Pay Property Taxes Online Rebate period for 2022 23 Assessment Year is extended till 30th of April 2022 only for Full year payments of property taxes For Online payment mode request to pay the taxes well in advance to avoid payment failures due to technical issues at the last hour BBMP is not responsible for any double excess payments

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account converting the property from an investment property to a Property Tax Notices are sent the last week in January Pay Online January 31st August 31st Additional processing fees may apply Payments will be recorded as paid on the date submitted but it may not be reflected in your bank or credit card account for 1 2 business days and may not be posted to the property tax record for 2 4 business days

Pay Property Taxes Online

Pay Property Taxes Online

https://www.sobha.com/blog/wp-content/uploads/2023/03/BBMP-Property-Tax-Online-Payment-Step-by-Step-Process-scaled.jpg

Look Up Pay Property Taxes

https://cityofdearborn.org/media/com_mtree/images/listings/o/206.jpg

General Tax Bill Payment Information DeKalb Tax Commissioner

https://dekalbtax.org/sites/default/files/inline-images/2022 Pay property taxes online.png

If you owe tax from before 6 April 2022 you cannot see and pay tax using your Personal Tax Account You ll need the 14 character payment reference number starting with X on your Simple Information about the program is available at anchor nj gov Applicants may also call the ANCHOR hotline 609 826 4282 or 1 888 238 1233 or get in person assistance at a Regional Information Center The state of New Jersey s official Department of the Treasury Web site is the gateway to NJ Treasury information and services for

Payments may be made online by phone mail or in person Processing fees may apply Online at cobbtax via e Check debit or credit card Phone automated system at 1 866 PAY COBB 1 866 729 2622 Mail to Cobb County Tax Commissioner PO Box 100127 Marietta GA 30061 Visit our office in person at any of the following HELENA Gov Greg Gianforte on Thursday listened to recommendations for property tax reform presented by members of his appointed task force while offering limited insight into his support or disapproval of specific proposals that will likely be debated in the upcoming legislative session During the 20 minute meeting in the governor s

Download Pay Property Taxes Online

More picture related to Pay Property Taxes Online

You Can Now Pay Property Taxes ONLINE Orange City Council

https://orangetwpnjcc.org/wp-content/uploads/2019/07/paypropertytaxesonline-2019-800x450.png

Make An Online Property Tax Payment Part 3 YouTube

https://i.ytimg.com/vi/f-Pi0T40bbI/maxresdefault.jpg

ACI Payments Inc Pay Ohio Property Taxes Online

https://www.officialpayments.com/images/oh_prop_tax.jpg

Request an extension by mail 1 File Form 4868 Application for Automatic Extension of Time To File U S Individual Income Tax Return You can file by mail online with an IRS e filing partner or through a tax professional 2 Estimate how much tax you owe for the year on the extension form Subtract the taxes you already paid for the filing In 2022 the governor proposed 2 000 in property tax rebates for Montana homeowners at their primary residence in his Budget for Montana Families For additional information about the property tax rebate or to check on the status of the income or property tax rebates secured by Gov Gianforte in 2023 please visit getmyrebate mt gov

You will need the property ID number owner s name or the street address Then go to our online payments portal and follow the instructions Thank you Note property tax bills for 2024 have not been calculated but if you still owe money for back taxes you can pay online Town of Lyndeborough 9 Citizens Hall Road Property Tax Page 1 of 1 Mill Rates A mill rate is the rate that s used to calculate your property tax To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1 000 There are different mill rates for different towns and cities Agency Office of Policy and Management

MCD Property Tax Online Payment In Delhi 2020 How To Pay House Tax

https://i.ytimg.com/vi/wdFVCSpnfw0/maxresdefault.jpg

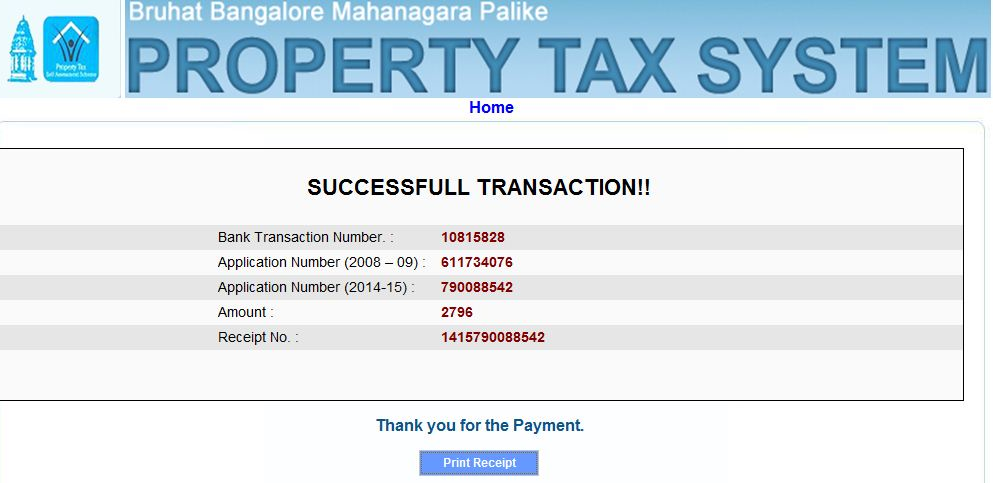

Mind Reader Pay BBMP Property Tax Online

https://3.bp.blogspot.com/-KAXZL8gPzIE/U1u-4q0TTkI/AAAAAAAACPc/a91QwzbxFvg/s1600/BBMP+tax+receipt.png

https://bbmptax.karnataka.gov.in

Rebate period for 2022 23 Assessment Year is extended till 30th of April 2022 only for Full year payments of property taxes For Online payment mode request to pay the taxes well in advance to avoid payment failures due to technical issues at the last hour BBMP is not responsible for any double excess payments

https://www.investopedia.com/surprising-ways-to...

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account converting the property from an investment property to a

How To pay Property Taxes Online YouTube

MCD Property Tax Online Payment In Delhi 2020 How To Pay House Tax

ACI Payments Inc Pay California Property Taxes Online

How To Pay Property Tax Online In 2023 The Ultimate Guide

Property Tax Online Payment KMC KMC Property Tax Kolkata Municipal

How To Pay GHMC Property Tax Online Greater Hyderabad Municipal

How To Pay GHMC Property Tax Online Greater Hyderabad Municipal

How To Pay Municipal Property Tax Online Complete Guide

How To Pay Property Tax Water Tax Online Online Payment Of Property

How To Compute File And Pay Estate Tax YouTube

Pay Property Taxes Online - Many of the services provided in the office can be processed online Below you ll find a quick and easy payment portal for each online service Important Information Online E check payments are free Credit Card Payments will include a convenience fee per transaction This fee is charged by a 3rd party vendor The Tax Collector s Office does