Pa School Tax Rebate Web How does the Taxpayer Relief Act benefit taxpayers What powers does the Taxpayer Relief Act give to voters in each school district What is the source of funds for property tax relief How will the Senior Citizens Property Tax and Rent Rebate program be expanded Household Income Rebate 0 to 8 000 650

Web Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Web The best way to check the status of your rebate is by visiting Where s My PA Property Tax Rent Rebate As a reminder paper application forms are typically loaded into the Department of Revenue s processing system in late April There will not be any updated information available on the status of your application until that time

Pa School Tax Rebate

Pa School Tax Rebate

https://www.pdffiller.com/preview/535/27/535027308/large.png

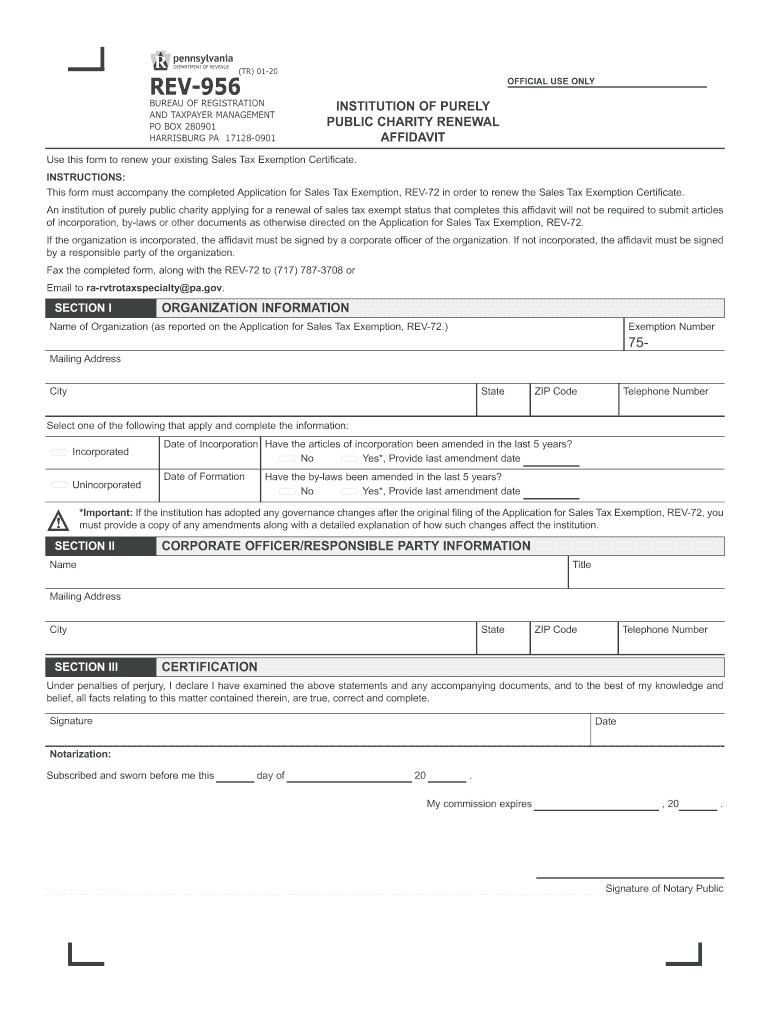

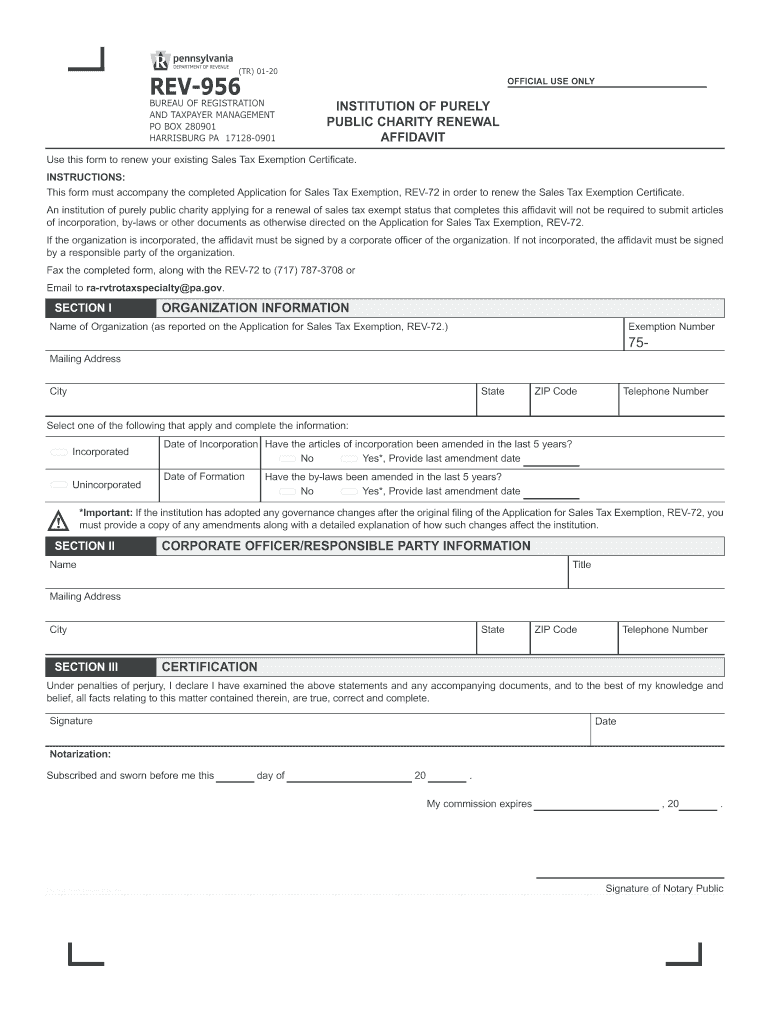

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/511/885/511885264/large.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

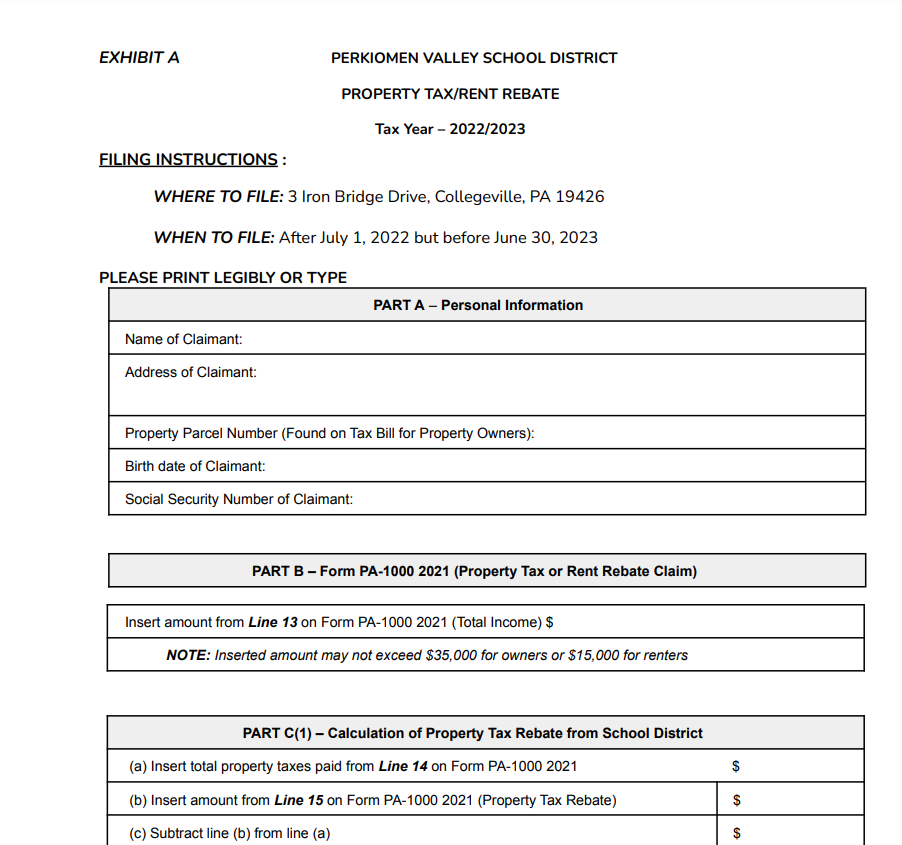

Web 6 nov 2014 nbsp 0183 32 The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district Property tax reduction will be through a homestead or farmstead exclusion Generally most owner occupied homes and farms are eligible for property tax reduction Only a primary residence is eligible for Web 16 mars 2020 nbsp 0183 32 The District s application period for the 2022 Senior Citizens Property Tax Rebate Program will start July 1 2023 through October 31 2023 All applications must be postmarked no later than October 31 2023 Late applications will NOT be accepted 2022 Senior Rebate Information Letter 2022 Senior citizen School Tax Rebate Form

Web INCOME 35 000 or less AMOUNT OF REBATE based on income as follows Household Income Rebate Amount 0 8 000 650 00 8 001 15 000 500 00 15 001 18 000 300 00 18 001 35 000 250 00 35 001 or over 0 00 MAXIMUM REBATE cannot exceed 650 00 on homestead only Web When combined with the senior citizen Property Tax Rent Rebate program total state funded property tax relief will be 864 4 million next year Each school district will determine the actual amount of property tax relief for each homestead and farmstead after determining its 2023 24 real estate tax rate

Download Pa School Tax Rebate

More picture related to Pa School Tax Rebate

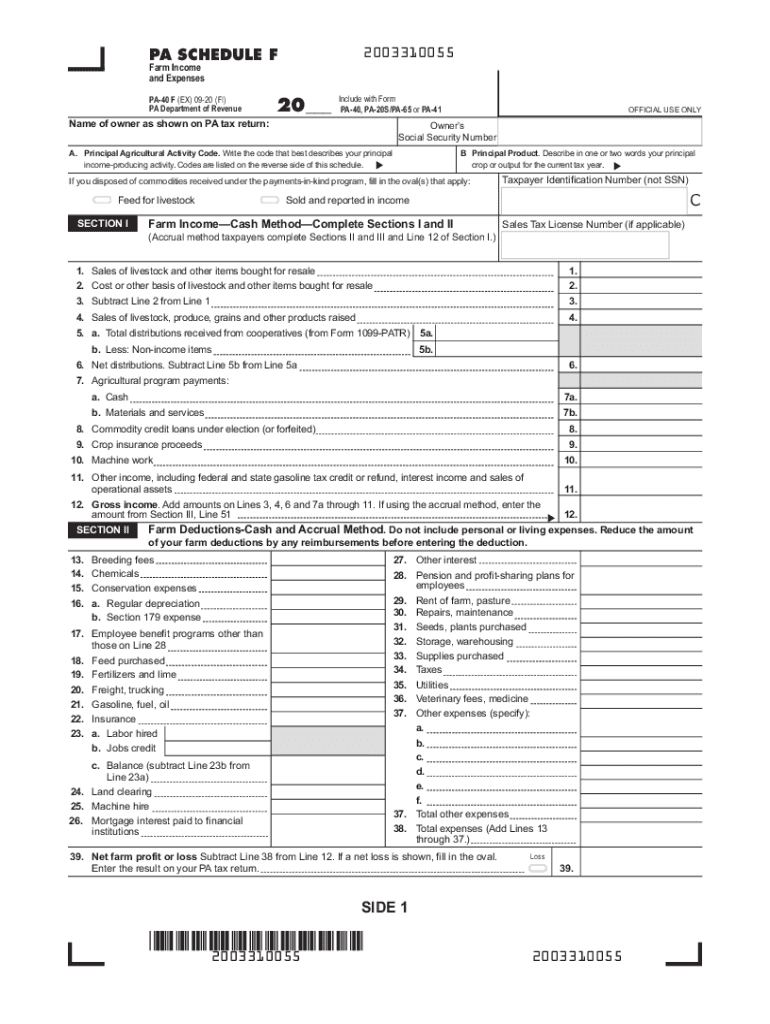

Pa 40 F Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/563/641/563641337/large.png

2023 Tax Exemption Form Pennsylvania ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/pa-exemption-certificate-fill-out-and-sign-printable-pdf-template-4.png

Increase The Threshold For Qualifying For Tax Forgiveness PennLive

https://www.pennlive.com/resizer/m4KwUD7bWaXPCpyOB7MZ4BmTwYs=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/U5MVCZVZI5COTCDGVU3MWDQABQ.png

Web The Pleasant Valley School District offers a rebate on taxes paid after the maximum rebate from the State Homestead Property Tax Rebate Schedule of Rebate for taxes in excess of 650 Household Income Rebate Amount 35 001 or over Not eligible for rebate MAXIMUM REBATE cannot exceed 650 on homestead only 5 Web These tax credits economic development programs refund rebate opportunities and incentive programs provide economic assistance and tax reductions to individual and business taxpayers For more information or to see

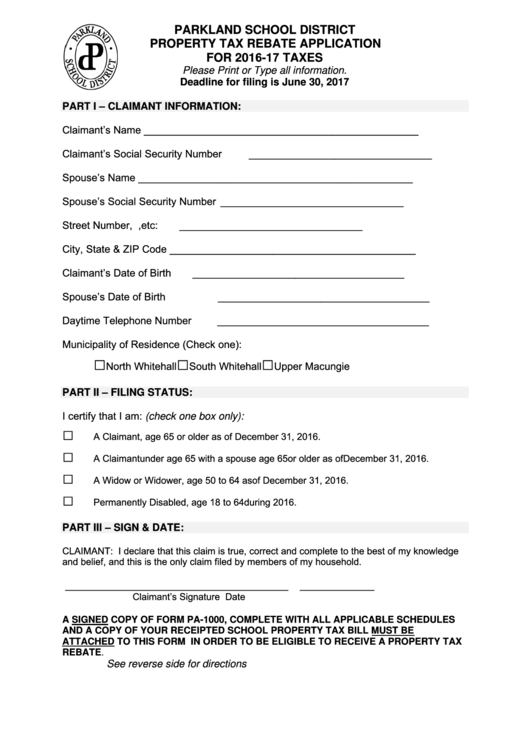

Web Property Tax Rent Rebate claim forms are available online at http www revenue state pa us or by calling the department s information line at 1 888 728 2937 Individuals who may claim the rebate must fall into one of the following categories 65 years of age or older Widow or widower age 50 or older Age 18 or more and Web You will need to provide a signed copy of your Form PA 1000 Property Tax or Rent Rebate Claim and copy of your 2022 receipted school property tax bill First time filers will need to submit proof of age death or disability and copies

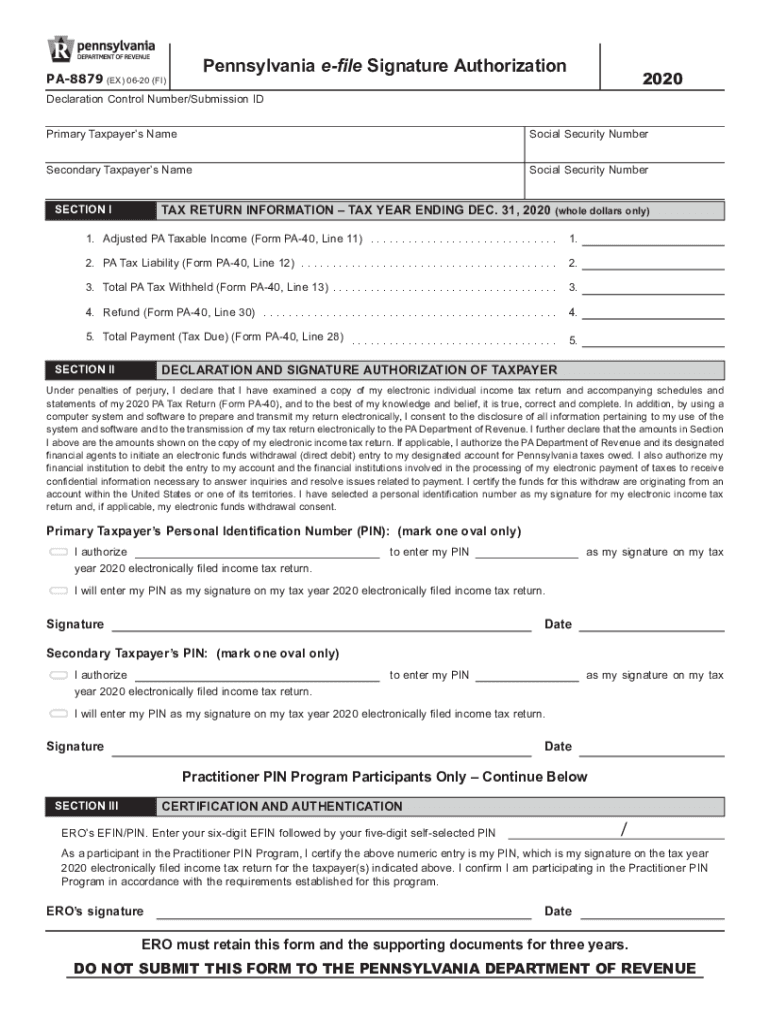

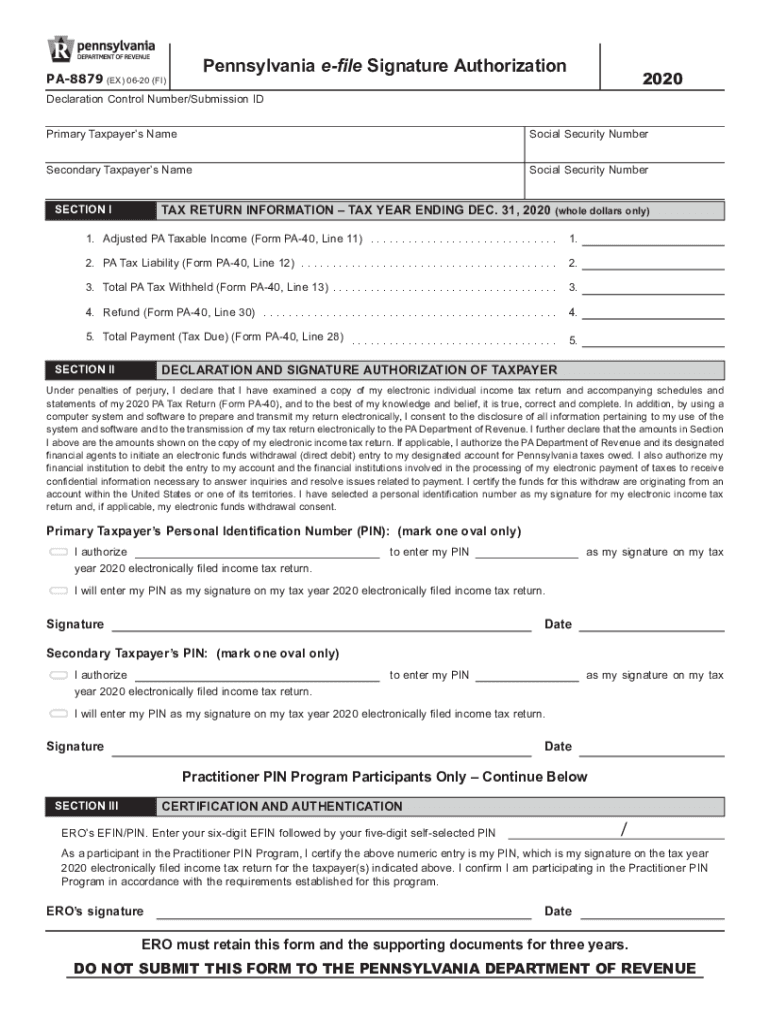

Pa Form 8879 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/547/504/547504644/large.png

Overrides

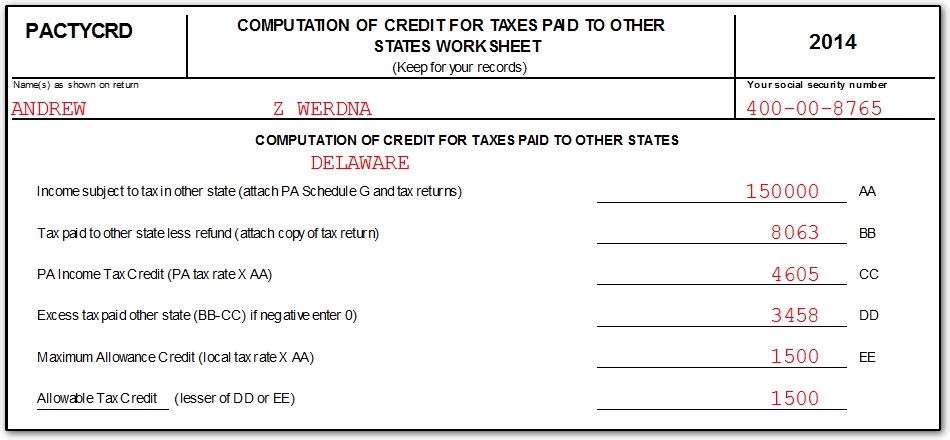

http://kb.drakesoftware.com/Site/Uploads/Images/13589 pa - municipality tax return - out-of-state credit for school tax 2.jpg

https://www.education.pa.gov/Policy-Funding/PropertyTax/Pages/FAQ.aspx

Web How does the Taxpayer Relief Act benefit taxpayers What powers does the Taxpayer Relief Act give to voters in each school district What is the source of funds for property tax relief How will the Senior Citizens Property Tax and Rent Rebate program be expanded Household Income Rebate 0 to 8 000 650

https://www.revenue.pa.gov/Pages/default.as…

Web Property Tax Rent Rebate Program Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022

Parkland School District Property Tax Rebate Application Printable Pdf

Pa Form 8879 Fill Out Sign Online DocHub

Pa 1000 Fill Out Sign Online DocHub

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Province Of Manitoba School Tax Rebate

2022 Pa Property Tax Rebate Forms PropertyRebate

2022 Pa Property Tax Rebate Forms PropertyRebate

PA Property Tax Rebate Fillable Form Printable Rebate Form

PA Rent Rebate Form Printable Rebate Form

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pa School Tax Rebate - Web INCOME 35 000 or less AMOUNT OF REBATE based on income as follows Household Income Rebate Amount 0 8 000 650 00 8 001 15 000 500 00 15 001 18 000 300 00 18 001 35 000 250 00 35 001 or over 0 00 MAXIMUM REBATE cannot exceed 650 00 on homestead only