Partner Income Tax Return Due Date If the partnership pays any tax after its due date you will receive a summary of tax status to which a reminder letter is added If the partnership has temporary financial

A partnership does not pay tax on its income but passes through any profits or losses to its partners Partners must include partnership items on their tax or information returns Form 1065 is due to the IRS by the 15th day of the third month following the date the tax year ended for the business If your business follows a calendar year the due date is March 15 Article Sources Investopedia

Partner Income Tax Return Due Date

Partner Income Tax Return Due Date

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

Knowledge Bank ThinkWrite

https://www.thinkwriteba.com/wp-content/uploads/2021/11/income-tax-return-filing-2021-last-date-extended-defd84d9.jpg

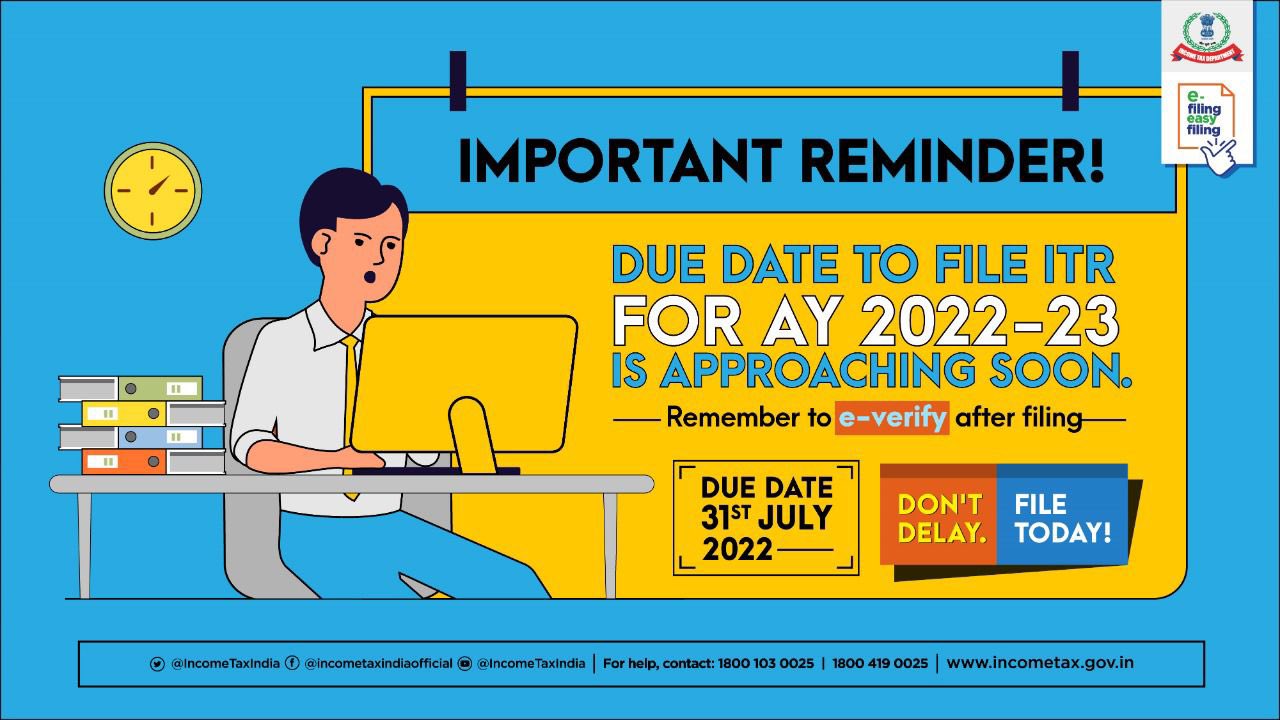

Income Tax India On Twitter Have You Filed Your ITR Yet Due Date To

https://pbs.twimg.com/media/FXhKfnhUUAAxG68.jpg:large

Generally a domestic partnership must file Form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of Form 1065 For calendar year 4 Ordinary income loss from other partnerships estates and trusts attach statement

To be furnished one month before the due date for furnishing the return of income under sub section 1 of section 139 Report from a chartered accountant containing details of all Extension of Due Date The deadline for filing the Return of Income under section 139 1 of the Income Tax Act has been moved from October 31 2024 to November 15 2024

Download Partner Income Tax Return Due Date

More picture related to Partner Income Tax Return Due Date

INCOME TAX RETURN FILING FY 2021 22 AY 2022 23

https://blog.caonweb.com/wp-content/uploads/2022/05/INCOME-TAX-RETURN-FILING-FY-2021-22-AY-2022-23.png

Income Tax Return Due Date Last Date 2021 ITR Filing Online Payment

https://static.india.com/wp-content/uploads/2021/12/Income-Tax-Return-ITR-Filing-News.jpg

File Your Income Tax Return Now For AY 2023 24 Only 28 Days Left

https://www.nbaoffice.com/wp-content/uploads/2023/06/Green-and-White-Tax-Day-Social-Media-Graphic.png

Use these instructions to help you complete the Partnership tax return 2024 Deadline for Partnership Tax Filing The deadline for filing an income tax for a partnership firm is dependent upon whether the firm is required to be audited or not The deadlines for filing

The deadline for filing income tax returns for a partnership firm is determined based on whether the firm needs to be audited The due dates for filing ITR for partnership Form 1065 is used to report partnership income

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

No Extension For Income Tax Return Due Date 2023

https://sirwiznews.com/wp-content/uploads/2023/07/sirpraradox_Income_Tax_Return_Filing_in_India_7bd82339-1ec8-43c4-b577-a0da9bd01f50.png

https://www.vero.fi/en/businesses-and-corporations/...

If the partnership pays any tax after its due date you will receive a summary of tax status to which a reminder letter is added If the partnership has temporary financial

https://www.irs.gov/forms-pubs/about-form-1065

A partnership does not pay tax on its income but passes through any profits or losses to its partners Partners must include partnership items on their tax or information returns

Worked Here Income Tax Return 3 Picture Irs Labels Card Holder Rolodex

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

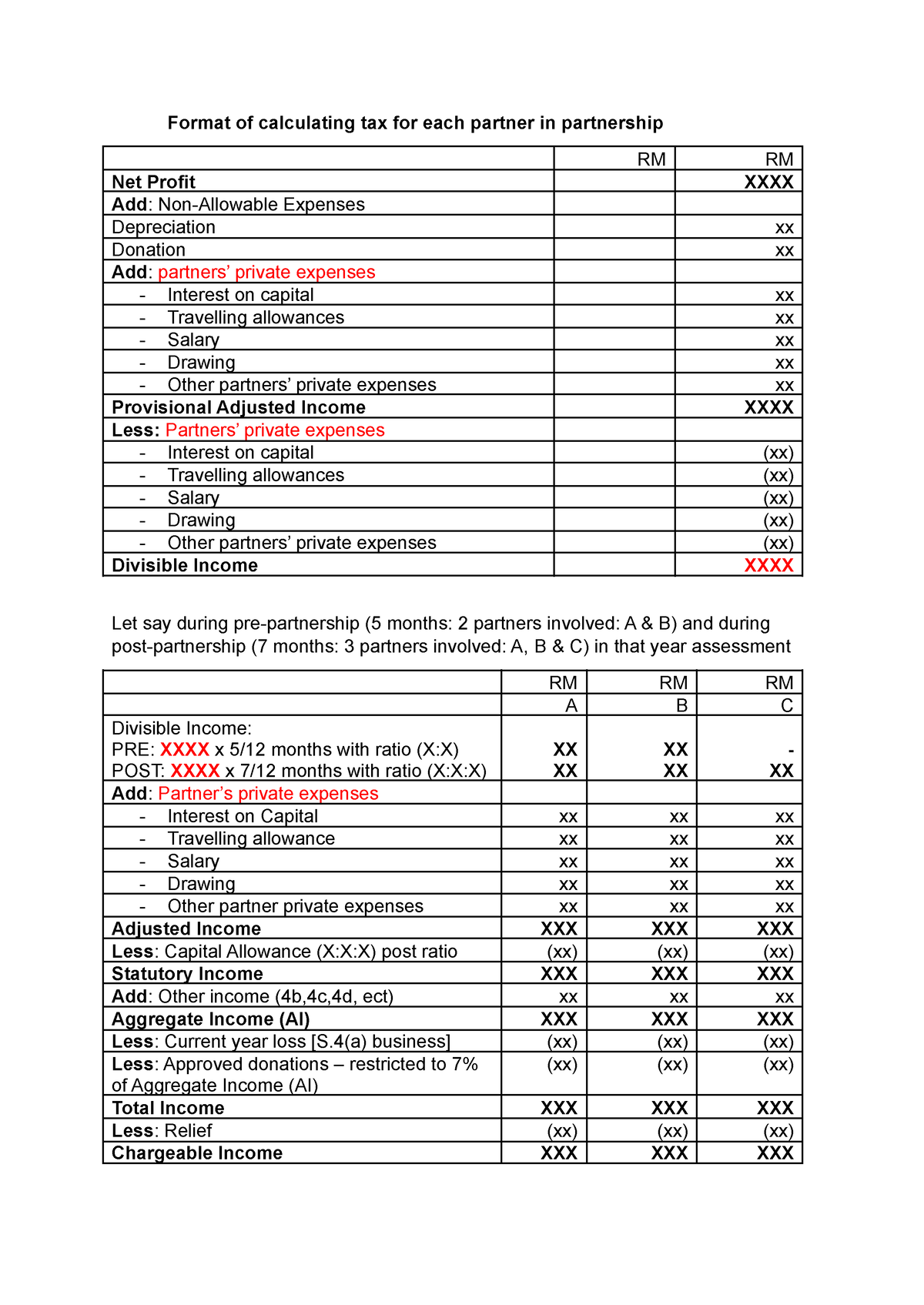

Format Of Partnership Format Of Calculating Tax For Each Partner In

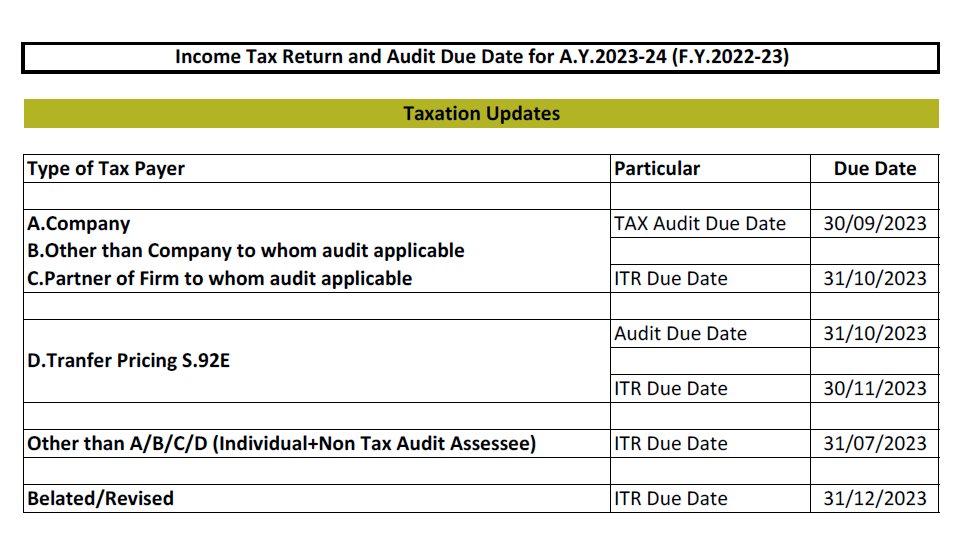

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Latest ITR Forms Archives Certicom

Income Tax Due Date Extension Update New Notification On Income Tax

Income Tax Due Date Extension Update New Notification On Income Tax

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

File Your Income Tax Return By 31st July Ebizfiling

Partner Income Tax Return Due Date - 4 Ordinary income loss from other partnerships estates and trusts attach statement