Parents Medical Bills For Tax Exemption India Your senior citizen parents medical bills can help you save tax Here s how By Preeti Motiani ET Online Last Updated Jun 16 2023 12 58 00 PM IST Synopsis

Frequently Asked Questions What is Section 80D of the Income Tax Act Section 80D of the Income Tax Act 1961 was Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of

Parents Medical Bills For Tax Exemption India

Parents Medical Bills For Tax Exemption India

https://www.taxscan.in/wp-content/uploads/2022/04/Abhi.jpg

Medical Bills Tax Exemption For AY 2019 20 Rules How To Claim

https://www.paisabazaar.com/wp-content/uploads/2017/06/img3.jpg

Can My Work related Phone Bills And WiFi Bills Help Me Reduce Taxes

https://life.futuregenerali.in/media/qptadiyc/reduce-taxes-with-phone-and-wifi-bills.jpg

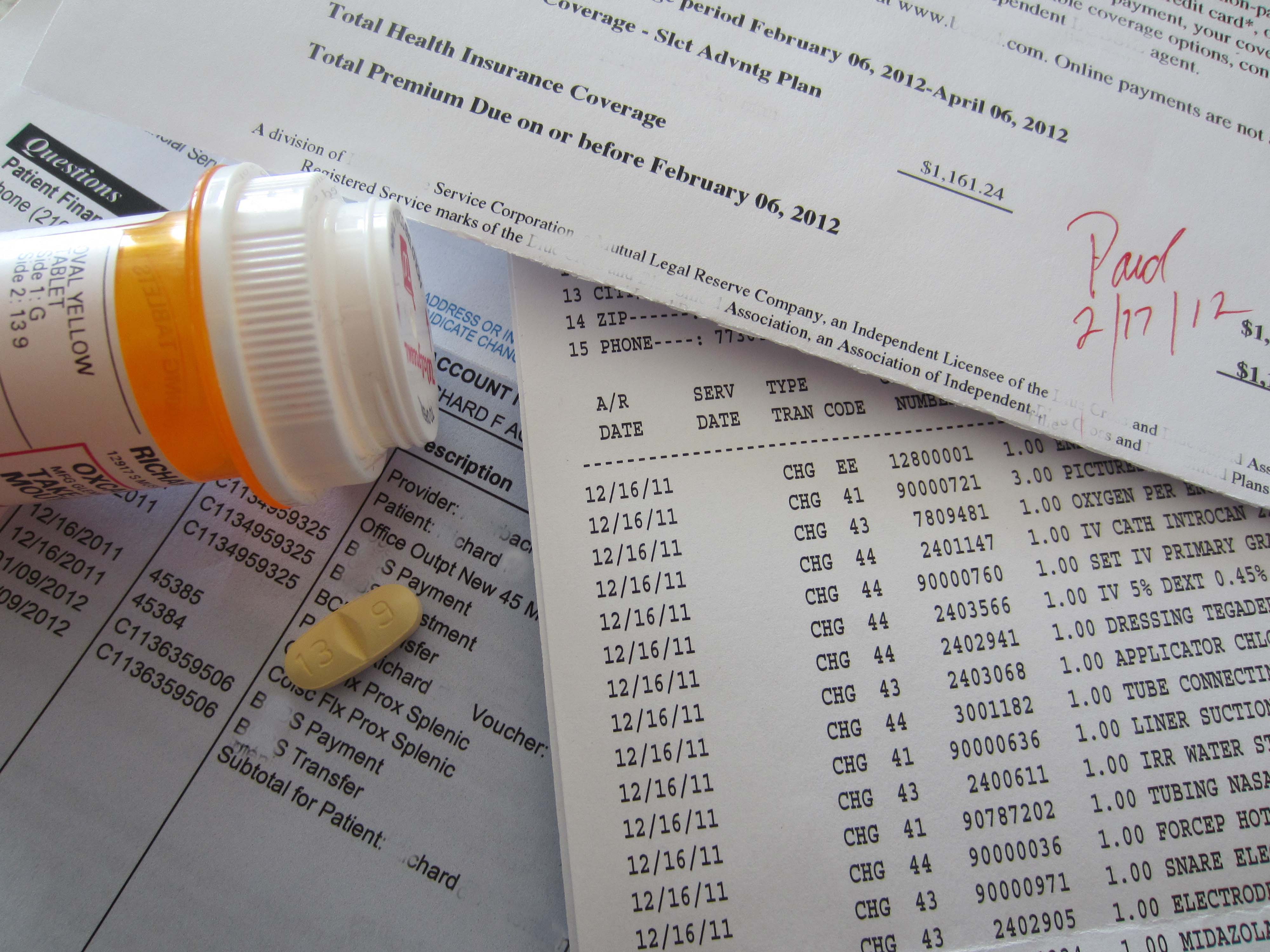

Don t worry did you know even the medical bills of your senior citizen parents can save your taxes Let s get to know how this works Medical expenditure Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been

Section 80D of the Income Tax Act 1961 provides tax deductions for medical expenditure made for the self and for his family members up to Rs 50 000 You can claim deduction under this section Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If

Download Parents Medical Bills For Tax Exemption India

More picture related to Parents Medical Bills For Tax Exemption India

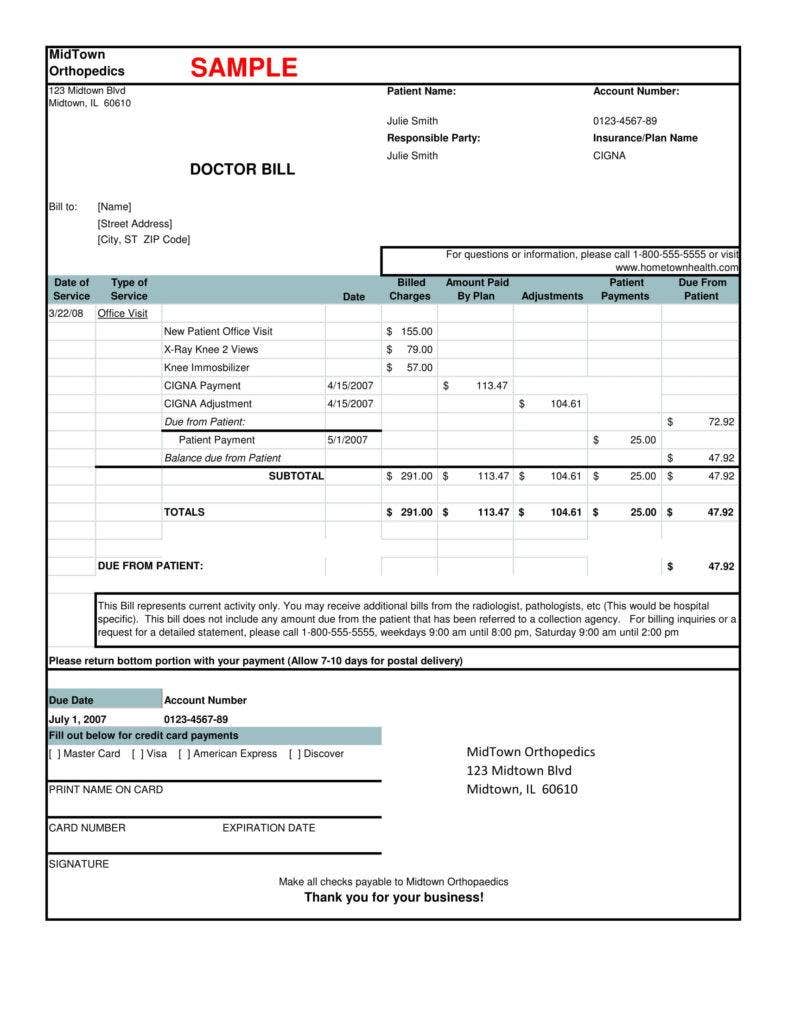

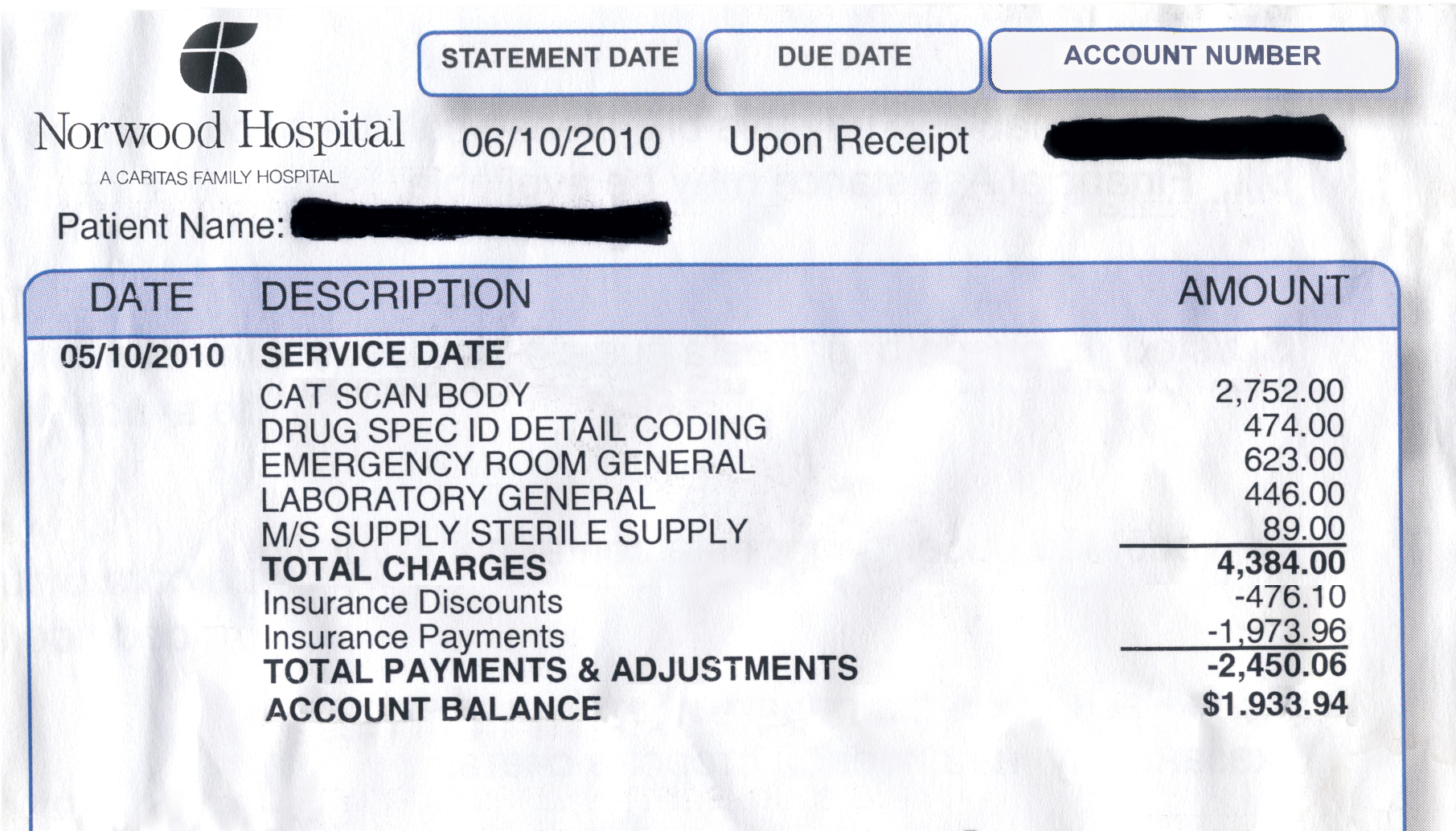

Sample Medical Bill Receipt Invoice Template

https://1.bp.blogspot.com/-MDdgYM0imQY/YH7cixrUfSI/AAAAAAAGqRg/C-kMYr9cjcEAPoeBhia21Vq5puWbhZdWACLcBGAsYHQ/s16000/hospitality-hospitality-hospital-bill-sample.jpg

Corporate Tax Exemption For Companies And Startup India In Budget 2020

https://i.pinimg.com/originals/80/ec/8f/80ec8f44c6e24f28d449224cd7996b8f.png

US Lawmakers New Legislation Seeking Tax Exemption On Small Crypto

https://www.thecoinrepublic.com/wp-content/uploads/2022/07/US-Senators-Introduce-Bill-to-Make-Crypto-Purchases-Less-Than-50-Tax-Free-1536x864.jpg

Under the Section 80D of the Income Tax Act expenditure amounting to 50 000 on health condition of parents who fall in the senior citizen category can be claimed as a tax rebate The A deduction of INR 25 000 per annum can be claimed for medical insurance done for self spouse and children and INR 25000 for parents Whether dependent or not You need to get a medical

The tax provision to medical expenses deduction in income tax for parents who are senior citizens came as an amendment in the Budget 2018 under Section 80D An important Team Acko Jan 16 2024 As senior citizens navigate their golden years managing medical expenses becomes a priority The Indian Income Tax Act provides valuable provisions

Do You Have To Pay Your Medical Bills From A Personal Injury Settlement

https://www.injurylawrights.com/wp-content/uploads/2020/04/medical-bill-from-personal-injury-settlement.jpg

Healthcare A Bitter Pill Read And Do Something About It Image With

http://www.vision4scrm.com/wp-content/uploads/2013/02/Medical-Bills-Photo-Small.jpg

https://m.economictimes.com/wealth/tax/your-senior...

Your senior citizen parents medical bills can help you save tax Here s how By Preeti Motiani ET Online Last Updated Jun 16 2023 12 58 00 PM IST Synopsis

https://tax2win.in/guide/section-80d-deduction...

Frequently Asked Questions What is Section 80D of the Income Tax Act Section 80D of the Income Tax Act 1961 was

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Do You Have To Pay Your Medical Bills From A Personal Injury Settlement

Anatomy Of A Medical Bill

Negotiating Unpaid Medical Bills What Are Illegal Discounts Texas

Will Unpaid Medical Bills From My Accident Hurt My Credit Score

Submission Of Medical Bills For Reimbursement Claim Certain

Submission Of Medical Bills For Reimbursement Claim Certain

Fundraiser By Rabia Shahid Medical Bills Support

Gnr8tr Online Mobile Bill Receipts

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Parents Medical Bills For Tax Exemption India - Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If