Personal Tax Credits Canada 2023 Tax deductions are amounts you subtract from your total income making your taxable income lower This means you d be charged taxes on a smaller amount of income An example would be self employed business expenses Tax credits are amounts that reduce the tax you pay on your taxable income

Your BPA will be 12 298 In addition the maximum BPA will be increased to 15 000 by 2023 as follows 13 808 for the 2021 taxation year 14 398 for the 2022 taxation year and 15 000 for the 2023 taxation year and indexed for inflation for subsequent years Millions of Canadians file their income tax and benefit returns every year For the 2022 tax filing season Canadians filed approximately 31 million returns and 92 of them were filed electronically Also there were over 17 million refunds processed resulting in a total amount of 37 billion

Personal Tax Credits Canada 2023

Personal Tax Credits Canada 2023

https://i.pinimg.com/originals/aa/60/32/aa60329d06ee2c2b47c1f795c44d3048.png

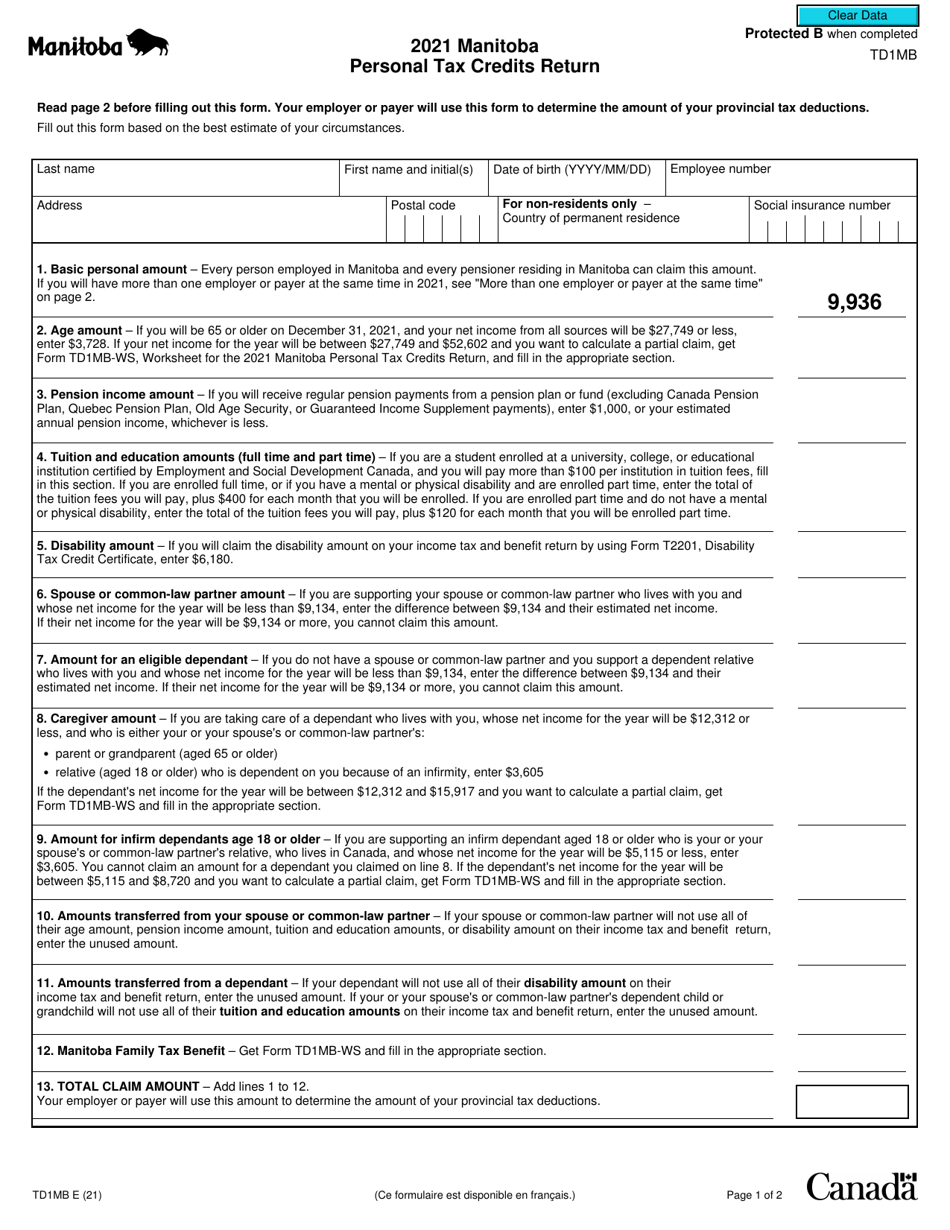

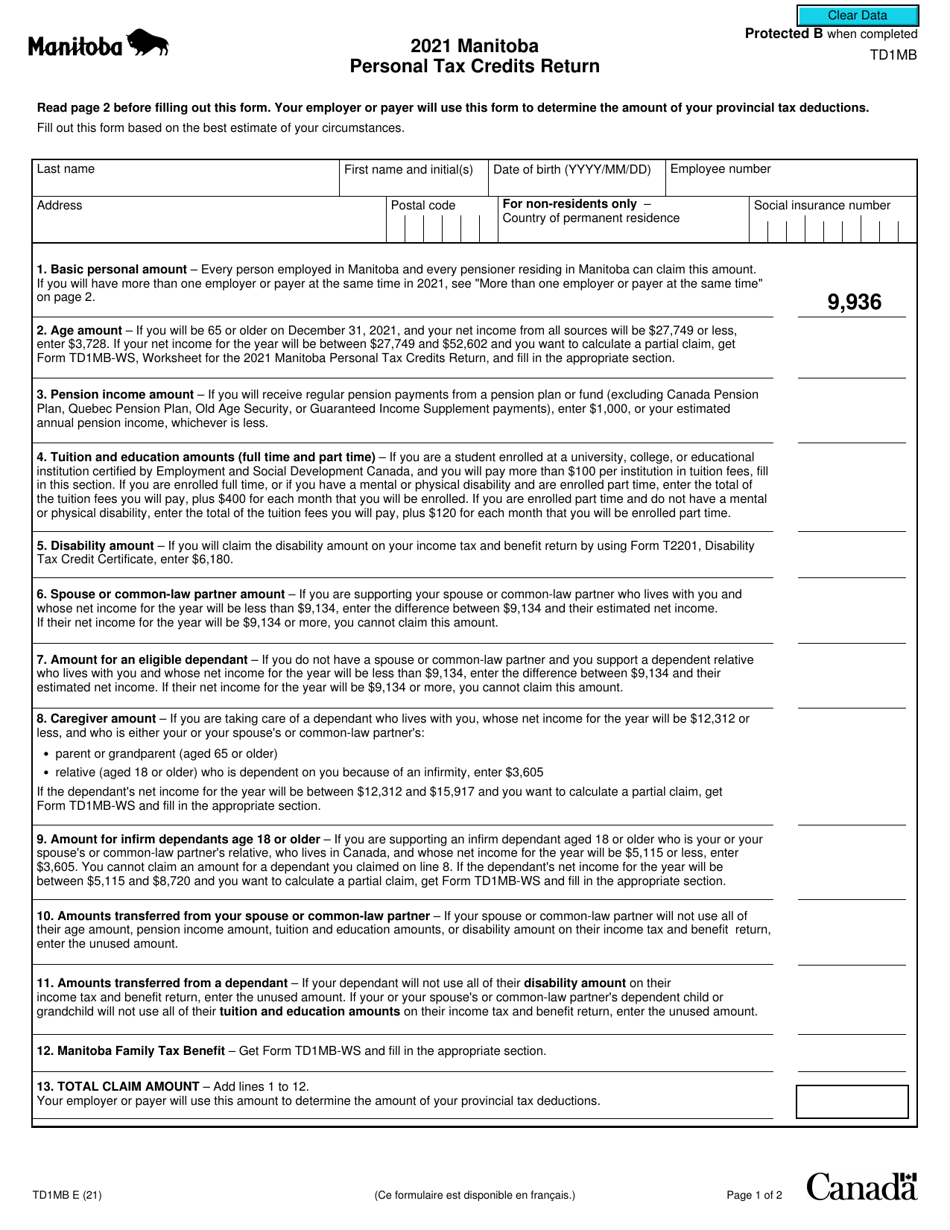

Form TD1MB Download Fillable PDF Or Fill Online Manitoba Personal Tax

https://data.templateroller.com/pdf_docs_html/2119/21193/2119310/form-td1mb-manitoba-personal-tax-credits-return-canada_print_big.png

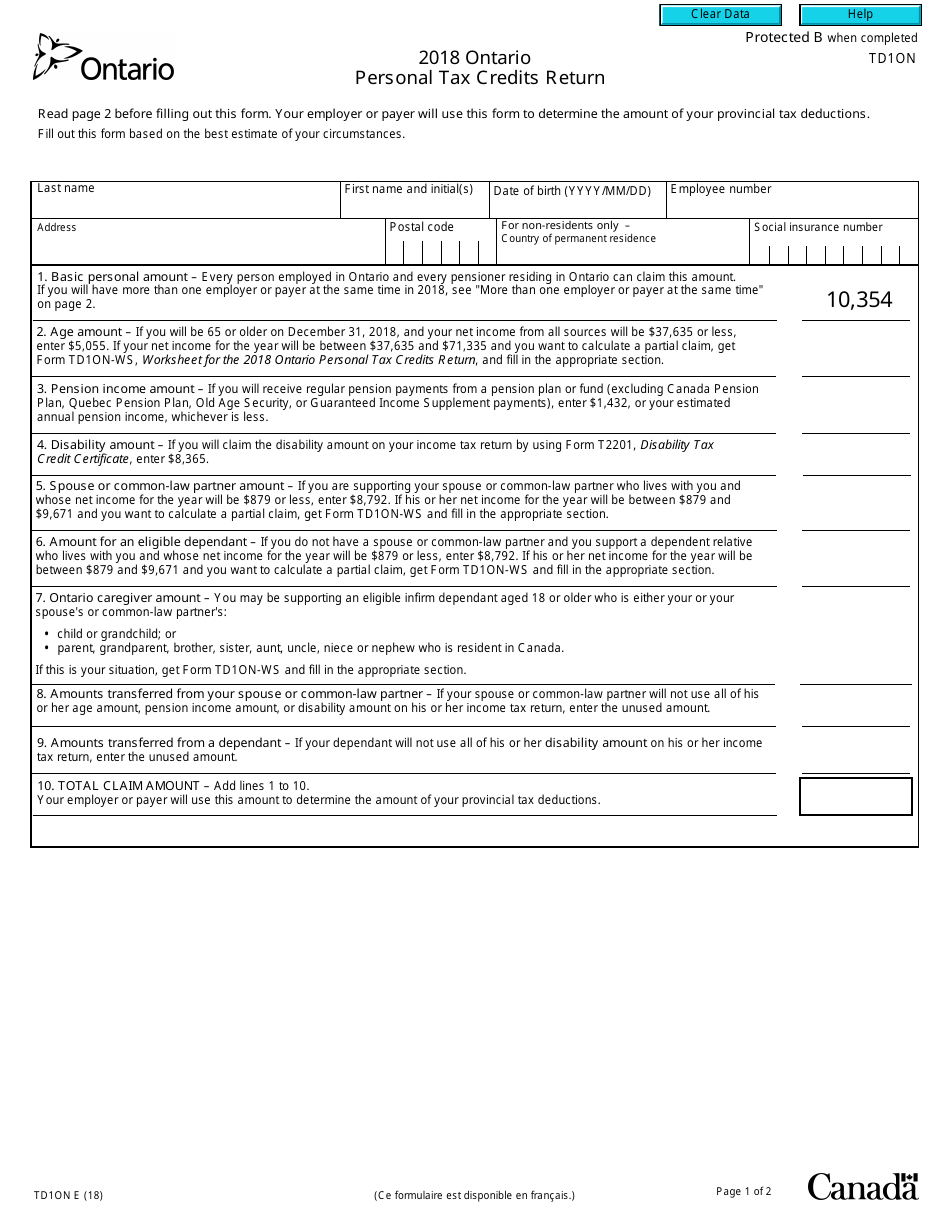

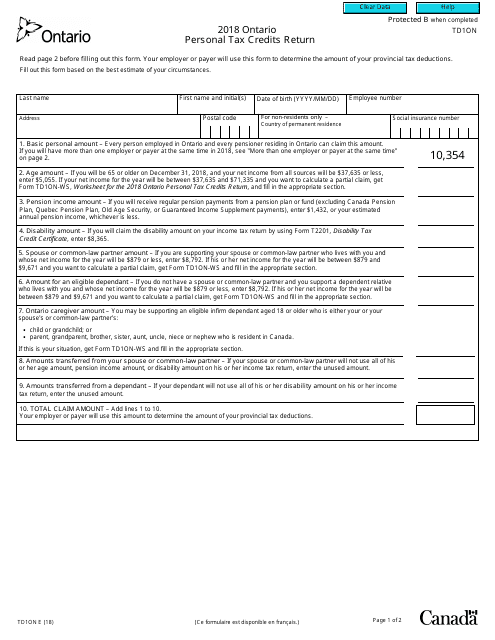

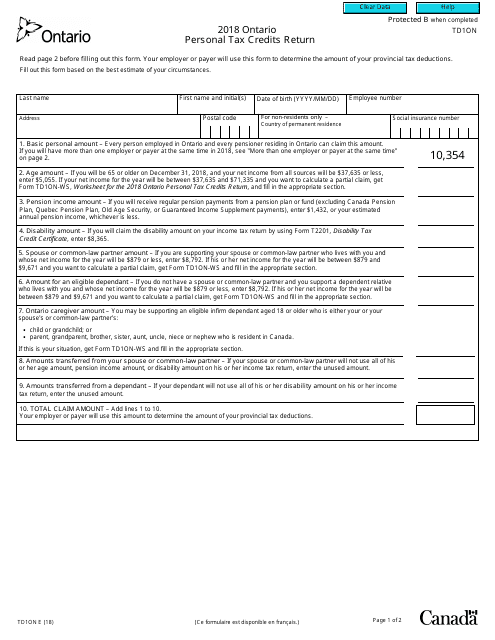

Td1on Fillable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1729/17291/1729183/form-td-1on-2018-ontario-personal-tax-credits-return-ontario_print_big.png

All deductions credits and expenses Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay You can use the tick boxes to filter by topic enter a keyword at Filter items sort by line number topic or category Personal tax changes for individuals in 2023 and later years Looking ahead if we find out about other developments that you should consider when preparing personal tax returns we ll provide updates on our Canadian tax news webpage The CRA has also released its T1 package for the 2022 tax year WHAT S NEW FOR 2022 PERSONAL

How does Canada s personal income tax brackets work How much federal tax do I have to pay based on my income If your taxable income is less than the 53 359 threshold your federal marginal tax rate is 15 New alternative minimum tax changes As of January 1 2024 the AMT rate is 20 5 previously 15 Essentially the AMT is a minimum level of tax for Canadians who claim certain deductions

Download Personal Tax Credits Canada 2023

More picture related to Personal Tax Credits Canada 2023

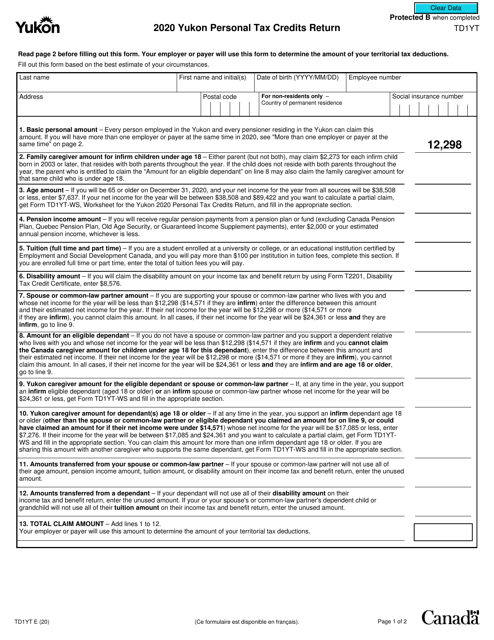

Form TD1YT 2020 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2002/20028/2002848/form-td1yt-yukon-personal-tax-credits-return-yukon-canada_big.png

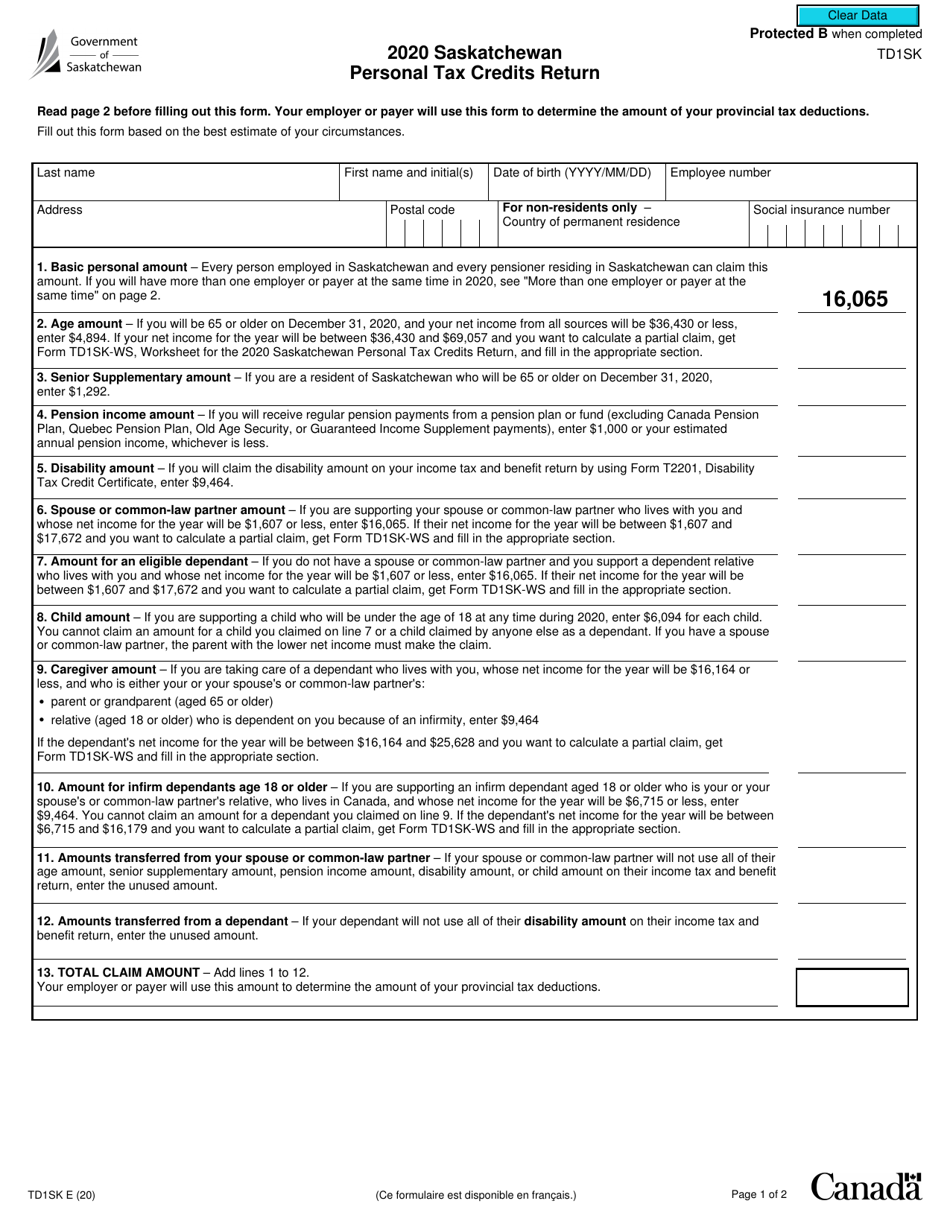

Form TD1SK 2020 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2031/20312/2031272/form-td1sk-saskatchewan-personal-tax-credits-return-canada_print_big.png

Canada Tax Software Arcadia Solution Corp Canadian Tax Software

http://www.mytaxexpress.com/images/print04.gif

Federal personal tax credits Federal personal allowances in Canada take the form of tax credits The following credits apply for 2023 15 of eligible pension income maximum credit is CAD 300 5 15 of eligible fees minimum CAD 100 per institution Unused credits can be carried forward indefinitely As part of their policy to continue increasing it over time the government increased the Basic Personal Amount for the 2023 tax year to 15 000 This means that every Canadian will get a slight boost to their return this year and it s likely you can expect another increase next year as well

Tax Calculators 2023 Personal Tax Calculator Skip to the content These calculations do not include non refundable tax credits other than the basic personal tax credit Provincial health premiums and other levies are also excluded from the tax payable calculations The rates apply to the actual amount of taxable dividends received Canada 2024 and 2023 Tax Rates Tax Brackets Income Tax Act s 117 117 1 121 The Federal tax brackets and personal tax credit amounts are increased for 2024 by an indexation factor of 1 047 a 4 7 increase

Free Digital TD1 2024 Form Personal Tax Credits Return

https://public-site.marketing.pandadoc-static.com/app/uploads/canada-personal-tax-credits-return-500x648.png

TaxTips ca Canadian Non refundable Personal Tax Credits

https://www.taxtips.ca/nrcredits/2021-personal-tax-credits.jpg

https://turbotax.intuit.ca/tips/popular-canadian...

Tax deductions are amounts you subtract from your total income making your taxable income lower This means you d be charged taxes on a smaller amount of income An example would be self employed business expenses Tax credits are amounts that reduce the tax you pay on your taxable income

https://www.canada.ca/.../basic-personal-amount.html

Your BPA will be 12 298 In addition the maximum BPA will be increased to 15 000 by 2023 as follows 13 808 for the 2021 taxation year 14 398 for the 2022 taxation year and 15 000 for the 2023 taxation year and indexed for inflation for subsequent years

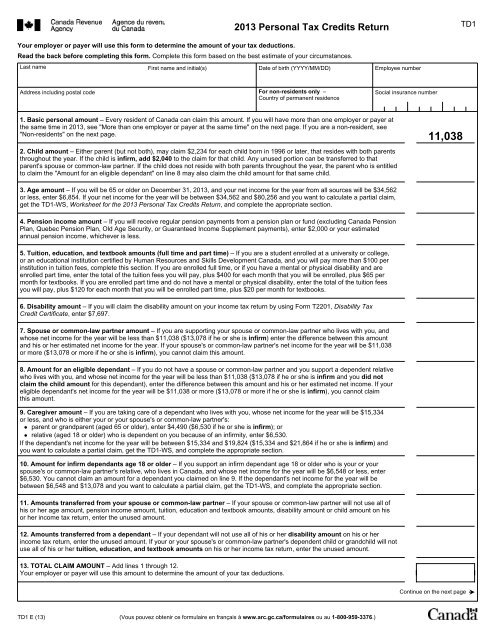

TD1 2013 Personal Tax Credits Return

Free Digital TD1 2024 Form Personal Tax Credits Return

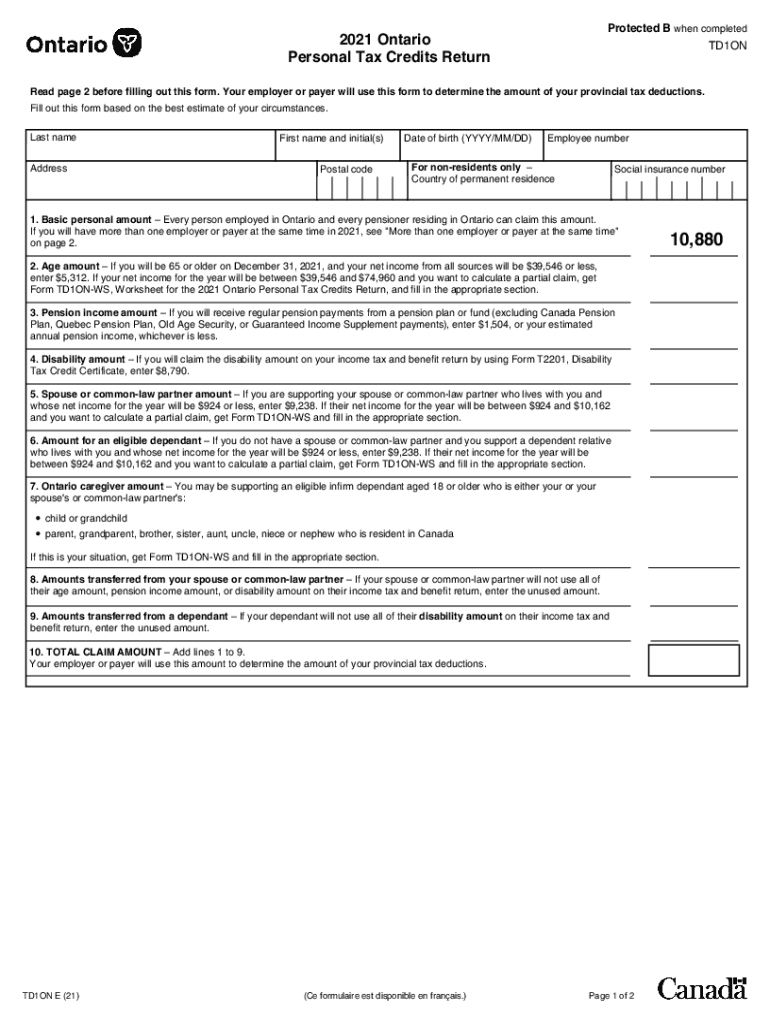

Canada TD1ON 2021 2022 Fill And Sign Printable Template Online US

The Luck Financial Group Resources

2019 Form Canada T3 Fill Online Printable Fillable Blank PdfFiller

Form TD1ON 2018 Fill Out Sign Online And Download Fillable PDF

Form TD1ON 2018 Fill Out Sign Online And Download Fillable PDF

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

Td1 On 2023 Form Printable Forms Free Online

Alberta Tax Form 2023 Printable Forms Free Online

Personal Tax Credits Canada 2023 - The contribution limit increased from 29 210 in 2022 to 30 780 for tax year 2023 Having said that your contribution limit is still capped at 18 of your earned income unless you have carry