Pa Property Tax Rebate Bonus Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities

Web First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to 45 000 a Web 2 ao 251 t 2022 nbsp 0183 32 Renters with eligible incomes up to 8 000 would receive an extra 455 and those with incomes between 8 001 and 15 000 a 350 bonus rebate Funding for the extra rebates which combined are

Pa Property Tax Rebate Bonus

Pa Property Tax Rebate Bonus

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/form-pa-1000-download-fillable-pdf-or-fill-online-property-tax-or-rent-32.png?fit=500%2C640&ssl=1

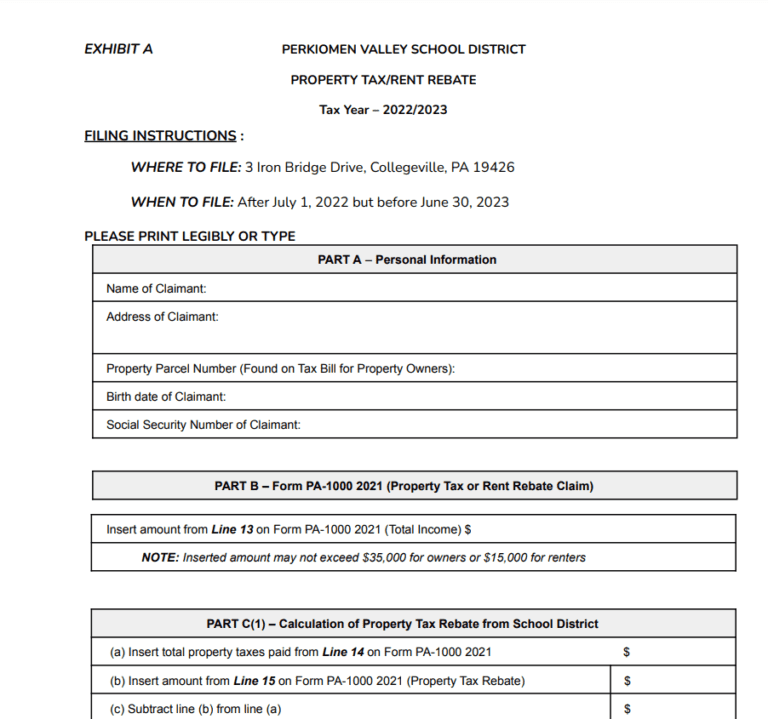

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

2022 Pa Property Tax Rebate Forms PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/return-to-claim-notice-4.jpg

Web 24 ao 251 t 2022 nbsp 0183 32 The Property Tax Rent Rebate Program benefits Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 Web 4 ao 251 t 2023 nbsp 0183 32 HARRISBURG Thousands more older and disabled Pennsylvanians will qualify for help from a landmark state property tax rebate program after Democratic

Web 3 juil 2023 nbsp 0183 32 07 03 2023 283 468 rebates on property taxes and rent paid in 2022 will be made starting today Harrisburg PA Starting today 283 468 older homeowners Web 1 d 233 c 2022 nbsp 0183 32 WHTM Pennsylvanians who qualify for the Property Tax Rent Rebate Program must apply by December 31 2022 to receive their annual rebate plus a one

Download Pa Property Tax Rebate Bonus

More picture related to Pa Property Tax Rebate Bonus

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://www.propertyrebate.net/wp-content/uploads/2023/05/property-tax-rebate-form-for-seniors-in-pa-printable-rebate-form-1.png

Pennsylvanians Eligible For Property Tax Or Rent Rebate To Get Bonus

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA10k30E.img?w=1280&h=720&m=4&q=79

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Web 5 juin 2023 nbsp 0183 32 The legislation aims to follow through on one of Democratic Gov Josh Shapiro s budget proposals increasing the maximum rebate for seniors from 650 to Web 11 mars 2023 nbsp 0183 32 Pa Property Tax Rebate Bonus If you own a property in Pennsylvania you can apply for a Property Tax Rebate The program is a way to reduce your

Web 14 juil 2022 nbsp 0183 32 The 45 2 billion state budget that Gov Tom Wolf signed into law last week providing a 140 million increase to the state s Property Tax Rent Rebate Program an Web Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

https://www.revenue.pa.gov/IncentivesCreditsPrograms...

Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to 45 000 a

Pa 2023 Property Tax Rebate Form PropertyRebate

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

PA Rent Rebate Form Printable Rebate Form

PA Property Tax Rent Rebate Applications Now Available

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

Can I Still File For 2022 Pa Property Tax Rebate PropertyRebate

Can I Still File For 2022 Pa Property Tax Rebate PropertyRebate

Rent Rebate Fill Online Printable Fillable Blank PdfFiller

Pa Property Tax Rebate 2022 PropertyRebate

2020 Form PA ET 1 Pittsburgh Fill Online Printable Fillable Blank

Pa Property Tax Rebate Bonus - Web 24 ao 251 t 2022 nbsp 0183 32 The Property Tax Rent Rebate Program benefits Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18