Parenthood Tax Rebate Amount Parenthood Tax Rebate PTR The PTR is a credit to offset your tax payable You can make a one time claim for PTR in the year following your child s year of birth

The Parenthood Tax Rebate serves as an essential support mechanism for Singaporean families aiming to alleviate the financial burdens associated with raising children By understanding the eligibility criteria and How Much is The Rebate Amount The number of children in the household determines how much of a rebate is given As per the regulations a certain amount will be

Parenthood Tax Rebate Amount

Parenthood Tax Rebate Amount

https://static.cdntap.com/tap-assets-prod/wp-content/uploads/sites/12/2011/12/iStock-1166413714.jpg

Parenthood Tax Rebate And Other Reliefs

http://www.theastuteparent.com/wp-content/uploads/2016/03/p-e1459570743699.jpg

All About The Parenthood Tax Rebate In Singapore 2023

https://www.smartparents.sg/sites/default/files/styles/fbimage/public/2021-07/Mother and newborn baby.jpg?itok=q1-OJ2zD

Provides a one off tax rebate of up to 20 000 per child to eligible parents to encourage them to have more children What are the benefits Who is eligible How to apply Where can I find help Find out how to pay less tax Learn more on tax reliefs deductions rebates for individuals to maximise your tax savings

What Parenthood Tax Rebate PTR Who can claim Parents Married divorced or widowed Singaporeans Eligibility Your child has to be born a Singapore citizen or become one within the 12 months from birth Amount claimed This Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child

Download Parenthood Tax Rebate Amount

More picture related to Parenthood Tax Rebate Amount

Tax Rebate 20 000 Malaysia Feb 22 2022 Johor Bahru JB Malaysia

https://cdn1.npcdn.net/image/16455009486814b66de718d60548210c07af1f078b.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

What Is Parenthood Tax Rebate In 2023 Heads Up Mom

https://headsupmom.com/wp-content/uploads/2022/12/What-is-Parenthood-Tax-Rebate-1024x576.jpg

Proposal To Update Ailing Pa Rent Property Tax Rebate Program Would

https://whyy.org/wp-content/uploads/2023/05/property-tax-rebate-spotlight-pa-2023-05-04.png

You can claim personal reliefs and rebates if you are a Singapore tax resident and have met the qualifying conditions for the respective reliefs rebates in the preceding year You may check Parents can claim a one time amount of 5 000 for their first child 10 000 for their second and 20 000 for their third and each subsequent child Any unutilised balance is automatically carried forward and offsets your future

The Parenthood Tax Rebate PTR awards a one off tax rebate of 5 000 for your first child 10 000 for your second child and 20 000 for your third and subsequent child If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and subsequent

MP Louis Ng Urged The Government To Extend The Parenthood Tax Rebate

https://www.hcsaspin.sg/wp-content/uploads/2022/11/canva_-_parenting.jpeg

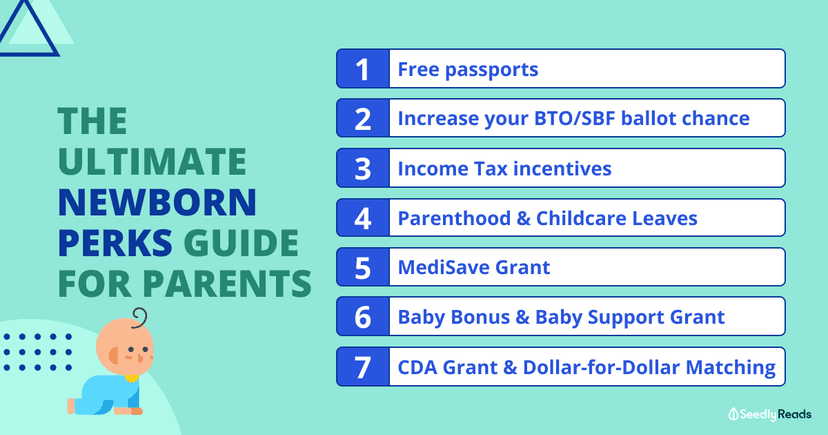

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

https://blog.seedly.sg/_next/image/?url=https:%2F%2Fcdn-blog.seedly.sg%2Fwp-content%2Fuploads%2F2022%2F09%2F27154053%2FBaby-Bonus-Parenthood-Tax-Rebate-More_-Perks-For-Making-Babies.png&w=828&q=75

https://www.iras.gov.sg/taxes/individual-inc…

Parenthood Tax Rebate PTR The PTR is a credit to offset your tax payable You can make a one time claim for PTR in the year following your child s year of birth

https://www.theeducationisthub.com/parent…

The Parenthood Tax Rebate serves as an essential support mechanism for Singaporean families aiming to alleviate the financial burdens associated with raising children By understanding the eligibility criteria and

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

MP Louis Ng Urged The Government To Extend The Parenthood Tax Rebate

IRAS The Parenthood Tax Rebate And Qualifying Child

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

Thousands Of Americans To Receive One time Summer Payment Worth Up To

Thousands Of Americans To Receive One time Summer Payment Worth Up To

Editorial Whitmer Tax Rebate A Hike In Disguise

Form For Renters Rebate RentersRebate

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

State Officials To Provide Update On State Child Tax Rebate

Parenthood Tax Rebate Amount - Parenthood Tax Rebate PTR 1st child 5 000 2nd child 10 000 3rd child beyond 20 000 To encourage couples to have kids parents receive a one time PTR for each