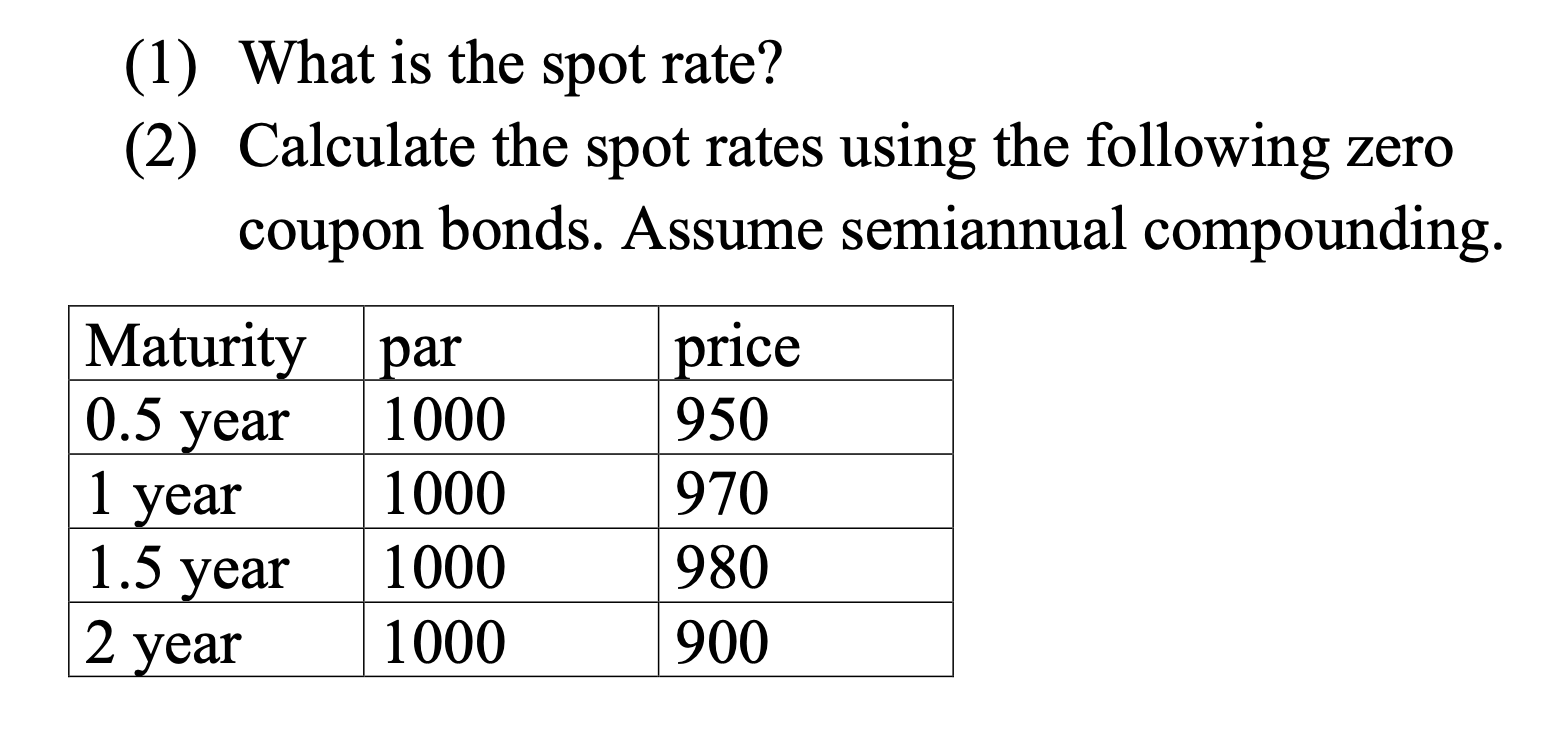

Par Rate To Spot Rate Formula A par yield is the coupon rate at which bond prices are zero A par yield curve represents bonds that are trading at par In other words the par yield curve is a

How do you calculate the 5th year spot rate when given the following information 1 year Par rate 2 5 Spot rate 2 5 2 year Par rate 2 99 Spot Obtaining Par Rates from Spot Rates Since the par curve is a sequence of yields to maturity and each bond is priced at par value the formula to obtain par rates is

Par Rate To Spot Rate Formula

Par Rate To Spot Rate Formula

https://i.ytimg.com/vi/iJw9UByHX1s/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLD02DUA3rZR4_RdbrmjhtZSslPZdQ

Spot Rates Forward Rates Exam FM Financial Mathematics Lesson 30

https://i.ytimg.com/vi/JrRyLAnk_04/maxresdefault.jpg

Daily Treasury Par Yield Curve Rates 29 Dec 2022 Actuarial News

https://www.actuarial.news/wp-content/uploads/2022/12/image-29.png

For swap rate first compute the 6 months 180 days discount rate d180 as above and then use the following formula to compute the 1 year 360 days discount factor d360 In the formula a is the end future date for example five years and b is the closer future date for example three years based on the spot rate curve

Bootstrapping spot rates is a forward substitution method that allows investors to determine zero coupon rates using the par yield curve The par curve shows the The formula for the par rate is P V t 1 n C 1 r p a r t F 1 r p a r n F Where P V is the present value of the bond s cash flows C is the coupon payment r p a

Download Par Rate To Spot Rate Formula

More picture related to Par Rate To Spot Rate Formula

Understanding Forward Rates InfoComm

https://www.infocomm.ky/wp-content/uploads/2022/10/1666731004.jpeg

Spot Rate Curve PDF Derivative Finance Securities Finance

https://imgv2-2-f.scribdassets.com/img/document/594802753/original/5bd67626d6/1663457142?v=1

Spot Rates

https://i.shgcdn.com/adb0df6f-60b5-4ce1-942b-9c77daa979e2/-/format/auto/-/preview/3000x3000/-/quality/lighter/

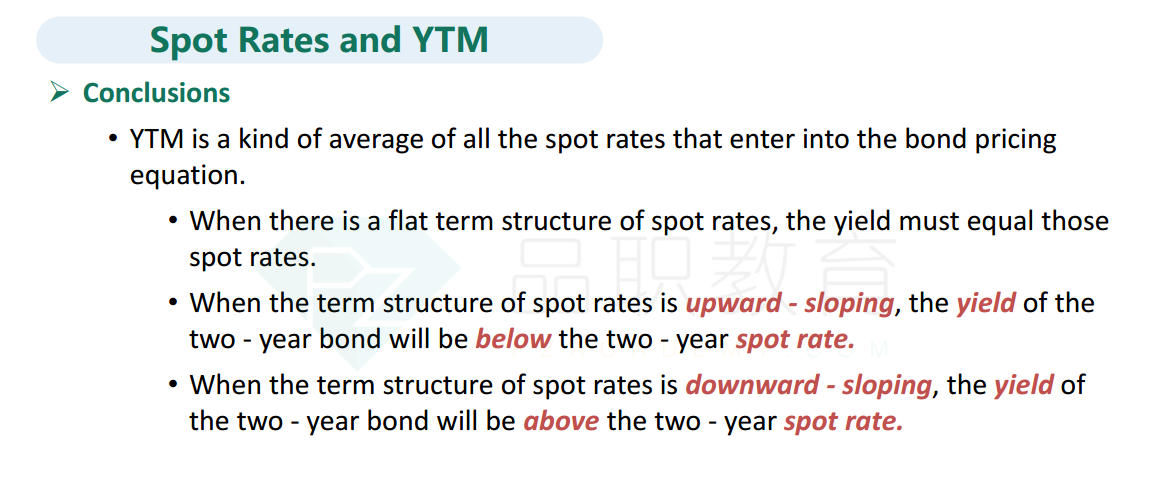

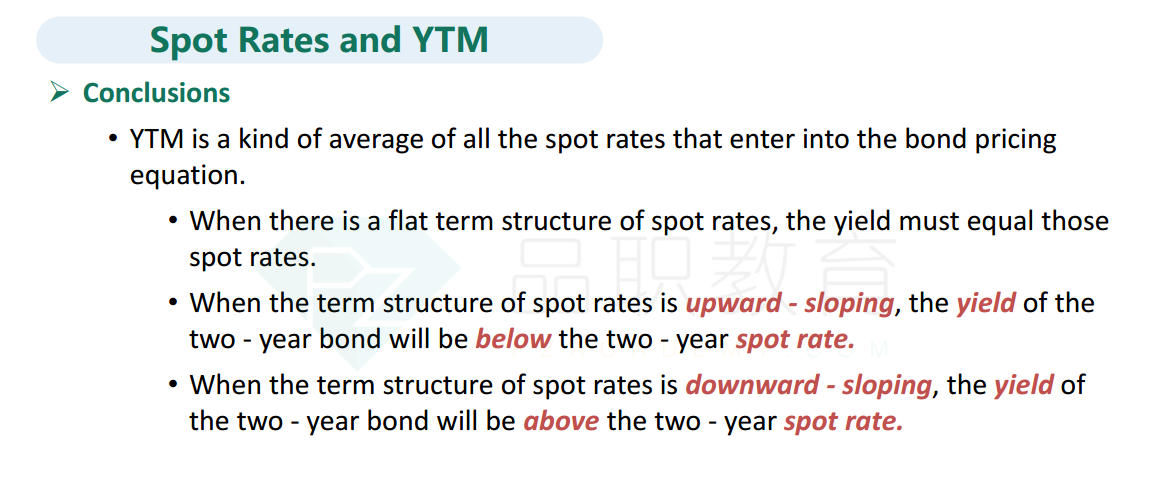

KEY TAKEAWAYS The YTM is the annual rate of return IRR calculated as if the investor will hold the asset until maturity The spot rate is the rate of return earned The spot curve is used to derive two other important yield curves the par curve and the forward curve A par curve involves bond yields for hypothetical benchmark securities

A calculation reference to determine Spot Rates Forward Rates and Yield to Maturity using both Trial error method and EXCEL s Goal Seek functionality Bootstrapping spot rates using the par curve is a very important method that allows investors to derive zero coupon interest rates from the par rate curve Bootstrapping the

Ytm Spot Rate Par Rate CFA ESG FRM CPA

https://resources.pzacademy.com/image/qa/168432715898698.png

Flow Rate Formula R math4nurses

https://preview.redd.it/flow-rate-formula-v0-n7w6w4bemxx91.jpg?width=1080&crop=smart&auto=webp&s=af0616a4528e21bd42fe2a87a621ed40962444ba

https://www.investopedia.com › terms › par-yield-curve.asp

A par yield is the coupon rate at which bond prices are zero A par yield curve represents bonds that are trading at par In other words the par yield curve is a

https://www.analystforum.com › calculate-spot-rate-from-par-rate

How do you calculate the 5th year spot rate when given the following information 1 year Par rate 2 5 Spot rate 2 5 2 year Par rate 2 99 Spot

Solved 1 What Is The Spot Rate 2 Calculate The Spot Chegg

Ytm Spot Rate Par Rate CFA ESG FRM CPA

Formula Forward Rate Invatatiafaceri ro

Figure 17 1 An Example Of A One Factor Spot Rate Process Figure 17 1

How To Calculate Bootstrapping Spot Rates In Excel 2 Examples

Spot Rate By HossiKk On Dribbble

Spot Rate By HossiKk On Dribbble

Interest Rates Formula Accountings Hub

RBA Raises Interest Rates By 25 Basis Points Bringing Cash Rate To 2 85

Figure 17 1 An Example Of A One Factor Spot Rate Process Figure 17 1

Par Rate To Spot Rate Formula - The general formula for the relationship between the two spot rates and the implied forward rate is 1 Z A A 1 IFR A B A B A 1 Z B B Where