Payroll Tax Rebate 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

What s New Pub 15 is now for all employers Pub 15 can now be used by all employers including agricultural employers and employers in the U S territories Pub 51 Agricultural Medicare tax This tax is 1 45 for the employee and 1 45 for the employer totaling 2 9 of earned wages Additional Medicare Tax The employee pays 0 9 of their earned wages above 200 000

Payroll Tax Rebate 2024

Payroll Tax Rebate 2024

https://ampifire.com/video/images/stock-pexels-photo-3483098.jpeg

Franchise Payroll Tax Rebate Eligibility Check Claims Risk Free ERTC Application In 2022

https://i.pinimg.com/originals/f4/95/07/f49507d1ca2634104efb375286d9e305.png

Fillable Online Payroll Tax Rebate Application Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/677/283/677283620/large.png

Maximum Taxable Income 2024 Income Taxes Other Payroll Costs and Deductions Penalties for Missed or Late Payments Frequently Asked Questions FAQs Show more Payroll taxes are the The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Last quarterly payment for 2023 is due on Jan 16 2024

Up from a cap of 160 000 for 2023 in 2024 the maximum SSA taxable earnings for 2024 will be 5 2 higher at 168 000 With the Social Security tax rate at 6 2 the maximum Social Security tax an employee can pay in 2024 is 10 453 20 6 2 x 168 600 This taxable income also known as the wage base is being increased to align with the The wage base increases to 168 600 for Social Security and remains UNLIMITED for Medicare For Social Security the tax rate is 6 20 for both employers and employees Maximum Social Security tax withheld from wages is 10 453 20 in 2024 For Medicare the rate remains unchanged at 1 45 for both employers and employees

Download Payroll Tax Rebate 2024

More picture related to Payroll Tax Rebate 2024

Quickbooks Payrolls Certified Payroll Forms Maryland

http://teamsoftware.com/wp-content/uploads/2016/12/Payroll-Tax-2-02.jpg

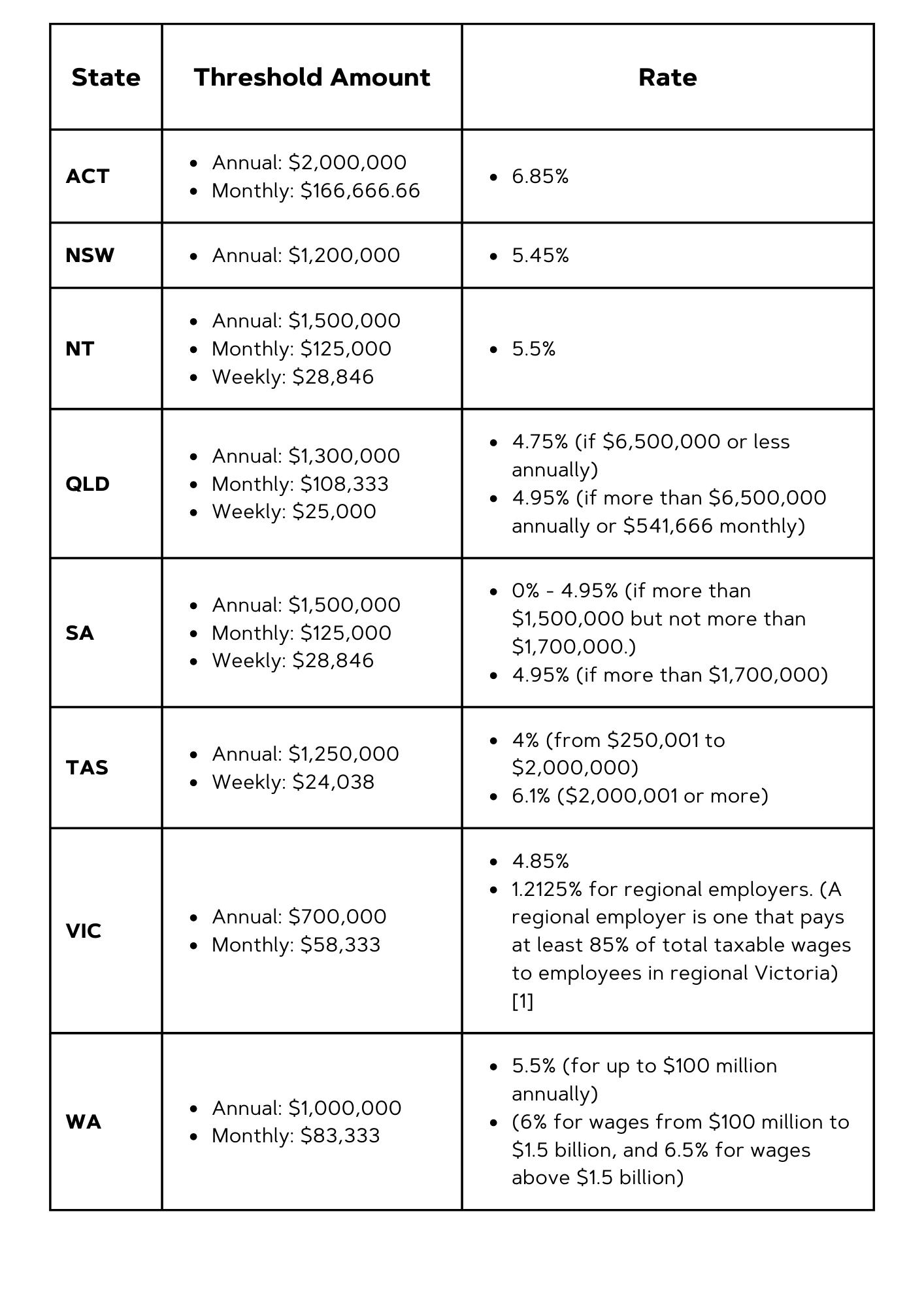

Payroll Tax And Medical Practices Alecto Australia

https://www.alectoaustralia.com/wp-content/uploads/2022/09/Payroll-Tax.png

IRS Outlines Procedures For Payroll Tax Credits And Rapid Refunds For Sick Leave

https://harriscpas.com/wp-content/uploads/2020/03/payroll-tax-credits-e1585251131836.jpeg

Below are federal payroll tax rates and benefits contribution limits for 2024 Social Security tax In 2024 the Social Security tax rate is 6 2 for employers and employees unchanged from 2023 The Social Security wage base is 168 600 for employers and employees increasing from 160 200 in 2023 Self employed people must pay 12 4 on the first 168 600 For 2024 the standard deduction also increased for inflation rising to 14 600 for single filers up from 13 850 in 2023 Married couples filing jointly may claim 29 200 up from 27 700

Be proactive in navigating the dynamic payroll landscape with Wipfli s 2024 payroll update guide This comprehensive resource covers a variety of crucial payroll topics for the upcoming year including W 2 year end basics and updated guidance on ERC claims remote workers and health savings accounts We ve also included a convenient summary Earned Income Tax Credit EITC is a tax break for low to moderate income workers and families This credit can reduce the taxes you owe and maybe even result in a bigger refund For tax year 2023 this tax credit is worth up to 7 430 for a family with three kids Tax filers with no kids must be at least age 25 but under age 65 to claim the

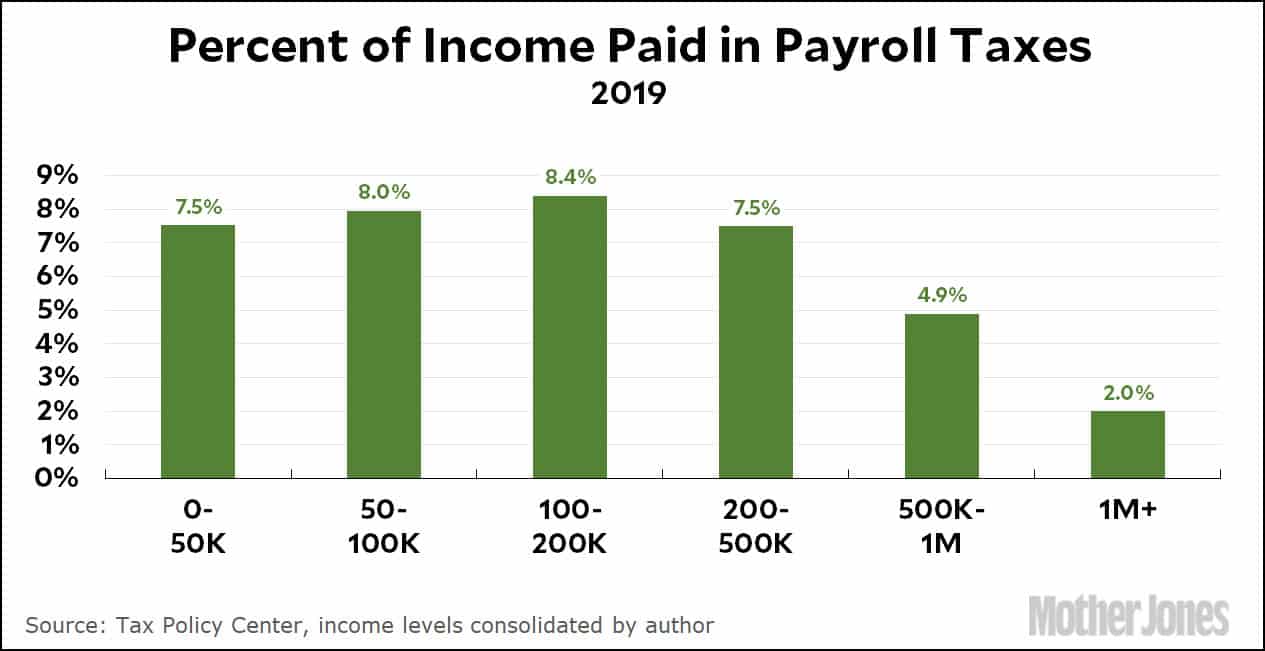

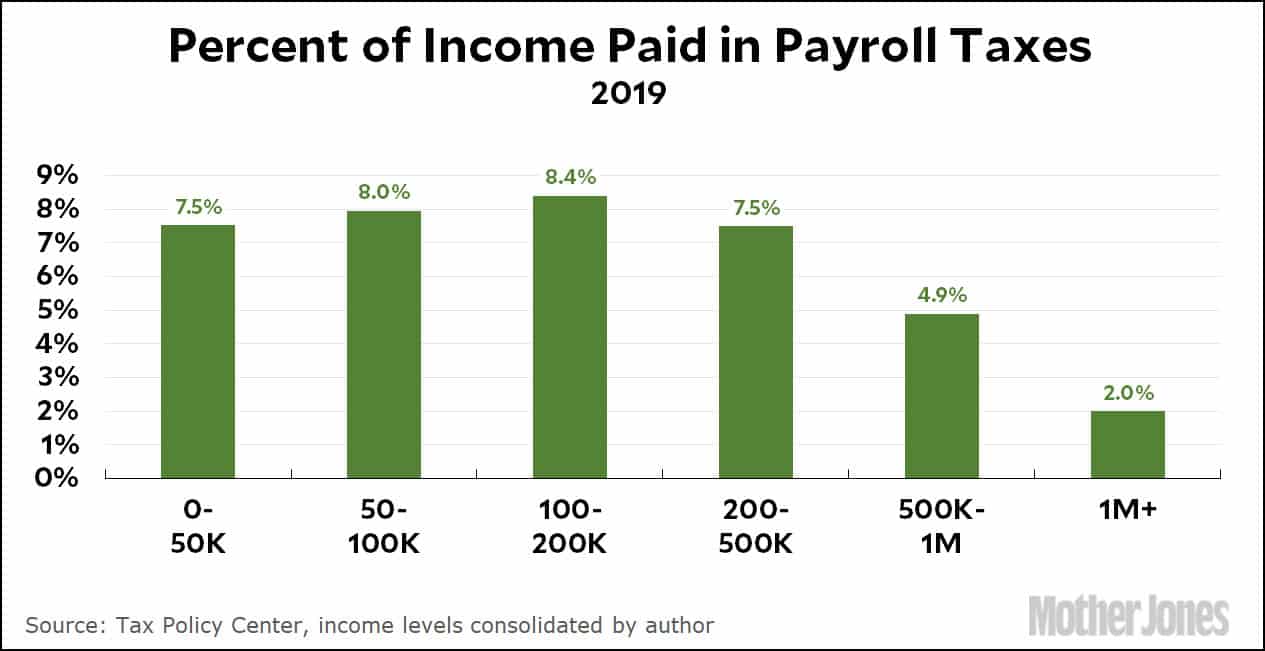

Payroll tax distribution NCPSSM

https://www.ncpssm.org/wp-content/uploads/2020/05/payroll-tax-distribution.jpg

Payroll Tax Vs Income Tax Wagepoint

https://wagepoint.com/blog/wp-content/uploads/2022/11/payroll-tax-vs-income-tax-how-they-work-for-canadian-payroll.jpg

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.irs.gov/pub/irs-prior/p15--2024.pdf

What s New Pub 15 is now for all employers Pub 15 can now be used by all employers including agricultural employers and employers in the U S territories Pub 51 Agricultural

Payroll Tax Rates And Contribution Limits For 2023

Payroll tax distribution NCPSSM

Tax Rebate Service No Rebate No Fee MBL Accounting

Payroll Tax Rebate A Time Consuming bureaucratic Nightmare Former Finance Minister The

Fast IRS Payroll Tax Rebate For SMBs Non Profits Free Eligibility Check 2022 The DailyMoss

Employee Retention Credit

Employee Retention Credit

Employers Beware The Pitfalls Of Payroll Tax Sajen Legal

Payroll Tax Vs Income Tax What s The Difference Pherrus

Understanding California Payroll Tax Finansdirekt24 se

Payroll Tax Rebate 2024 - This relief was intended for employers but it also applied to self employed individuals In particular the law allows self employed individuals to defer the employer portion of Social Security payroll tax payments that would usually be due from March 27 2020 to December 31 2020 You must still pay the full employee side of Social Security