Pension Death Benefits After Age 75 Hmrc How to deal with lump sum death benefit payments and what tax to deduct A lump sum death benefit payment is a lump sum paid from a pension scheme following the death of

From April 2015 lump sum death benefits paid from a registered pension scheme or non UK pension scheme are taxed at 45 where the owner of the pension rights dies age 75 or over If the individual or beneficiary dies on or after age 75 benefits are taxable on the recipient at their marginal rate If death benefit payments are made to a non qualifying person

Pension Death Benefits After Age 75 Hmrc

Pension Death Benefits After Age 75 Hmrc

https://www.woodruff-fp.co.uk/wp-content/uploads/2017/06/pension-death-benefits-changes-1900.jpg

Workplace Pension Re enrolment Tax Hints Tips Galley Tindle

https://www.galleyandtindle.co.uk/wp-content/uploads/2019/08/pension-enrolment-1024x683.jpg

Pension Death Benefits indefensibly Generous Financial Times

https://www.ft.com/__origami/service/image/v2/images/raw/https://d1e00ek4ebabms.cloudfront.net/production/d10a549b-f5fc-4468-9f25-24e5efc8ddb6.jpg?source=next-opengraph&fit=scale-down&width=900

Death benefits are usually paid tax free if the individual dies under age 75 assuming benefits are paid out within the relevant two year period where benefits are uncrystallised HMRC has confirmed that for lump sum death benefits paid from funds crystallised by individuals before 6 April 2024 who die under the age of 75 after 6 April 2024 these

Like under the old lifetime allowance rules if you die before age 75 any lump sums your beneficiaries get that are within your remaining lump sum and death benefit allowance will normally Registered pension schemes may pay benefits following the death of a member or a beneficiary a dependant nominee or successor

Download Pension Death Benefits After Age 75 Hmrc

More picture related to Pension Death Benefits After Age 75 Hmrc

Will Your Pension Death Benefits End Up In The Right Hands At The

https://www.krestonreeves.com/wp-content/uploads/2021/05/Pension-death-benefits-SC.png

What Happens If You Die Before Taking Your Pension GreenSky Wealth

https://greenskywealth.co.uk/wp-content/uploads/2015/03/pensiondeath_Dollarphotoclub_53668107_low.jpg

Do You Know What Happens To Your Pension If You Die

https://rtsfinancialplanning.co.uk/wp-content/uploads/2017/06/pension-death-benefits.jpg

Under current rules if you die before 75 your beneficiaries can inherit your defined contribution pension tax free if it is under your lifetime allowance HMRC has now confirmed If he dies before reaching age 75 successor s income can be paid tax free however if he dies after reaching age 75 then income will be taxed at the son s marginal rate

The tax that applies if you die after taking benefits from your pension depends on the benefit option you re receiving and your age when you die Your remaining drawdown fund can be Care should be taken as on death after age 75 as any benefits taken are taxable there is no tax free element The right to a pension commencement lump sum ends when the

What Is Pension Death Tax What Is Going To Change And How Will It

https://static.independent.co.uk/s3fs-public/thumbnails/image/2014/07/29/17/web-pension-scam-RF-gettyc.jpg

Lifettime Allowance Inflation Protection

https://i.ytimg.com/vi/dzr31oiNdo4/maxresdefault.jpg

https://www.gov.uk/guidance/pension-administrators...

How to deal with lump sum death benefit payments and what tax to deduct A lump sum death benefit payment is a lump sum paid from a pension scheme following the death of

https://assets.publishing.service.gov.uk/...

From April 2015 lump sum death benefits paid from a registered pension scheme or non UK pension scheme are taxed at 45 where the owner of the pension rights dies age 75 or over

Pension Death Benefits What Can You Pass On BBT Bebbington

What Is Pension Death Tax What Is Going To Change And How Will It

Post retirement Death Benefit Archives New York Retirement News

Pension Death Benefits Talis Independent Financial Advisers

D o Pension Pensioners Welfare GoI On Twitter Department Of

How To Claim SSS Death Benefit In 4 Easy Steps TWGPH

How To Claim SSS Death Benefit In 4 Easy Steps TWGPH

Pension Death Benefits

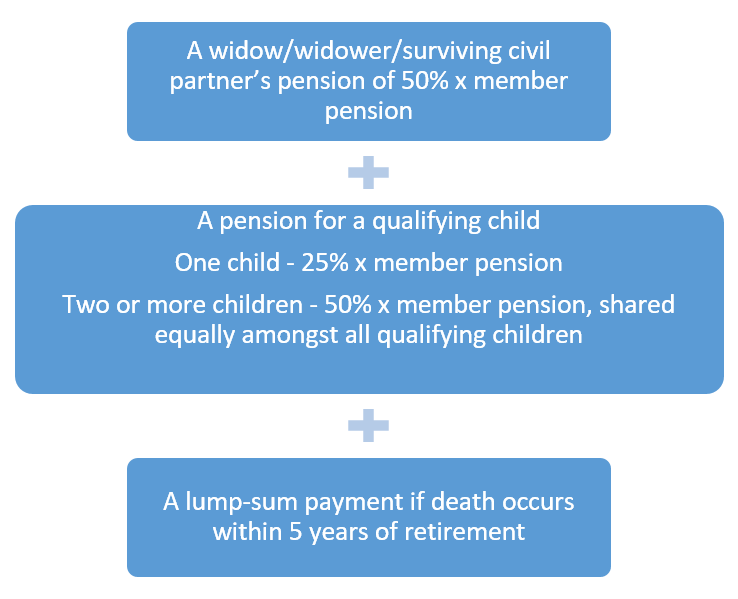

Death Benefits After Retirement Merchant Navy Officers Pension Fund

Taxation Of Pension Death Benefits Pre And Post Age 75

Pension Death Benefits After Age 75 Hmrc - Registered pension schemes may pay benefits following the death of a member or a beneficiary a dependant nominee or successor