Paye Tax Rebate For Tools Web There are actually two ways to claim You can either claim for exactly what you ve spent so you ll need to keep receipts to prove that

Web 28 f 233 vr 2023 nbsp 0183 32 A tool tax rebate can be claimed by employees who buy their own tools to use for work It is often referred to as a mechanics tool rebate but it applies to other industries too As well as tools you can Web Yes You cannot get a tax rebate that is superior in value to the amount of tax you paid A tax rebate is simply the repayment of overpaid tax How far back can I claim tax relief for my tools You can claim back tax relief for

Paye Tax Rebate For Tools

Paye Tax Rebate For Tools

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/86202/BPTaltsoftEYU_1_.png

Milwaukee Tool Rebates Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/06/Milwaukeetool-Rebates.png

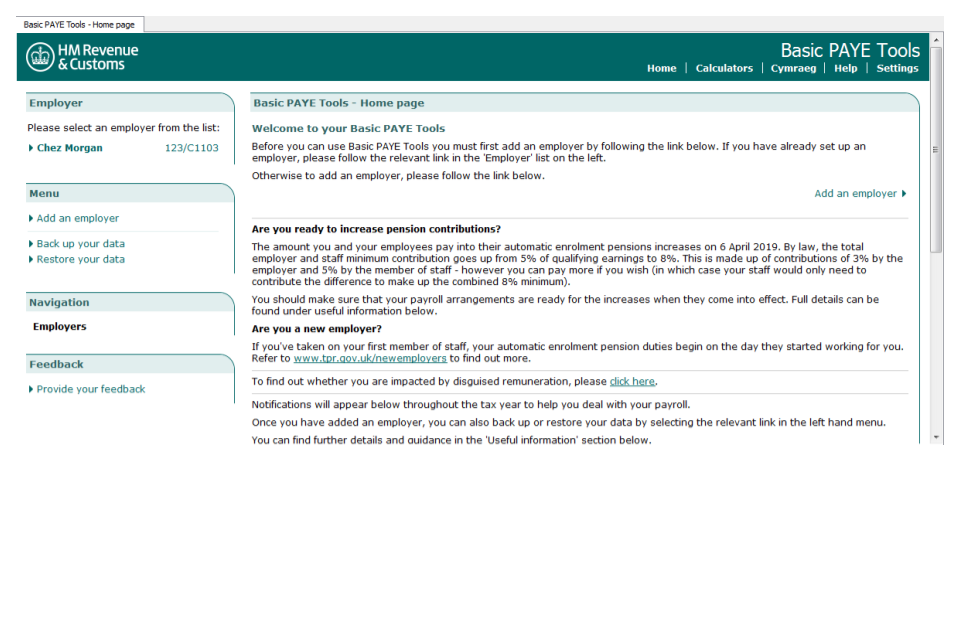

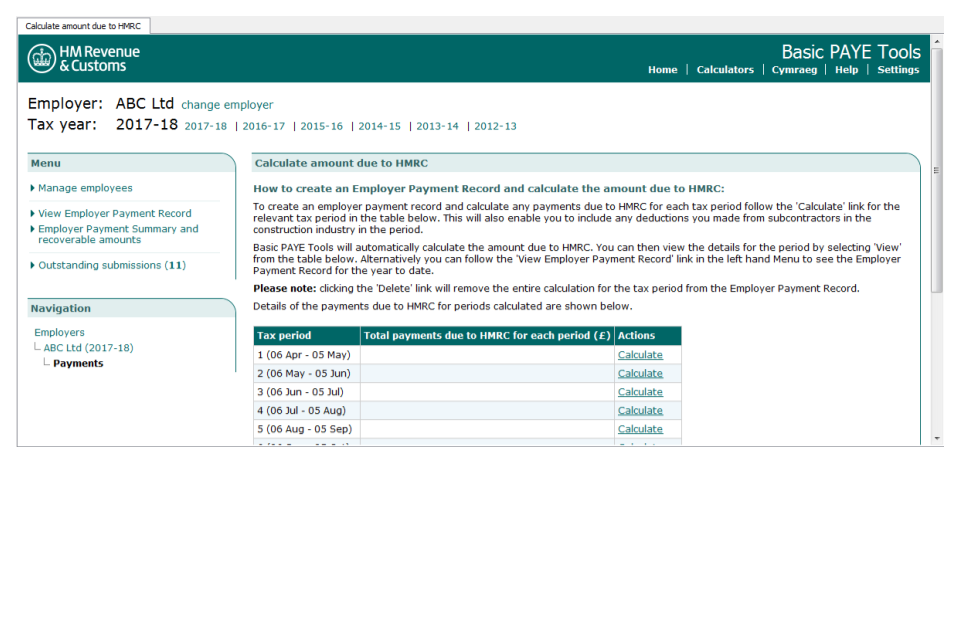

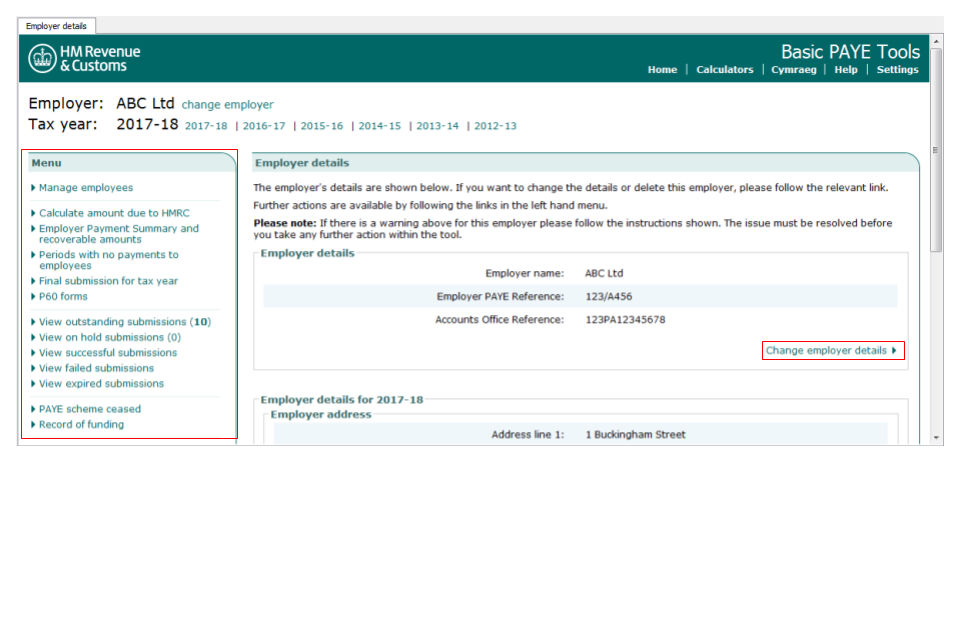

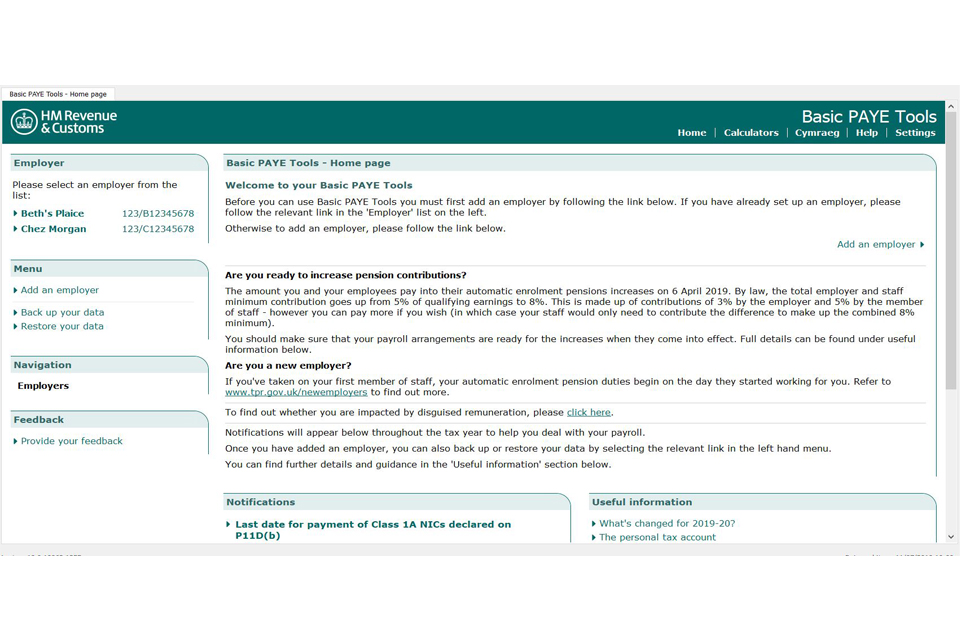

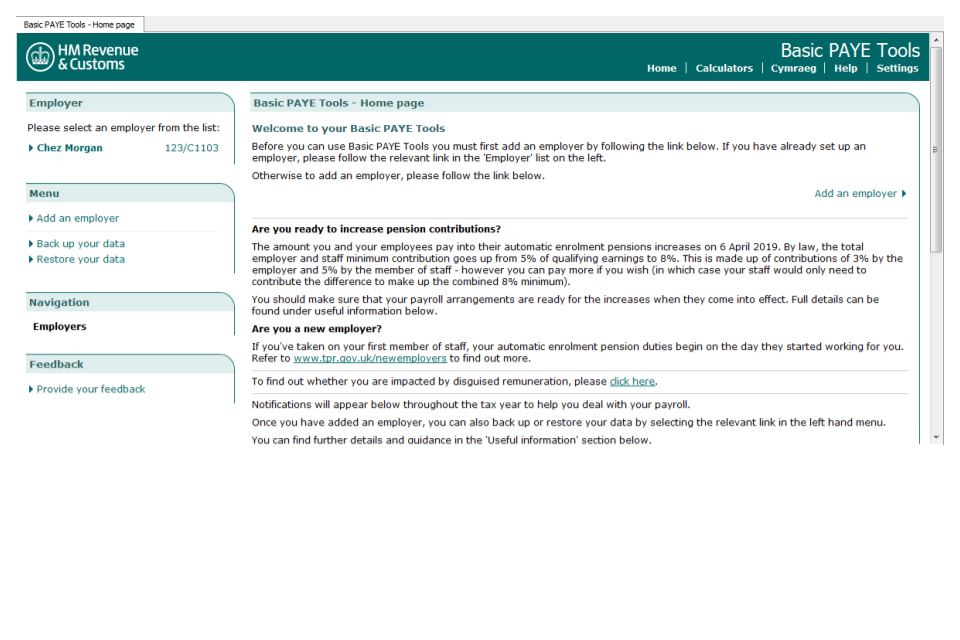

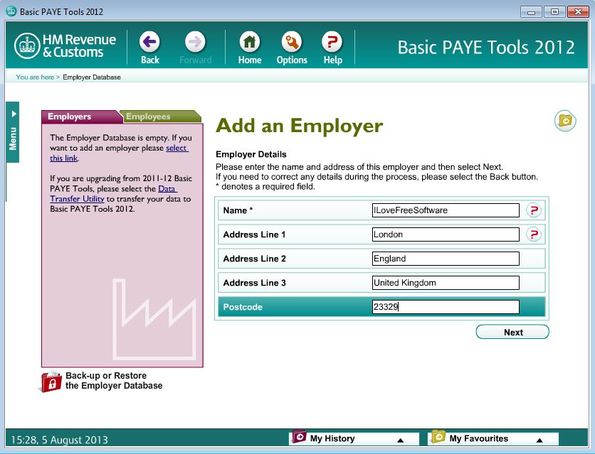

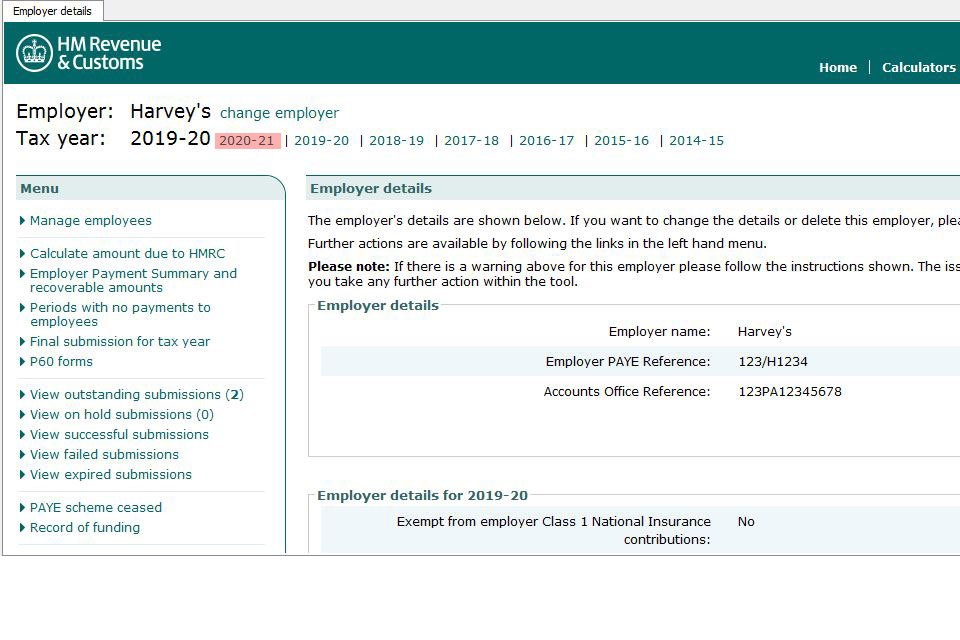

Basic PAYE Tools User Guide GOV UK

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/62875/BPTuserguide_40___1_.png

Web The tool tax allowance is usually worth up to 163 120 per year which is an agreed upon amount for particular trades that can be claimed without the need for receipts So if you Web To qualify for a tools tax rebate you must Purchase the equipment and tools you need for work with your own money Have written evidence of these purchases like

Web At the moment the amount that you can claim back on tools stands at around 20 of the initial purchase value including VAT So if you ve spent 163 2000 on a shiny new high end Web There are four main categories that PAYE builders can claim for Travel If you drive to a temporary site in your own vehicle you can claim mileage on your fuel and if you get

Download Paye Tax Rebate For Tools

More picture related to Paye Tax Rebate For Tools

Basic PAYE Tools User Guide GOV UK

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/62838/BPTuserguide_2___1_.png

SARS Tax Brackets Tax Tables For 2022 2023 QuickBooks South Africa

https://i.ytimg.com/vi/ZZjVYJlYUSY/sddefault.jpg

Basic PAYE Tools User Guide GOV UK

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/124708/Capture01.png

Web If you are eligible for tax relief for tools and specialist equipment or clothing you can usually claim a tool tax relief flat rate deduction In most circumstances you do not need to Web You may be able to claim a tool tax rebate for tools and specialist equipment through a capital allowances claim In this case full receipts or proof of purchase will be required

Web 3 mars 2016 nbsp 0183 32 How to claim tax relief on money you ve spent on things like a work uniform and clothing tools business travel professional fees and subscriptions From HM Web 24 avr 2017 nbsp 0183 32 Tax claims for expenses such as tools are measured in two different brackets claims up to 163 2500 per tax year and those over 163 2500 per tax year

Basic PAYE Tools Earlier Year Update

https://s2.studylib.net/store/data/018262223_1-d090f52fbdb9abf16bd6f8cb11557875-768x994.png

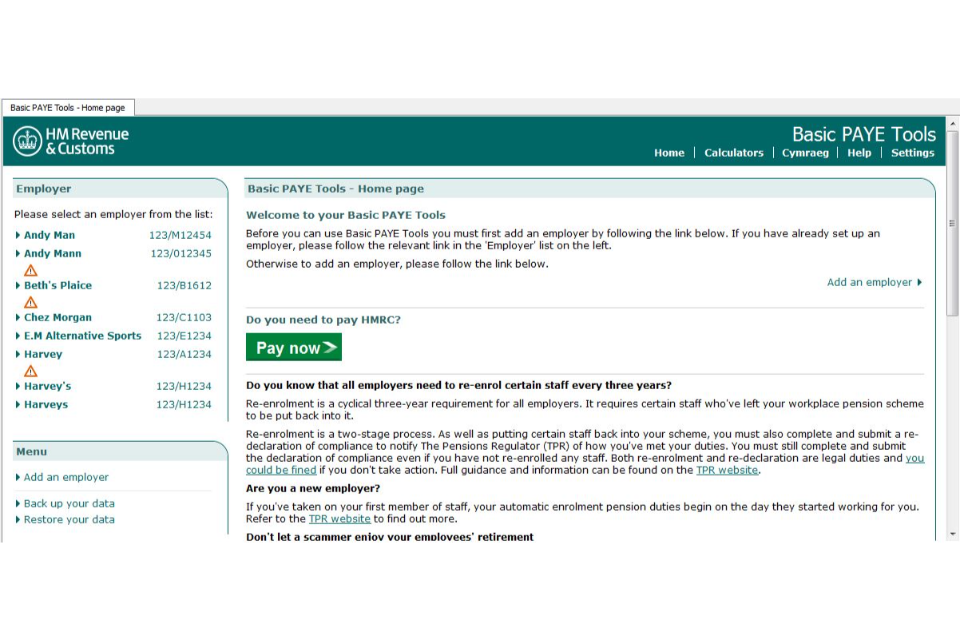

Basic PAYE Tools User Guide GOV UK

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/90451/1_Basic_PAYE_Tools_Home_page.jpg

https://brianalfred.co.uk/guides/claiming-tax-b…

Web There are actually two ways to claim You can either claim for exactly what you ve spent so you ll need to keep receipts to prove that

https://www.safeworkers.co.uk/finance/tool-ta…

Web 28 f 233 vr 2023 nbsp 0183 32 A tool tax rebate can be claimed by employees who buy their own tools to use for work It is often referred to as a mechanics tool rebate but it applies to other industries too As well as tools you can

Free UK Payroll Tax Calculator Basic PAYE Tools

Basic PAYE Tools Earlier Year Update

Check A National Insurance Number Using Basic PAYE Tools GOV UK

Pin On Payslips Online UK

P60

Working From Home Tax Rebate Form 2022 Printable Rebate Form

Working From Home Tax Rebate Form 2022 Printable Rebate Form

A Guide To UK PAYE Tax Forms P45 P60 And P11D

First Time Users Download And Install Basic PAYE Tools GOV UK

Free UK Payroll Tax Calculator Basic PAYE Tools

Paye Tax Rebate For Tools - Web At the moment the amount that you can claim back on tools stands at around 20 of the initial purchase value including VAT So if you ve spent 163 2000 on a shiny new high end