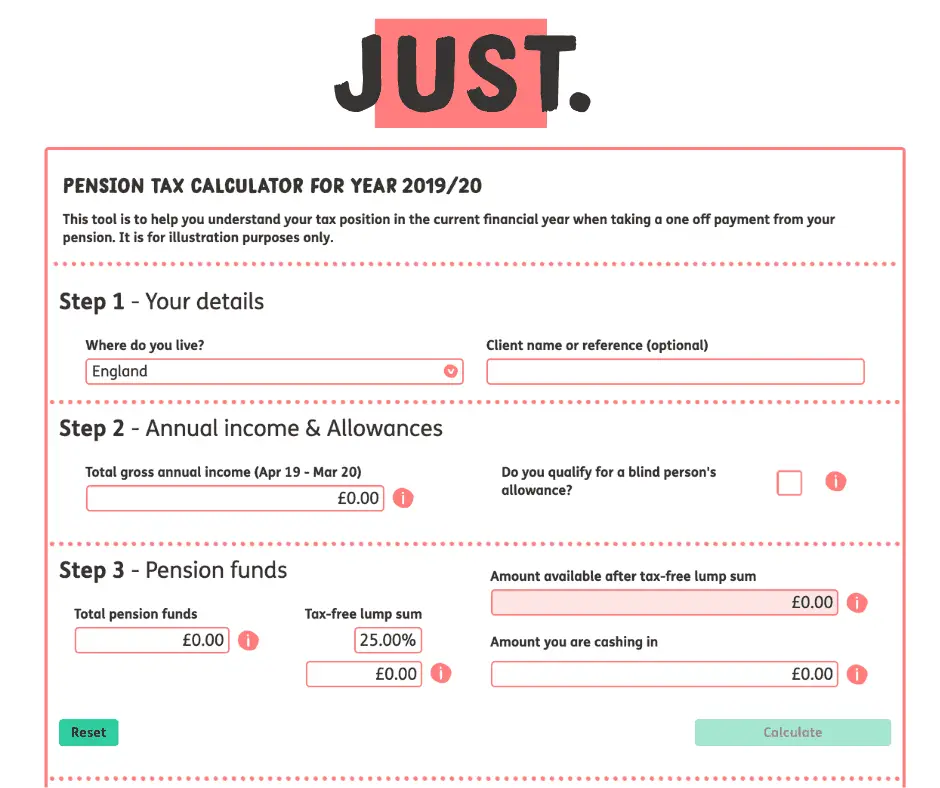

Pension Scheme Income Tax Rebate Web 12 mai 2016 nbsp 0183 32 You can claim tax relief on your Self Assessment return for contributions you make towards registered pension schemes

Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax Web 6 avr 2023 nbsp 0183 32 The annual allowance for contributions to all pensions within any one tax year including tax relief is 163 60 000 This limit applies to

Pension Scheme Income Tax Rebate

Pension Scheme Income Tax Rebate

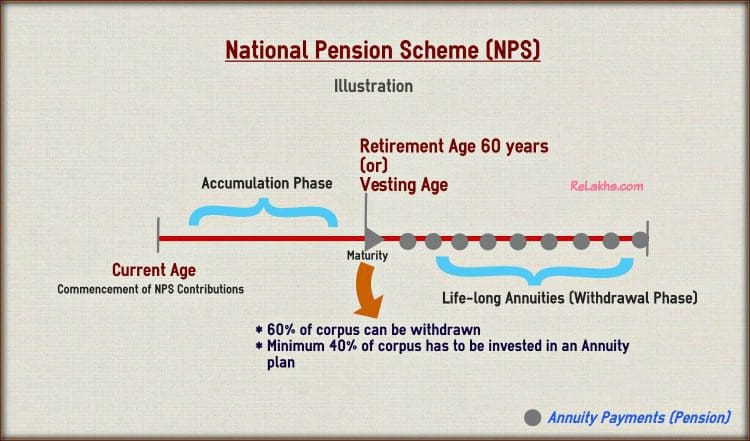

https://www.relakhs.com/wp-content/uploads/2016/07/National-Pension-Scheme-How-NPS-Scheme-works-Example-Illustration-pic.jpg

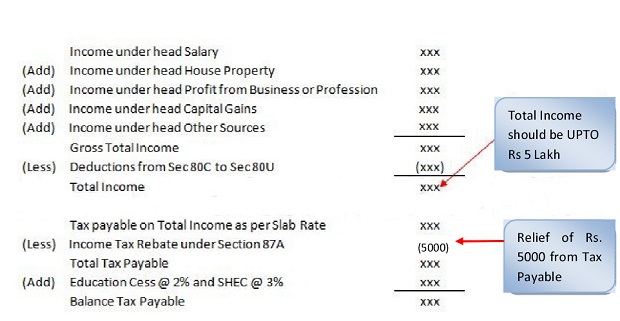

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

2019 2022 Form UK NHS RF12 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/495/136/495136692/large.png

Web 13 avr 2023 nbsp 0183 32 The last point means that if your pension uses the relief at source method of tax relief and you earn say 163 5 000 in the 2023 24 tax year you can make a gross contribution of up to 163 5 000 into that Web 30 mai 2023 nbsp 0183 32 Any additional tax relief from your pension can be enjoyed in three ways A reduction in your annual tax bill A change to your tax code reducing your tax bill for the following year A tax rebate How does

Web Pension scheme administration Form Claim back a flexibly accessed pension overpayment English Cymraeg Use the online service or form P55 to reclaim an Web 6 avr 2023 nbsp 0183 32 Tax relief on pension contributions The video below illustrates how tax relief on pension contributions works The tax relief is available on contributions up to 100 of your annual earnings i e if you

Download Pension Scheme Income Tax Rebate

More picture related to Pension Scheme Income Tax Rebate

Application For Opting Out Of The NHS Pension Scheme SD502

https://www.pdffiller.com/preview/518/43/518043821/large.png

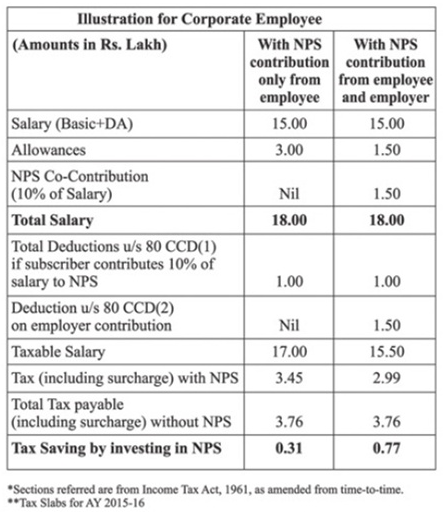

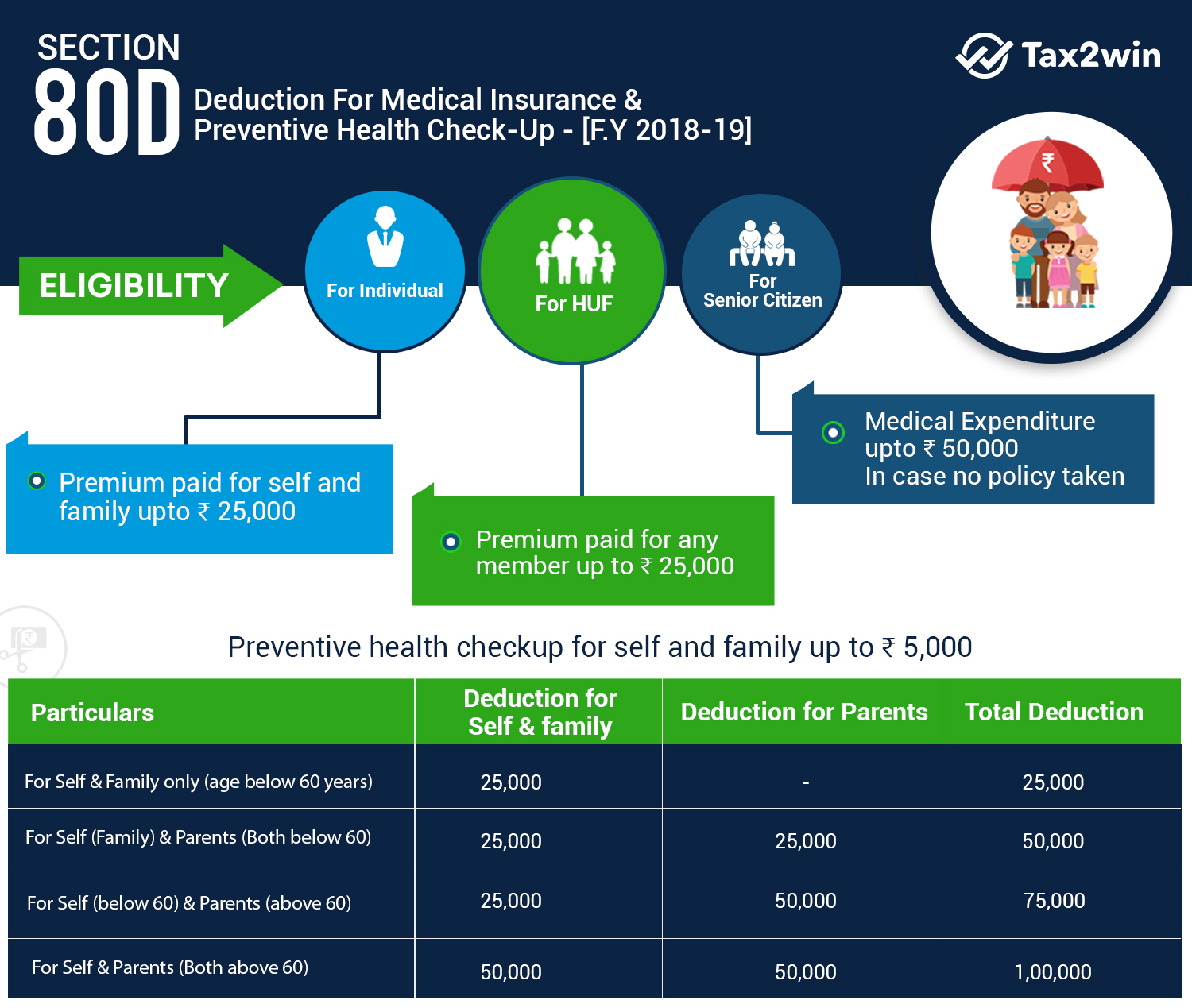

NPS Tax Benefit U s 80CCD 1 80CCD 2 And 80CCD 1B

https://www.apnaplan.com/wp-content/uploads/2015/12/NPS-illustration-of-Tax-Exemption-on-NPS-by-restructing-of-Salary.png

6 Simple Steps To Conquering Self employed Pensions FreeAgent

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/netlify/guides__small-business__pensions__whopays.png

Web You are liable to a tax charge if the overall amount of the increase in your pension savings your pension input amount in overseas pension schemes and UK registered pension Web 6 mars 2023 nbsp 0183 32 To use this calculator simply add your annual income and how much you are paying into your pension We ll break down exactly how much tax relief will be added This calculator has been updated for the

Web 21 janv 2021 nbsp 0183 32 As a result with the annual tax credit being equivalent to 25 of contributions made or 750 the annual contributions which may be made into a Web If you took your pension on or after 6 April 2023 you ll pay Income Tax on some or all of the lump sum if it is more than 25 of the standard lifetime allowance If you hold lifetime

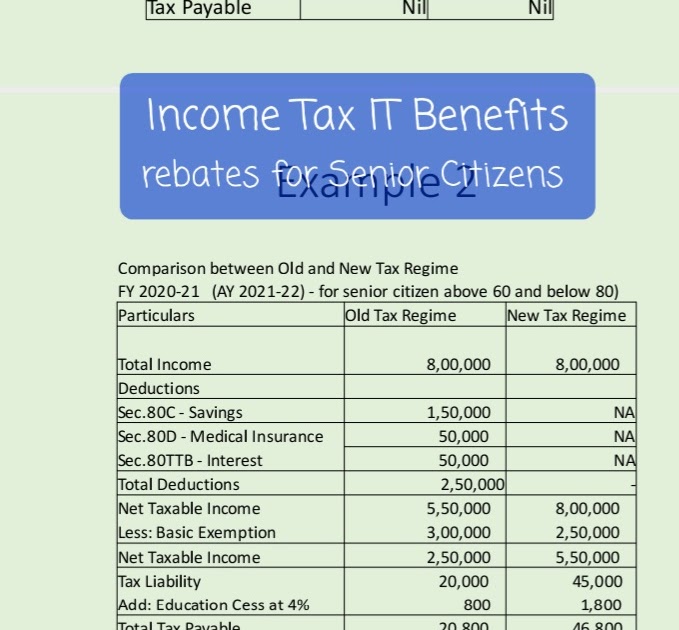

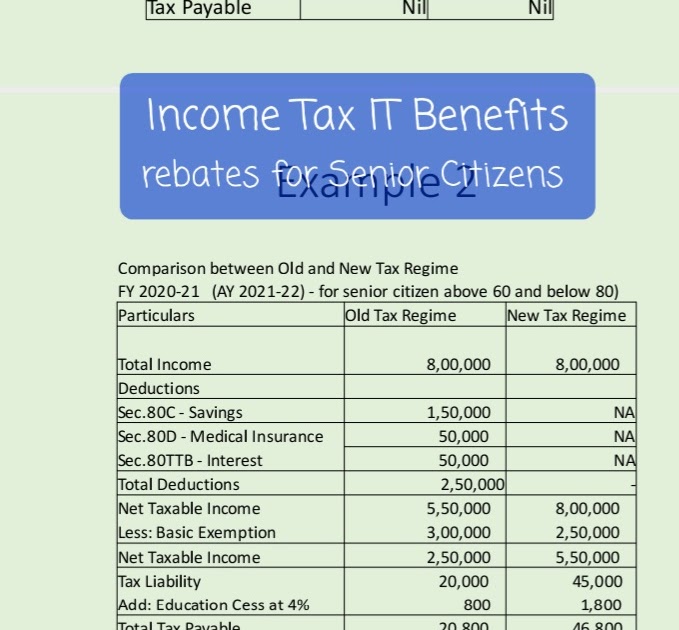

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

https://www.gov.uk/guidance/self-assessment-claim-tax-relief-on...

Web 12 mai 2016 nbsp 0183 32 You can claim tax relief on your Self Assessment return for contributions you make towards registered pension schemes

https://www.unbiased.co.uk/discover/pensions-retirement/managing-a...

Web 7 sept 2023 nbsp 0183 32 A basic rate tax relief of 20 is automatically applied on the whole amount You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax

How Are Lump Sum Pensions Taxed TaxesTalk

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

2007 Tax Rebate Tax Deduction Rebates

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Rebate Under Section 87A

What s The Distinction Between PMI And Home Loan Defense Insurance

Pension Scheme Income Tax Rebate - Web 30 mai 2023 nbsp 0183 32 Any additional tax relief from your pension can be enjoyed in three ways A reduction in your annual tax bill A change to your tax code reducing your tax bill for the following year A tax rebate How does