Pension Plan Tax Deduction Pensions are taxed according to the income tax rate The differences to taxation of wages are the various tax deductions and social insurance contributions Read more on Etk fi More on other

In many countries contributions made to pension plans are tax deductible This means that individuals can deduct the amount they contribute to their pension plans from their The Registered Pension Plan RPP deduction is a tax benefit available to individuals who contribute to a registered pension plan through their employer This deduction allows individuals to reduce their taxable income by

Pension Plan Tax Deduction

Pension Plan Tax Deduction

https://i.ytimg.com/vi/XG2F4XmVZJA/maxresdefault.jpg

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

https://live.staticflickr.com/4856/32641508108_4eef691caa_b.jpg

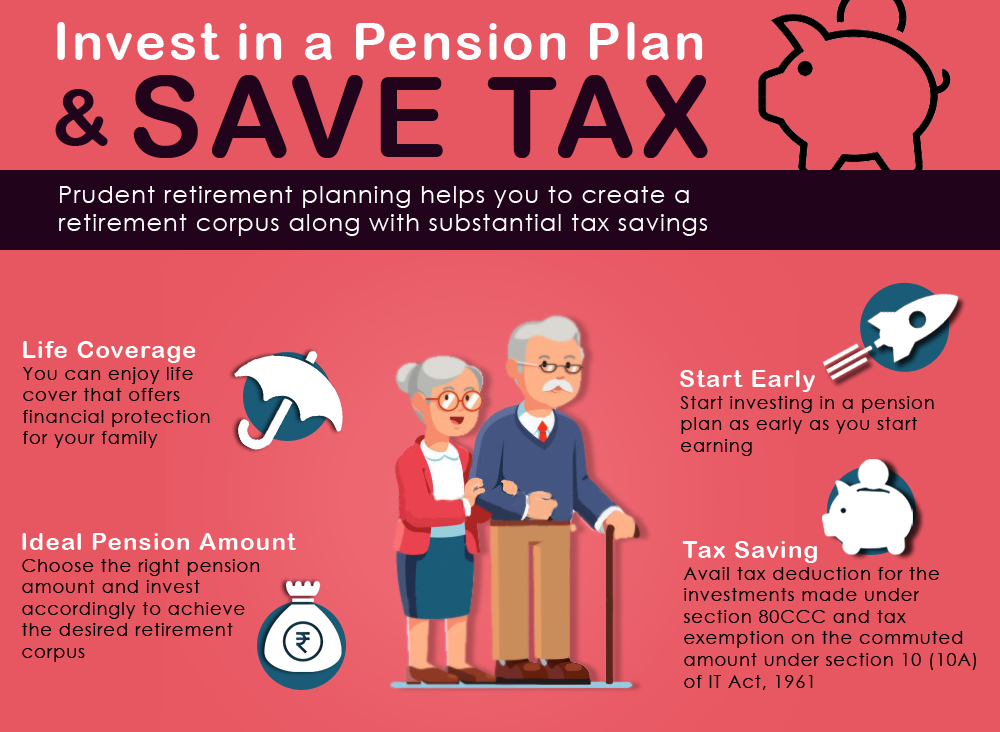

Updated for tax year 2024 We all know how important it is to save for retirement If you ve started contributing to a retirement plan at work or on your own the next thing you ll The Section 80CCC of the Income Tax Act was introduced by the government in order to make people invest in pension plans Under this any investment made towards pension plans can be deducted from gross income

You fill out a pretend tax return and calculate that you will owe 5 000 in taxes That is a 10 rate You can have 10 in federal taxes withheld directly from your pension and IRA distribution so that you would receive a net A pension plan tax deduction is a way to reduce your taxable income by contributing to a pension plan This deduction allows you to save for retirement while also

Download Pension Plan Tax Deduction

More picture related to Pension Plan Tax Deduction

Pdf Non deduction Of Income Tax At Source From Pension

https://geod.in/wp-content/uploads/2021/05/Non-deduction-of-Income-Tax-at-source-from-Pension.jpg

What Is Provident Fund And How To Withdraw Provident Fund

https://static.wixstatic.com/media/d856da_5d1cbe03e9b4450da926f17fffbf2350~mv2.jpeg/v1/fit/w_1000%2Ch_1000%2Cal_c%2Cq_80/file.jpeg

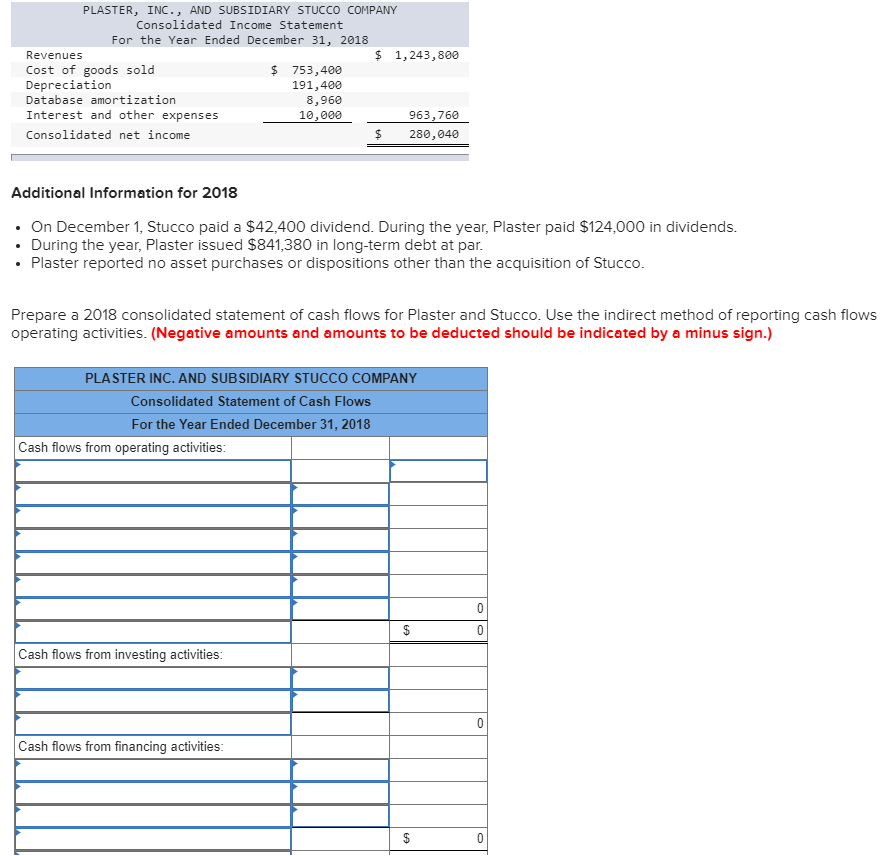

Solved On June 30 2018 Plaster Inc Paid 940 000 For 80 Chegg

https://media.cheggcdn.com/media/ac8/ac817654-9839-4cfb-92db-2ea150ea8138/php67dFP6.png

Generally if you pay administration fees or you make contributions to your employee s savings or pension plan the benefit is taxable Non taxable situations do not deduct income tax on the While many pension plan contributions get the benefit of being tax deductible not all contributions are If you are making contributions to a Simplified Employee Pension SEP or some other kind of pension plan you may want to

For example there is a 31 110 deduction available for state private and military retirement plans Tax on Taxable Income Flat 4 for 2024 Social Security Not taxable Understanding pension related deduction strategies can be crucial in optimizing tax savings for retirement It s important to consult with a financial advisor or do your own

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

https://c1.staticflickr.com/9/8606/28374128013_523fe7f52b_b.jpg

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

https://www.etk.fi › en › finnish-pension-system › ...

Pensions are taxed according to the income tax rate The differences to taxation of wages are the various tax deductions and social insurance contributions Read more on Etk fi More on other

https://canpension.ca › articles › are-pension-plans...

In many countries contributions made to pension plans are tax deductible This means that individuals can deduct the amount they contribute to their pension plans from their

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

80CCC Tax Deductions Tax Deductions Personal Loans Refinance Loans

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

Maximising Tax Benefits Your Guide To Claiming A Rental Property

How Pension Plans Help To Save Taxes Comparepolicy

How Pension Plans Help To Save Taxes Comparepolicy

Tax Deduction Tracker Printable Tax Sheet Business Decduction Log

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

State Pension Funding State Pension Plan Finances Tax Foundation

Pension Plan Tax Deduction - Is a defined benefit plan tax deferred Section 401 a of the Internal Revenue Code specifies defined benefit pension plans as qualified plans Accordingly S corporations sole proprietors