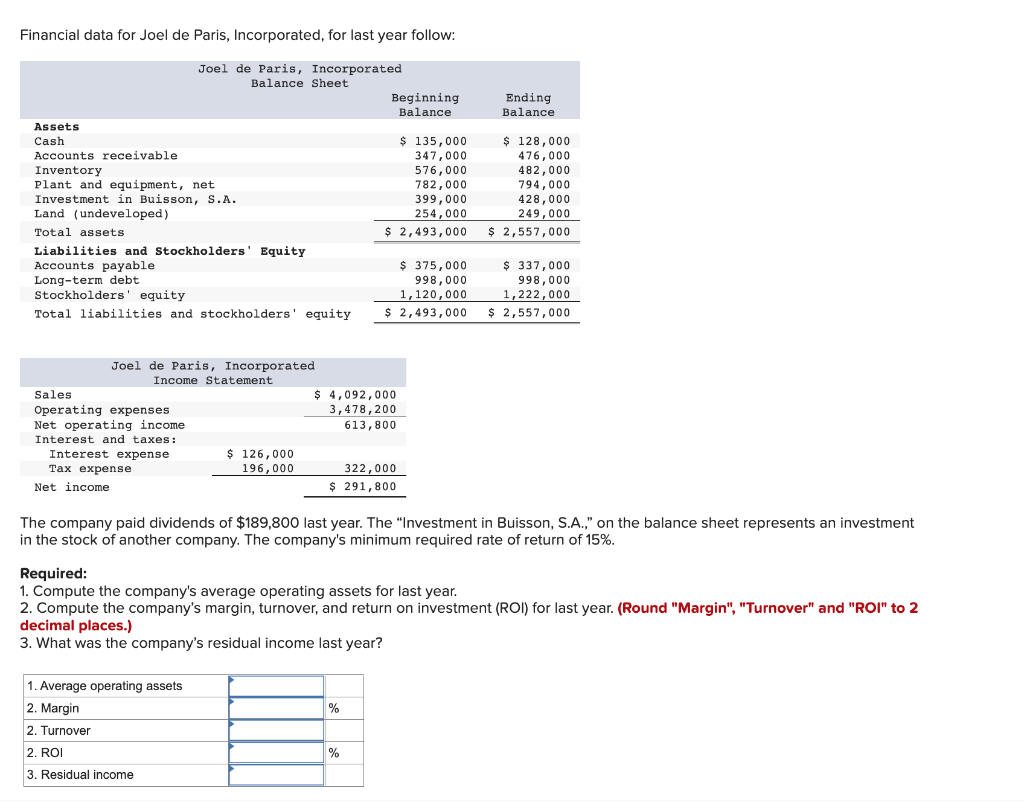

Paris Sales Tax Rate Here s a calculator for the VAT in France that will indicate the amount of payable taxes based on the selling price and the type of rate If you click on the other tab you can also reverse the calculation by inserting the

How much is VAT in France The standard VAT rate in France is 20 It applies to most goods and services The two reduced VAT rates are 10 and 5 5 The super reduced Taxes Tipping In Paris Including The French Sales Tax In this article we explain the VAT in France and how you can get a refund when you depart VAT is the Value Added

Paris Sales Tax Rate

Paris Sales Tax Rate

https://www.allbusinesstemplates.com/thumbs/6e659190-6e21-499f-b500-e7f0a3517f93_1.png

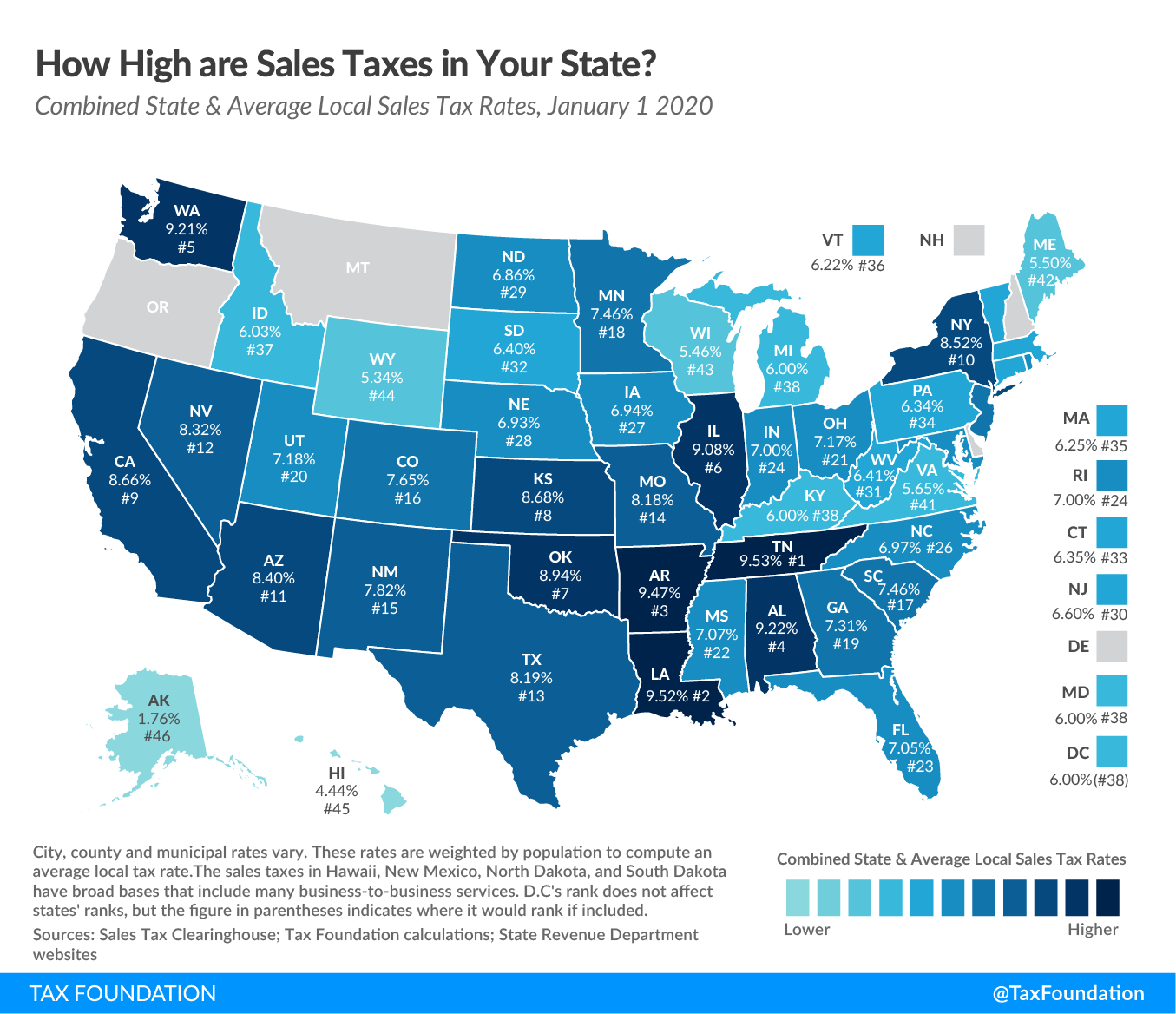

Report Shows Trends Around Sales Tax Rates And Rules CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2021/02/Sales_Tax_Rates_Jan_2020_Tax_Foundation.6022aae4ca07d.png

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales

https://i.ytimg.com/vi/ylWfLX1B9Zo/maxresdefault.jpg

The standard VAT rate in France is 20 on most goods and services a significant amount that when refunded can make a notable difference in the price paid Sales Tax Rate in France is expected to reach 20 00 percent by the end of 2024 according to Trading Economics global macro models and analysts expectations In the long term

In France there are multiple VAT rates ranging from 2 1 to 20 depending on the type of products or services The table below lists the types of VAT rates VAT reduced rates in France s lowest rate of 11 only kicks in at 11 294 so anyone earning below this doesn t pay income tax The top rate of 45 is payable on earnings over 177 107 Non residents pay tax on French

Download Paris Sales Tax Rate

More picture related to Paris Sales Tax Rate

Setup Tax Rates For Invoicing

https://cdn.filestackcontent.com/Mt1PLGTYS5GUUyTCcWv6

Tax App

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100087510464361

Sales Tax Calculations Smartsheet Community

https://aws.smartsheet.com/storageProxy/image/images/u!1!jh9C46ac1vQ!pQjBqe70ryQ!gMFfLd8y2Vf

7 rowsFrench VAT rates and VAT compliance Avalara Whilst France follows the EU rules on VAT compliance it is still free to set its own standard upper VAT rate The only Texas Paris paris Tax jurisdiction breakdown for 2024 What does this sales tax rate breakdown mean Sales tax rates are determined by exact street address The

France currently maintains this 5 5 rate for sales of artworks being imported into the country or being sold by an artist to a gallery A 20 VAT rate only applies in theory to profits made from Paris collects the maximum legal local sales tax The 8 25 sales tax rate in Paris consists of 6 25 Texas state sales tax 0 5 Lamar County sales tax and 1 5 Paris tax There

Tax Sales Carroll County Tax Commissioner

https://150087485.v2.pressablecdn.com/wp-content/uploads/2023/06/IMG_20201022_1548596812-scaled.jpg

PDF How Mark to Market Taxation Can Lower The Corporate Tax Rate And

https://i1.rgstatic.net/publication/282647355_How_Mark-to-Market_Taxation_Can_Lower_the_Corporate_Tax_Rate_and_Reduce_Income_Inequality/links/56152f1208ae983c1b41ebff/largepreview.png

https://www.creditfinanceplus.com/calcul…

Here s a calculator for the VAT in France that will indicate the amount of payable taxes based on the selling price and the type of rate If you click on the other tab you can also reverse the calculation by inserting the

https://wise.com/gb/vat/france

How much is VAT in France The standard VAT rate in France is 20 It applies to most goods and services The two reduced VAT rates are 10 and 5 5 The super reduced

Exploring Financial Havens The World s Lowest Tax Rate Countries

Tax Sales Carroll County Tax Commissioner

Sales Tax Raidagatraten Medium

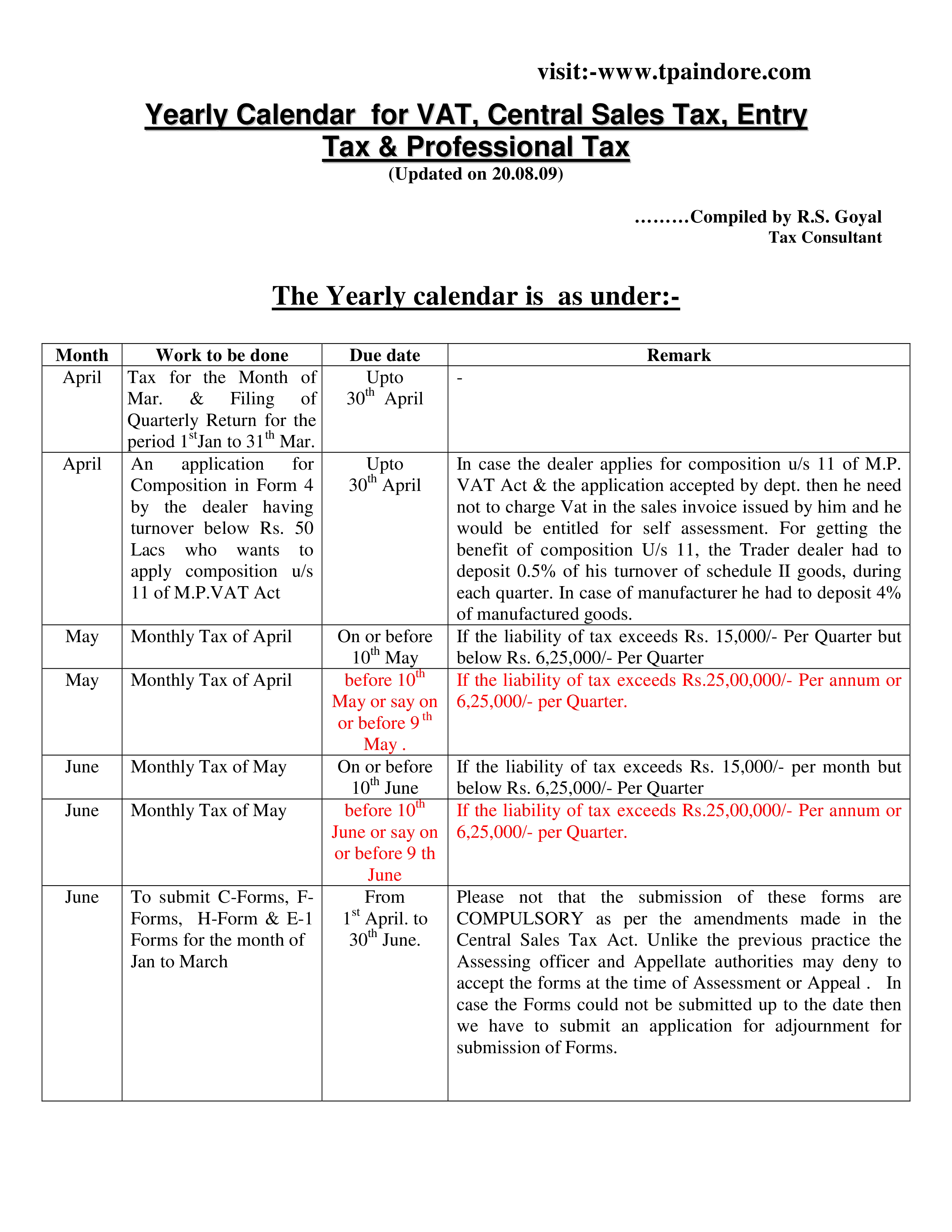

Solved Financial Data For Joel De Paris Inc For Last Year Chegg

Monthly Sales Tax Revenue Report A Boost For Most Bay Area Cities

FBR Clarifies News About Payment Of Total Assessed Tax Demand For

FBR Clarifies News About Payment Of Total Assessed Tax Demand For

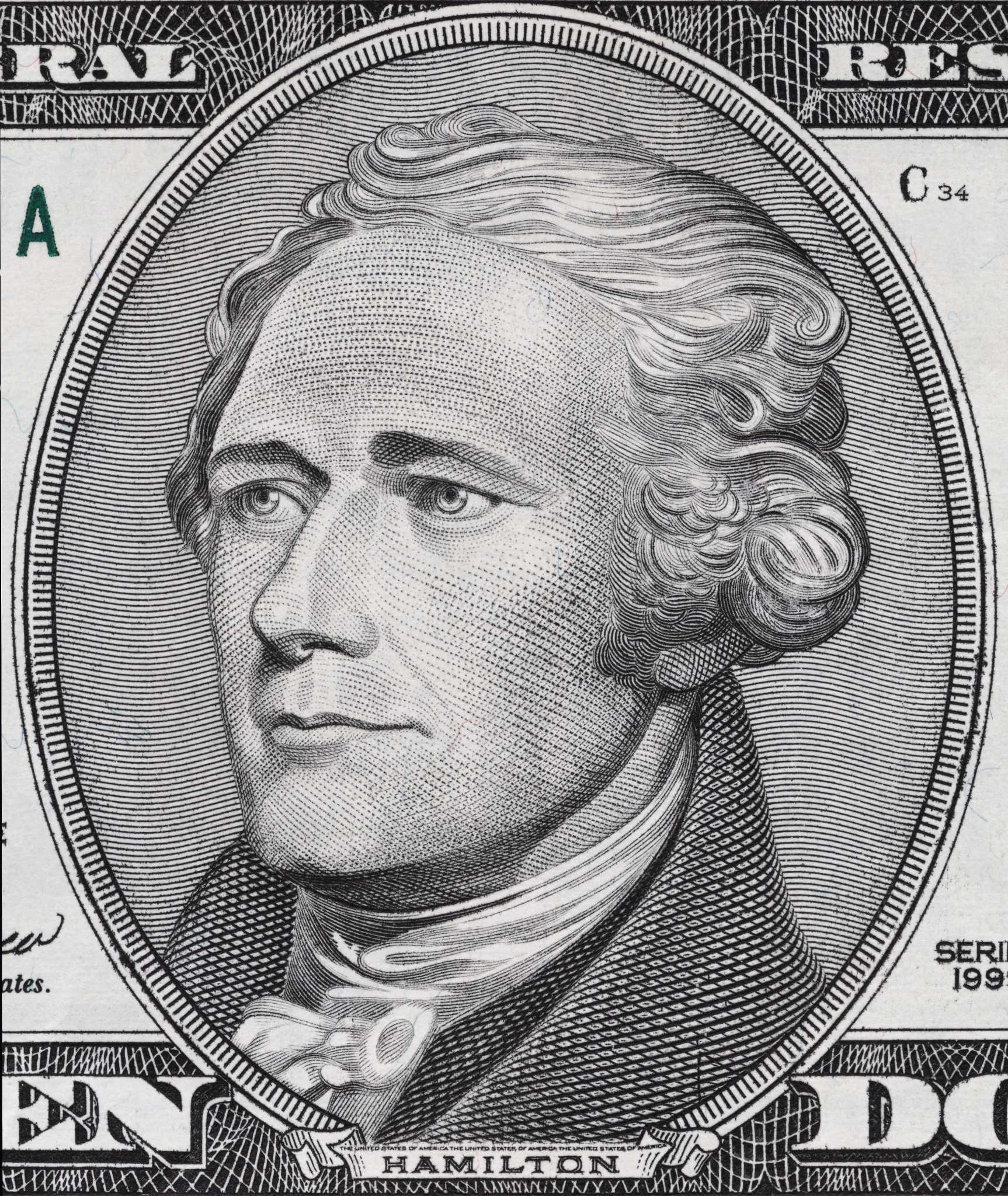

Solved Financial Data For Joel De Paris Incorporated For Chegg

French Taxes How Taxation In France Works HubPages

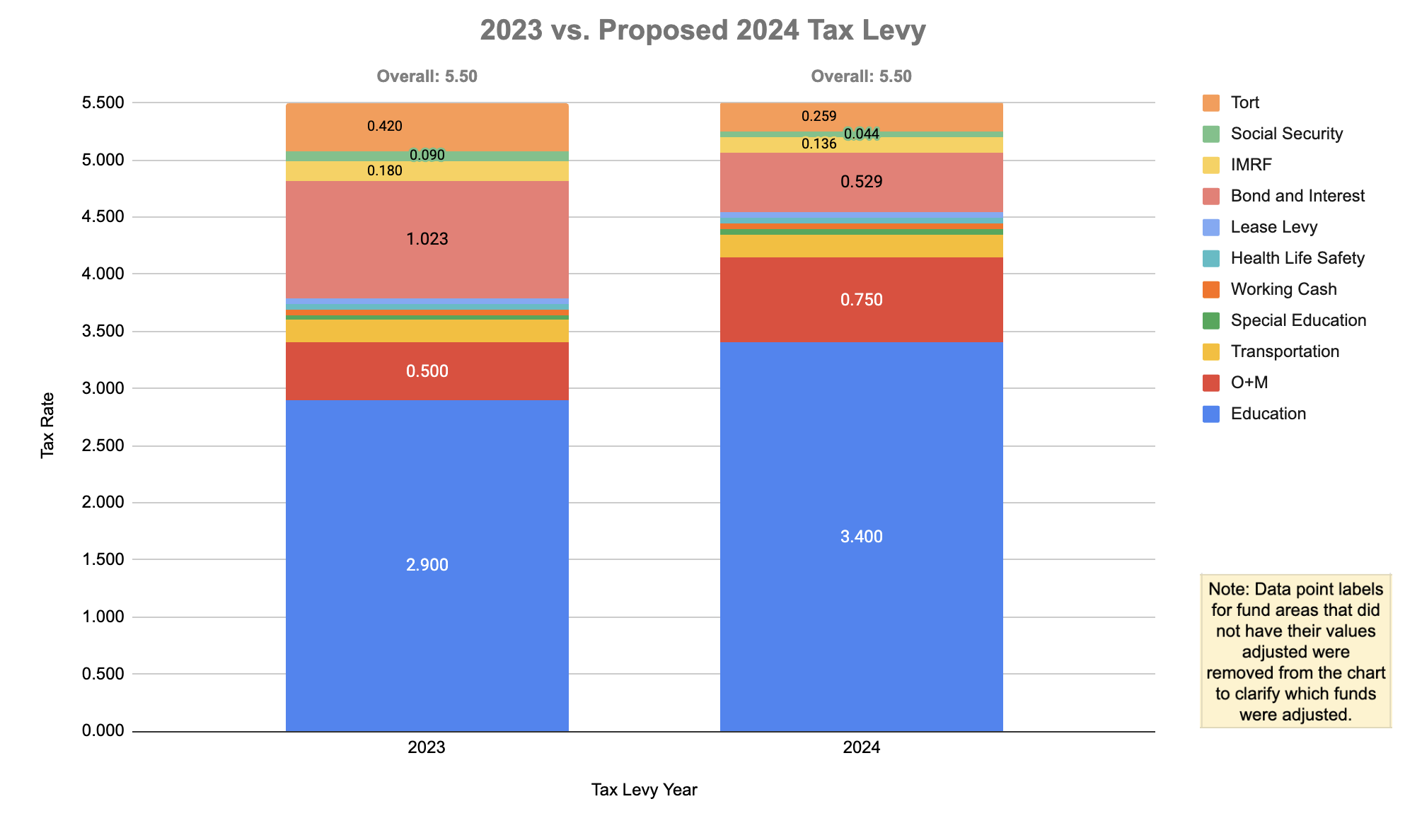

Referendum Overview Olympia CUSD 16

Paris Sales Tax Rate - In France there are multiple VAT rates ranging from 2 1 to 20 depending on the type of products or services The table below lists the types of VAT rates VAT reduced rates in