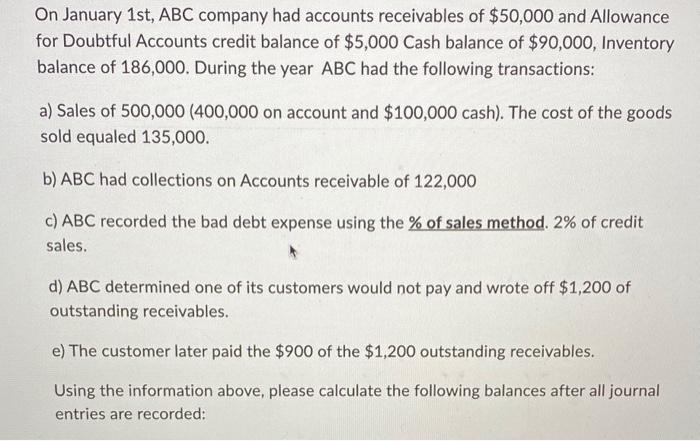

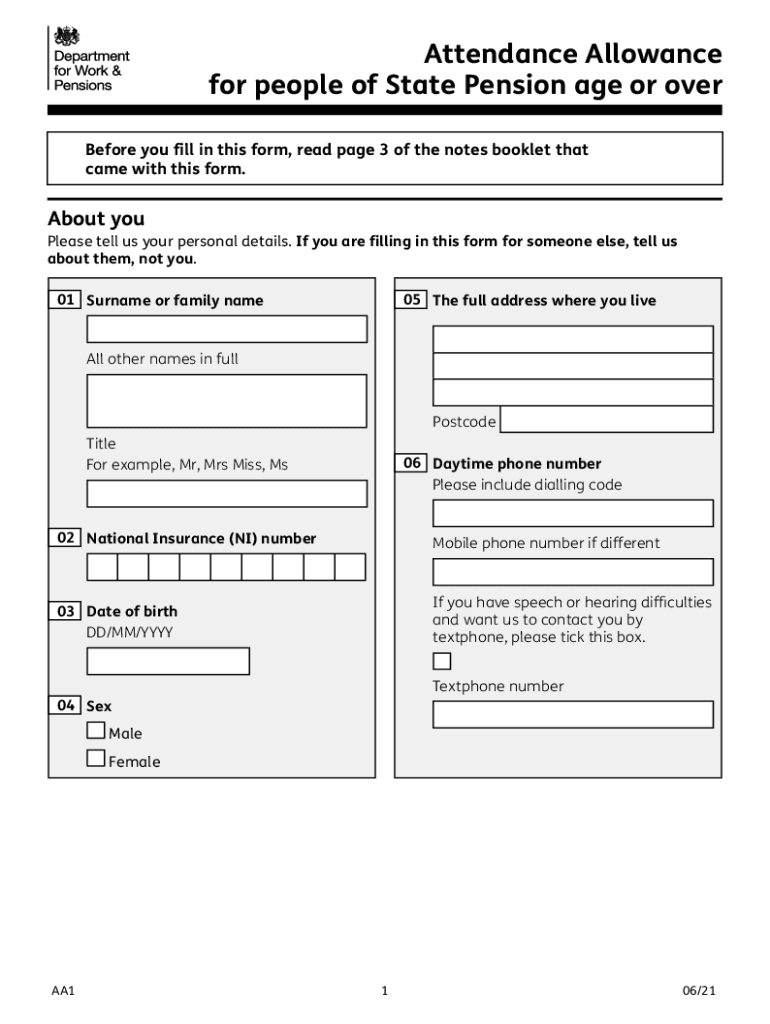

Personal Allowance 2022 23 Over 100k 3 min read Last updated 13 May 2024 One of the major tax implications for high earners is that you start losing your Personal Allowance over 100K and the dreaded but unofficial 60 tax rate

Income related reduction to the Personal Allowance where you have an adjusted net income over 100 000 regardless of your date of birth High Income Child Wherever you live in the UK your personal allowance will reduce by 1 for every 2 you earn over 100 000 So by the time you earn 125 140 you ll pay income

Personal Allowance 2022 23 Over 100k

Personal Allowance 2022 23 Over 100k

https://taxscouts.com/wp-content/uploads/TaxScouts_IncomeTax-scaled.jpg

2022 Basic Allowance For Housing Will The Rates Increase In 2022 Marca

https://phantom-marca.unidadeditorial.es/42f0b77d87dbc687f375b3f629b24103/resize/1200/f/jpg/assets/multimedia/imagenes/2021/12/15/16396010103204.jpg

W 2 Form 2023 Fill Out And Print Out

https://www.pdffiller.com/preview/579/133/579133029/big.png

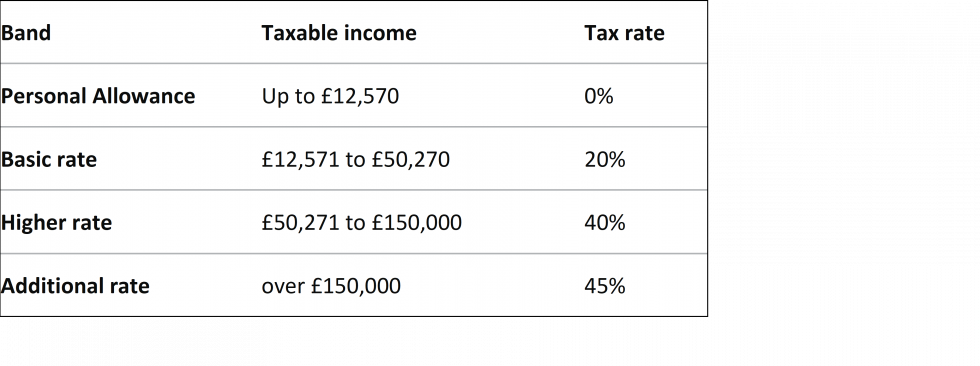

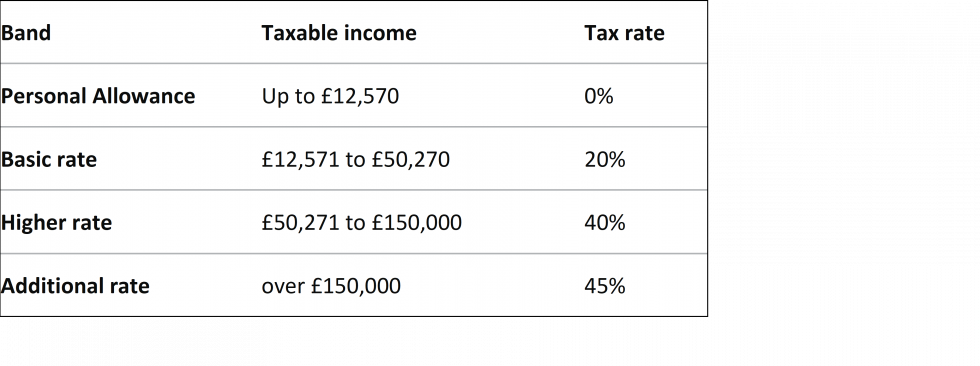

Incomes of 100 000 Sees Personal Allowance Taper Towards 0 For the tax year 2023 24 the personal allowance is 12 570 above which income tax needs to Knowledge UK Tax rates tax thresholds tax bands and tax allowances for the 2022 23 and 2023 24 tax years Lucinda Watkinson Updated on June 15 2023

The personal allowance is the amount you can earn from your salary whether you re employed or self employed before paying income tax For 2022 23 this Those earning more than 100 000 will see their personal allowance reduced by 1 for every 2 they earn over the threshold meaning that anyone who earns

Download Personal Allowance 2022 23 Over 100k

More picture related to Personal Allowance 2022 23 Over 100k

Personal Tax Allowance In 2022 23 Countingup

https://countingup.com/wp-content/uploads/2021/06/when-do-you-start-paying-tax.png

Self Assessment Tax Returns For 100k Earners

https://goselfemployed.co/wp-content/uploads/2021/11/self-assessment-for-100k-earners.jpg

Revised Pay Scale 2022 Pay Scale Chart In Pakistan Government Jobs

https://governmentjob.pk/wp-content/uploads/2022/06/Revised-Pay-scale-Budget-2022-1024x659.jpg

With a Personal Allowance for 2022 23 of 12 570 any income up to that threshold is tax free After that the tax you pay will depend on the tax bands your income falls into Here For the tax year 2022 23 the basic personal allowance is 12 570 the same as 2021 22 People with income above 100 000 will have their personal allowance reduced if their

Allowances 2024 to 2025 2023 to 2024 2022 to 2023 2021 to 2022 Personal Allowance 12 570 12 570 12 570 12 500 Income limit for Personal Allowance If you earn over 100 000 in any tax year your personal allowance is gradually reduced by 1 for every 2 of adjusted net income over 100 000 irrespective of age

Attendance Allowance 2021 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/572/552/572552996/large.png

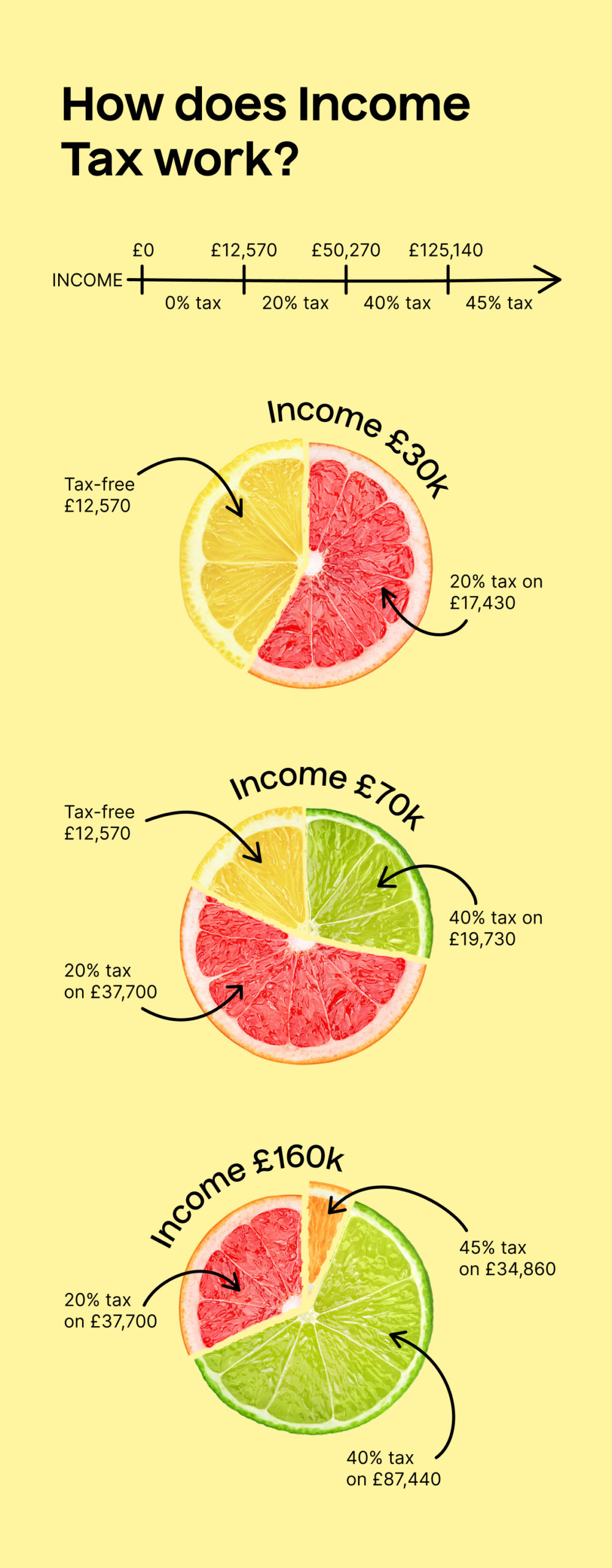

Solved On January 1st ABC Company Had Accounts Receivables Chegg

https://media.cheggcdn.com/study/fa1/fa18812d-9886-4878-bda0-6a34a849a948/image

https://taxscouts.com/high-earner-tax-ret…

3 min read Last updated 13 May 2024 One of the major tax implications for high earners is that you start losing your Personal Allowance over 100K and the dreaded but unofficial 60 tax rate

https://www.gov.uk/guidance/adjusted-net-income

Income related reduction to the Personal Allowance where you have an adjusted net income over 100 000 regardless of your date of birth High Income Child

De4 2021 2024 Form Fill Out And Sign Printable PDF Template

Attendance Allowance 2021 2024 Form Fill Out And Sign Printable PDF

Latest News About NSFAS Allowance 2022 Student Opportunities

Claiming The Employment Allowance In 2021 2022 Saint

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

Your Guide To 2022 2023 Tax Allowances Magenta Financial Planning

Your Guide To 2022 2023 Tax Allowances Magenta Financial Planning

Budget 2022 Ireland What Are The Changes To The Carer s Allowance

What Employers Must Know About Employee Personal Allowances

Clarification Of Special Allowance Notification Punjab 2022 Info Ghar

Personal Allowance 2022 23 Over 100k - The Personal Allowance if you earn over 100 000 If you earn over 100 000 the figure of 12 570 will be reduced by 1 for every 2 earned over the 100 000 limit