Pensioners Tax Allowance In Spain On average Spanish pensioners are taxed at source at a rate of 7 7 although the percentage varies depending on your pension The highest state pensions are taxed at least 19 at source What about personal allowances Pensioners have

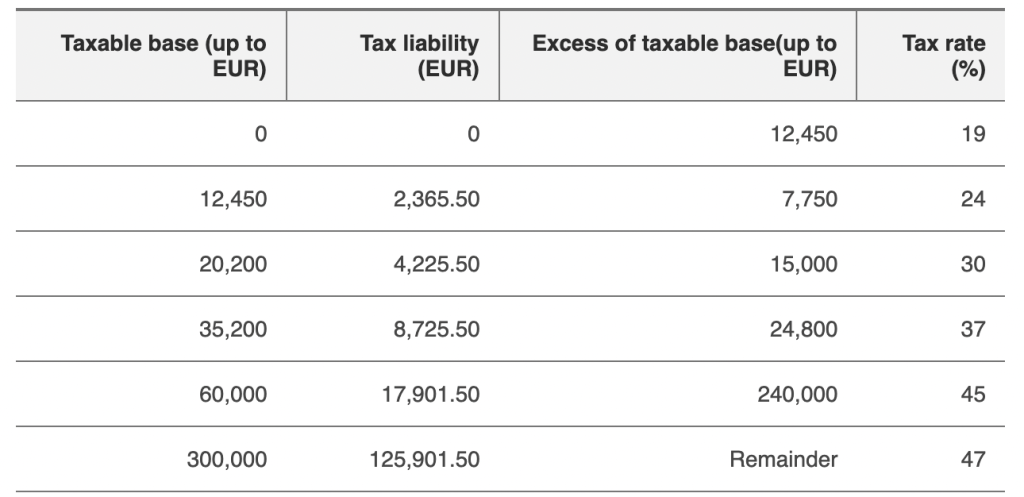

Other deductions and tax allowances in Spain Generally you can also claim deductions and tax credits for Social security contributions deducted at source by an employer Pension contributions Mandatory contributions to mutual benefit societies for widows widowers and orphans upon the death of the participant Spain taxes employment income at a progressive rate ranging from 19 to 45 In this situation an annual income of 55 000 euros corresponds to a tax rate of 26 This 26 will only apply to the taxable income which is 25 000 for private pensions

Pensioners Tax Allowance In Spain

Pensioners Tax Allowance In Spain

https://blog.abacoadvisers.com/wp-content/uploads/2019/08/residency-pensioners-spain_0-1-768x512.jpg

How To Pay Tax In Spain And What Is The Tax Free Allowance

https://images.ctfassets.net/qr8kennq1pom/4NHjP2IVsdNCW4iM1w6Rlx/c8d19241223ac716251c295e5006c06e/kelly-sikkema-xoU52jUVUXA-unsplash.jpg?fm=jpg&fl=progressive&q=70

Doctors Win Latest Compensation Fight Over Poor COVID 19 Protection In

https://www.theolivepress.es/wp-content/uploads/2022/02/Doctors-win-latest-compensation-fight-over-poor-COVID-19-protection-in-Spains-Valencia-scaled.jpg

Your personal allowance is normally 5 550 However the allowance is 6 700 when the taxpayer is over 65 years of age and 8 100 when the taxpayer is over 75 years of age How the Spanish tax office treats pensions paid by a The good news is that because pensions are treated as earned income in addition to personal 5 550 and age allowances 65 1 150 75 1 400 an extra 2 000 general deduction plus a further low income deduction of up to 5 565 are available This means that a person over 75 years old pays no income tax on pension income

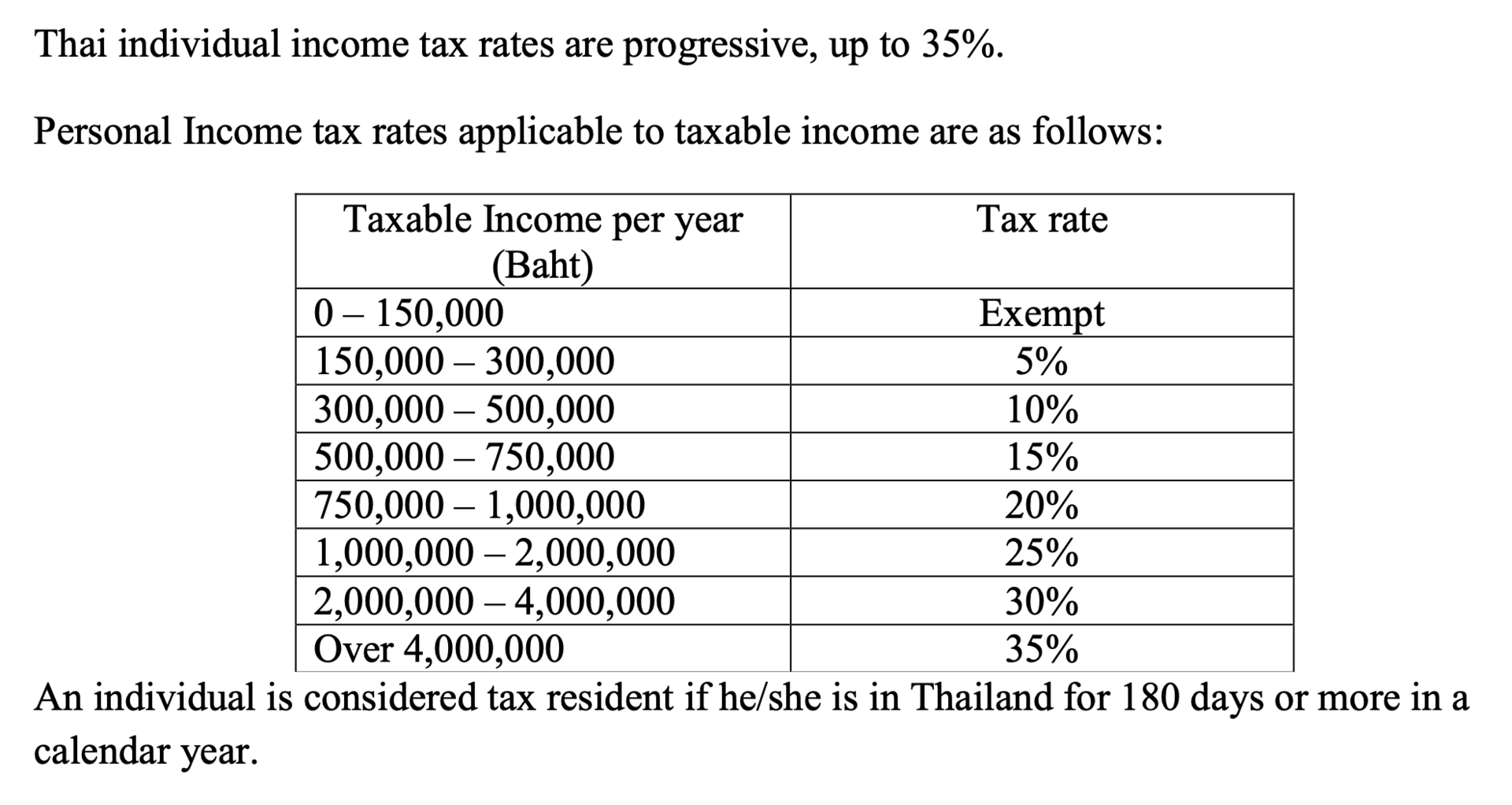

In Spain income tax is charged at the same rate for both general income and pensions Therefore pensions in Spain are subject to progressive tax rates ranging from 19 to 47 as follows Up to 12 450 19 12 451 20 200 24 20 201 35 200 30 35 201 60 000 37 60 001 300 000 45 Over 300 000 47 Your tax experts in Spain The good news is that because pensions are treated as earned income in addition to personal 5 550 and age allowances 65 1 150 75 1 400 an extra 2 000 general deduction plus a further low income deduction of up to 5 565 are available This means a person over 75 years old pays no income tax on pension income below

Download Pensioners Tax Allowance In Spain

More picture related to Pensioners Tax Allowance In Spain

Autumn Statement 2022 HMRC Tax Rates And Allowances For 2023 24

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt8743826b67930bd8/63767939ac59ed1089b31054/table_1.png

Expat Taxes In Spain 2023 Non Resident Tax Rates Spain

https://www.myspanishresidency.com/wp-content/uploads/2022/01/Screenshot-2022-01-05-at-18.58.37-1024x497.png

End Of Year Tax Rules For Retirees Retirement Essentials

https://retirementessentials.com.au/wp-content/uploads/2022/06/EOFY-tax-rules-for-retirees.jpg

Pension income tax in Spain Income taxes on pensions Pensions from the government and private companies are both taxed as if they were earned profits Taxes on state benefits are frequently paid in the country that pays the pension The investment tax laws apply to the majority of personal pensions A tax rate of 24 will be applied up to 600 000 and income exceeding that amount is taxed at 47 the previous rate was 45 The taxation of insurance premiums has increased to 8 up from 6 State pension payments increased by 0 9 and noncontributory pensions increased by 1 8 The public pension payment is capped at

If your total income including pension and other sources like rental income exceeds 12 000 per year and the income from the smallest source is more than 1 500 per year you must submit an income declaration and pay taxes on your pension Pensions received from outside Spain In certain cases the agreement may provide for an exemption for a pension received in the country of residence Spain although this would be on a progressive basis meaning that the exempted income would be added to the person s remaining income in order to calculate the rate of tax applicable to their remaining income Volver arriba

Spanish Budget Passes In Congress With Support From Pro independence

https://all-andorra.com/wp-content/uploads/2021/11/Spanish-budget-passes-in-Congress-with-support-from-pro-independence-parties.jpg

How To Pay Tax In Spain And What Is The Tax Free Allowance

https://images.ctfassets.net/qr8kennq1pom/76WonvQ08bif2lq8946mtF/dad591c8520757b55e876d17012cfd41/Spain_inheritance_tax_rate_2022.png?fm=jpg&fl=progressive&q=70&w=1440

https:// costaluzlawyers.es /blog/your-guide-to-tax-on-pensions-in-spain

On average Spanish pensioners are taxed at source at a rate of 7 7 although the percentage varies depending on your pension The highest state pensions are taxed at least 19 at source What about personal allowances Pensioners have

https:// blog.abacoadvisers.com /deductions-and-tax...

Other deductions and tax allowances in Spain Generally you can also claim deductions and tax credits for Social security contributions deducted at source by an employer Pension contributions Mandatory contributions to mutual benefit societies for widows widowers and orphans upon the death of the participant

3 4 Million Pensioners Missing Out On Help Up To 4 500 P yr Aged

Spanish Budget Passes In Congress With Support From Pro independence

Pension Annual Allowance Making Tax Relieved Contributions

Income Tax Thresholds

Who Isn t Eligible For The Foreign Pensioners Tax Break IIA

Spanish Pensioners Move To Portugal For Tax Benefits Essential Business

Spanish Pensioners Move To Portugal For Tax Benefits Essential Business

5 Steps To Plan Your Personal Income Tax 2022 To Have More Savings

Ways To Reduce Tax Bill For Individuals Businesses And People Of

When Do Pensioners Get The 300 Cost Of Living Payment Who Gets Winter

Pensioners Tax Allowance In Spain - The good news is that because pensions are treated as earned income in addition to personal 5 550 and age allowances 65 1 150 75 1 400 an extra 2 000 general deduction plus a further low income deduction of up to 5 565 are available This means a person over 75 years old pays no income tax on pension income below