Pa Rent Rebate Income Limits Web The income cap for homeowners will increase from 35 000 to 45 000 The income cap for renters will increase from 15 000 to 45 000 Third the income caps will be tied to the cost of living moving forward meaning those who receive a rebate won t lose their eligibility in the future due to no fault of their own

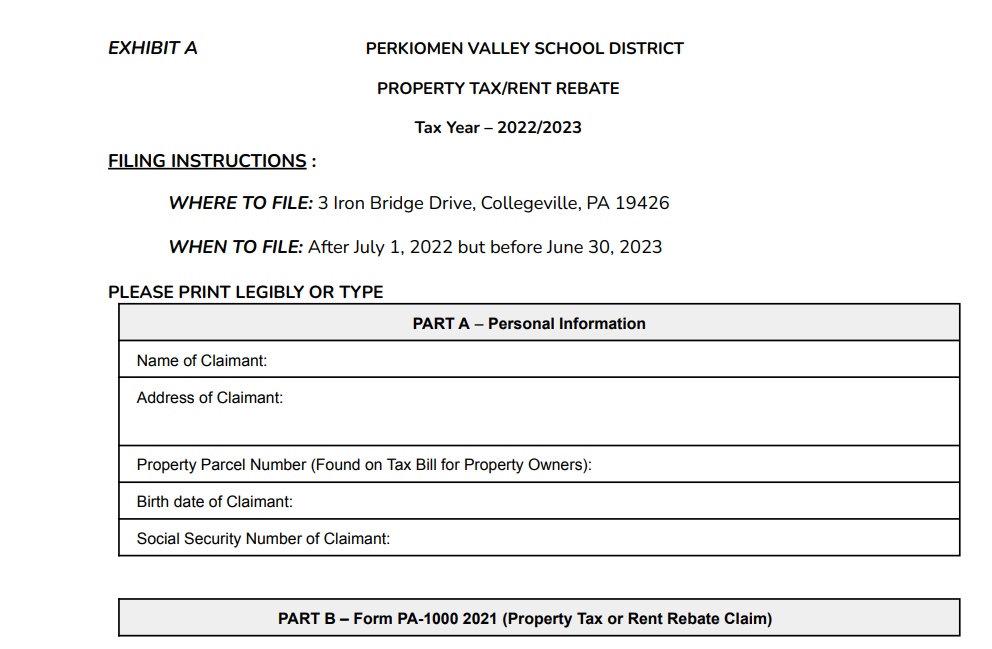

Web The Property Tax Rent Rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income limit is 35 000 a year for homeowners and 15 000 annually for renters Claimants may exclude half of their Social Security income Web 30 juin 2022 nbsp 0183 32 HOMEOWNERS Income Maximum Rebate 0 to 8 000 650 8 001 to 15 000 500 15 001 to 18 000 300 18 001 to 35 000 250 RENTERS Income Maximum Rebate

Pa Rent Rebate Income Limits

Pa Rent Rebate Income Limits

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pennsylvania-property-tax-rent-rebate-5-free-templates-in-pdf-word-4.png

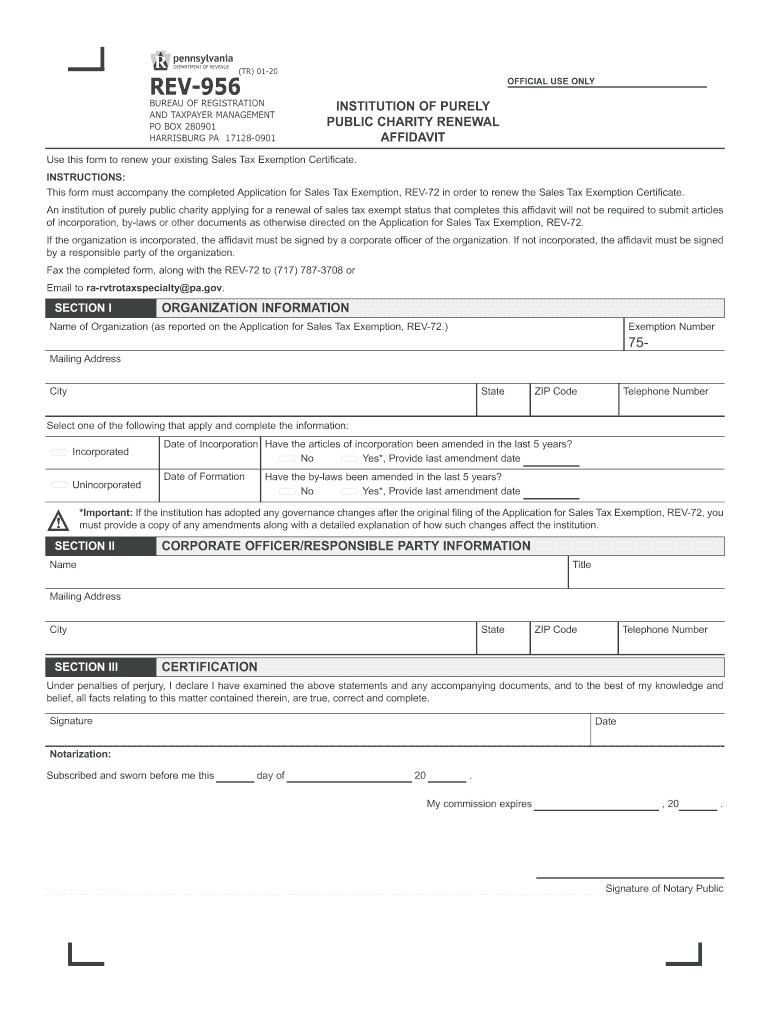

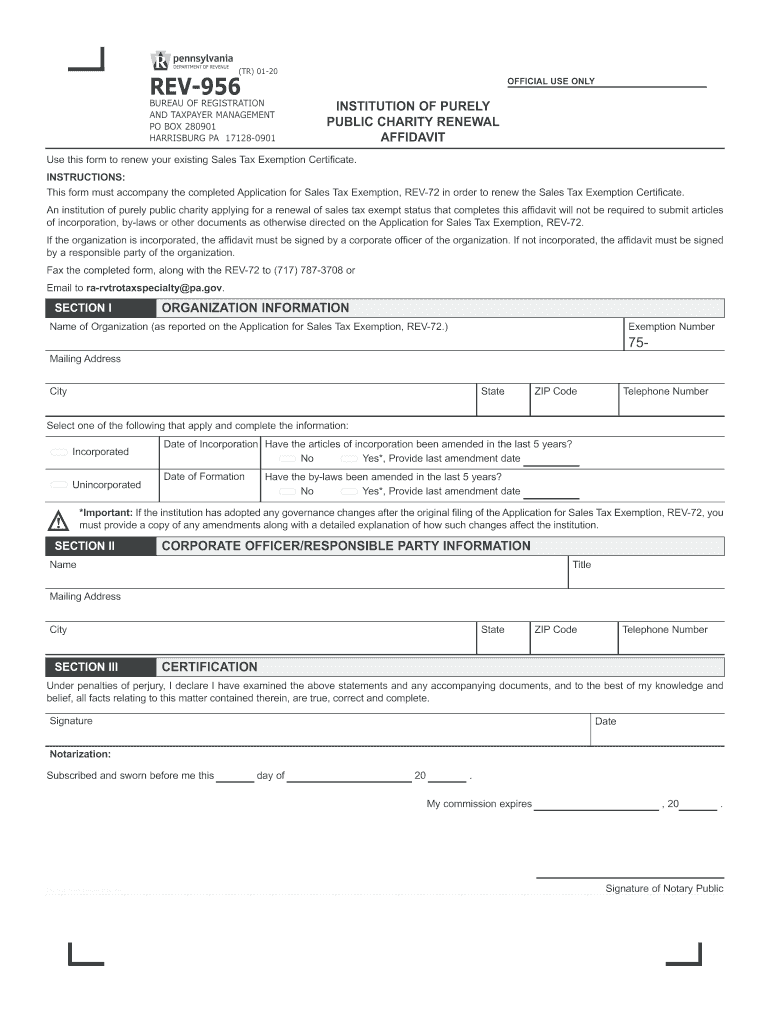

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/511/885/511885264/large.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Web The Property Tax Rent Rebate Preparation Guide s purpose is to provide volunteer preparers and Department of Revenue Field Office personnel with additional information and instructions for the prepa ration of the PA 1000 Property Tax or Rent Rebate Claim GENERAL INFORMATION Web 28 sept 2022 nbsp 0183 32 If you re 65 or older or receive disability benefits and paid rent or property taxes last year you qualify if you meet the income requirements The income limit is 35 000 per household for homeowners and 15 000 per household for renters If you receive Social Security benefits the state only counts half of that towards the income cap

Web 3 juil 2023 nbsp 0183 32 Under the Governor s proposal the maximum standard rebate would increase from 650 to 1 000 Meanwhile the income limits for renters and homeowners would be made equal and both increase to 45 000 Web 6 ao 251 t 2023 nbsp 0183 32 Under a bill Governor Josh Shapiro signed on Friday the maximum rent rebate will rise from 650 up to 1 000 Also the income cap for renters and homeowners to be eligible is now 45 000

Download Pa Rent Rebate Income Limits

More picture related to Pa Rent Rebate Income Limits

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Rent Rebate Status Pa 2023 Rent Rebates

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/pa-1000-2014-property-tax-or-rent-rebate-claim-free-download-1.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Web 4 ao 251 t 2023 nbsp 0183 32 Previously the income cap to qualify was 15 000 for renters and 35 000 for homeowners The new measure eliminates this disparity by raising the limit to 45 000 for both As before the program s rules only count half of someone s income from Social Security benefits Web 19 janv 2023 nbsp 0183 32 The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income limit is 35 000 a year for homeowners and 15 000 annually for renters and half of Social Security income is excluded

Web 3 d 233 c 2002 nbsp 0183 32 Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental property You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer Web 28 sept 2022 nbsp 0183 32 The income limit is 35 000 per household for homeowners and 15 000 per household for renters If you receive Social Security benefits the state only counts half of that towards the income cap

2016 Form PA PA 1000 RC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/404/584/404584833/large.png

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web The income cap for homeowners will increase from 35 000 to 45 000 The income cap for renters will increase from 15 000 to 45 000 Third the income caps will be tied to the cost of living moving forward meaning those who receive a rebate won t lose their eligibility in the future due to no fault of their own

https://www.revenue.pa.gov/FormsandPublications/Formsfor…

Web The Property Tax Rent Rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income limit is 35 000 a year for homeowners and 15 000 annually for renters Claimants may exclude half of their Social Security income

PA Rent Rebate Deadline 2023 Apply Now To Get Financial Assistance

2016 Form PA PA 1000 RC Fill Online Printable Fillable Blank PdfFiller

Fillable Pa 40 Fill Out Sign Online DocHub

Economic Recovery Rebate Income Limits Recovery Rebate

PA Rent Rebate Program Unlocking Financial Relief For Pennsylvania

2023 Recovery Rebate Credit Income Limits Recovery Rebate

2023 Recovery Rebate Credit Income Limits Recovery Rebate

Renters Rebate Vermont Income Limit 2022 48000 RentersRebate

Budget 2023 Key Updates Income Tax Rebate Limit Increased From Rs 5

Rent Rebate 2023 PA Eligibility Application Process Deadline Rent

Pa Rent Rebate Income Limits - Web 28 sept 2022 nbsp 0183 32 If you re 65 or older or receive disability benefits and paid rent or property taxes last year you qualify if you meet the income requirements The income limit is 35 000 per household for homeowners and 15 000 per household for renters If you receive Social Security benefits the state only counts half of that towards the income cap