Partial Ad Valorem Tax Rebate Web Une taxe ad valorem est une taxe bas 233 e sur la valeur imposable d un objet tel qu un bien immobilier ou personnel Les taxes ad valorem les plus courantes sont les taxes

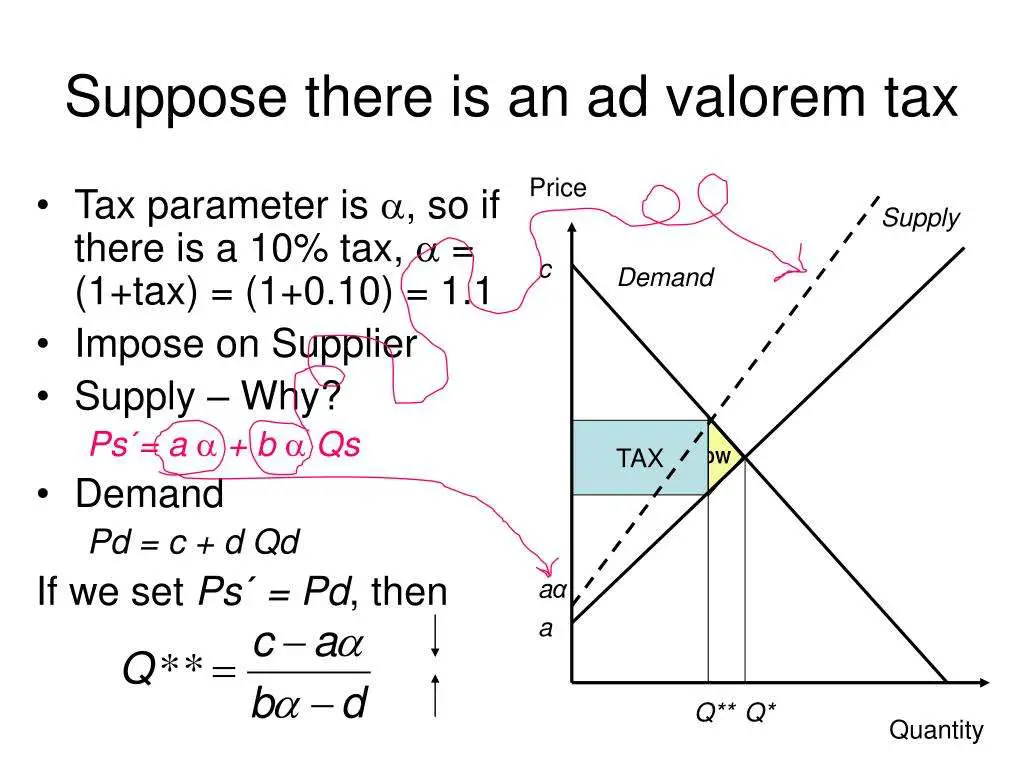

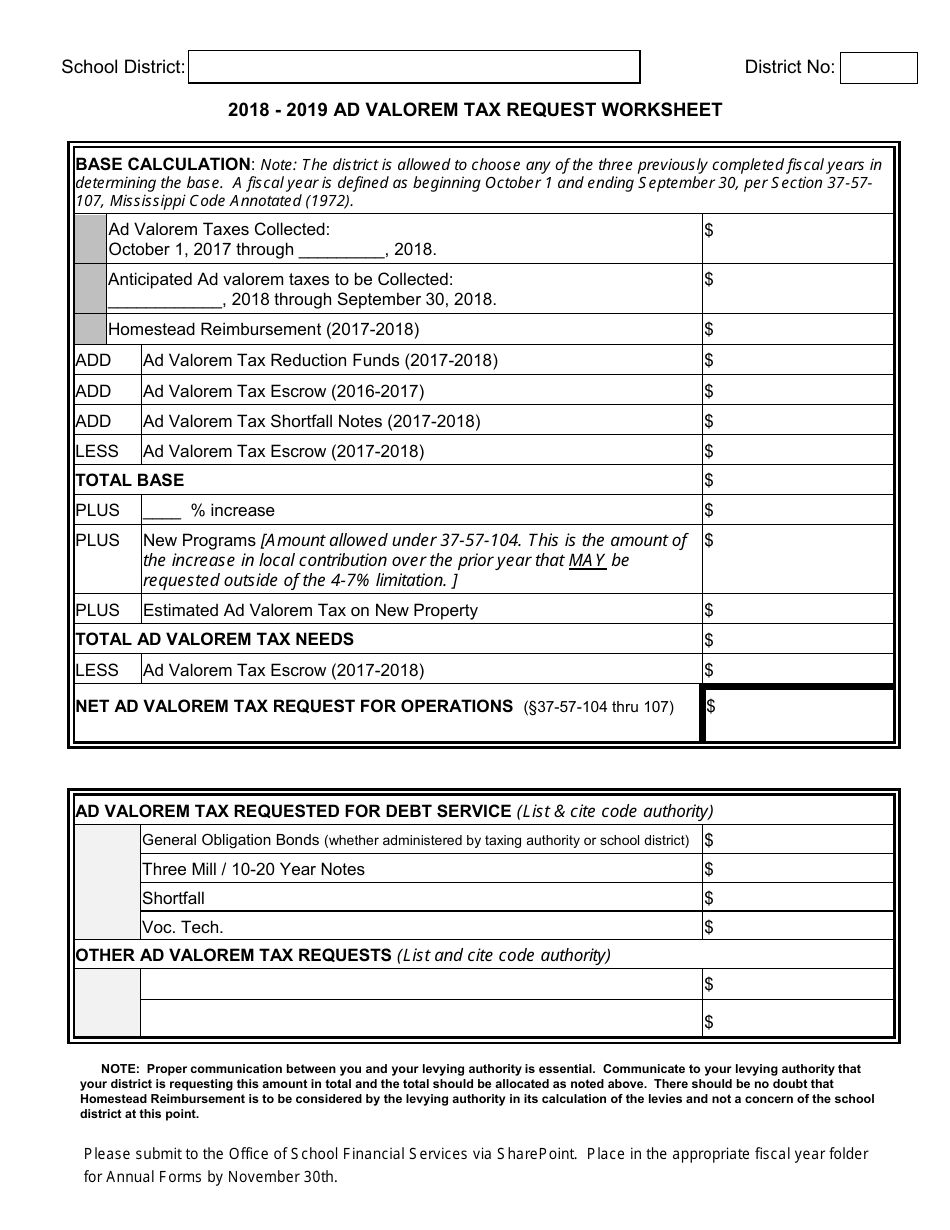

Web L objectif principal de cet article est de faire le point sur la litt 233 rature 233 conomique traitant du choix entre taxe ad valorem taxe sur la valeur des ventes et taxe unitaire taxe sur le Web C est 224 dire qu un pourcentage qui repr 233 sente ad valorem est appliqu 233 au produit d une part Et de l autre un taux fixe qui repr 233 sente le tarif sp 233 cifique Exemple de taxe ad

Partial Ad Valorem Tax Rebate

Partial Ad Valorem Tax Rebate

https://tutor2u-net.imgix.net/subjects/economics/tax_ad_valorem_2021.jpg?auto=compress%2Cformat&fit=clip&q=80&w=800

:max_bytes(150000):strip_icc()/advaloremtax.asp-final-029f64b4f4d648a0b20fee668599b47a.png)

Ad Valorem Tax Definition And How It s Determined

https://www.investopedia.com/thmb/NLBsAGsSmmGTf2vuXushVn_yVXk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/advaloremtax.asp-final-029f64b4f4d648a0b20fee668599b47a.png

Ad Valorem Tax Meaning Types Examples With Calculation

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Ad-Valorem-Tax-1.jpg

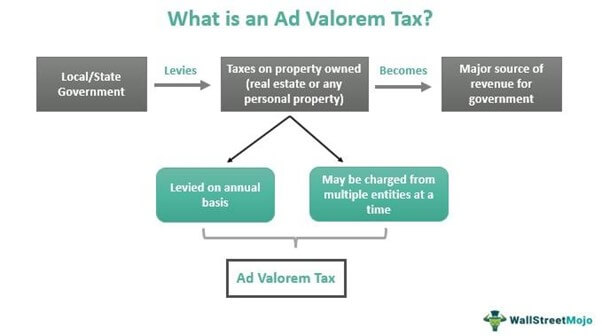

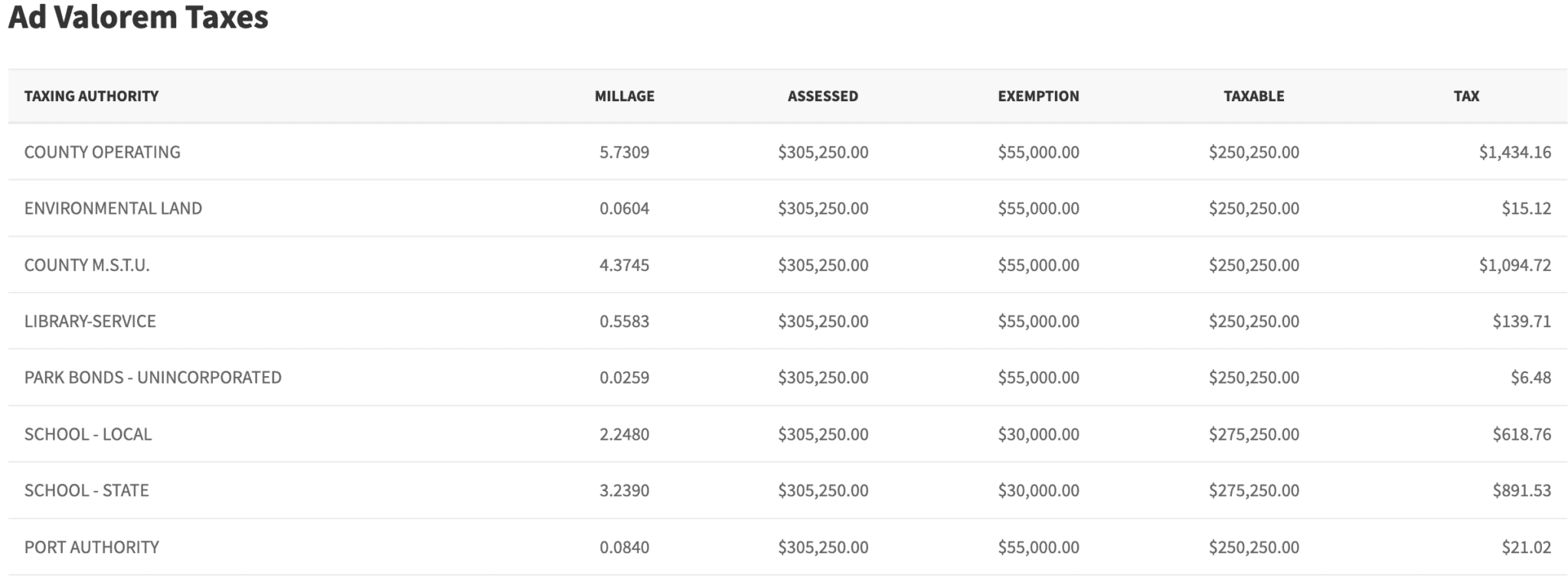

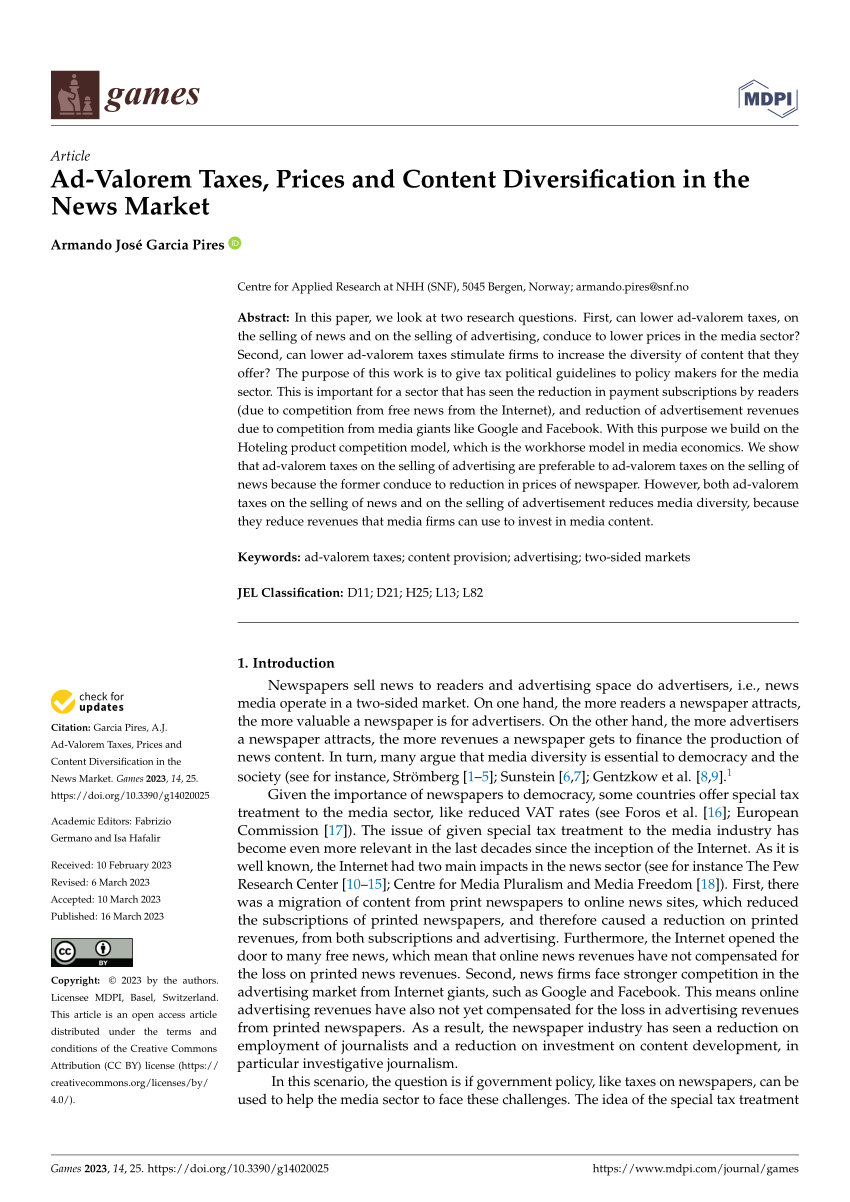

An ad valorem tax Latin for quot according to value quot is a tax whose amount is based on the value of a transaction or of a property It is typically imposed at the time of a transaction as in the case of a sales tax or value added tax VAT An ad valorem tax may also be imposed annually as in the case of a real or personal property tax or in connection with another significant event e g inheritance tax expatriation tax or tariff In some countries a stamp duty is imposed as an ad va Web Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R 11 21 section 196 1975 F S PDF 174 KB DR 504W Ad Valorem Tax Exemption

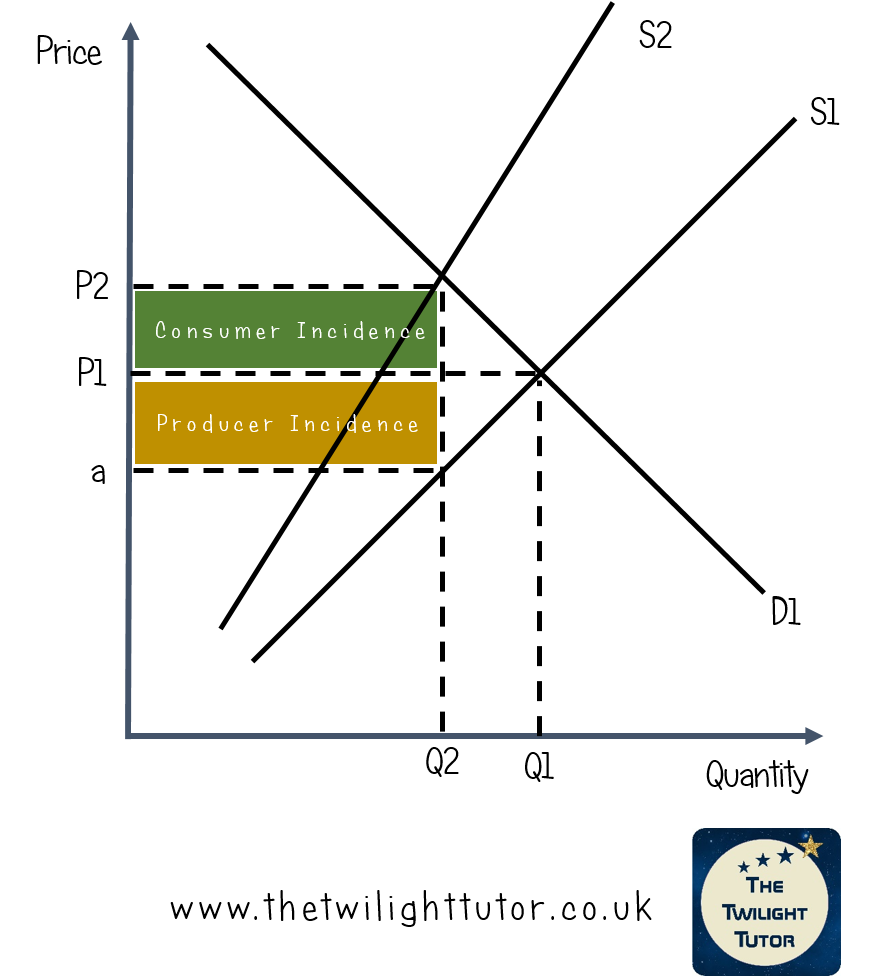

Web 5 avr 2022 nbsp 0183 32 An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property The most common ad valorem taxes are property taxes Web 13 juil 2019 nbsp 0183 32 Partial privatisation 0 lt lt 1 also leads to a decreasing equilibrium total output whether the tax is fixed by unit tax rate or by ad valorem tax rate Tax

Download Partial Ad Valorem Tax Rebate

More picture related to Partial Ad Valorem Tax Rebate

.png)

Welcome To Wakulla Co FL

https://www.mywakulla.com/Ad Valorem Tax Exemptions FAQ (1).png

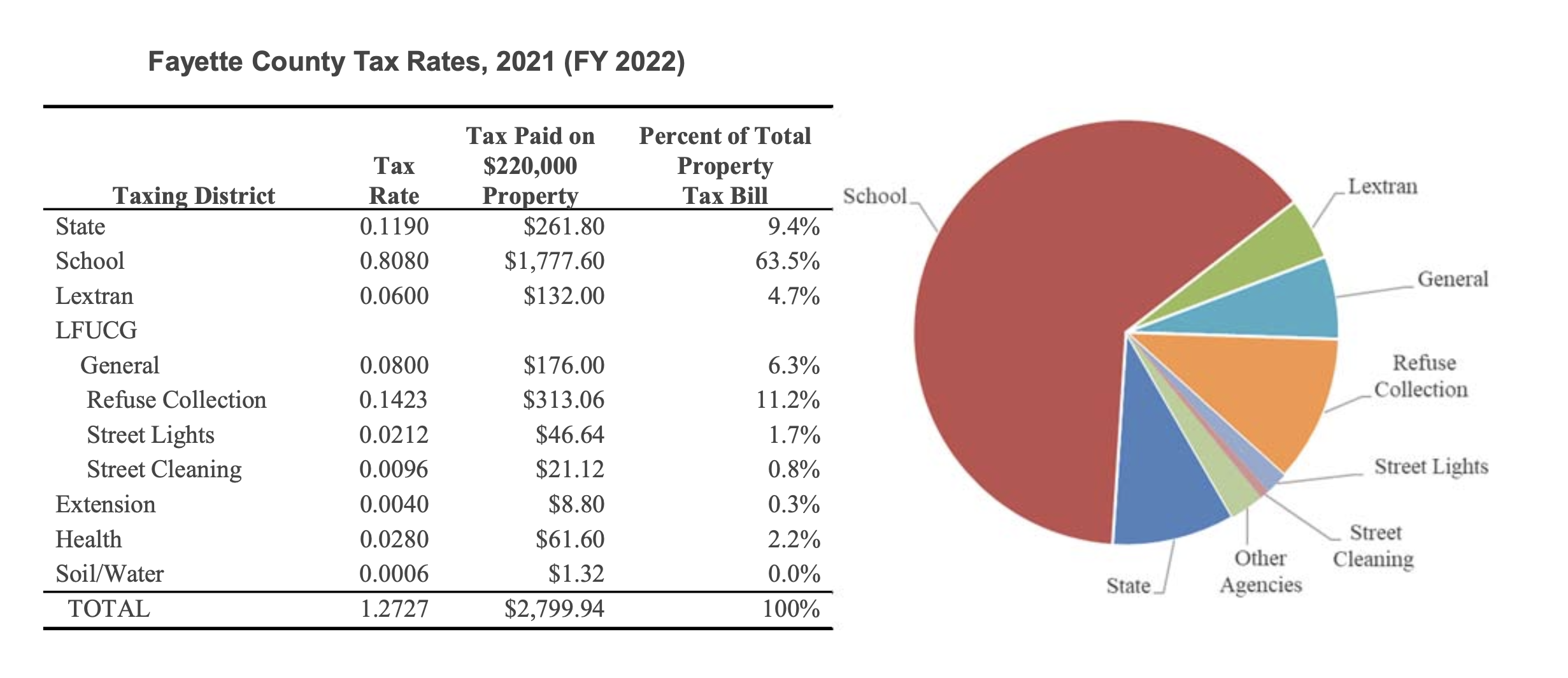

2022 Changes To Ad Valorem Taxes CivicLex

https://images.squarespace-cdn.com/content/v1/5ec3e8d457e5067ea0119afb/377c6a2e-810e-4c5d-915c-cddd768420ef/Screen+Shot+2022-08-12+at+12.16.38+PM.png

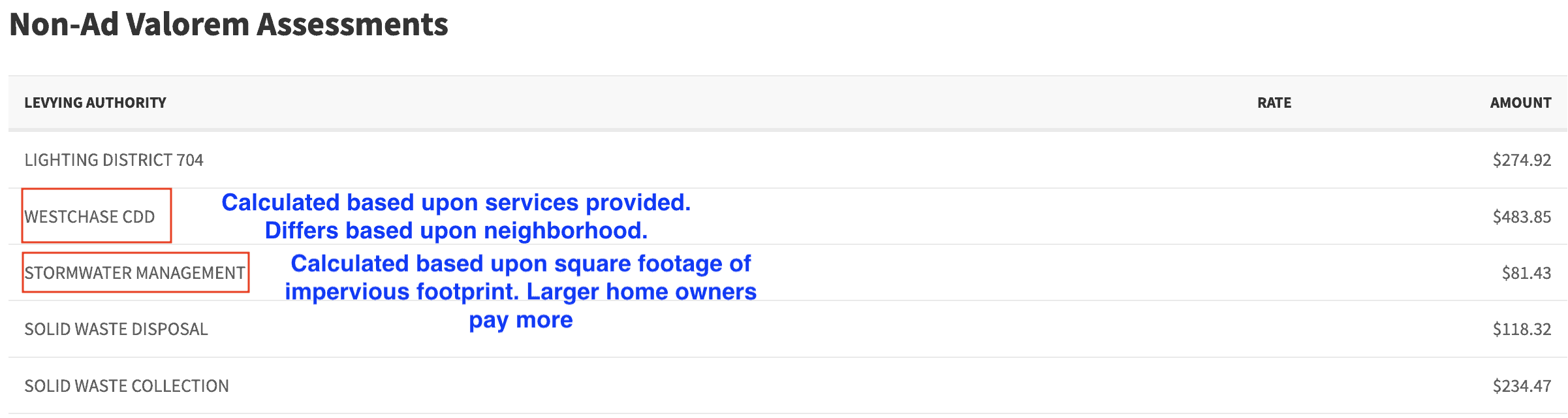

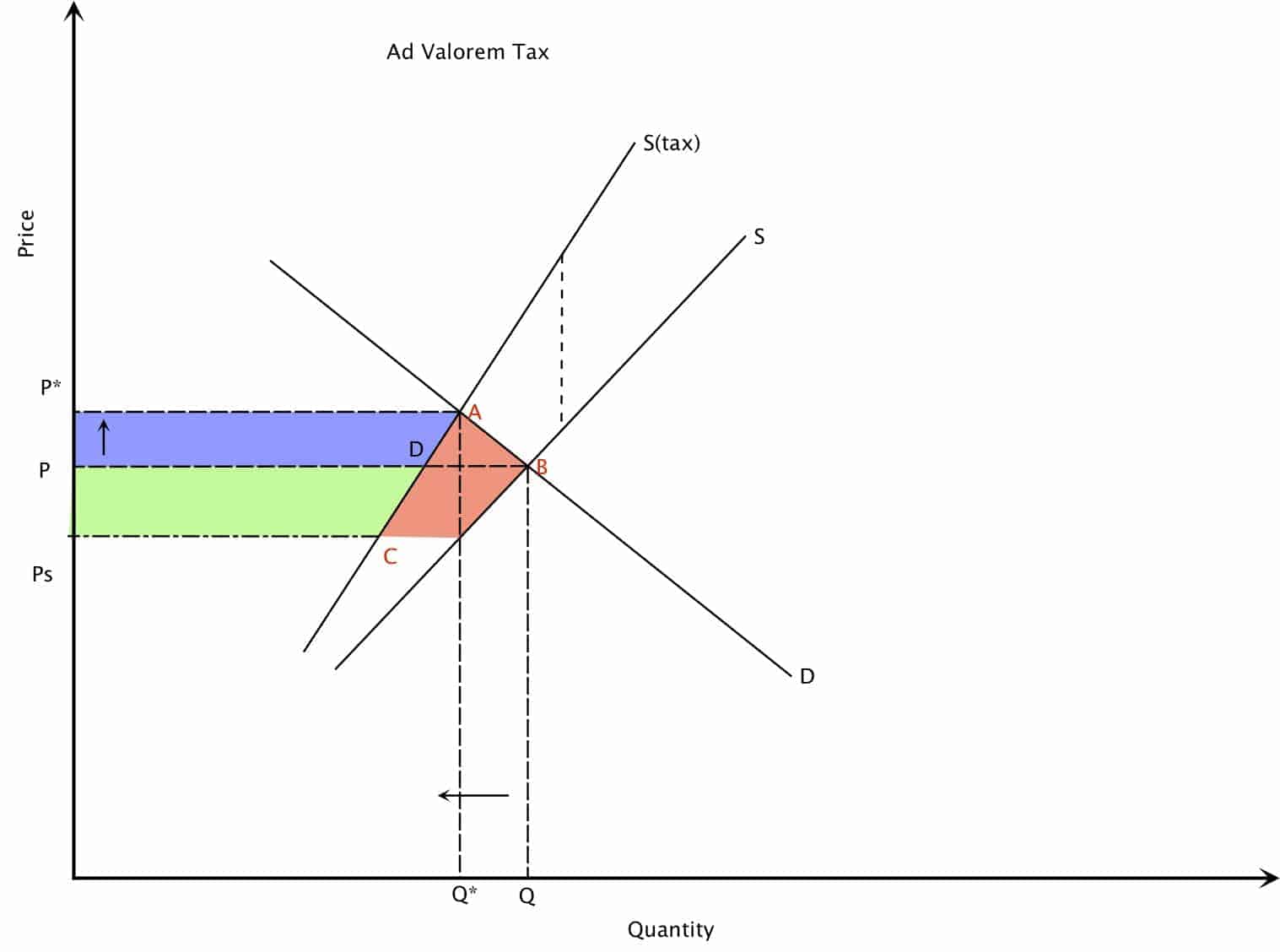

What Is Non Ad Valorem Tax

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/02/ad_valorem_tax_example-2048x752.png

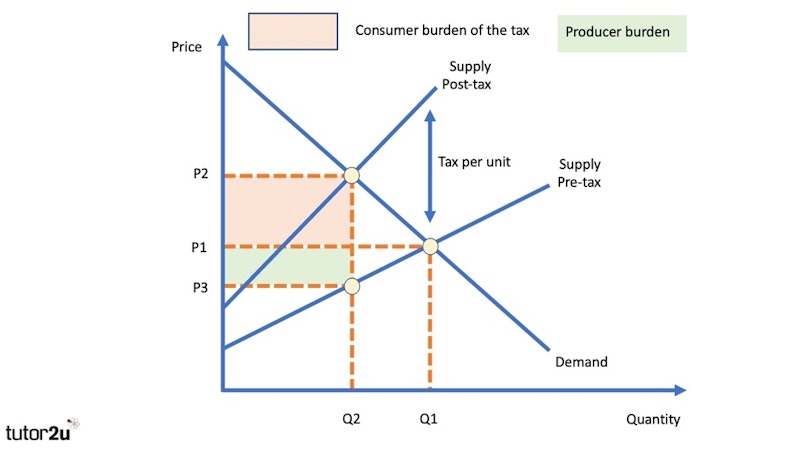

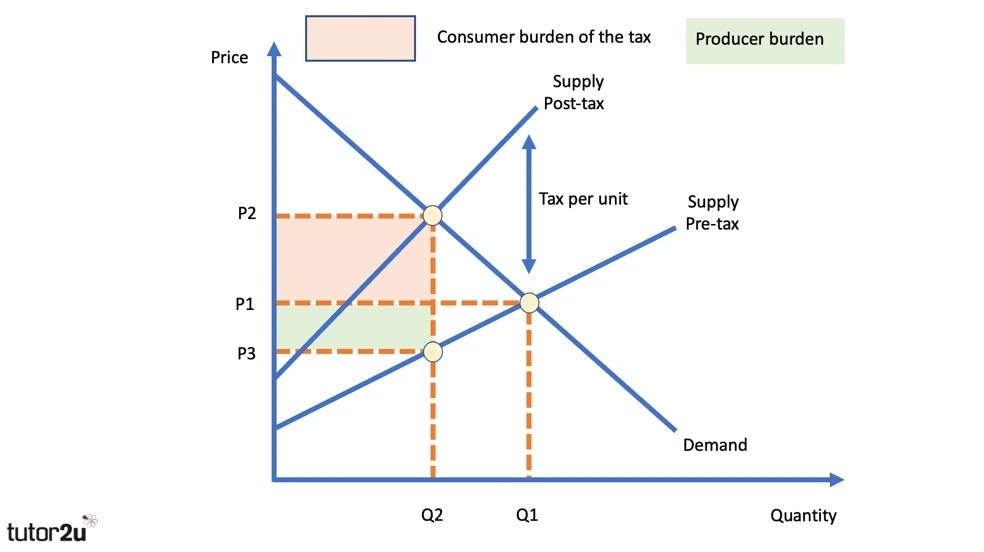

Web When a government levies taxes on a firm two forms of taxes are in the designer s choice set ad valorem taxation the amount of which is based on the value of a transaction Web If we say that the consumers pay 3 30 and the new equilibrium quantity is 80 then the producers keep 2 80 and the total tax revenue equals 0 50 x 80 40 00 The burden

Web 31 mai 2023 nbsp 0183 32 Property tax abatement percentages vary depending on the type of improvement and property location New additions and renovations under 23 000 Web 6 janv 2023 nbsp 0183 32 Key Takeaways Ad valorem which means quot according to value quot in Latin refers to the fact that a tax is levied as a percentage of a property s value Ad valorem

Ad Valorem Definition What Does Ad Valorem Mean

https://mugshotbot.com/m?color=363636&hide_watermark=true&mode=light&pattern=bubbles&url=https://legal-explanations.com/definition/ad-valorem/

Key Diagrams Specific And Ad Valorem Taxes Economics Tutor2u Free

https://tutor2u-assets.ams3.digitaloceanspaces.com/transforms/s3library/Economics/1371654/2022-04-24_07-56-13_2558ca17cfd574efc553cd677b3d659b.png

https://www.investirsorcier.com/definition-de-la-taxe-ad-valorem

Web Une taxe ad valorem est une taxe bas 233 e sur la valeur imposable d un objet tel qu un bien immobilier ou personnel Les taxes ad valorem les plus courantes sont les taxes

:max_bytes(150000):strip_icc()/advaloremtax.asp-final-029f64b4f4d648a0b20fee668599b47a.png?w=186)

https://www.persee.fr/doc/rfeco_0769-0479_2003_num_17_3_1468

Web L objectif principal de cet article est de faire le point sur la litt 233 rature 233 conomique traitant du choix entre taxe ad valorem taxe sur la valeur des ventes et taxe unitaire taxe sur le

What Is Ad Valorem Tax TaxesTalk

Ad Valorem Definition What Does Ad Valorem Mean

PDF Ad Valorem Taxes Prices And Content Diversification In The News

What Is An Ad Valorem Tax Definition Example TheStreet

What Are Indirect Taxes The Twilight Tutor

What Is Non Ad Valorem Tax

What Is Non Ad Valorem Tax

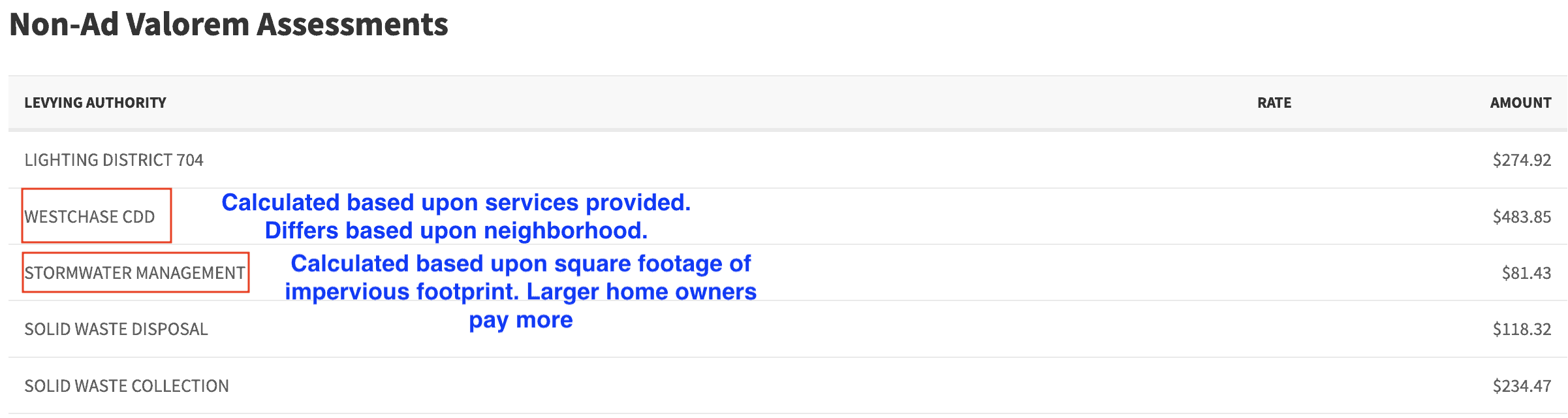

Mississippi Refund Request Form Download Fillable Pdf Templateroller

Meaning Of Ad Valorem

Indirect Taxes Intelligent Economist

Partial Ad Valorem Tax Rebate - Web 13 juil 2019 nbsp 0183 32 Partial privatisation 0 lt lt 1 also leads to a decreasing equilibrium total output whether the tax is fixed by unit tax rate or by ad valorem tax rate Tax