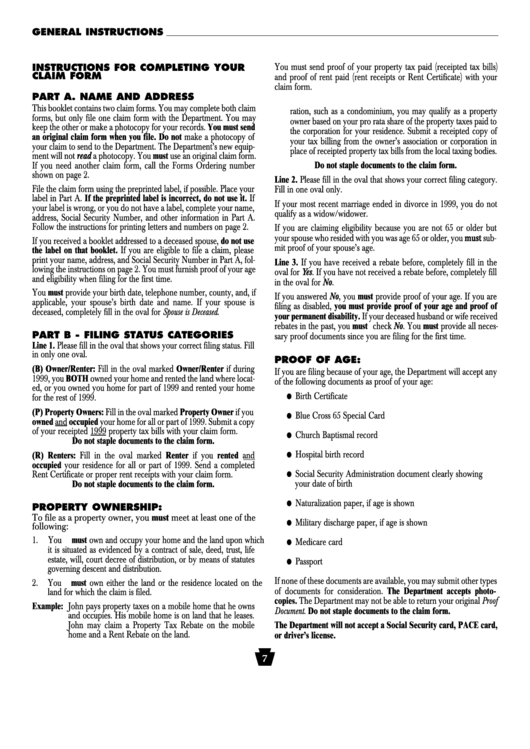

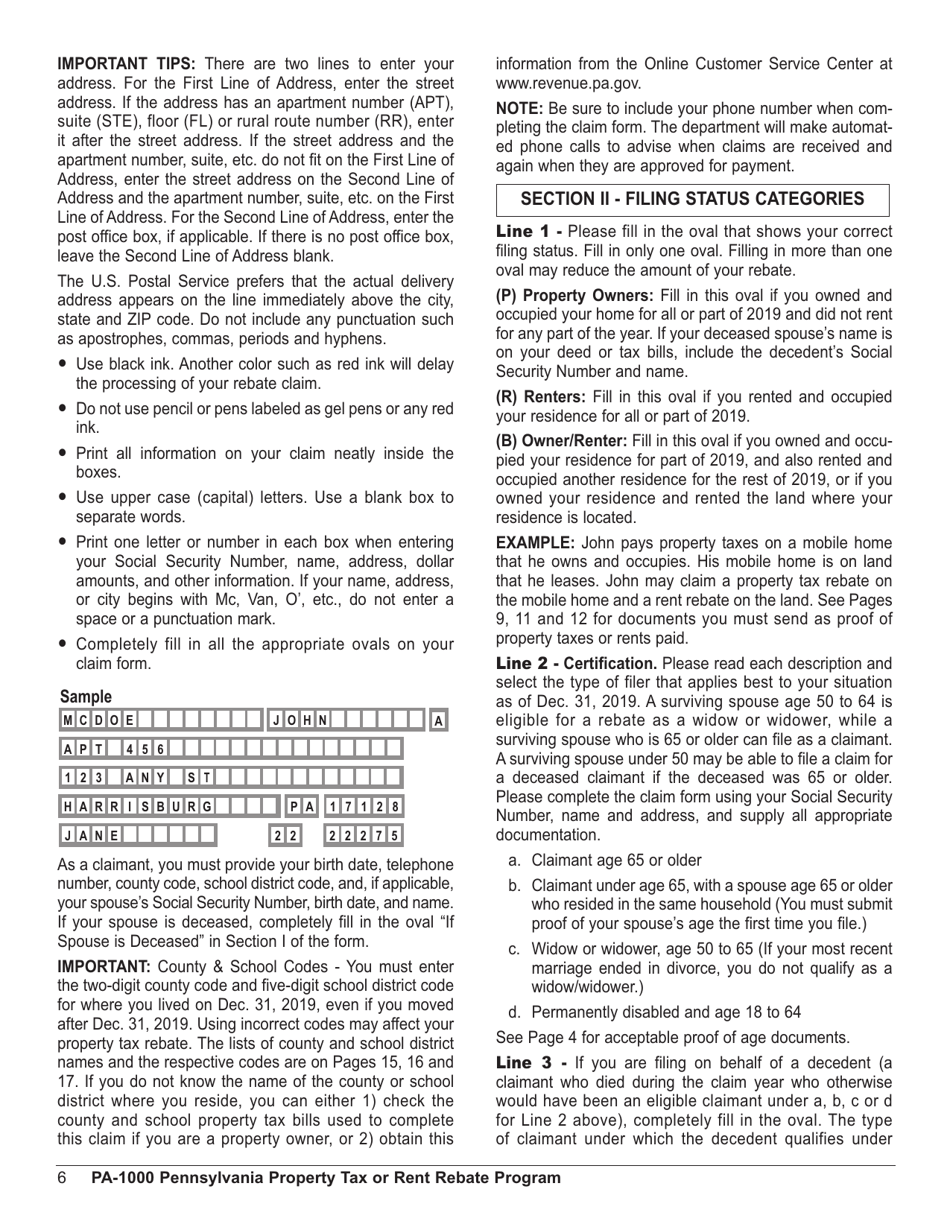

Form Pa 1000 Instructions For Completing Your Claim Form Property

Form Pa 1000 Instructions For Completing Your Claim Form Property

Download Instructions For Form PA 1000 Property Tax Or Rent Rebate

Pa 1000 Fill Out Sign Online DocHub

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pa Home Tax Rebate - Web 27 avr 2009 nbsp 0183 32 Here is the link where you can check on the status of your Property Tax Rent Rebate Property Tax Rent Rebate Status Please wait 8 10 weeks from the date you