Personal Loan Interest Rebate In Income Tax Web 3 juil 2022 nbsp 0183 32 Answer No tax benefits are available for repayment of a personal loan However interest paid on a personal loan can be

Web 29 mars 2021 nbsp 0183 32 While there are some loans with tax deductible interest payments including student loans mortgages and business loans personal loans interest payments generally are not tax deductible Web The limit on Income Tax reliefs restricts the total amount of qualifying loan interest relief and certain other reliefs in each year to the greater of 163 50 000 and 25 of adjusted total income

Personal Loan Interest Rebate In Income Tax

Personal Loan Interest Rebate In Income Tax

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

![]()

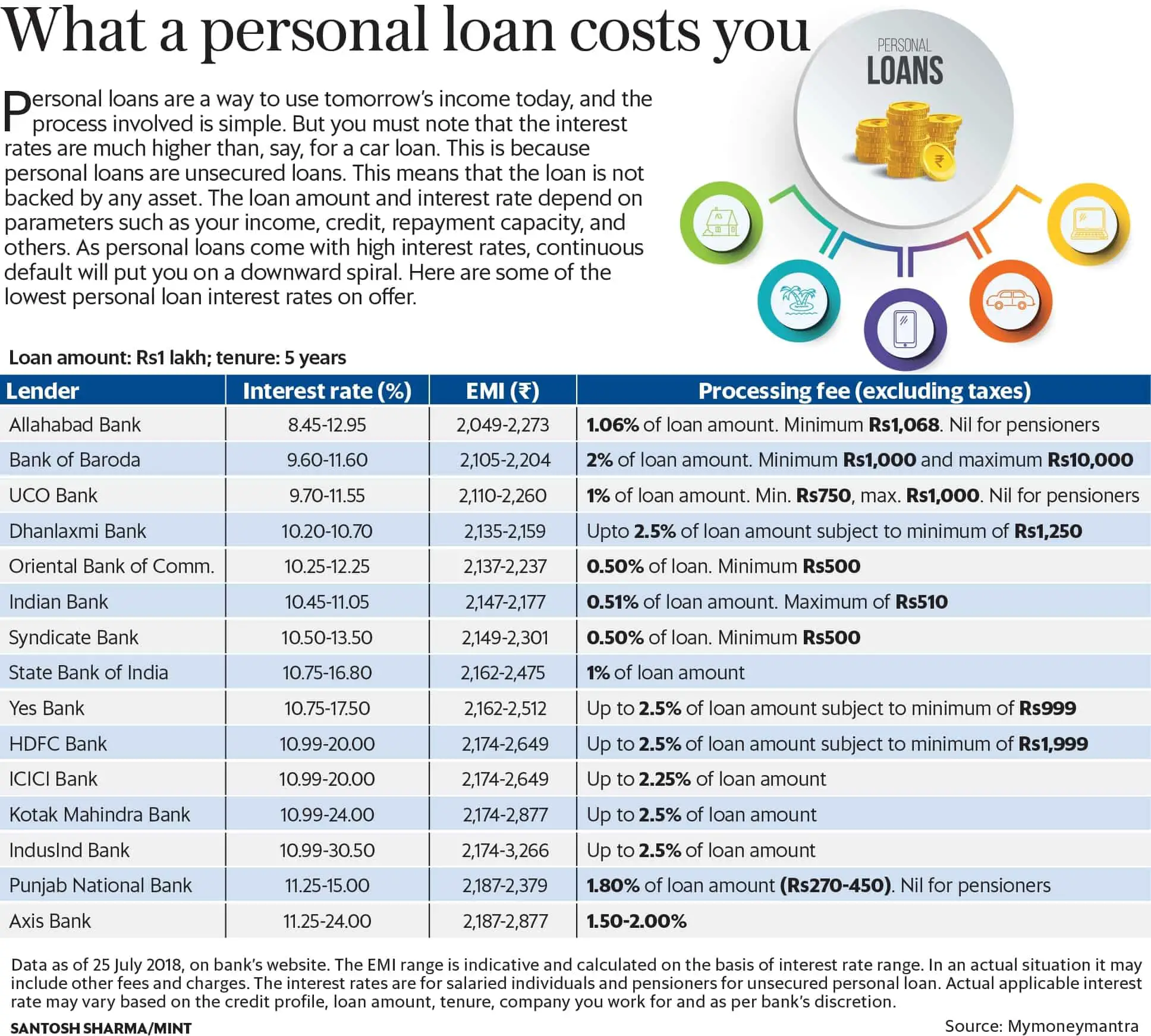

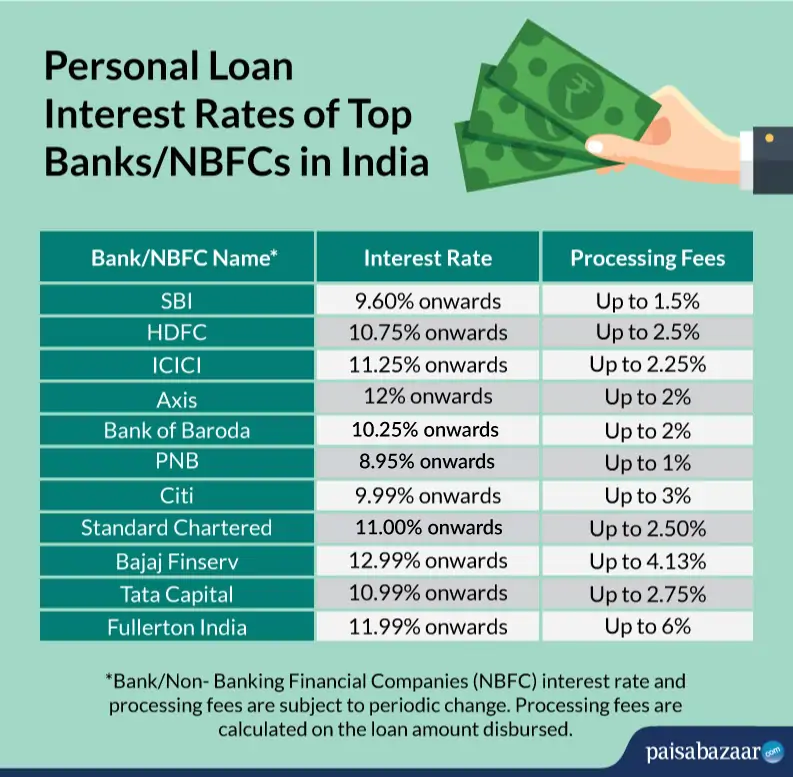

Personal Loan Interest Rates 2020 Compare All Banks Calculation

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_793/https://www.paisabazaar.com/wp-content/uploads/2018/01/01-1.jpg

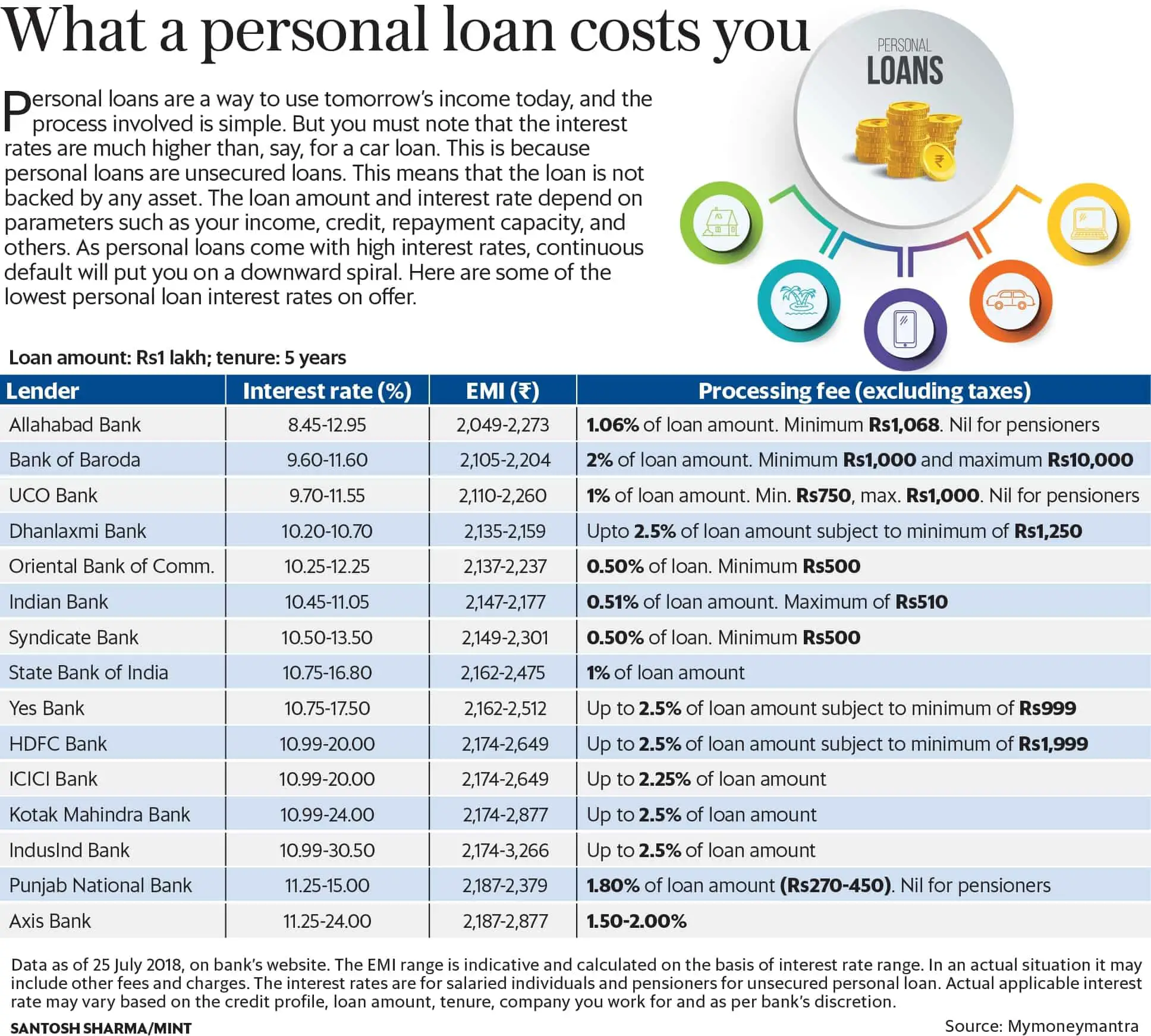

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

https://images.livemint.com/img/2019/10/20/original/Homeloan_1571577540061.png

Web One can avail tax benefits from their personal loan if they have used the personal loan money for the purchase or construction of a residential property The borrower can avail tax benefits for repayment of interest for the same under Web 30 sept 2020 nbsp 0183 32 As it says on our page repayments on a personal loan are not tax deductible Just as funding from it isn t considered taxable income making payments on a personal loan or on interest for it isn t deductible However there are some exceptions Here are a list of uses for personal loans that are tax deductible

Web 25 ao 251 t 2023 nbsp 0183 32 Interest paid on personal loans is not tax deductible If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does not reduce your tax Web 22 janv 2022 nbsp 0183 32 Rebate A rebate is the portion of interest or dividends earned by the owner lender of securities that are paid to a short seller borrower of the securities The borrower is required to pay

Download Personal Loan Interest Rebate In Income Tax

More picture related to Personal Loan Interest Rebate In Income Tax

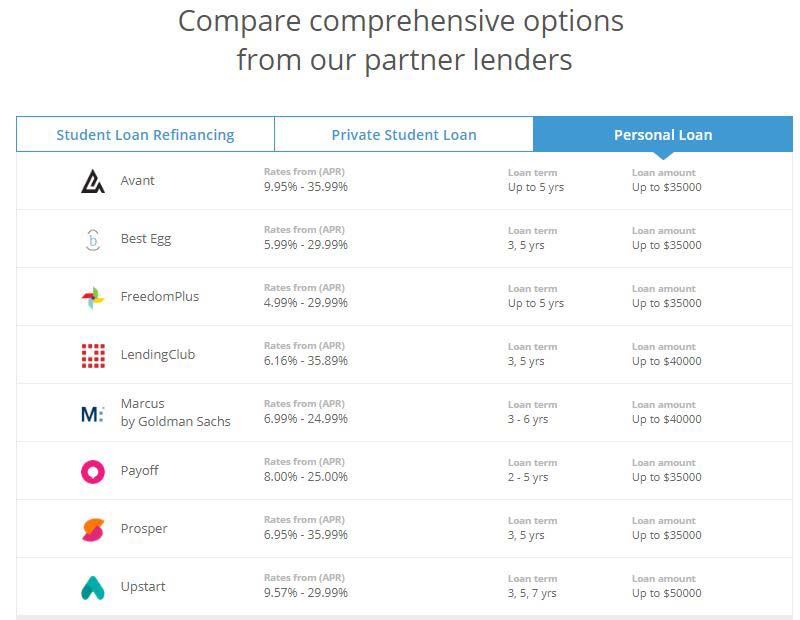

Credible Personal Loan Interest Rates Student Debt Warriors

http://studentdebtwarriors.com/wp-content/uploads/2018/07/Credible-Personal-Loan-Interest-Rates.jpg

12 Interest Rate Bank Deposit For You

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/09/RD-Interest-Rates-of-Major-Banks-for-Tenure-up-to-2-years-October-2020_Featured.png?fit=1024%2C710&ssl=1

Best Personal Loan Interest Rate 2021 Finance Buddha Blog Enlighten

https://i0.wp.com/financebuddha.com/blog/wp-content/uploads/2021/02/Capture.png?w=416&ssl=1

Web 10 f 233 vr 2023 nbsp 0183 32 The short answer is unfortunately no The interest paid on personal loans is generally not tax deductible If however you used a personal loan to fund college expenses or business expenses Web 11 mars 2022 nbsp 0183 32 Here s how a personal loan can be advantageous to use when it comes to your taxes 1 Can Borrow Enough to Repay Your Tax Bill The minimum amount available for a personal loan is typically

Web 25 mai 2021 nbsp 0183 32 Generally personal loans are not taxable since the loan amount is not considered part of your income when filing income tax returns This means that you won t need to pay any income tax on personal loans Web 24 f 233 vr 2023 nbsp 0183 32 You might already benefit from other loan tax deductions on interest for your mortgage or student loans In most cases the interest payments on personal loans aren t tax deductible

Interest Rates For Personal Loans UnderstandLoans

https://www.understandloans.net/wp-content/uploads/personal-loan-interest-rates-emis-and-charges-a-ready-reckoner.jpeg

Download Home Loan Interest Rates In India Home

https://images.livemint.com/img/2020/07/03/original/loan_1593743157471.png

https://www.livemint.com/money/personal-fin…

Web 3 juil 2022 nbsp 0183 32 Answer No tax benefits are available for repayment of a personal loan However interest paid on a personal loan can be

https://www.forbes.com/advisor/personal-loa…

Web 29 mars 2021 nbsp 0183 32 While there are some loans with tax deductible interest payments including student loans mortgages and business loans personal loans interest payments generally are not tax deductible

Current Personal Loan Interest Rates InterestProTalk

Interest Rates For Personal Loans UnderstandLoans

Income Tax Rebate On Home Loan Fy 2019 20 A design system

DEDUCTION UNDER SECTION 80C TO 80U PDF

Current Personal Loan Interest Rates InterestProTalk

Minimum Credit Score For Personal Loan In India Bruin Blog

Minimum Credit Score For Personal Loan In India Bruin Blog

Interest Expense In Income Statement Meaning Journal Entries

Tumblr Loan Interest Rates Personal Loans Credit Agencies

Compare Personal Loan Interest Rates 2020 All Banks

Personal Loan Interest Rebate In Income Tax - Web 22 janv 2022 nbsp 0183 32 Rebate A rebate is the portion of interest or dividends earned by the owner lender of securities that are paid to a short seller borrower of the securities The borrower is required to pay