Payroll Tax Rebate Program 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season Amount to 500 000 for tax years beginning after Decem ber 31 2022 The payroll tax credit election must be made on or before the due date of the originally filed income tax return including extensions The portion of the credit used against payroll taxes is allowed in the first calendar quarter beginning after the date that the qualified small

Payroll Tax Rebate Program 2024

Payroll Tax Rebate Program 2024

https://imengine.editorial.prod.rgb.navigacloud.com/?uuid=12D0A6E3-12BF-4D44-AA54-F7958F804379&type=primary&function=cover&source=false&width=800

Quickbooks Payrolls Certified Payroll Forms Maryland

http://teamsoftware.com/wp-content/uploads/2016/12/Payroll-Tax-2-02.jpg

Fast IRS Payroll Tax Rebate For SMBs Non Profits Free Eligibility Check 2022 The DailyMoss

https://www.dailymoss.com/wp-content/uploads/2022/08/fast-irs-payroll-tax-rebate-for-smbs-amp-non-profits-free-eligibility-check-2022-62f4300d560db.jpeg

On January 19 2024 the House Ways and Means Committee overwhelmingly approved the Tax Relief for American Families and Workers Act of 2024 by a 40 3 vote The bill provides for increases in the child tax credit delays the requirement to deduct research and experimentation expenditures over a five year period extends 100 percent bonus 511 per day 100 of average pay at the employee s regular rate Other paid sick leave options also exist but at a different pay rate This type of qualifying leave requires a person to be unable to work because they were Caring for someone impacted by COVID 19 up to 10 days

Qualifying children This policy would be effective for tax years 2023 2024 and 2025 Modification in Overall Limit on Refundable Child Tax Credit Under current law the maximum refundable child tax credit is limited to 1 600 per child for 2023 even if the earned income limitation described above is in excess of this amount Up from a cap of 160 000 for 2023 in 2024 the maximum SSA taxable earnings for 2024 will be 5 2 higher at 168 000 With the Social Security tax rate at 6 2 the maximum Social Security tax an employee can pay in 2024 is 10 453 20 6 2 x 168 600 This taxable income also known as the wage base is being increased to align with the

Download Payroll Tax Rebate Program 2024

More picture related to Payroll Tax Rebate Program 2024

IRS Outlines Procedures For Payroll Tax Credits And Rapid Refunds For Sick Leave

https://harriscpas.com/wp-content/uploads/2020/03/payroll-tax-credits-e1585251131836.jpeg

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

Payroll Tax Vs Income Tax Wagepoint

https://wagepoint.com/blog/wp-content/uploads/2022/11/payroll-tax-vs-income-tax-how-they-work-for-canadian-payroll.jpg

FY 2024 COVID 2 1 2 Payroll Support Program Air Carrier Worker Support Pandemic Relief for Aviation Workers dependent care tax credits and made changes to the Earned Income Tax Credits 3Excludes Recovery Rebate Credits associated with all Economic Impact Payments FY 2021 Budget Authority 38 512M of which 23 4 03M Summary H R 7024 would amend portions of the Internal Revenue Code of 1986 The revisions discussed in this estimate include those concerning the child tax credit the employee retention tax credit ERTC and various business tax deductions The bill also would provide tax relief to some people affected by federally declared disasters make

Medicare tax This tax is 1 45 for the employee and 1 45 for the employer totaling 2 9 of earned wages Additional Medicare Tax The employee pays 0 9 of their earned wages above 200 000 This relief was intended for employers but it also applied to self employed individuals In particular the law allows self employed individuals to defer the employer portion of Social Security payroll tax payments that would usually be due from March 27 2020 to December 31 2020 You must still pay the full employee side of Social Security

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

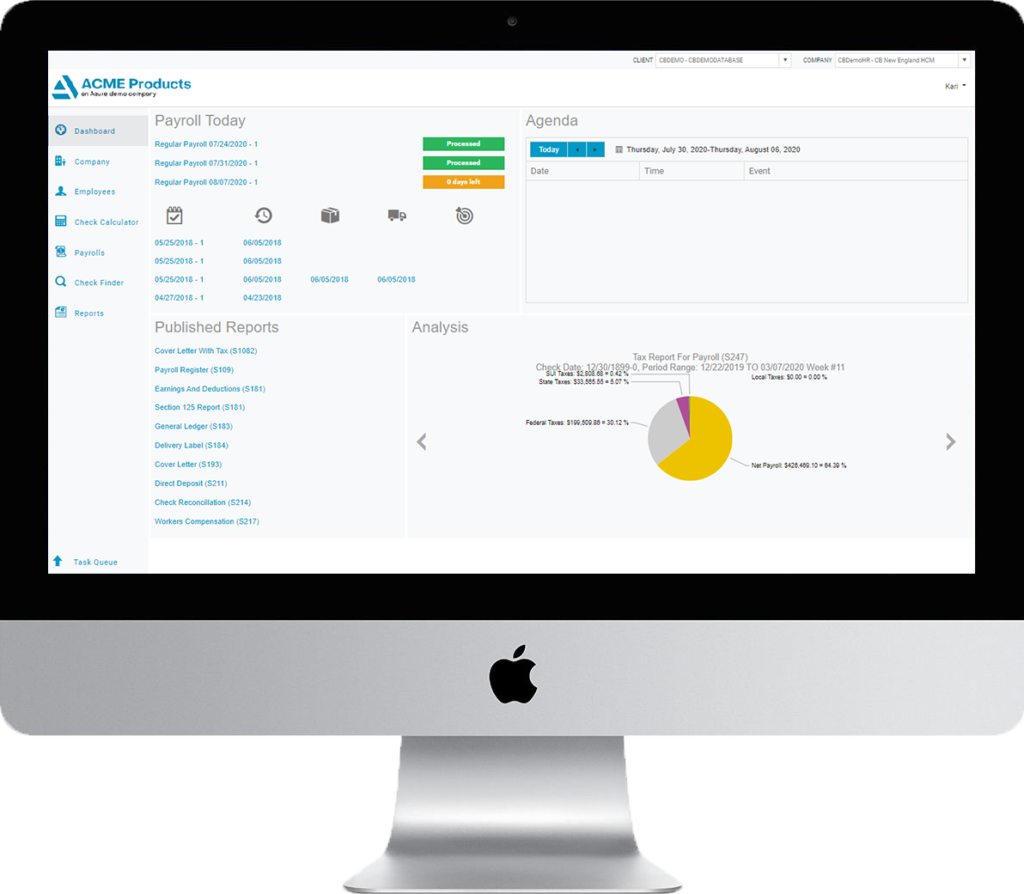

Payroll Tax Filing Basicpayrollservice

https://basicpayrollservice.com/wp-content/uploads/2021/10/Payroll-Tax-dashboard-monitor-1024x894.png

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

WASHINGTON The Internal Revenue Service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return next year This is the second in a series of reminders to help taxpayers get ready for the upcoming filing season

Payroll Tax Vs Income Tax What s The Difference Pherrus

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Employers Beware The Pitfalls Of Payroll Tax Sajen Legal

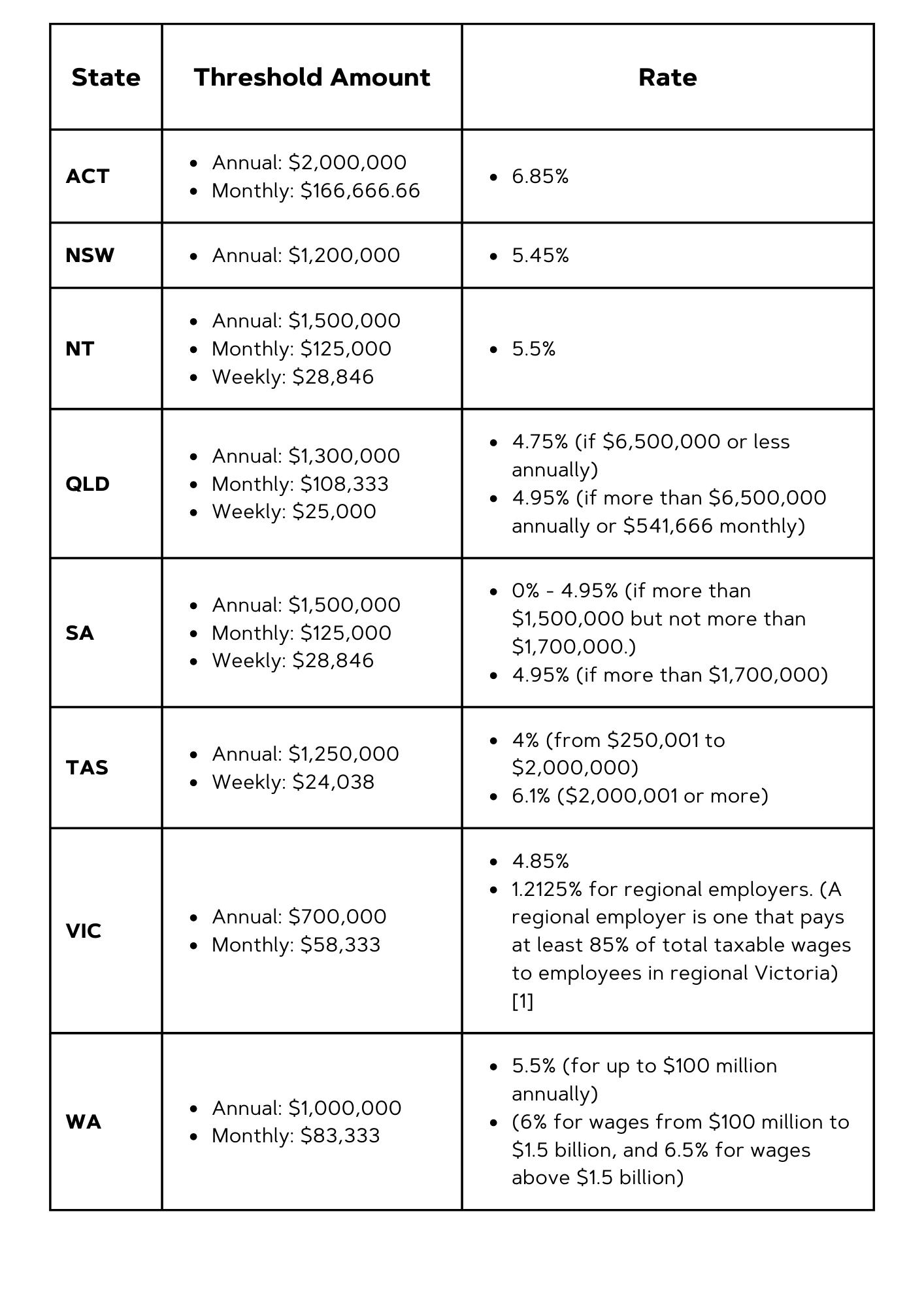

Payroll Tax Changes PVW Partners Townsville

Us Payroll Tax Calculator 2023 IngridEkanshi

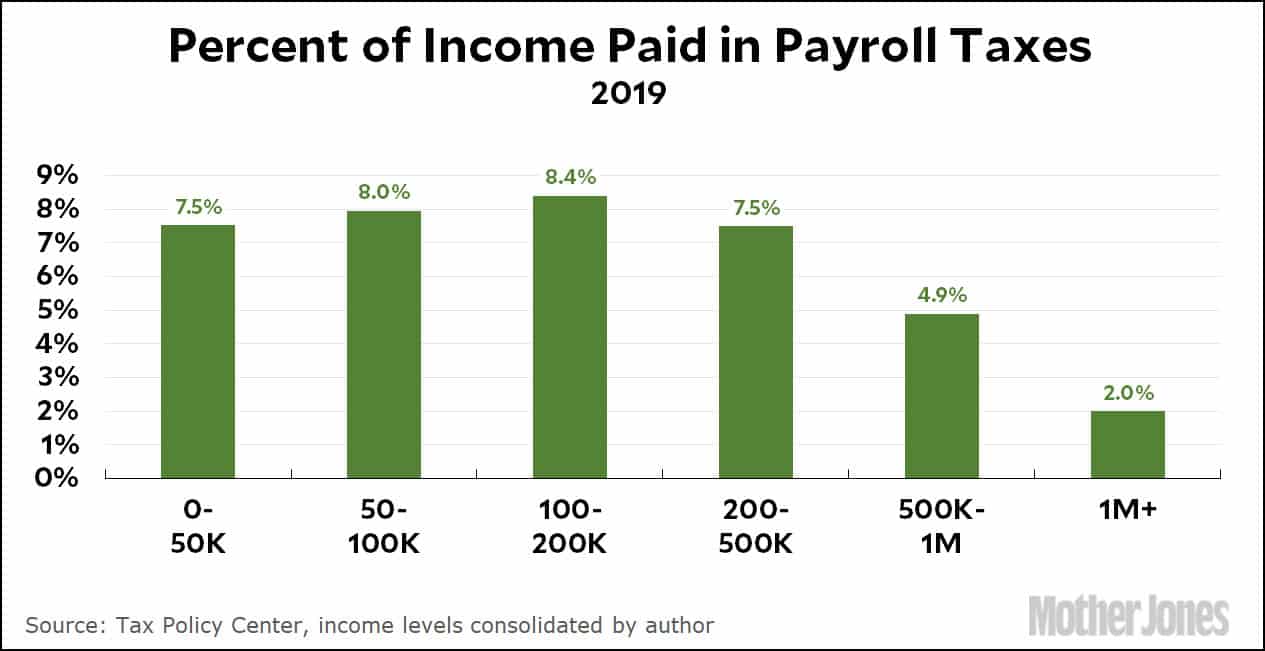

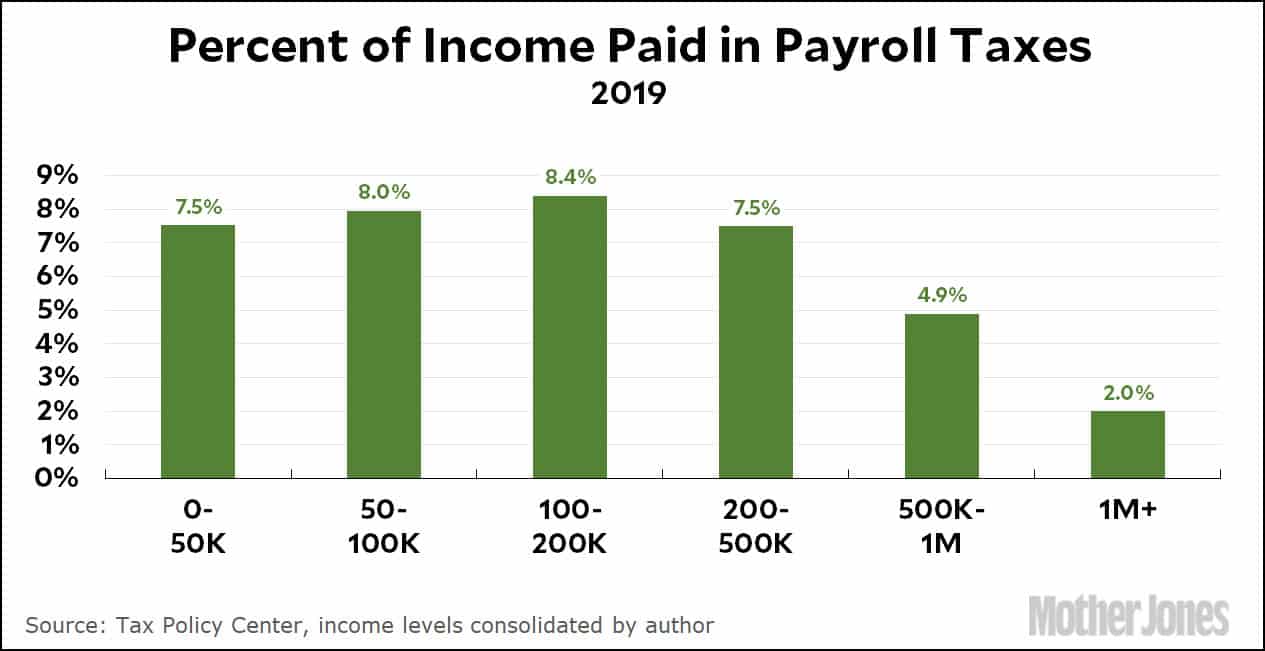

Payroll tax distribution NCPSSM

Payroll tax distribution NCPSSM

Today Is The First Day Of The Payroll Tax Deferral It s Complicated Here s What We Know The

8 Must Ask Questions For Finding The Right Payroll Tax Management Software Paycom Blog

Pre Tax Benefits What Services Complete Payroll Solutions Offers

Payroll Tax Rebate Program 2024 - How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax