Pa Prop Tax Rebate Web Under the expansion first proposed by the Governor nearly 175 000 more Pennsylvanians will qualify for a property tax or rent rebate At the same time many of the 430 000

Web 3 juil 2023 nbsp 0183 32 07 03 2023 283 468 rebates on property taxes and rent paid in 2022 will be made starting today Harrisburg PA Starting today 283 468 older homeowners Web The quot Where s My Rebate quot system to track the status of a claim online The benefit of error reducing automatic calculators User friendly features that are not available when filing a

Pa Prop Tax Rebate

Pa Prop Tax Rebate

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

PA Property Tax Rent Rebate Apply By 12 31 2022 New 1 time Bonus

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/e360ee85-5401-487c-8277-ee6939ff697b/2022-8-2+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg

Web Make a Payment Where s My Income Tax Refund Property Tax Rent Rebate Status Pennsylvania Department of Revenue gt Forms and Publications gt Forms for Individuals Web 28 sept 2022 nbsp 0183 32 Yes In July state lawmakers approved a one time increase to this year s rebates so recipients will get their usual amount plus 70 So if you normally get 650

Web 19 janv 2023 nbsp 0183 32 Harrisburg PA Older and disabled Pennsylvanians can now apply for rebates on property taxes or rent paid in 2022 the Department of Revenue announced Web The Property Tax Rent Rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older

Download Pa Prop Tax Rebate

More picture related to Pa Prop Tax Rebate

PA Property Tax Rebate Forms Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Brewster Property Tax Rent Rebate Application Period Extended To End

https://www.senatorbrewster.com/wp-content/uploads/2020/03/PropertyTax.jpg

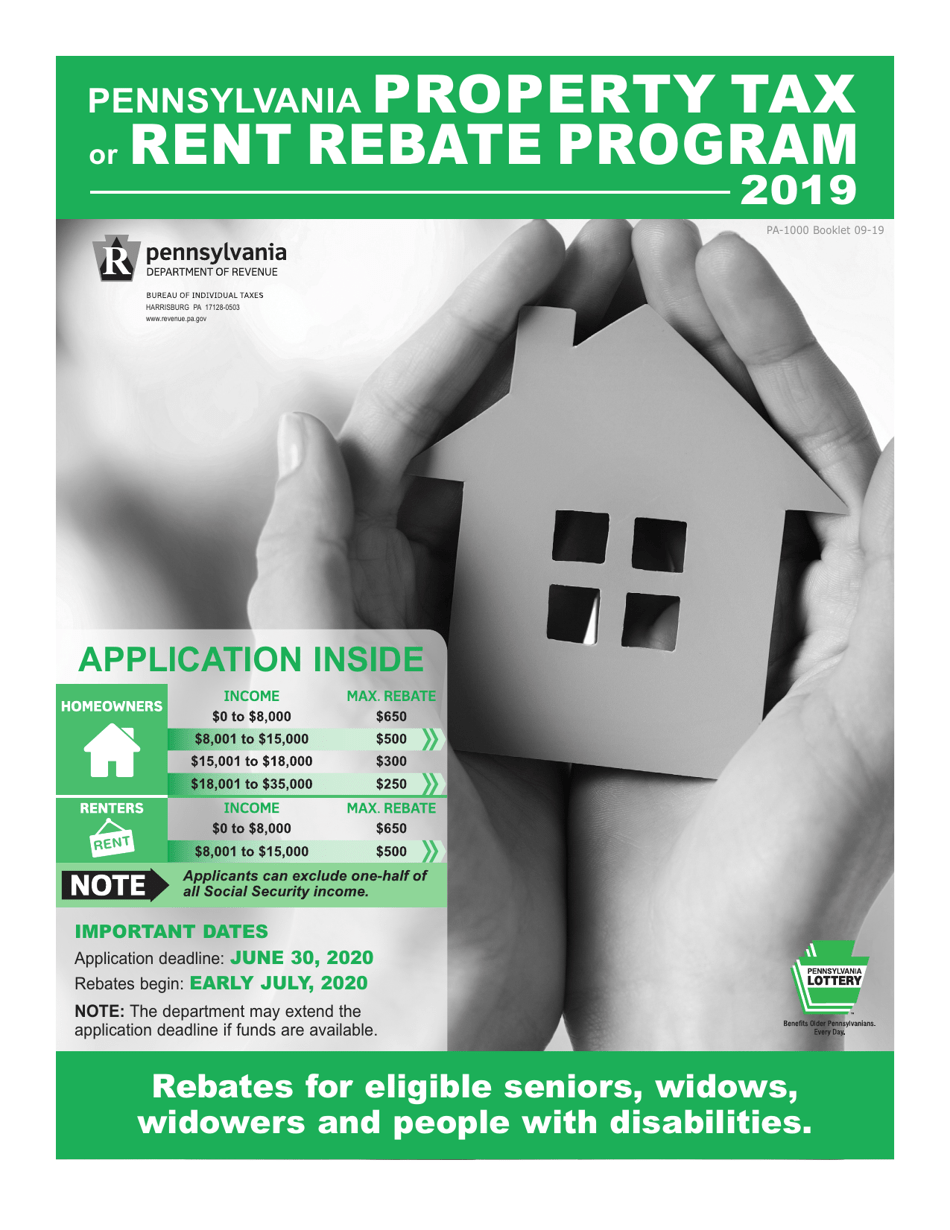

Web 30 juin 2022 nbsp 0183 32 RENT REBATE PROGRAM 2021 PROPERTY TAX or PA 1000 Booklet 06 21 Rebates for eligible seniors widows widowers and people with disabilities Web 28 sept 2022 nbsp 0183 32 The exact amount depends on your income whether you re a renter or a homeowner and where in the state you live You can find a breakdown here Normally the maximum rebate you can receive is

Web Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More Web 23 juin 2023 nbsp 0183 32 Online application https mypath pa gov Link RebateApply Download or request a paper application Deadline to apply Sunday Dec 31 2023 Resources on

Pa Renters Rebate Status RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/pa-1000-2014-property-tax-or-rent-rebate-claim-free-download-1.png?fit=728%2C943&ssl=1

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

https://asapapartmentfinders.com/wp-content/uploads/2016/12/tax-rebate-768x561.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web Under the expansion first proposed by the Governor nearly 175 000 more Pennsylvanians will qualify for a property tax or rent rebate At the same time many of the 430 000

https://www.media.pa.gov/Pages/Revenue-Details.aspx?newsid=402

Web 3 juil 2023 nbsp 0183 32 07 03 2023 283 468 rebates on property taxes and rent paid in 2022 will be made starting today Harrisburg PA Starting today 283 468 older homeowners

PA PA 1000 2021 2022 Fill And Sign Printable Template Online US

Pa Renters Rebate Status RentersRebate

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Tax Rebate For Individual Tax Rebate For First Time Homeowners How

5 Million Lottery Ticket Sold In Dauphin County Pennlive

PA Property Tax Rebate What To Know Credit Karma

PA Property Tax Rebate What To Know Credit Karma

Boise Will Offer Property Tax Rebate To Low income Seniors Veterans

Download Instructions For Form PA 1000 Property Tax Or Rent Rebate

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pa Prop Tax Rebate - Web 2 ao 251 t 2022 nbsp 0183 32 Homeowners with eligible income under 8 000 would receive a 455 bonus 8 001 to 15 000 an extra 350 15 001 to 18 000 an extra 210 and