Parenthood Tax Rebate Singapore Pr Web 27 sept 2022 nbsp 0183 32 Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child

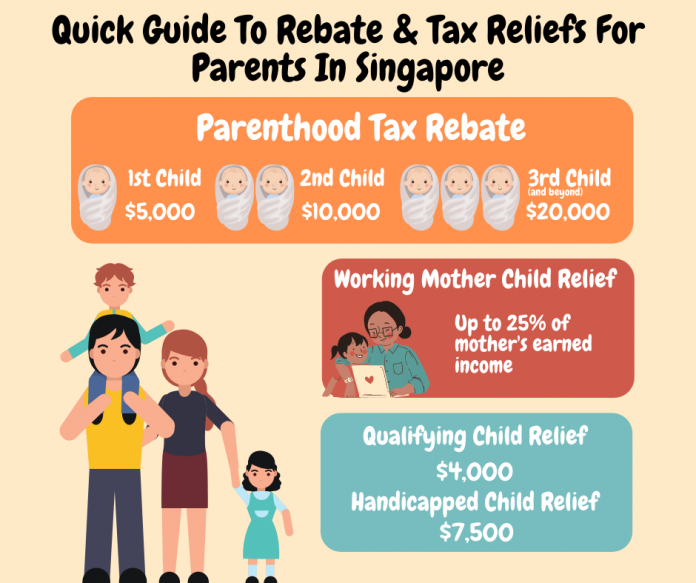

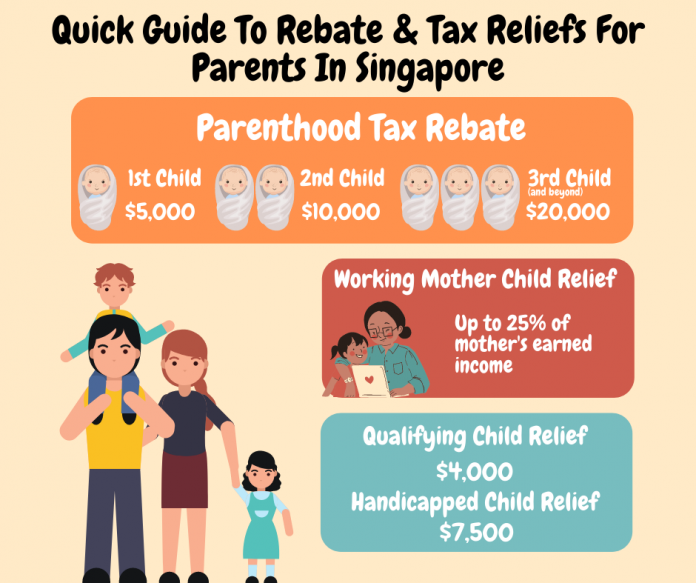

Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third Web Here s How Singapore s Parenthood Tax Rebate 2023 Can Save You up to 50 000 Tax season in Singapore is here Did you know that you re entitled to a range of parenting

Parenthood Tax Rebate Singapore Pr

Parenthood Tax Rebate Singapore Pr

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-696x583.png

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/PTR2-696x281.jpg

All About The Parenthood Tax Rebate In Singapore

https://www.smartparents.sg/sites/default/files/sites/default/files/inline-images/Parenthood Rebate Claims_0.JPG

Web When you share the QCR HCR with your spouse ex spouse the total claim amounts must not exceed 4 000 QCR and 7 500 HCR for each child Expand all Example 3 Web Parenthood Tax Rebate PTR You and your spouse may share the rebate based on an apportionment agreed by both of you Tax deductions Deductions on rental expenses

Web Enlisted below are 6 types of tax incentives for parenthood specifically which are applicable only to citizens and do not extend to PR s or foreigners Parenthood Tax Web You are eligible for PTR of 20 000 if you are a Singapore tax resident in the year your child was adopted This PTR may be shared with your spouse if he she is also a

Download Parenthood Tax Rebate Singapore Pr

More picture related to Parenthood Tax Rebate Singapore Pr

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM.png

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2781915438586529

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

https://financialhorse.com/wp-content/uploads/2022/01/maternity-leave-1024x708.jpg

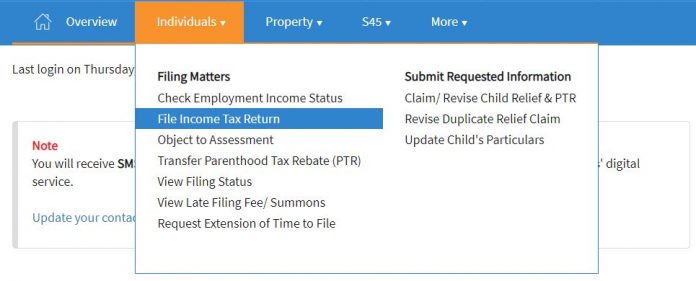

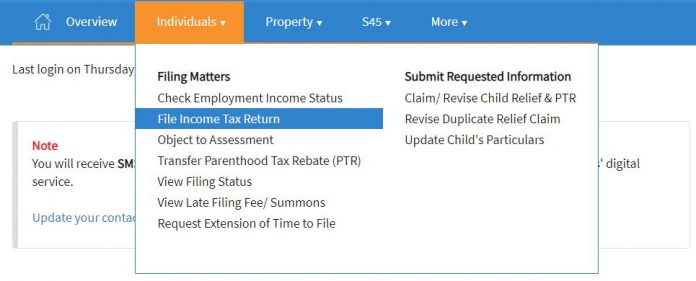

Web Parenthood Tax Rebate PTR is provided to tax residents to encourage them to have more children by easing up their expenses In order to qualify you must be a Singapore tax resident who is married divorced or Web 27 avr 2018 nbsp 0183 32 Parenthood Tax Rebate PTR The Parenthood Tax Rebate PTR allows married divorced or widowed tax resident parents to claim rebates of up to SGD 20 000 per child To qualify for the PTR a

Web 11 nov 2021 nbsp 0183 32 The Parenthood Tax Rebate PTR is easily the most available tax rebate for most parents in Singapore The PTR was implemented to encourage families to have Web claim Parenthood Tax Rebate PTR if you are a married divorced or widowed tax resident of Singapore who has a a child born to you and your spouse ex spouse in 2016 and

Discover The Joy Of Being A Parent With Singapore s Parenthood Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cCarR.img?w=670&h=445&m=4&q=84

Parenthood Pays Off Singapore s Tax Rebate For Families

https://static.cdntap.com/tap-assets-prod/wp-content/uploads/sites/12/2011/12/iStock-1166413714.jpg

https://parentology.sg/complete-guide-to-the-parenthood-tax-rebate-ptr

Web 27 sept 2022 nbsp 0183 32 Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

Discover The Joy Of Being A Parent With Singapore s Parenthood Tax Rebate

Parenthood Tax Rebate Singapore 2021 How Much You Can Claim

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Parenthood Pays Off Singapore s Tax Rebate For Families

Parenthood Pays Off Singapore s Tax Rebate For Families

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

So We Asked A Sandwich class S porean The Million dollar Question Is

Parenthood Tax Rebate Singapore Pr - Web Parenthood Tax Rebate PTR You and your spouse may share the rebate based on an apportionment agreed by both of you Tax deductions Deductions on rental expenses