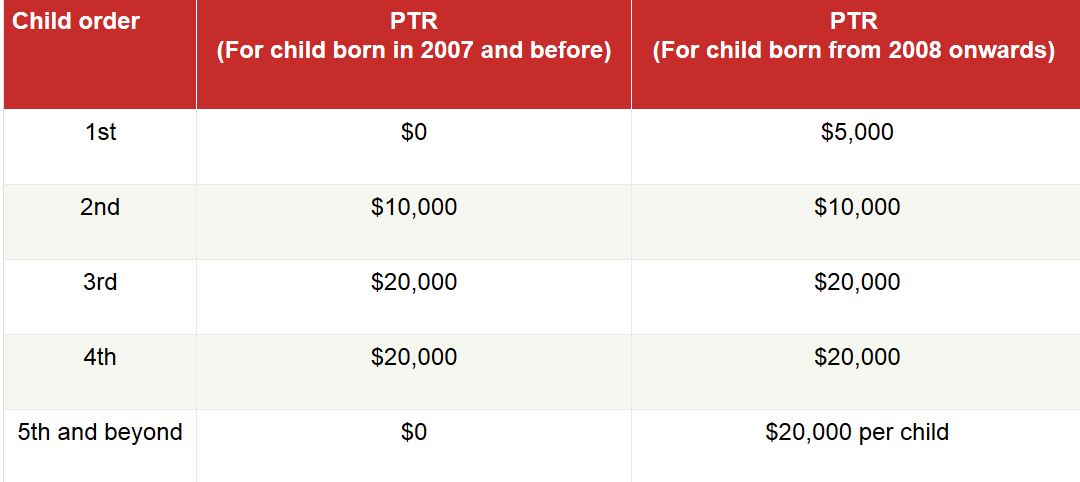

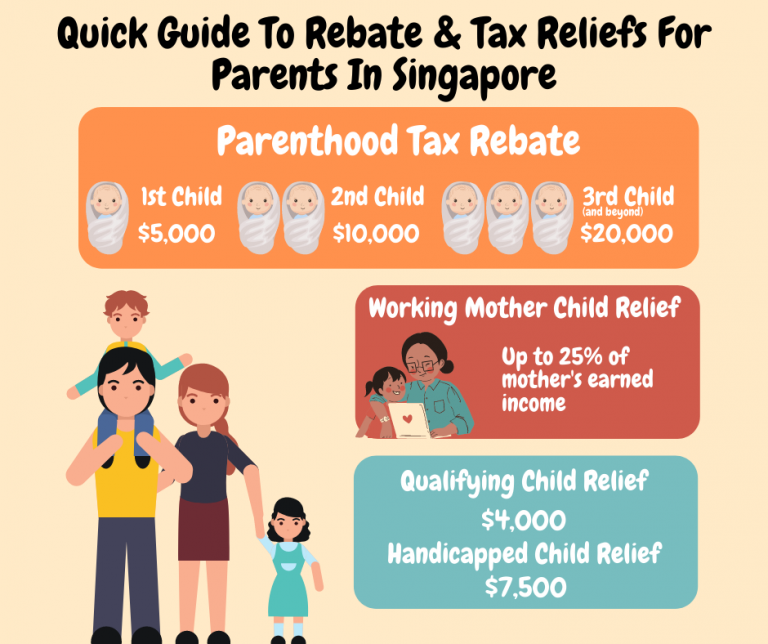

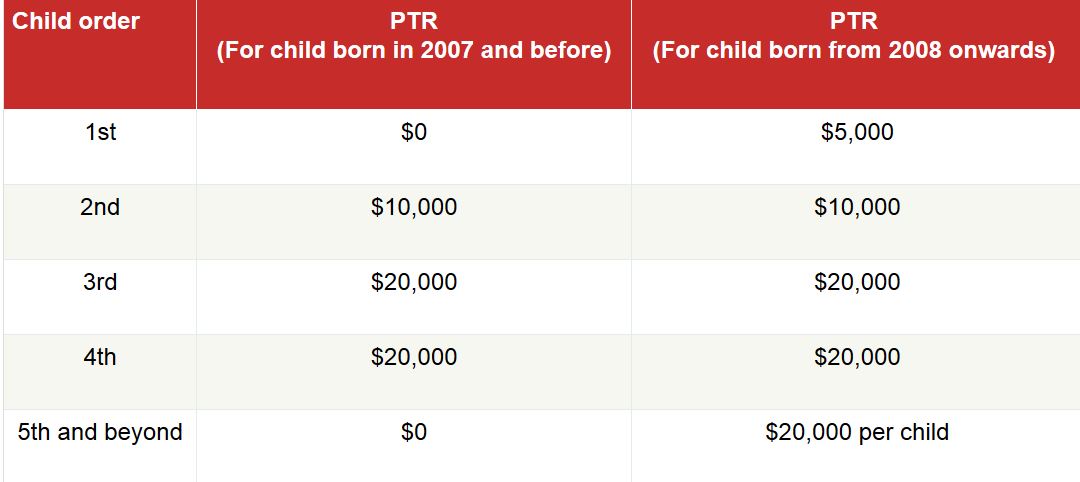

Parenthood Tax Rebate Iras Web Parenthood Tax Rebate PTR The PTR is a credit to offset your tax payable You can make a one time claim for PTR in the year following your child s year of birth Any

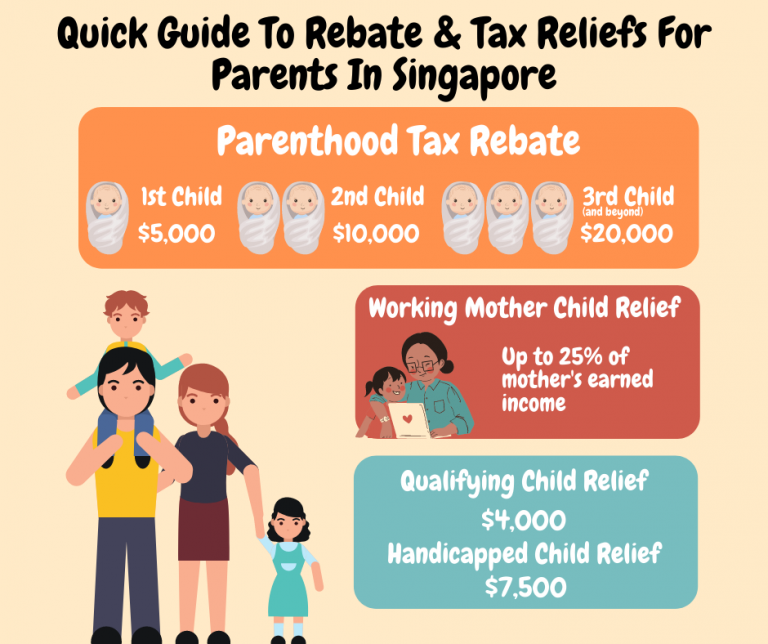

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per Web claim Parenthood Tax Rebate PTR if you are a married divorced or widowed tax resident of Singapore who has a a child born to you and your spouse ex spouse in 2016 and

Parenthood Tax Rebate Iras

Parenthood Tax Rebate Iras

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Parenthood Tax Rebate Guide For Singapore Parents

https://raisingangels.sg/wp-content/uploads/2021/11/PTR2.jpg

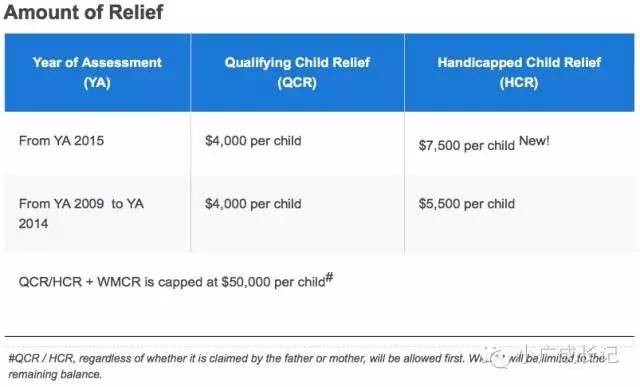

Web When you share the QCR HCR with your spouse ex spouse the total claim amounts must not exceed 4 000 QCR and 7 500 HCR for each child Expand all Example 3 Web Check your Eligibility for Parenthood Tax Rebate PTR only applies to children born to the family adopted by family on or after 1 Jan 2008 Is your child a Singapore citizen at the

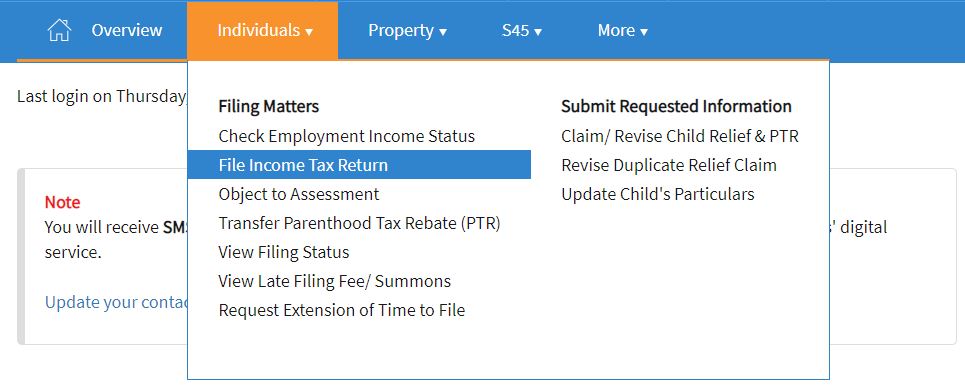

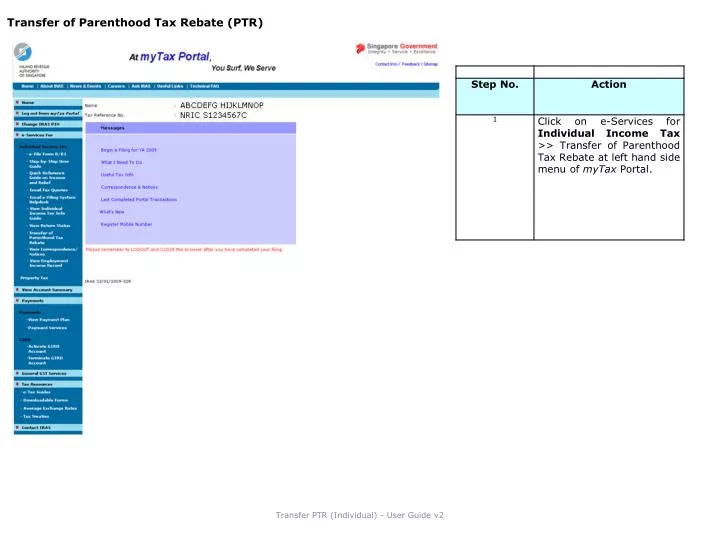

Web 11 nov 2021 nbsp 0183 32 How to claim the Parenthood Tax Rebate When your income tax is due this year simply log into myTax Portal via IRAS at https mytax iras gov sg and under Web Check your Eligibility for Parenthood Tax Rebate PTR only applies to children born to the family adopted by family on or after 1 Jan 2008 Is your child a Singapore citizen at the

Download Parenthood Tax Rebate Iras

More picture related to Parenthood Tax Rebate Iras

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM-1024x450.png

IRAS Tax Savings For Married Couples And Families

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/tax-savings.png?sfvrsn=80db0649_0

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2016/04/table.jpg?fit=654%2C320&ssl=1

Web April 3 2022 183 The Parenthood Tax Rebate and Qualifying Child Relief Handicapped Child Relief are available to all eligible parents Claim these reliefs when filing your taxes to lower your tax bill this tax season Web Parenthood Tax Rebate PTR can be shared between you and your spouse To transfer unutilised PTR to your spouse log in to myTax Portal gt Transfer PTR to transfer the balance to your spouse More

Web Parenthood Tax Rebate Transfer of Excess Qualifying Deductions NSmenRelief for NSman wife or parent of NSman CPF Cash Top Up Relief DONATIONS For YA2017 a Web Parent Tax Rebate by married couples with children who are Singapore Citizens A Singapore Government Agency Websites How to identify Officials website links end with

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-768x644.png

.png?sfvrsn=d0aa2658_3)

IRAS Parent Relief Handicapped Parent Relief 2022

https://www.iras.gov.sg/images/default-source/assets/example-on-sharing-of-parent-relief-(staying).png?sfvrsn=d0aa2658_3

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web Parenthood Tax Rebate PTR The PTR is a credit to offset your tax payable You can make a one time claim for PTR in the year following your child s year of birth Any

https://parentology.sg/complete-guide-to-the-parenthood-tax-rebate-ptr

Web 27 sept 2022 nbsp 0183 32 The lump sum rebate is given to most Singapore tax residents who may be married divorced or widowed and if you are qualified you can claim up to 20 000 per

Parenthood Tax Rebate Rocks SimplyJesMe

Parenthood Tax Rebate Guide For Singapore Parents

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

All About The Parenthood Tax Rebate In Singapore

All About The Parenthood Tax Rebate In Singapore

PPT Transfer Of Parenthood Tax Rebate PTR PowerPoint Presentation

Parenthood Tax Rebate Rocks SimplyJesMe

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

Parenthood Tax Rebate Iras - Web When you share the QCR HCR with your spouse ex spouse the total claim amounts must not exceed 4 000 QCR and 7 500 HCR for each child Expand all Example 3