Parent Rebate Tax Web 4 sept 2014 nbsp 0183 32 Si votre parent est invalide 224 80 minimum vous pouvez d 233 duire la pension alimentaire de vos revenus imposables ou le rattacher 224 votre foyer fiscal Dans

Web J ai de nouvelles personnes 224 charge Un nouveau n 233 le rattachement d un enfant majeur l accueil d un parent sous votre toit des changements sont intervenus dans vos Web 8 juin 2023 nbsp 0183 32 Imp 244 t sur le revenu Pension alimentaire vers 233 e 224 un parent ou un grand parent d 233 duction V 233 rifi 233 le 08 juin 2023 Direction de l information l 233 gale et

Parent Rebate Tax

Parent Rebate Tax

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Guide On Tax Reliefs For First Time Working Parents Heartland Boy

https://i2.wp.com/heartlandboy.com/wp-content/uploads/Child-Related-Reliefs-1.jpg?ssl=1

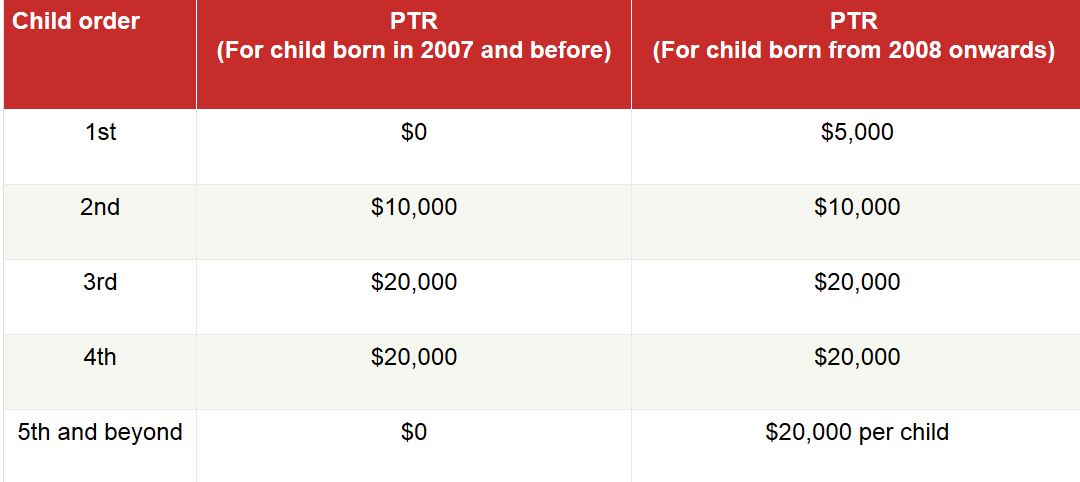

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2016/04/table.jpg?fit=654%2C320&ssl=1

Web 8 juin 2023 nbsp 0183 32 V 233 rifi 233 le 08 juin 2023 Direction de l information l 233 gale et administrative Premi 232 re ministre Vous 234 tes dans le besoin et vous touchez une pension alimentaire Web 28 juil 2023 nbsp 0183 32 Lorsque vous les aidez 224 subvenir aux besoins essentiels de la vie courante vous pouvez d 233 duire les d 233 penses correspondantes nourriture logement

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR Web 28 juin 2021 nbsp 0183 32 The amount of the sole parent rebate notional tax offset for an income year is 1 607 This amount is not indexed and not subject to an income test The offset is

Download Parent Rebate Tax

More picture related to Parent Rebate Tax

10 Things All Working Mums Should Know

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

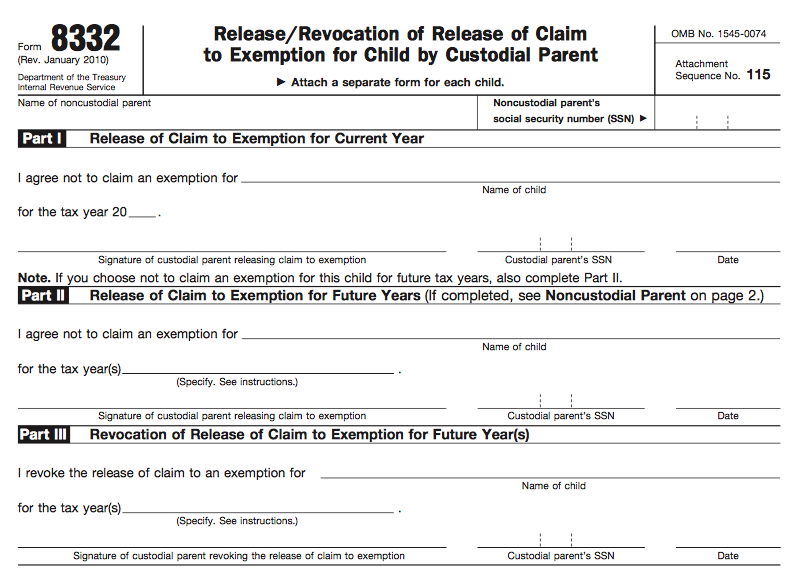

Printable 8332 Form Printable Forms Free Online

https://yourtaxmatterspartner.com/wp-content/uploads/2021/03/f8332.png

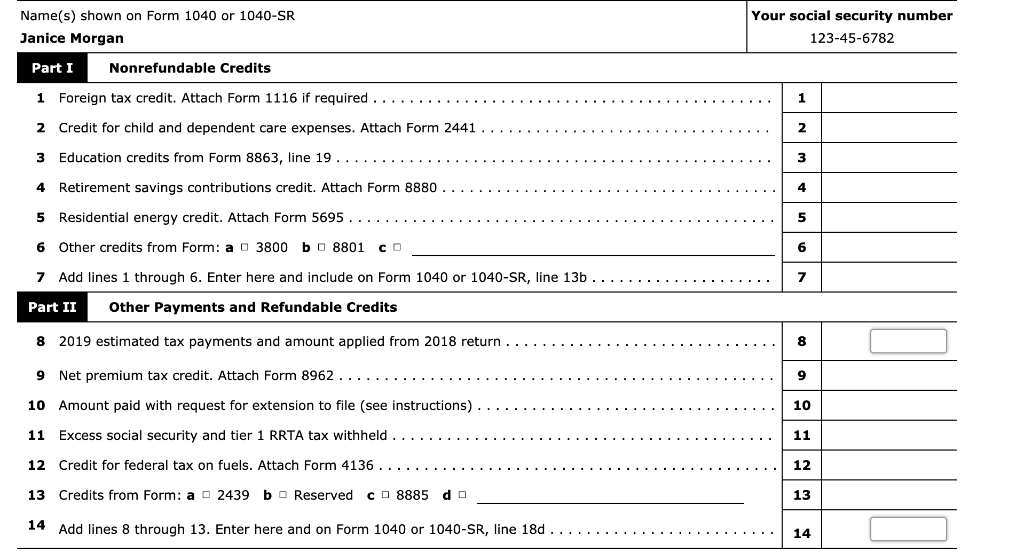

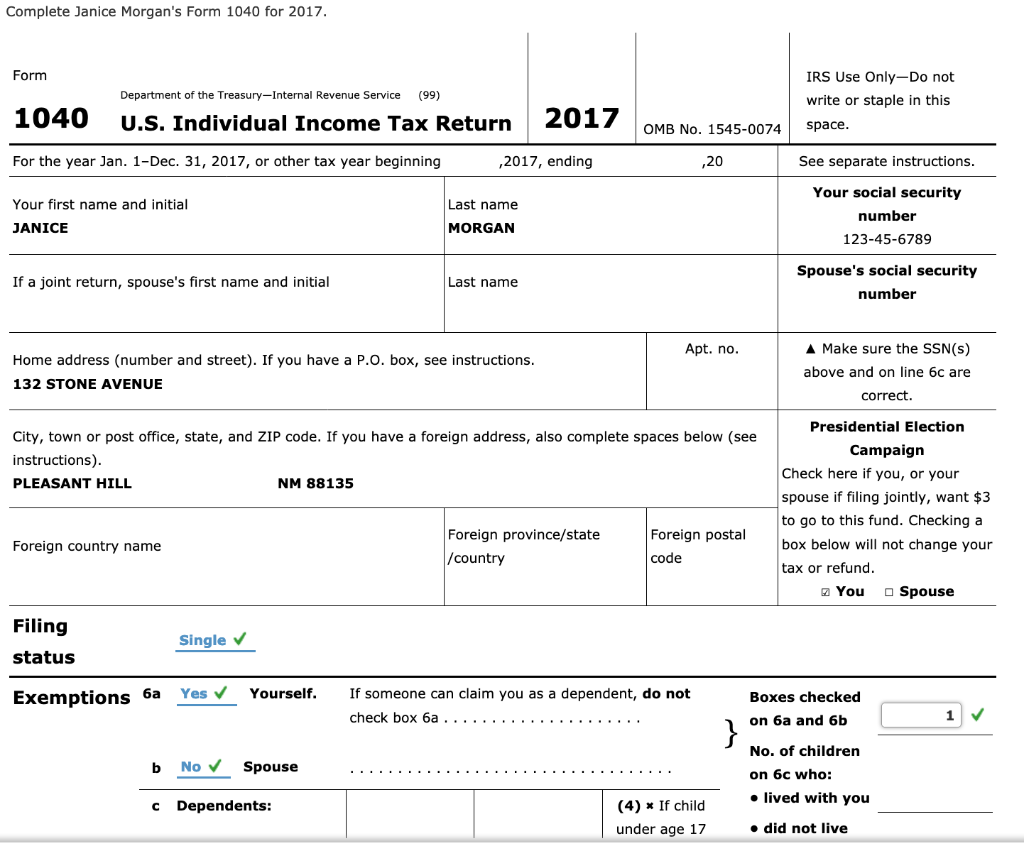

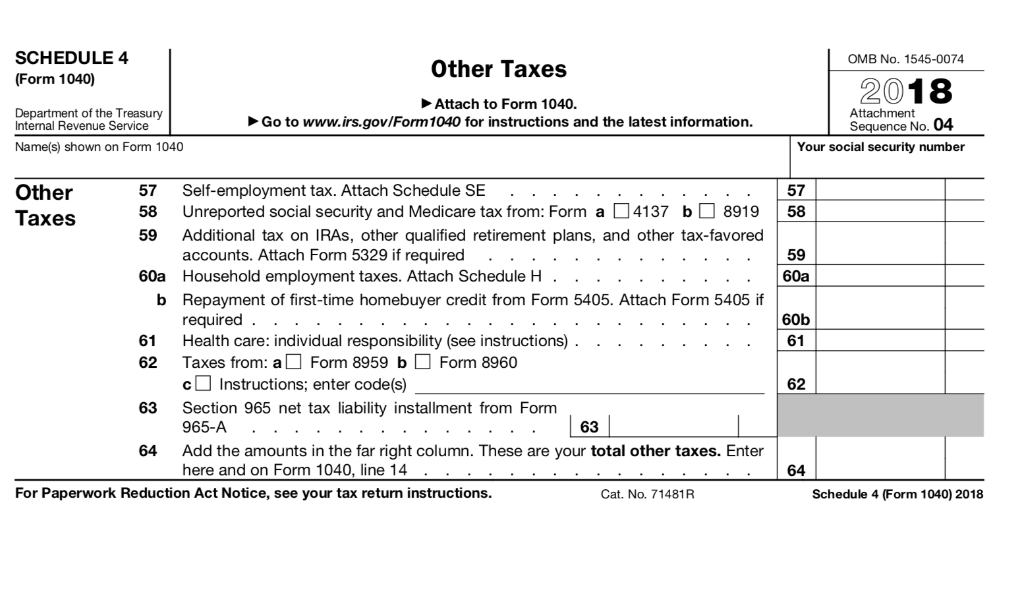

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 for Web Property Tax Rent Rebate Program The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities

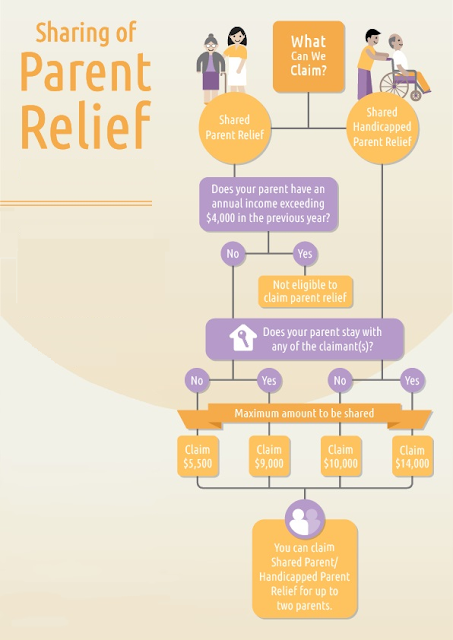

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per Web The total allowable Parent Relief claim will be 9 000 in the Year of Assessment 2023 If Mr Chan did not stay with any of his 3 children in 2022 the total allowable Parent Relief

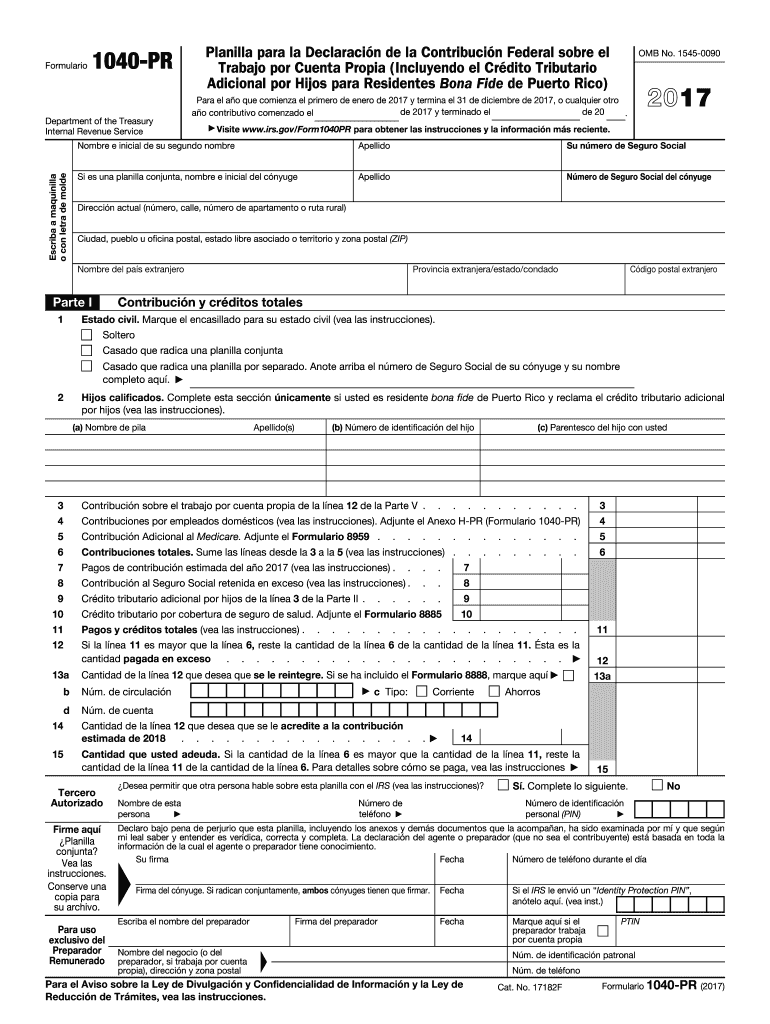

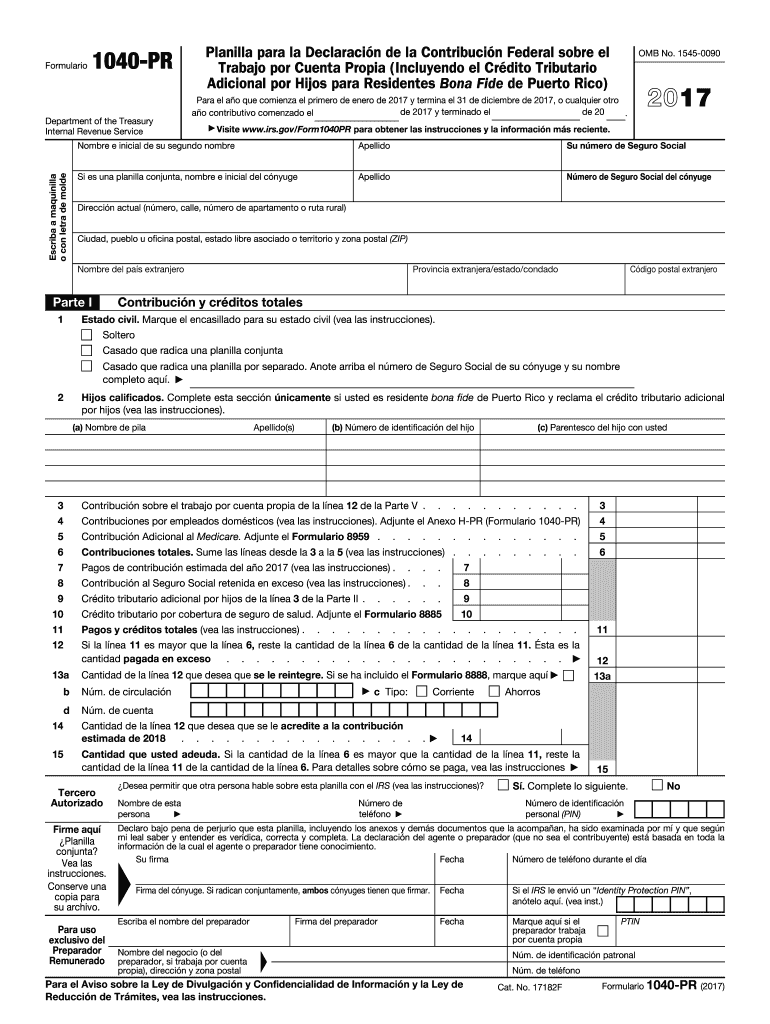

1040pr 2017 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/430/362/430362133/large.png

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/e40/e40704e5-b559-4cc6-9813-0237a8a5e3d1/phpzsNBgK

https://www.lerevenu.com/comment-donner-de-largent-vos-parents-en...

Web 4 sept 2014 nbsp 0183 32 Si votre parent est invalide 224 80 minimum vous pouvez d 233 duire la pension alimentaire de vos revenus imposables ou le rattacher 224 votre foyer fiscal Dans

https://www.impots.gouv.fr/particulier/jai-de-nouvelles-personnes-charge

Web J ai de nouvelles personnes 224 charge Un nouveau n 233 le rattachement d un enfant majeur l accueil d un parent sous votre toit des changements sont intervenus dans vos

Daycare Claim On Taxes Designadvent

1040pr 2017 Form Fill Out Sign Online DocHub

6 Super Sources Of Tax Relief For Parents Irish Tax Rebates

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Military Journal Nm State Rebate 2022 According To The Department

.png?sfvrsn=d0aa2658_3)

IRAS Parent Relief Handicapped Parent Relief 2022

.png?sfvrsn=d0aa2658_3)

IRAS Parent Relief Handicapped Parent Relief 2022

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

Solved Janice Morgan Age 24 Is Single And Has No Chegg

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Parent Rebate Tax - Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR