Parenthood Tax Rebate Yearly Web 27 sept 2022 nbsp 0183 32 September 27 2022 A Complete Guide to the Parenthood Tax Rebate PTR Last Updated on June 26 2023 by Parentology What exactly is the Parenthood

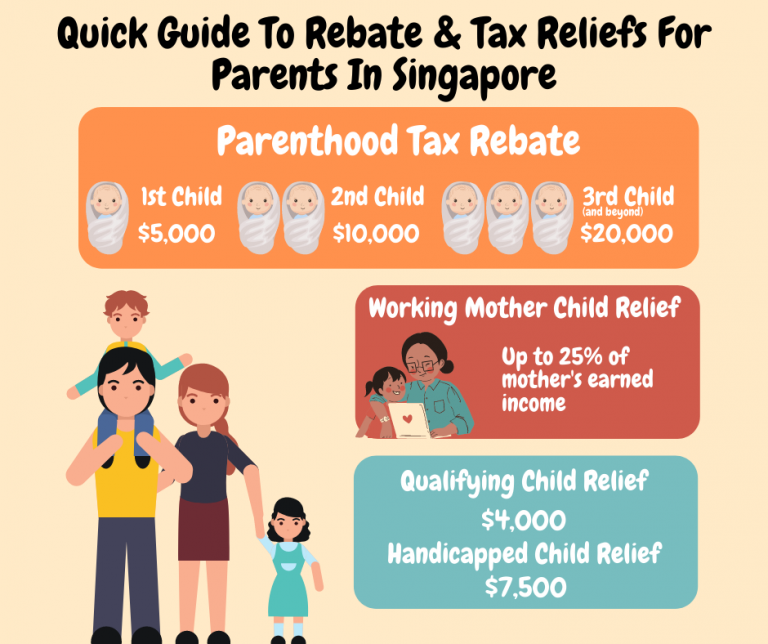

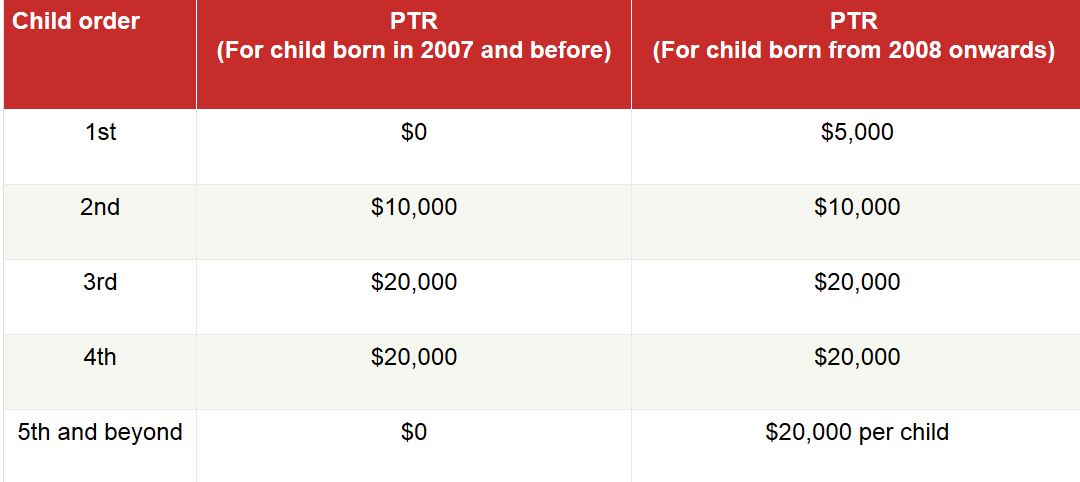

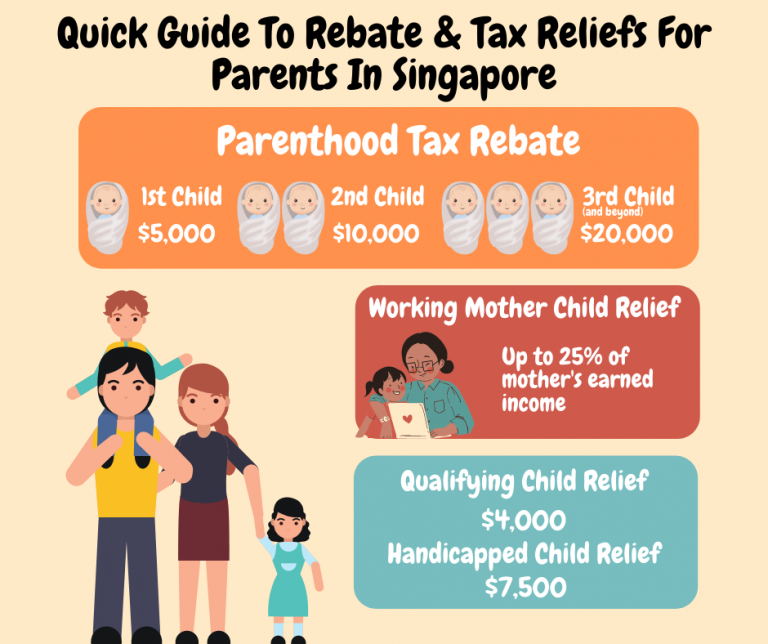

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per Web 11 nov 2021 nbsp 0183 32 The Parenthood Tax Rebate PTR is easily the most available tax rebate for most parents in Singapore The PTR was implemented to encourage families to have

Parenthood Tax Rebate Yearly

Parenthood Tax Rebate Yearly

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Parenthood Tax Rebate Guide For Singapore Parents

https://www.raisingangels.sg/wp-content/uploads/2021/11/Untitled-design-7-1-768x644.png

Parenthood Tax Rebate Guide For Singapore Parents

https://raisingangels.sg/wp-content/uploads/2021/11/PTR2.jpg

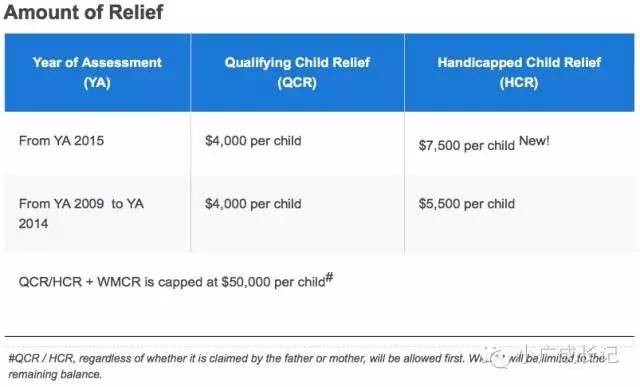

Web You may claim Qualifying Child Relief QCR Handicapped Child Relief HCR for the Year of Assessment 2023 if you are a parent maintaining an unmarried child who satisfies all Web You can claim Parenthood Tax Rebate PTR if you are a married divorced or widowed tax resident of Singapore who has a a child born to you and your spouse ex spouse in

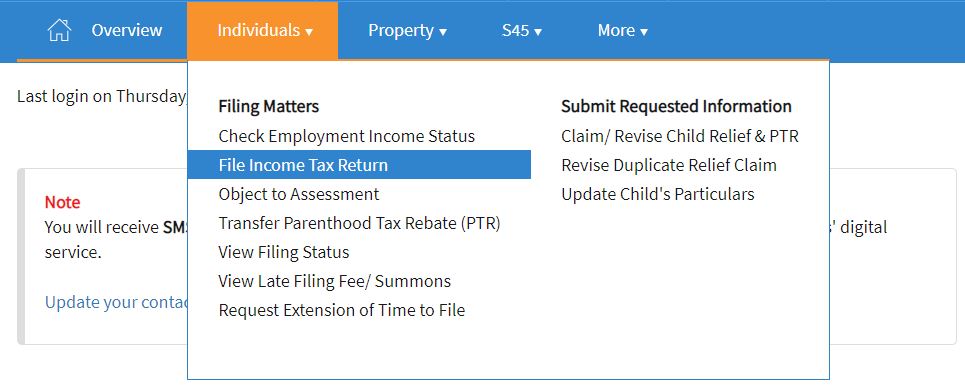

Web 3 mai 2023 nbsp 0183 32 La r 233 duction d imp 244 t est 233 gale 224 25 du montant des versements effectu 233 s des biens ou des droits attribu 233 s retenus dans la limite de 30 500 pour l ensemble de Web Transfer Parenthood Tax Rebate PTR Transfer the credit balance from your Parenthood Tax Rebate PTR account to your spouse s account Your tax reference number e g

Download Parenthood Tax Rebate Yearly

More picture related to Parenthood Tax Rebate Yearly

https://www.xinjiapo.news/image/a767a095880f5a7e35fa41114c0aff7d173d1296.jpeg

10 Things All Working Mums Should Know

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

IRAS Parenthood Tax Rebate PTR Can Be Shared Between Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2781915438586529

Web The Parenthood Tax Rebate PTR is a one time tax abatement that can be claimed in the year following your child s birth Each qualifying child entitles you to a rebate of up to Web 3 mai 2023 nbsp 0183 32 Last reviewed 03 May 2023 Parenthood tax rebate A rebate against either or both parents tax liability of SGD 5 000 SGD 10 000 and SGD 20 000 is available for

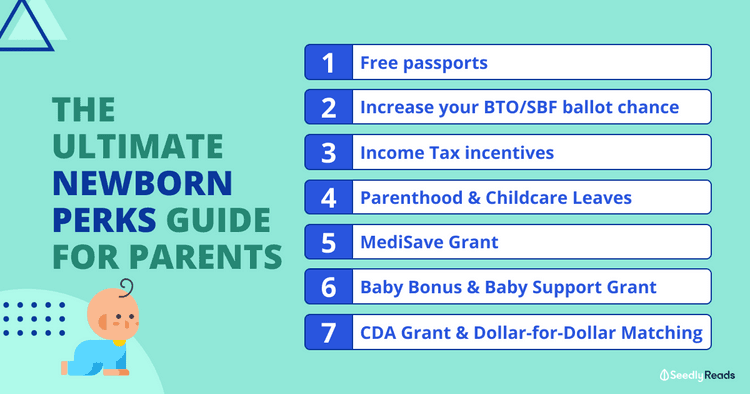

Web The AW subject to compulsory CPF contribution is capped at 36 000 Employment period 1 Jan 2023 to 31 Dec 2023 Ordinary Wage OW Additional Wage AW CPF Relief Web Here s How Singapore s Parenthood Tax Rebate 2023 Can Save You up to 50 000 Tax season in Singapore is here Did you know that you re entitled to a range of parenting

Index Of wp content uploads 2022 03

https://www.theastuteparent.com/wp-content/uploads/2022/03/tax-savings.png

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2016/04/table.jpg?fit=654%2C320&ssl=1

https://parentology.sg/complete-guide-to-the-parenthood-tax-rebate-ptr

Web 27 sept 2022 nbsp 0183 32 September 27 2022 A Complete Guide to the Parenthood Tax Rebate PTR Last Updated on June 26 2023 by Parentology What exactly is the Parenthood

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per

Parenthood Tax Rebate Rocks SimplyJesMe

Index Of wp content uploads 2022 03

Baby Bonus Child Development Account CDA Parenthood Tax Rebate

All About The Parenthood Tax Rebate In Singapore

Parenthood Tax Rebate Rocks SimplyJesMe

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

Baby Bonus Parenthood Tax Rebate More Perks For Making Babies

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

.png?sfvrsn=d0aa2658_3)

IRAS Parent Relief Handicapped Parent Relief 2022

Everything You Need To Know If You Are Expecting A Child In 2019

Parenthood Tax Rebate Yearly - Web The Parenthood Tax Rebate and Qualifying Child Relief Handicapped Child Relief are available to all eligible parents Claim these reliefs when filing your taxes to lower your