Parenthood Tax Rebate One Off Web 27 sept 2022 nbsp 0183 32 September 27 2022 A Complete Guide to the Parenthood Tax Rebate PTR Last Updated on June 26 2023 by Parentology What exactly is the Parenthood

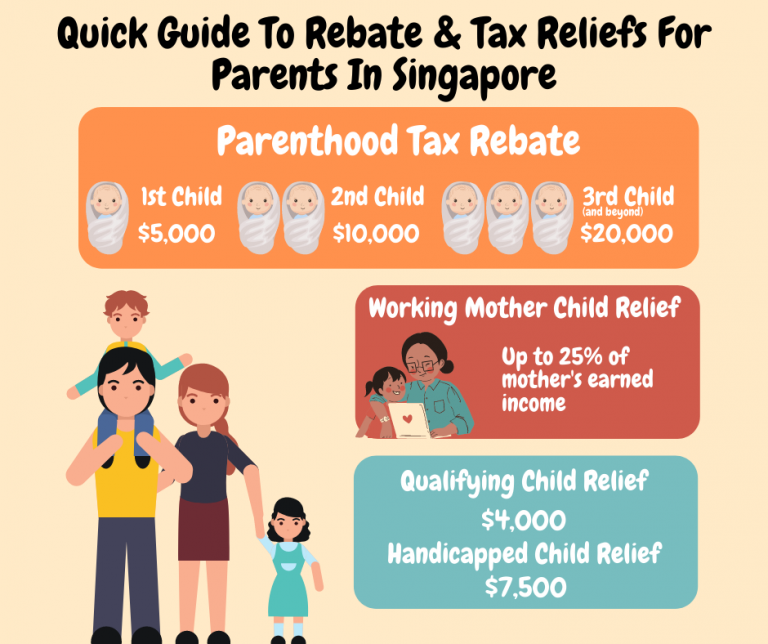

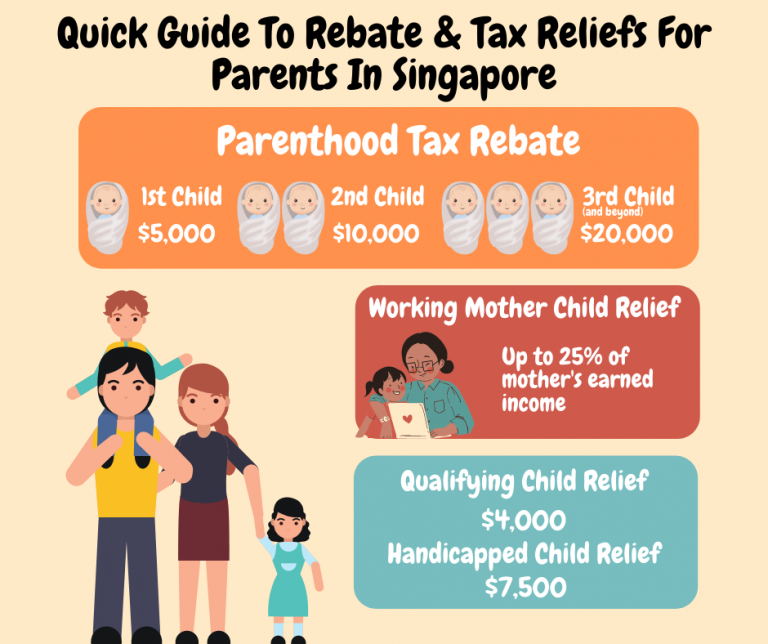

Web 20 of tax payable up to 500 The tax rebate is calculated based on the following The amount of tax payable after double taxation relief and other credits and The amount of Web 3 mai 2023 nbsp 0183 32 Parenthood tax rebate A rebate against either or both parents tax liability of SGD 5 000 SGD 10 000 and SGD 20 000 is available for the first second and each

Parenthood Tax Rebate One Off

Parenthood Tax Rebate One Off

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-768x644.png

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/PTR2-696x281.jpg

Web 11 nov 2021 nbsp 0183 32 1st child 5 000 2nd child 10 000 3rd subsequent child 20 000 If your child was born before 1 Jan 2008 you will not qualify for the 1st child rebate nor the Web 26 juin 2020 nbsp 0183 32 It is a one off claim you can only make the year after your kid is born Usually the tax deduction ranges from 5 000 to 20 000 depending on the child s birth order It can also be split between parents

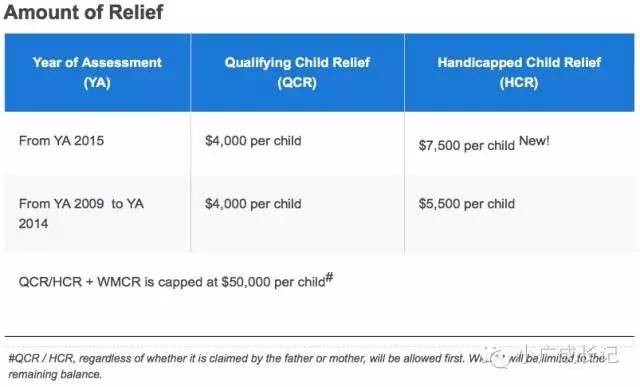

Web Taxes Individual Income Tax Basics of Individual Income Tax Tax reliefs rebates and deductions Qualifying Child Relief QCR Handicapped Child Relief HCR Qualifying Web 1st child 15 of mother s earned income 2nd child 20 of mother s earned income 3rd and each subsequent child 25 of mother s earned income Cumulative WMCR

Download Parenthood Tax Rebate One Off

More picture related to Parenthood Tax Rebate One Off

https://www.xinjiapo.news/image/a767a095880f5a7e35fa41114c0aff7d173d1296.jpeg

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

https://financialhorse.com/wp-content/uploads/2022/01/maternity-leave-1024x708.jpg

Parenthood Pays Off Singapore s Tax Rebate For Families

https://static.cdntap.com/tap-assets-prod/wp-content/uploads/sites/12/2011/12/iStock-1166413714.jpg

Web You can claim for tax rebates from the government as working parents under the Parenthood Tax Rebate PTR and Working Mother s Child Relief This benefit is available to adoptive parents as well Transferring Web How Much Can You Save Enjoying Substantial Savings The Parenthood Tax Rebate allows parents to save significantly on their taxes For your first child you ll receive a 5 000 offset The rebate increases to 10 000 for

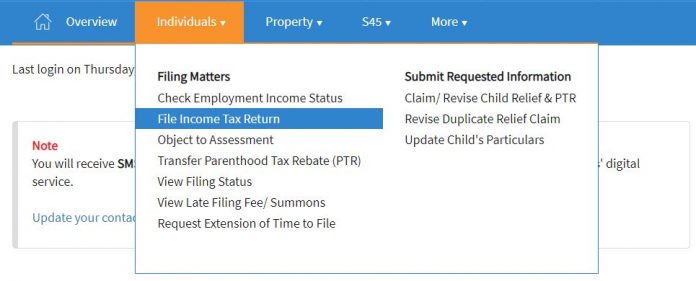

Web The PTR can be offset against either or your spouse s income tax If the income tax payable for that YA is less than the rebate any unutilised rebate will be carried forward to Web Here s How Singapore s Parenthood Tax Rebate 2023 Can Save You up to 50 000 Tax season in Singapore is here Did you know that you re entitled to a range of parenting

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

https://cdn-blog.seedly.sg/wp-content/uploads/2022/09/27154053/Baby-Bonus-Parenthood-Tax-Rebate-More_-Perks-For-Making-Babies-1024x538.png

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=348504300640971

https://parentology.sg/complete-guide-to-the-parenthood-tax-rebate-ptr

Web 27 sept 2022 nbsp 0183 32 September 27 2022 A Complete Guide to the Parenthood Tax Rebate PTR Last Updated on June 26 2023 by Parentology What exactly is the Parenthood

https://www.iras.gov.sg/.../tax-reliefs/personal-tax-rebate

Web 20 of tax payable up to 500 The tax rebate is calculated based on the following The amount of tax payable after double taxation relief and other credits and The amount of

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

Discover The Joy Of Being A Parent With Singapore s Parenthood Tax Rebate

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Parenthood Tax Rebate Guide For Singapore Parents

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Parenthood Tax Rebate Singapore 2021 How Much You Can Claim

Index Of wp content uploads 2022 03

IFG 3 PAP Nee Soon

Parenthood Tax Rebate One Off - Web 26 juin 2020 nbsp 0183 32 It is a one off claim you can only make the year after your kid is born Usually the tax deduction ranges from 5 000 to 20 000 depending on the child s birth order It can also be split between parents