Pension Plan Income Tax Deduction Web You can use some points in your tax return to reduce your income others can directly reduce your tax burden Deduct as a pensioner special expenses For example you can deduct medical and medication expenses due to illness as well as nursing home and funeral expenses as extraordinary expenses

Web Contributions are also classified as special expenses for tax purposes making them tax deductible in the annual income tax return up to 2 100 euros per year If you start contributing before the age of 25 you also receive a special one off bonus of 200 euros Web 26 Nov 2019 nbsp 0183 32 Pension expenses are deductible up to a certain percentage See the following chart to check the correlation between your expenses and the available tax refunds What is the deductible portion for other pension expenses The extent to which other pension expenses are tax deductible also depends on the occupational group

Pension Plan Income Tax Deduction

Pension Plan Income Tax Deduction

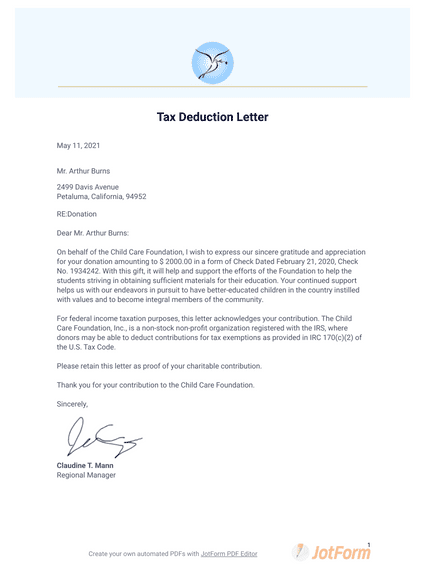

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Web 28 Dez 2023 nbsp 0183 32 Depending on how high your income will be during retirement the 25 or 18 capital gains tax can be a significant advantage compared to your potential personal income tax rate of up to 42 on state sponsored pension plans Web Premiums paid to one or more private pension contracts can only be deducted if the contract was concluded for a minimum duration of 10 years the accumulated savings are payable to the taxpayer at the earliest at the age of 60 and at the latest at the age of 75

Web According to a survey on pension provision in Germany 9 in western Germany in 1995 1 4 million men and 0 5 million women aged 55 and over were paid a company pension The average amount of DM 663 a month for men measured on the net standard pension 10 of DM 1 933 a month wasquite consider able Web 14 Juni 2021 nbsp 0183 32 In general roll overs are not taxed in the USA An exception is the rollover from a 401 k plan into a Roth IRA which is subject to US income taxation In Germany the transfer of funds from a qualified pension plan into a private pension plan is in general a taxable event The withdrawal from the plan will in most cases be subject to German

Download Pension Plan Income Tax Deduction

More picture related to Pension Plan Income Tax Deduction

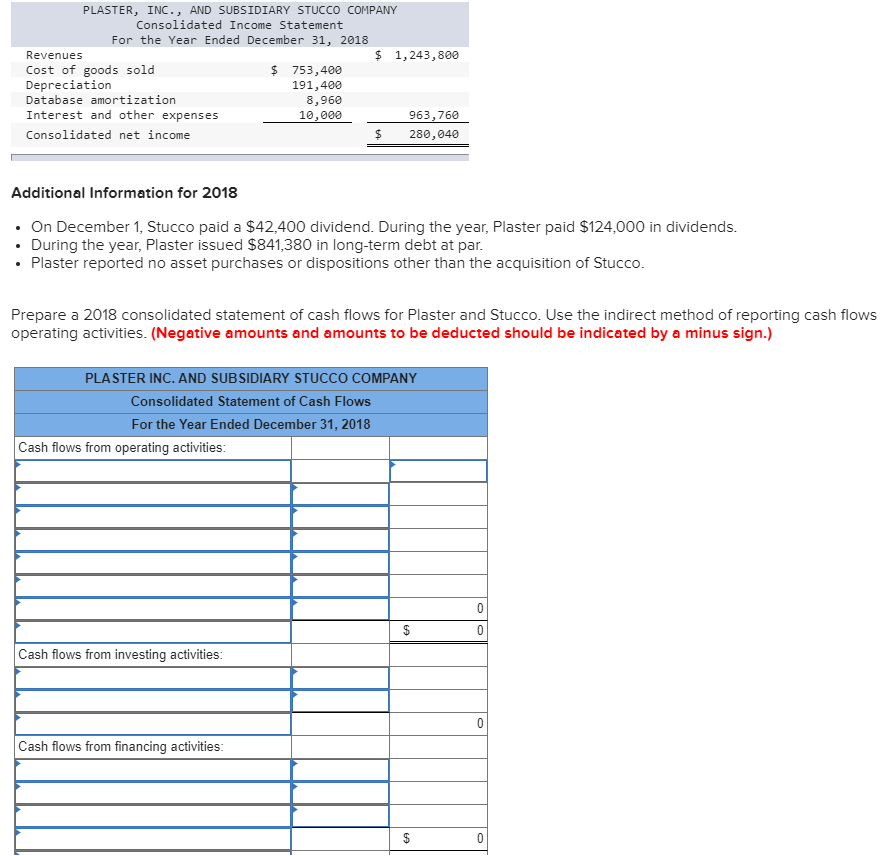

PLASTER INC AND SUBSIDIARY STUCCO COMPANYConsolidated Income

https://media.cheggcdn.com/media/ac8/ac817654-9839-4cfb-92db-2ea150ea8138/php67dFP6.png

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is Retirement Savings Tax Credit Leia Aqui Why Am I Getting A

https://www.investopedia.com/thmb/9Rj4BAvEf2P_WLFphJolmALSRUw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png

Pdf Non deduction Of Income Tax At Source From Pension

https://geod.in/wp-content/uploads/2021/05/Non-deduction-of-Income-Tax-at-source-from-Pension.jpg

Web 15 Dez 2023 nbsp 0183 32 The employee contributions are deducted from wages The employer may also match a portion of the worker s annual contributions up to a specific percentage or dollar amount There are two main types Web Topic No 410 Pensions and Annuities If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the amounts you receive may be taxable unless the payment is a qualified distribution from a designated Roth account This topic doesn t cover the taxation of

Web This publication discusses the tax treatment of distributions you receive from pension and annuity plans and also shows you how to report the income on your federal income tax return How these distributions are taxed depends on whether they are periodic payments amounts received as an annuity that are paid at regular intervals over several Web 4 Mai 2022 nbsp 0183 32 Withholding and Social Security Change in Withholding When You Reach 72 Frequently Asked Questions FAQs Photo Sam Edwards Getty Images When you start a pension you can choose to have federal and state taxes withheld from your monthly checks The goal is to withhold enough taxes that you won t owe much money when you

Income Tax Deduction Card For 2018 Displaying Pay Benefits Taxable

https://imgv2-1-f.scribdassets.com/img/document/416426564/original/3658f09db5/1707494181?v=1

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

https://komplytek.com/blogs/wp-content/uploads/2022/07/Income-Tax-Deduction-on-Crytocurrency.png

https://taxfix.de/en/tax-returns-pensioners

Web You can use some points in your tax return to reduce your income others can directly reduce your tax burden Deduct as a pensioner special expenses For example you can deduct medical and medication expenses due to illness as well as nursing home and funeral expenses as extraordinary expenses

https://www.iamexpat.de/expat-info/official-issues/pensions-retirement...

Web Contributions are also classified as special expenses for tax purposes making them tax deductible in the annual income tax return up to 2 100 euros per year If you start contributing before the age of 25 you also receive a special one off bonus of 200 euros

Section 80C Deductions List To Save Income Tax FinCalC Blog

Income Tax Deduction Card For 2018 Displaying Pay Benefits Taxable

Income Tax Savings Here s How You Can Claim Rs 50 000 Standard

Chapter 3 PDF Gross Income Tax Deduction

Income Tax Deduction From Salaries PDF Income Tax Employee Benefits

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

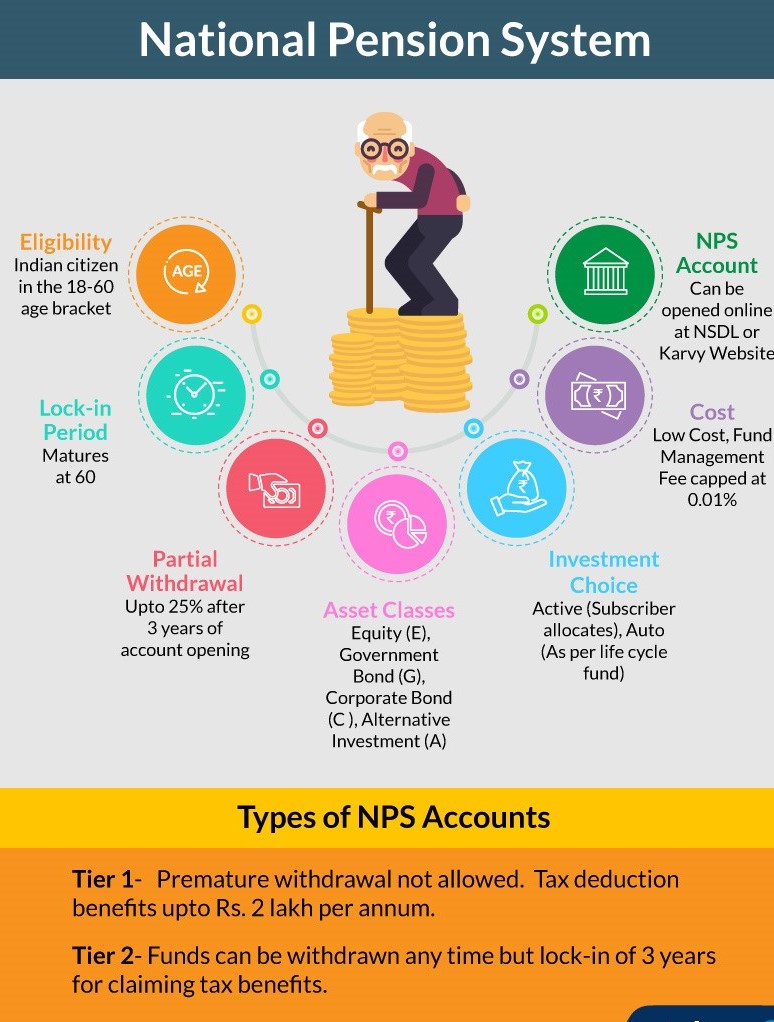

All About Of National Pension Scheme NPS CA Rajput Jain

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

Tax Deduction 2021 Everything You Should Know About TDS And VDS In

Pension Plan Income Tax Deduction - Web 14 Juni 2021 nbsp 0183 32 In general roll overs are not taxed in the USA An exception is the rollover from a 401 k plan into a Roth IRA which is subject to US income taxation In Germany the transfer of funds from a qualified pension plan into a private pension plan is in general a taxable event The withdrawal from the plan will in most cases be subject to German