Personal Income Tax Rebate Ya2018 Web From YA 2018 the total amount of personal reliefs an individual taxpayer can claim is subject to an overall relief cap of 80 000 Therefore the Total Personal Reliefs shown

Web Suite au d 233 p 244 t de votre d 233 claration et lors du calcul de votre imp 244 t sur les revenus de 2018 l imp 244 t sur vos revenus non exceptionnels de 2018 sera effac 233 Seuls les revenus Web 1 ao 251 t 2018 nbsp 0183 32 1 Earned Income Relief IRAS grants earned income relief to eligible tax resident employees and those individuals involved in trade or business Individuals

Personal Income Tax Rebate Ya2018

Personal Income Tax Rebate Ya2018

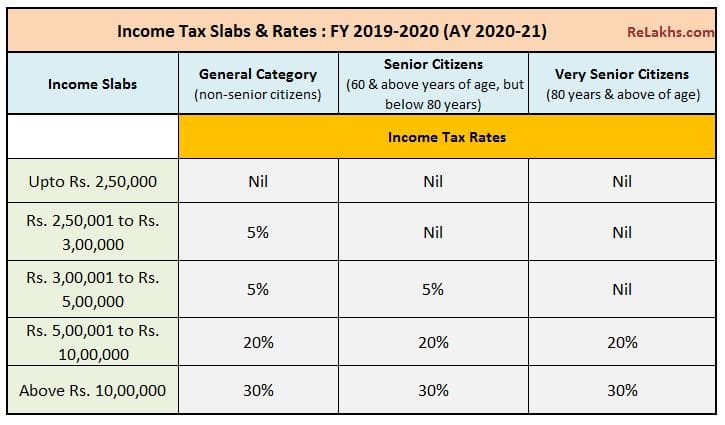

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Personal Income Tax YA 2021 Tax Relief And Rebates

https://static.wixstatic.com/media/912d02_2fb14c2955b4496697bc18fe0e49bdec~mv2.jpg/v1/fill/w_681,h_1000,al_c,q_85,usm_0.66_1.00_0.01/912d02_2fb14c2955b4496697bc18fe0e49bdec~mv2.jpg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Web 10 janv 2023 nbsp 0183 32 This simulator allows you to determine the amount of your income tax You can use one of the following 2 models Simplified model if you report wages pensions or Web 5 mars 2018 nbsp 0183 32 Imp 244 ts 2018 revalorisation du bar 232 me de l imp 244 t 1 c est la revalorisation des tranches du bar 232 me de l imp 244 t sur le revenu pr 233 vue dans la loi de finances pour

Web 15 janv 2019 nbsp 0183 32 Votre imp 244 t sur ces revenus courants de 2018 sera automatiquement effac 233 au titre de l ann 233 e de transition ce qu on appelle l ann 233 e blanche En Web 3 2 Total income for a year of assessment YA is the aggregate income less business losses for the basis year expenditure under Schedule 4 4B and gifts of money and

Download Personal Income Tax Rebate Ya2018

More picture related to Personal Income Tax Rebate Ya2018

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

https://images.moneycontrol.com/static-mcnews/2023/02/Budget-2023-I-T-slabs-tweaked-2.jpg

Web 1 mars 2018 nbsp 0183 32 Just want to confirm this There is no personal tax rebate for the assessment year 2018 that is on the income earned in calendar year 2017 is that right Web 14 mars 2019 nbsp 0183 32 Based on this amount the income tax to pay the government is RM1 640 at a rate of 8 However if you claimed RM13 500 in tax deductions and tax reliefs

Web 8 mars 2019 nbsp 0183 32 Here are some examples of tax relief that you can claim to maximise your tax refund in 2019 for YA 2018 Update 12 3 2019 An earlier version of the infographic Web 26 juil 2018 nbsp 0183 32 Dans cet exemple Jean ne peut pas d 233 duire la totalit 233 des 4800 euros de cotisations vers 233 es en 2019 Pour un m 234 me versement total de 5000 euros en 2018 et

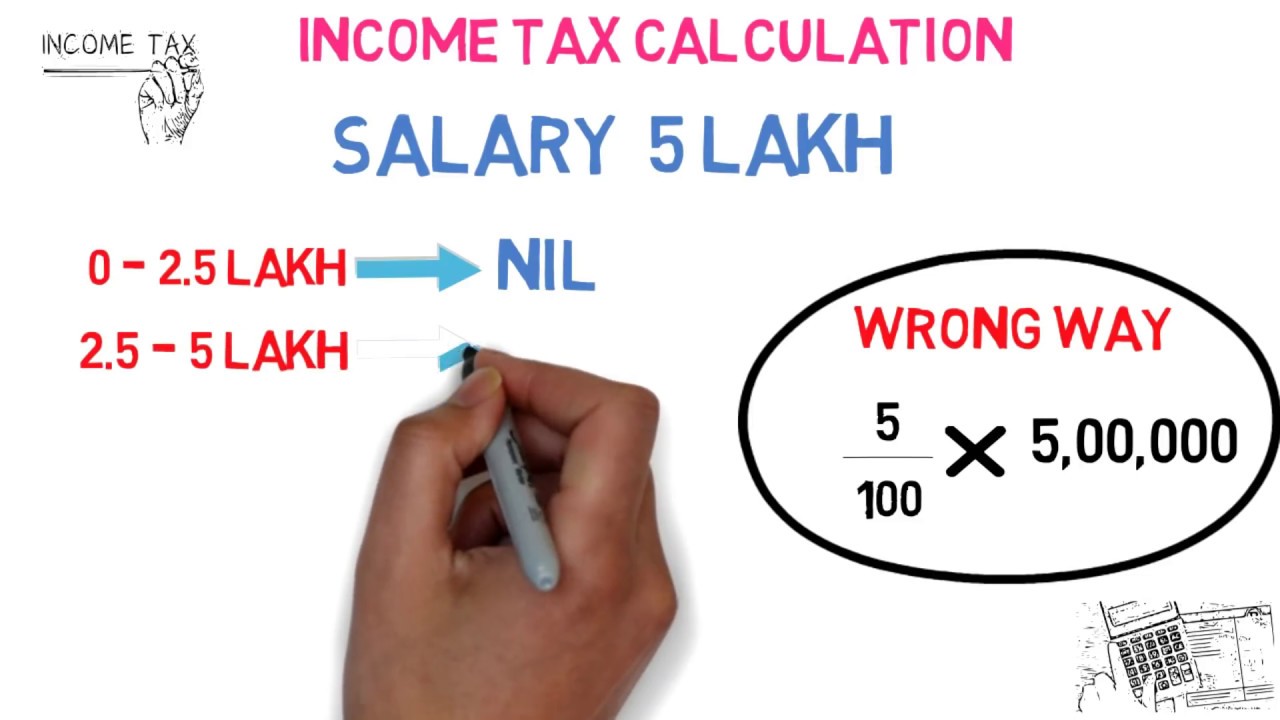

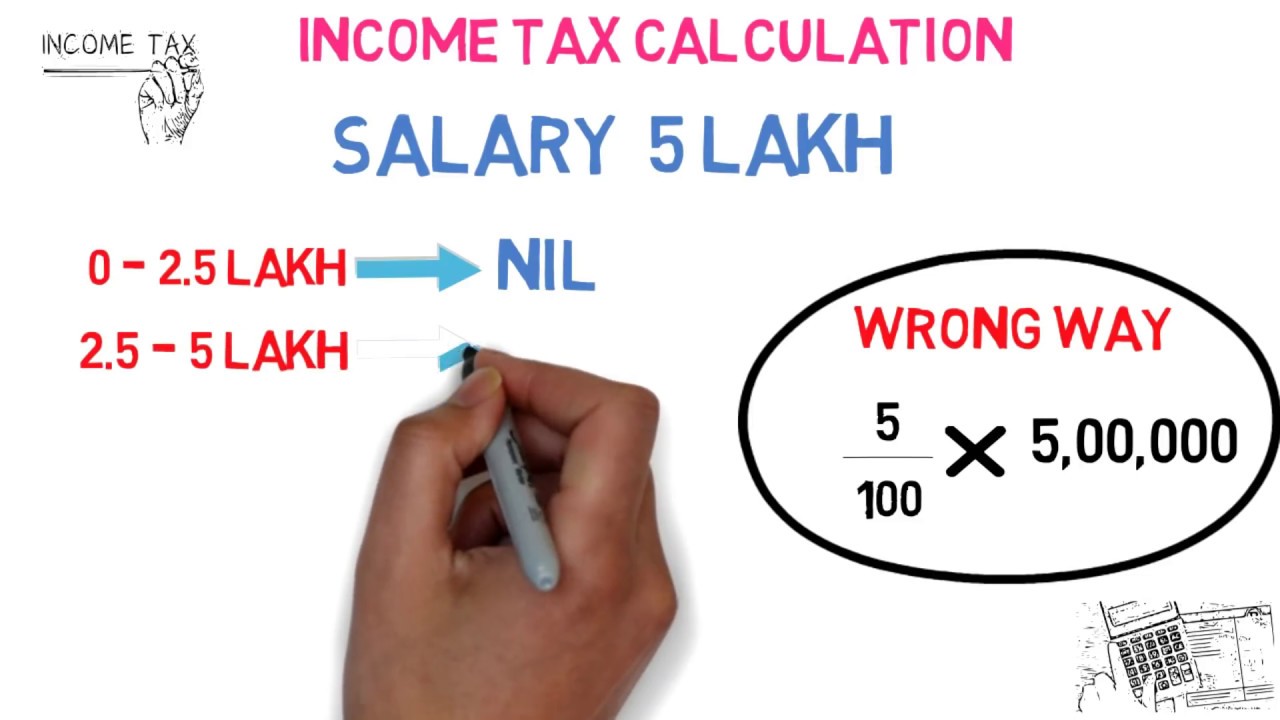

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

https://i.ytimg.com/vi/kqXo-8TT_Fc/maxresdefault.jpg

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

https://www.iras.gov.sg/media/docs/default-s…

Web From YA 2018 the total amount of personal reliefs an individual taxpayer can claim is subject to an overall relief cap of 80 000 Therefore the Total Personal Reliefs shown

https://www.impots.gouv.fr/annee-blanche-des-exemples-de-revenus...

Web Suite au d 233 p 244 t de votre d 233 claration et lors du calcul de votre imp 244 t sur les revenus de 2018 l imp 244 t sur vos revenus non exceptionnels de 2018 sera effac 233 Seuls les revenus

Budget 2019 Singapore Govt Introduces 50 Income Tax Rebate

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

Tax Exemption Malaysia 2019

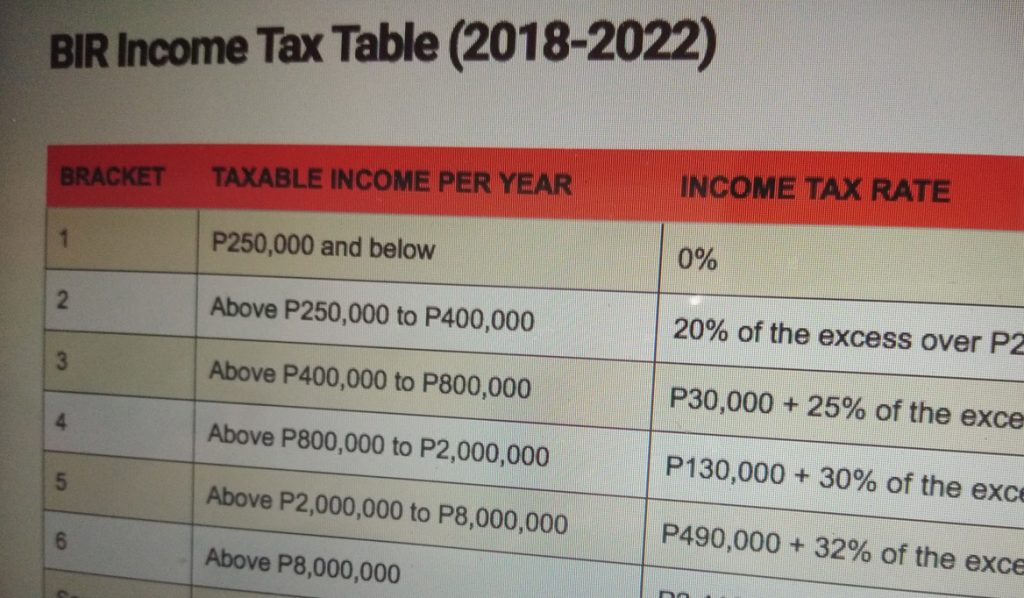

New BIR Income Tax Rates And Tax Table For 2018 In The Philippines

Malaysia Personal Income Tax Guide 2020 YA 2019

Print Borang Ea 2018

Print Borang Ea 2018

Union Budget 2023 Income Tax Rebate Limit Raised To Rs 7 Lakh The

No Income Tax For Individuals Earning Upto Rs 7 Lakhs FM Sitharaman

What Is The Singapore Personal Income Tax Rates In 2023 Infographics

Personal Income Tax Rebate Ya2018 - Web 15 janv 2019 nbsp 0183 32 Votre imp 244 t sur ces revenus courants de 2018 sera automatiquement effac 233 au titre de l ann 233 e de transition ce qu on appelle l ann 233 e blanche En