Pennsylvania Rebate Check 2024 JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0

Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk PA Tax Talk is the Department of Revenue s blog which informs taxpayers and tax professionals of the latest news and developments from the department First time filers who have filed by June 1 2024 should expect to receive their rebates between July 1 and September 1 2024 Some rebates may take additional time if DOR needs to correct or verify any information on a rebate application

Pennsylvania Rebate Check 2024

Pennsylvania Rebate Check 2024

https://cdn.mos.cms.futurecdn.net/jaFRiH6uJJKQXntkEG5DJF-1024-80.jpg

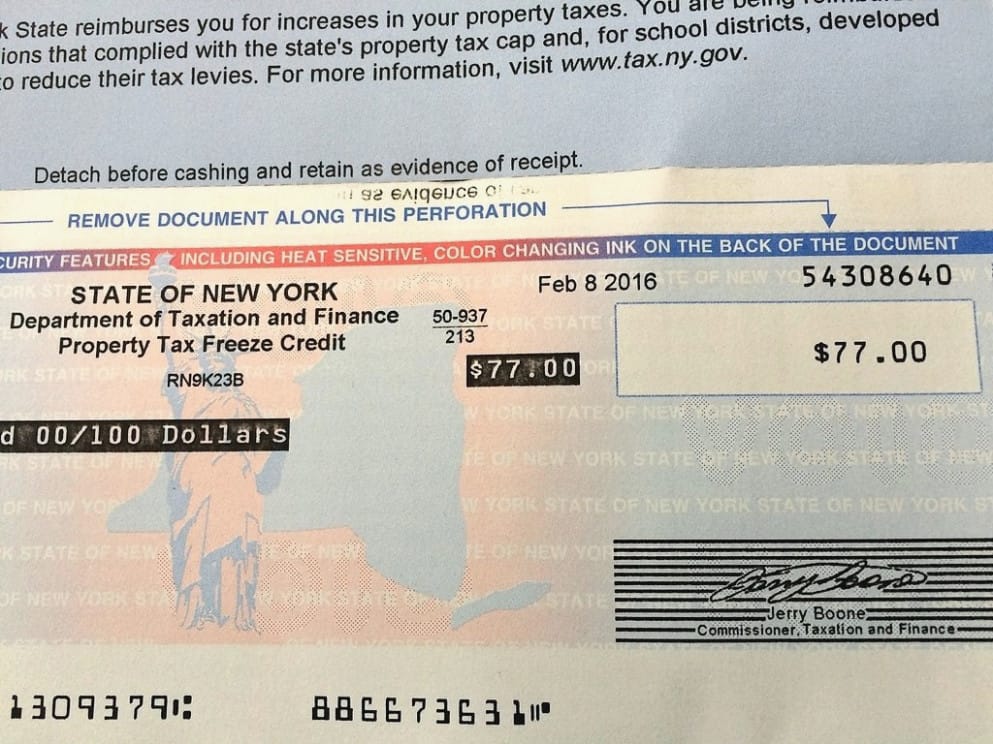

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to In 2024 Pennsylvania s maximum rebate will be 1 000 compared to 2023 s 650 The income cap also changed for renters and homeowners meaning more people will qualify Now renters and

To claim a 2023 rebate residents must have rented an apartment nursing home personal care boarding home or similar residence in Pennsylvania in 2022 and have income that does not exceed Pennsylvania State Treasurer Stacy Garrity Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000

Download Pennsylvania Rebate Check 2024

More picture related to Pennsylvania Rebate Check 2024

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Beaver County

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

Starting in mid January 2024 the Department of Revenue will open the filing period for eligible applicants to submit applications for rebates on property taxes and rent paid in 2023 The income limit will increase to 45 000 for both homeowners and renters The maximum rebate will increase from 650 to 1 000 Applicants can access forms and other information about the program at revenue pa gov ptrr and can call 1 888 222 9190 for assistance In person and mail options are available in addition to the

Yes In July state lawmakers approved a one time increase to this year s rebates so recipients will get their usual amount plus 70 So if you normally get 650 this year you ll get that plus 455 or a total of 1 105 How do I get the bonus If you ve already filed your application for this year you don t have to do anything else The easiest way to check the status of your rebate is to use the Rebates are funded by the Pennsylvania Lottery and revenue from slots gaming Reminder on Bonus Rebates During the prior claim year eligible claimants received a one time bonus rebate on property taxes or rent paid in 2021 Authorized by Act 54 of 2022 the one time bonus

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0

https://www.revenue.pa.gov/

Online filing for the Property Tax Rent Rebate Program is now available for eligible Pennsylvanians to begin claiming rebates on property taxes or rent paid in 2022 Learn More PA Tax Talk PA Tax Talk is the Department of Revenue s blog which informs taxpayers and tax professionals of the latest news and developments from the department

Nearly 300 000 Pennsylvania Residents To Receive Property Tax Rebates

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

One time Tax Rebate Checks For Idaho Residents KLEW

How To Apply For A Pennsylvania Property Tax Rebate Or Rent Rebate ExploreClarion

Auto Loan Rebate Financing Comparison Calculator

2023 Rent Rebate Form Printable Forms Free Online

2023 Rent Rebate Form Printable Forms Free Online

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Pennsylvania Rebate Check 2024 - HARRISBURG Thousands more older and disabled Pennsylvanians will qualify for help from a landmark state property tax rebate program after Democratic Gov Josh Shapiro signed a major expansion into law on Friday