Personal Income Tax Rebate Singapore Web 15 lignes nbsp 0183 32 3 mai 2023 nbsp 0183 32 Non resident individuals are taxed at a flat rate of 22 24

Web Taxes Personal Income Tax It is the Government s policy to keep our Personal Income Tax regime competitive and progressive This encourages employment innovation and Web These tax reliefs encourage Singapore tax residents to save up for retirement Generally topping up these accounts will give you a dollar for dollar income tax reduction but your

Personal Income Tax Rebate Singapore

Personal Income Tax Rebate Singapore

https://www.rikvin.com/wp-content/uploads/2020/03/personal-income-tax-rates-singapore.jpg

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

https://financialhorse.com/wp-content/uploads/2022/02/tax-2.png

Singapore Personal Tax Singapore Income Tax Rates Brapp

https://www.asiabriefing.com/site-mgmt/userfiles/resources/infographic/2015/05/Personal_Income_Tax_Singapore_for_2017.png

Web The maximum CPF Cash Top up Relief per Year of Assessment is 16 000 maximum 8 000 for self and maximum 8 000 for family members From Year of Assessment Web Please note that a personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed for each Year of Assessment Example 1 Claiming WMCR on 2

Web 24 janv 2020 nbsp 0183 32 Singaporean permanent residents and all other resident taxpayers are eligible for IRAS tax reliefs granted by the Authority Eligible payments can potentially qualify for different branches of tax reliefs to Web Resources Singapore Taxation Personal Tax Reliefs in Singapore This post is also available in Chinese Simplified Personal Tax Reliefs in Singapore

Download Personal Income Tax Rebate Singapore

More picture related to Personal Income Tax Rebate Singapore

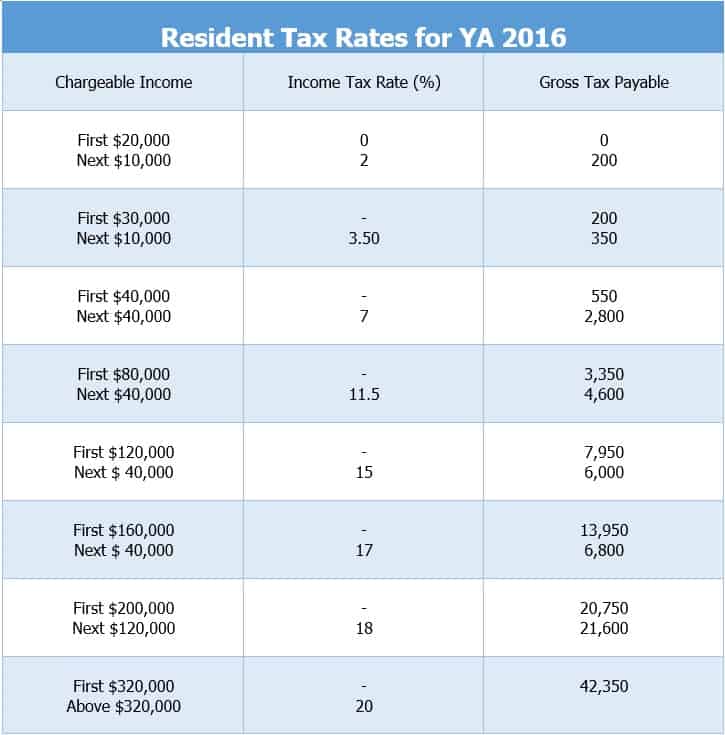

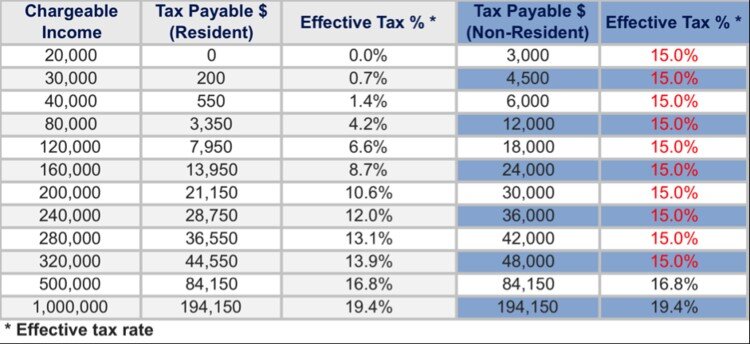

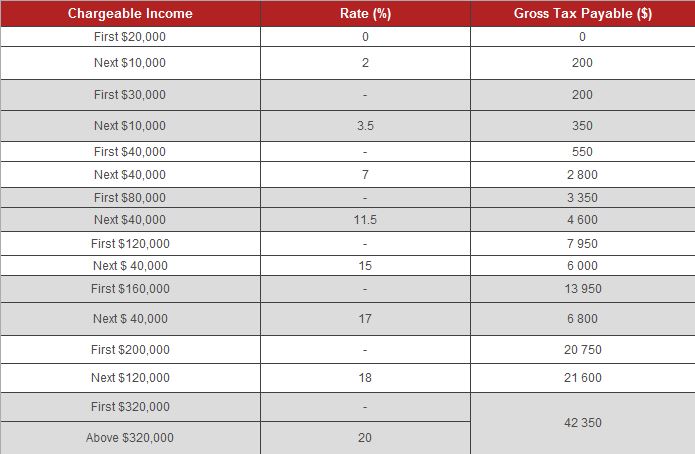

Personal Income Tax Rates For Singapore Tax Residents YA 2010 2019

https://www.rikvin.com/wp-content/uploads/singapore-personal-income-tax-rates-YA-2010-2019-infographic-rikvin.jpg

This 31 Facts About Iras Singapore Tax Rate Assist In Preparation

http://www.singaporeincorporationservices.com/wp-content/uploads/2016/03/singapore-individual-income-tax-filing-for-2016-1.jpg

Personal Income Tax 2017 Julianagwf

https://images.squarespace-cdn.com/content/v1/55b79c7fe4b0f338367f9329/1592260217307-RPQMLHKO1SFWJXGQO9SX/singapore-resident-tax-income-table.jpg

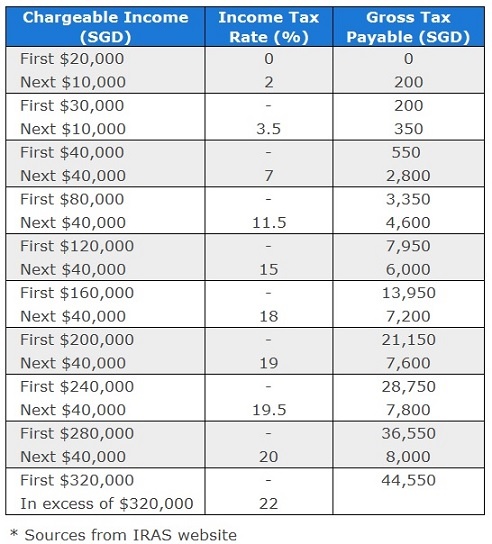

Web 13 mars 2023 nbsp 0183 32 You will have to pay taxes if you re a Singapore citizen earning an annual income of S 20 000 or more and the filing deadline for individuals is 18 April annually The income tax is assessed based on Web 3 mai 2023 nbsp 0183 32 For year of assessment 2023 income year 2022 the following amounts are deductible from the assessable income of a resident individual to arrive at the income

Web 25 janv 2022 nbsp 0183 32 You probably know that personal income tax applies to your salary This applies whether employed or freelance including bonuses but excluding compulsory Web 2 mars 2021 nbsp 0183 32 Do note that a personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed for each year of assessment There s a few months left

Income Tax Rates 2020 For Singapore Tax Residents Rikvin

https://www.rikvin.com/wp-content/uploads/personal-income-tax-rates-for-singapore-residents-ya-2019.jpg

Ca Individual Tax Rate Table 2021 2020 Brokeasshome

https://www.3ecpa.com.sg/wp-content/uploads/2018/07/photo-tax-rate-singapore-resident-tax-rates-from-ya-2017-400x652.jpg

https://taxsummaries.pwc.com/singapore/individual/taxes-on-personal-in…

Web 15 lignes nbsp 0183 32 3 mai 2023 nbsp 0183 32 Non resident individuals are taxed at a flat rate of 22 24

https://www.mof.gov.sg/policies/taxes/personal-income-tax

Web Taxes Personal Income Tax It is the Government s policy to keep our Personal Income Tax regime competitive and progressive This encourages employment innovation and

A Guide To Singapore Personal Tax

Income Tax Rates 2020 For Singapore Tax Residents Rikvin

Singapore Personal Income Tax Filing For YA 2015

The Beginner s Guide To Income Tax In Singapore NSCRA

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

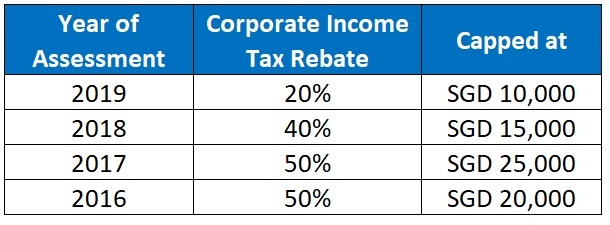

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Singapore Personal Income Tax Rates Infographics

Tax Services Singapore File Tax Returns On Time Company Taxation

Personal Tax Services Singapore Tax Efficient Tax Filing Compliance

Personal Income Tax Rebate Singapore - Web The Singapore tax rate which a foreigner pays depends on the tax residency status with the cut off periods being 60 days and 183 days Let s understand this in detail Related Read Singapore Personal Tax for