Paying Tax On Savings Interest Scotland Scottish Income Tax applies to your wages pension and most other taxable income You ll pay the same tax as the rest of the UK on dividends and savings interest The table shows the

Check here for guidance on personal tax accounts and your taxes post any questions you have and share your experiences with others Most people can earn some Interest earned outside tax wrappers like ISAs or pensions can be liable for tax In this article we explain whether you should be paying tax on your savings interest how to go about it and whether you can lower your tax bill

Paying Tax On Savings Interest Scotland

Paying Tax On Savings Interest Scotland

https://www.thompsontarazrand.co.uk/wp-content/uploads/2021/04/889cd595-3ee8-4543-852f-f6ab61d05575-1.jpg

How To Claim Pre trading Expenses When You re A Sole Trader British

https://britishexpatmoney.com/wp-content/uploads/2022/08/pre-trading-expenses.png

Tax On Savings Interest Thompson Taraz Rand

https://www.thompsontarazrand.co.uk/wp-content/uploads/2018/11/2017-03-23-391386-1.jpg

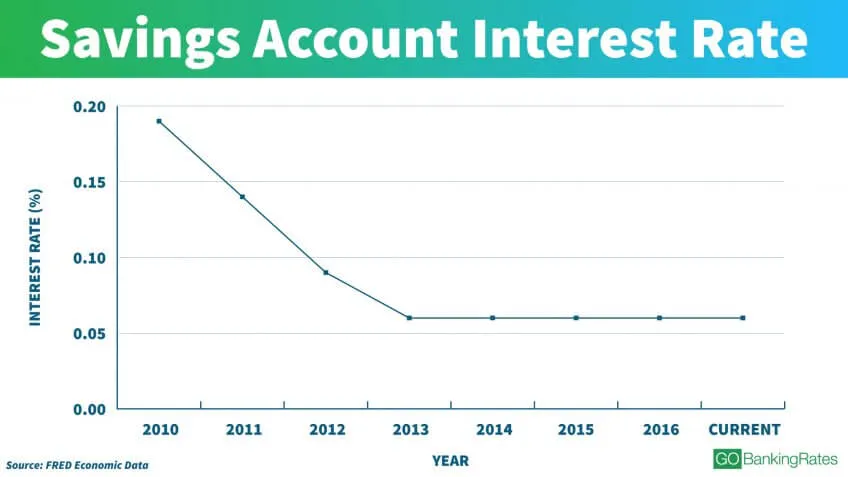

The personal savings allowance PSA lets most people earn up to 1 000 in interest without paying tax on it At current savings rates basic rate taxpayers need around 20 000 in the top easy access savings account to Guidance and forms for tax on savings and investments Including savings interest savings for children tax on shares and dividends and ISAs

I m resident in Scotland and I will be earning enough interest on my savings this year to have to pay income tax on it It would appear that savings interest is taxed on UK rates and bands as If you earn less than 18 570 in income and savings interest combined you can get all interest paid tax free Read MoneySavingExpert s guide to understand your allowance

Download Paying Tax On Savings Interest Scotland

More picture related to Paying Tax On Savings Interest Scotland

UK Investment Options For Non Residents British Expat Money

https://britishexpatmoney.com/wp-content/uploads/2021/07/173-UK-investment-options-for-non-residents.jpg

Explained Paying Tax On Savings Account Interest Finder

https://dvh1deh6tagwk.cloudfront.net/finder-au/wp-uploads/2016/04/InterestCalculator_Supplied_1800x1000.jpg

An Awesome Guide On How To Pay Tax On Savings Interest

https://www.accountingfirms.co.uk/wp-content/uploads/2021/10/How-To-Pay-Tax-on-Savings.png

Some savings products pay interest that s tax free regardless of how much you earn or other savings interest you are receiving These include cash ISAs for savings stocks and shares ISAs for investments saving into a pension Any Paying Tax on Savings Interest Basic rate taxpayers can earn up to 1 000 of interest on their savings each tax year or 500 for higher rate taxpayers without paying any tax on it

You pay tax on any interest over your allowances at your usual rate of income tax 20 40 or 45 Scottish income tax rates do not apply to savings and dividend income When HMRC calculates the tax you owe it ll From April 2016 HM Revenue and Customs introduced a tax free Personal Savings Allowance of 1 000 500 for higher rate taxpayers for savings income or interest The new allowance

How To Pay Tax On Savings Interest YouTube

https://i.ytimg.com/vi/9ssz7jTBnCY/maxresdefault.jpg

Save Now For Taxes Beyond Balanced Books

https://bbbooksinc.com/wp-content/uploads/2020/02/tax-savings-image.png

https://www.gov.uk › scottish-income-tax

Scottish Income Tax applies to your wages pension and most other taxable income You ll pay the same tax as the rest of the UK on dividends and savings interest The table shows the

https://community.hmrc.gov.uk › customerforums › pt

Check here for guidance on personal tax accounts and your taxes post any questions you have and share your experiences with others Most people can earn some

Personal Savings Allowance Explained Shawbrook

How To Pay Tax On Savings Interest YouTube

Tax On Savings Interest Thompson Taraz Rand

Resources There s A Way To Give More To Your Favorite Charity While

Millions Of Accounts Now Liable For Tax On Savings Interest Your Money

Article 4 2 Income Tax On Savings Interest

Article 4 2 Income Tax On Savings Interest

How To Pay Tax On Savings Interest Quick Guide

Interest Rate Rises Fuelling Increased Tax Take Barnes Roffe

Compare Interest Rates Uk Savings

Paying Tax On Savings Interest Scotland - The personal savings allowance PSA lets most people earn up to 1 000 in interest without paying tax on it At current savings rates basic rate taxpayers need around 20 000 in the top easy access savings account to