Pa Rent Rebate Deadline Web 12 juin 2023 nbsp 0183 32 Harrisburg PA The deadline for older adults and Pennsylvanians with disabilities to apply for rebates on rent and property taxes paid in 2022 has been

Web December 31 It is expected this will be the final filing deadline for rebate applications on property taxes or rent paid in 2023 How to File All eligible Pennsylvanians are Web 14 juin 2023 nbsp 0183 32 On Monday the Pennsylvania Department of Revenue announced that it would be extending the filing deadline for the Property Tax and Rent Rebate program

Pa Rent Rebate Deadline

Pa Rent Rebate Deadline

http://hips.htvapps.com/htv-prod-media.s3.amazonaws.com/images/property-deadline-1482361416.jpg?crop=1.00xw:1.00xh;0,0&resize=1200:*

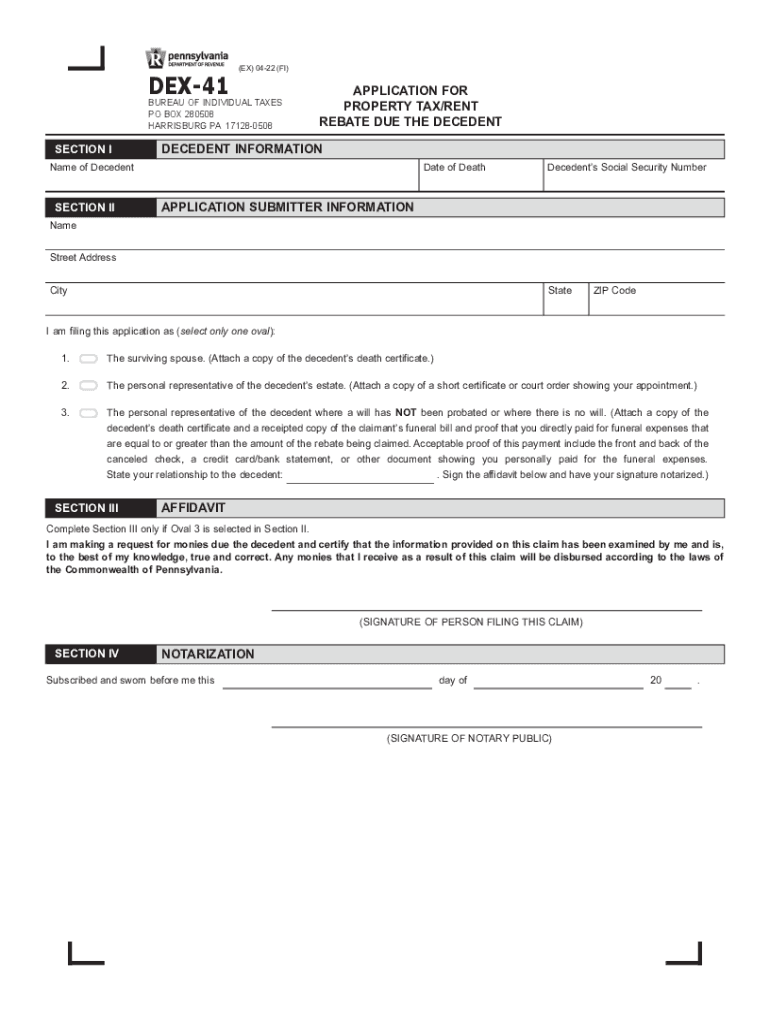

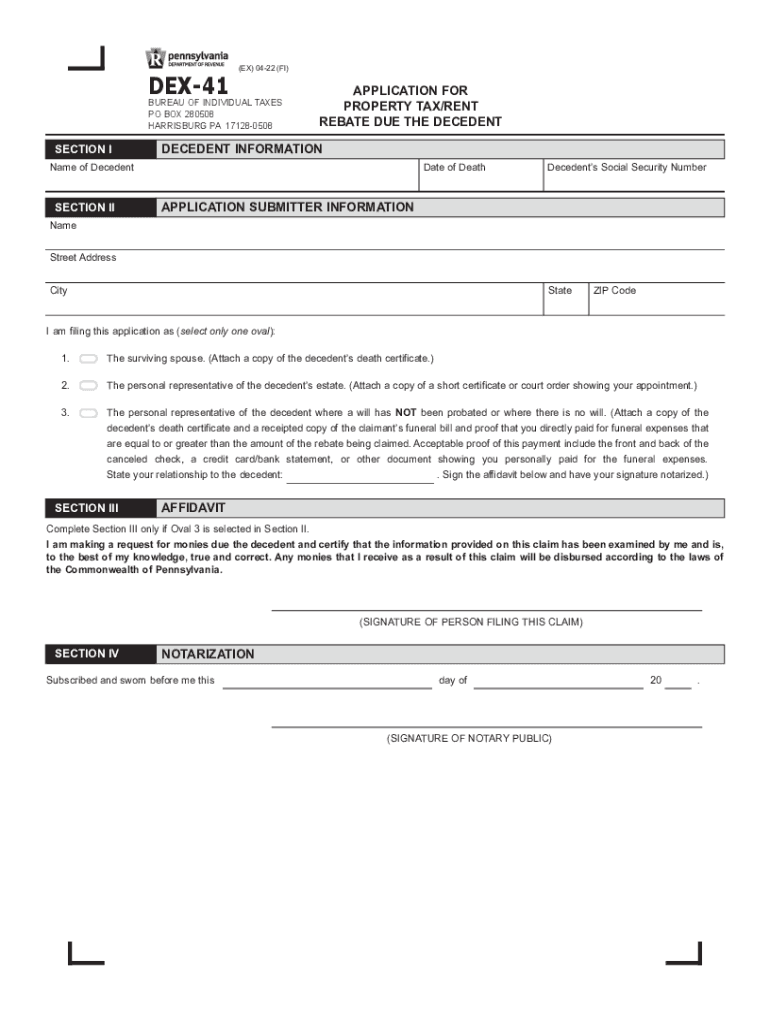

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pennsylvania-property-tax-rent-rebate-5-free-templates-in-pdf-word-4.png

PA Rent Rebate Deadline 2023 Apply Now To Get Financial Assistance

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/04/PA-Rent-Rebate-Deadline-2023.jpg?resize=1003%2C835&ssl=1

Web This year Pennsylvania has extended the filing deadline for the Property Tax or Rent Rebate Claim to December 31 2022 Typically the deadline is June 30 th Here s what you need to know about taking advantage of this Web 30 juin 2023 nbsp 0183 32 RENT REBATE PROGRAM 2022 PROPERTY TAX or PA 1000 Booklet 05 22 Rebates for eligible seniors widows widowers and people with disabilities

Web Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More Web 23 juin 2023 nbsp 0183 32 If you earned 8 001 15 000 in 2022 the maximum rebate is 500 If you earned 15 001 18 000 in 2022 the maximum rebate is 300 If you earned 18 001 35 000 in 2022 the maximum rebate is

Download Pa Rent Rebate Deadline

More picture related to Pa Rent Rebate Deadline

Rent Rebate Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/47/686/47686220/large.png

PA Rent Rebate Program Unlocking Financial Relief For Pennsylvania

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/PA-Rent-Rebate-Program.jpg?ssl=1

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Web 31 d 233 c 2021 nbsp 0183 32 Harrisburg PA Treasurer Stacy Garrity continues to urge eligible Pennsylvanians to apply for the state s Property Tax Rent Rebate Program The Web Learn more about the new online filing features for the Property Tax Rent Rebate Program by visiting myPATH Visit the Property Tax Rent Rebate Program page on the

Web 19 janv 2023 nbsp 0183 32 01 19 2023 Harrisburg PA Older and disabled Pennsylvanians can now apply for rebates on property taxes or rent paid in 2022 the Department of Revenue Web 12 juin 2023 nbsp 0183 32 Pa extends the deadline to apply for property tax rent rebates The deadline for older adults and Pennsylvanians with disabilities to apply for rebates on rent and

Rent Rebate Status Pa 2023 Rent Rebates

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/pa-1000-2014-property-tax-or-rent-rebate-claim-free-download-1.png

Fillable Pa 40 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/42/749/42749850/large.png

https://www.media.pa.gov/Pages/Revenue-Details.aspx?newsid=400

Web 12 juin 2023 nbsp 0183 32 Harrisburg PA The deadline for older adults and Pennsylvanians with disabilities to apply for rebates on rent and property taxes paid in 2022 has been

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web December 31 It is expected this will be the final filing deadline for rebate applications on property taxes or rent paid in 2023 How to File All eligible Pennsylvanians are

2016 Form PA PA 1000 RC Fill Online Printable Fillable Blank PdfFiller

Rent Rebate Status Pa 2023 Rent Rebates

Where My Rent Rebate Pa Rent Rebates

ExploreJeffersonPA How To Apply For A Pennsylvania Property Tax

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

2022 Form PA DEX 41 Fill Online Printable Fillable Blank PdfFiller

2022 Form PA DEX 41 Fill Online Printable Fillable Blank PdfFiller

Property Tax Rebate Pennsylvania LatestRebate

Application Deadline Extended For PA Property Tax Rent Rebate Program

Enews Updates June 18 2022 Senator Judy Ward

Pa Rent Rebate Deadline - Web This year Pennsylvania has extended the filing deadline for the Property Tax or Rent Rebate Claim to December 31 2022 Typically the deadline is June 30 th Here s what you need to know about taking advantage of this