Pennsylvania Property Tax Exemption For Disabled Regular Session 2023 2024 House Bill 1401 An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real

Summary An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real estate tax exemption further Regular Session 2021 2022 Senate Bill 244 An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real estate tax

Pennsylvania Property Tax Exemption For Disabled

Pennsylvania Property Tax Exemption For Disabled

https://blog.veteransloans.com/wp-content/uploads/2022/08/Blog-Cover-Disabled-Veteran-Property-Tax-Exemption.jpg

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Effective date of exemption a General rule Real property tax exemptions shall be effective as follows A qualified disabled veteran or unmarried surviving spouse shall Www veterans pa gov PAGE 3 DISABLED VETERANS REAL ESTATE TAX EXEMPTION Any honorably discharged Veteran who is a resident of Pennsylvania shall be exempt

Senate Bill 194 would exclude federal VA Aid and Attendance benefits as income when calculating eligibility for Pennsylvania s 100 Disabled Veterans Applicants with an annual income of 88 607 or less are given a rebutable presumption to have a need for the exemption Upon the death of a qualified veteran tax exemption

Download Pennsylvania Property Tax Exemption For Disabled

More picture related to Pennsylvania Property Tax Exemption For Disabled

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

https://img.hechtgroup.com/1664933010645.jpg

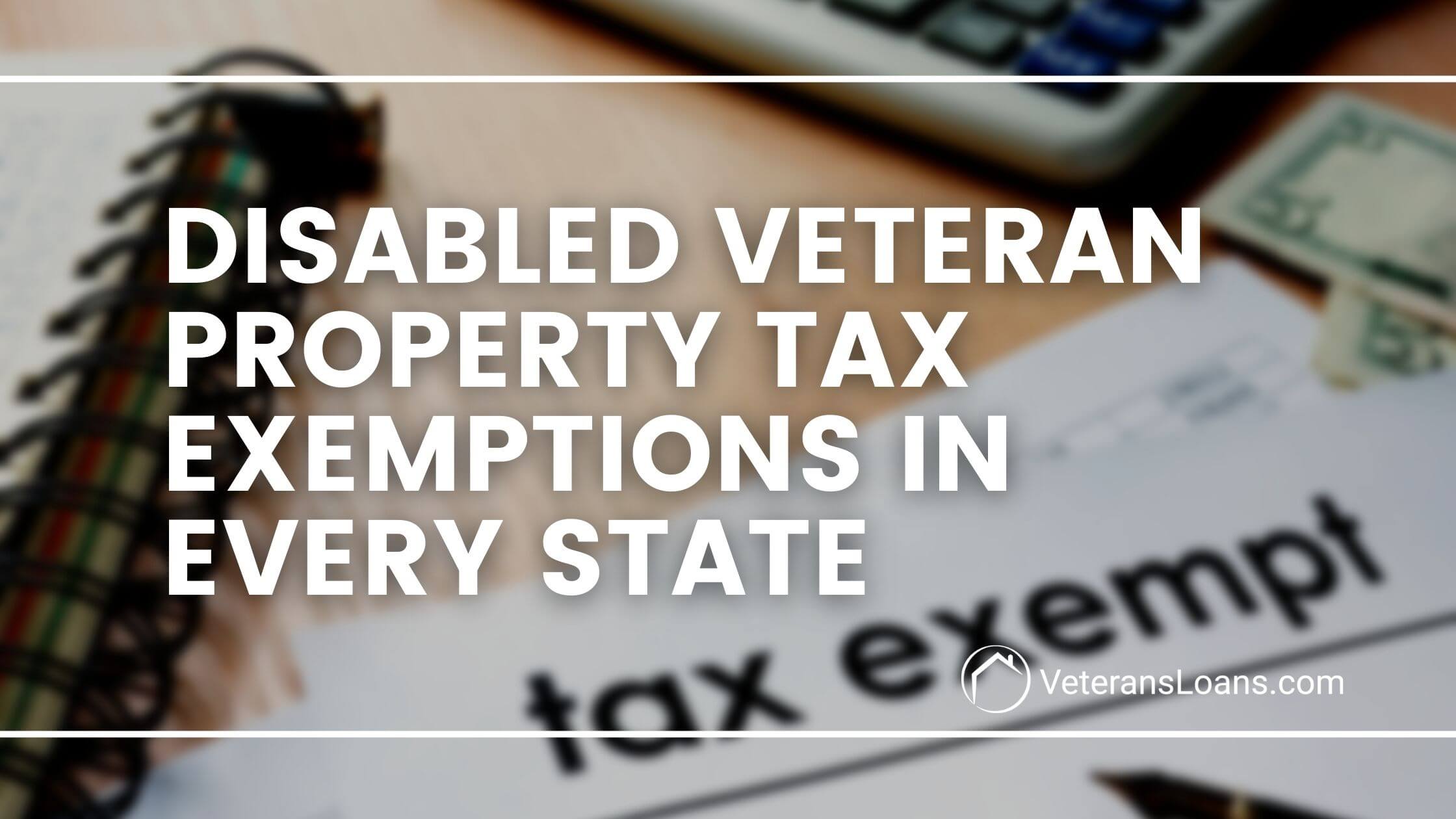

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-header.png

Disabled Veterans Real Estate Tax Exemption Program Purpose To provide real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of Disabled veterans in Pennsylvania can benefit from a property tax exemption on their primary residence providing them with reduced real estate taxes

Updated on June 21 2023 Veterans Check your 0 down eligibility today 242 Comments Expert Reviewed At a Glance Most states offer disabled Veterans property tax Disabled Veterans Tax Exemption The Disabled Veterans Tax Exemption provides real estate tax exemption for any honorably discharged veteran who is 100

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

https://www.exemptform.com/wp-content/uploads/2022/08/pennsylvania-tax-exempt-1.jpg

Property Tax Exemption For Illinois Disabled Veterans

https://www.homesteadfinancial.com/app/uploads/2023/05/VA-TAX-EXCEMPTION2.jpg

https://www. legis.state.pa.us /cfdocs/billInfo/...

Regular Session 2023 2024 House Bill 1401 An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real

https:// legiscan.com /PA/bill/SB194/2023

Summary An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real estate tax exemption further

Tax Exemption Form For Veterans ExemptForm

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

What Is The NYC Disabled Homeowners Property Tax Exemption

16 States With Full Property Tax Exemption For 100 Disabled Veterans

Sample Letter Exemption Doc Template PdfFiller

Online Tax Online Tax Exemption Certificate

Online Tax Online Tax Exemption Certificate

Property Tax Exemption For Disabled Veterans

Hecht Group Texas Veterans Now Eligible For Property Tax Exemption

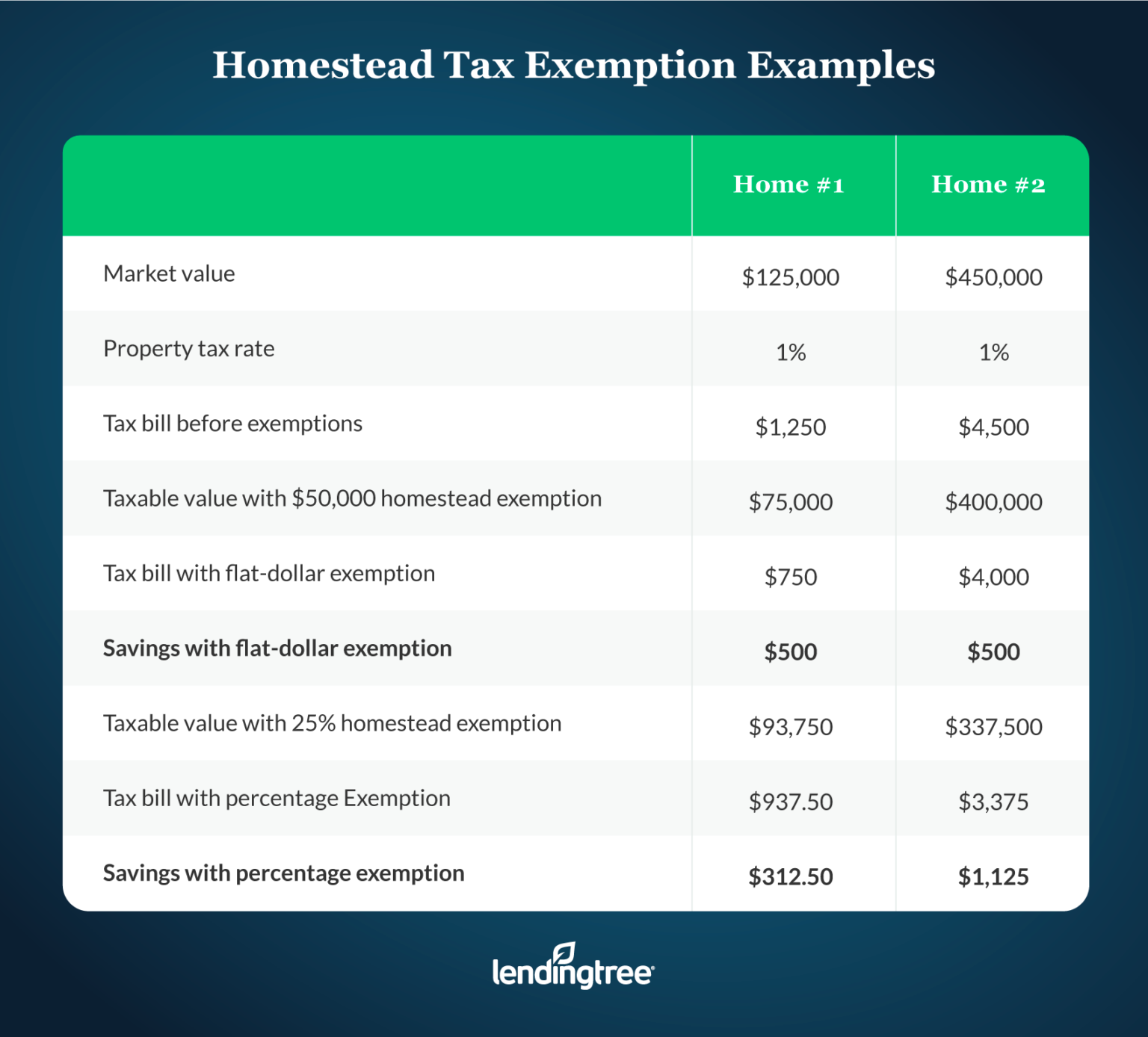

What Is A Homestead Exemption And How Does It Work LendingTree

Pennsylvania Property Tax Exemption For Disabled - The Center Square Legislation authored by state Sens Camera Bartolotta and Elder Vogel to expand property tax exemption for disabled veterans was