Personal Tax Exemption Philippines 2022 Web This means that if you are aware of a 2022 tax exemption or 2022 tax allowance in Philippines that you are entitled too BUT it isn t listed here that we don t allow for it in

Web Who are exempt from Income Tax a Income from abroad of a non resident citizen who is i A citizen of the Philippines who establishes to the satisfaction of the Commissioner Web Beginning 1 January 2023 Fringe benefits tax FBT Fringe benefits furnished to managerial and supervisory level employees by the employer are subject to a final FBT of 35 in

Personal Tax Exemption Philippines 2022

Personal Tax Exemption Philippines 2022

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

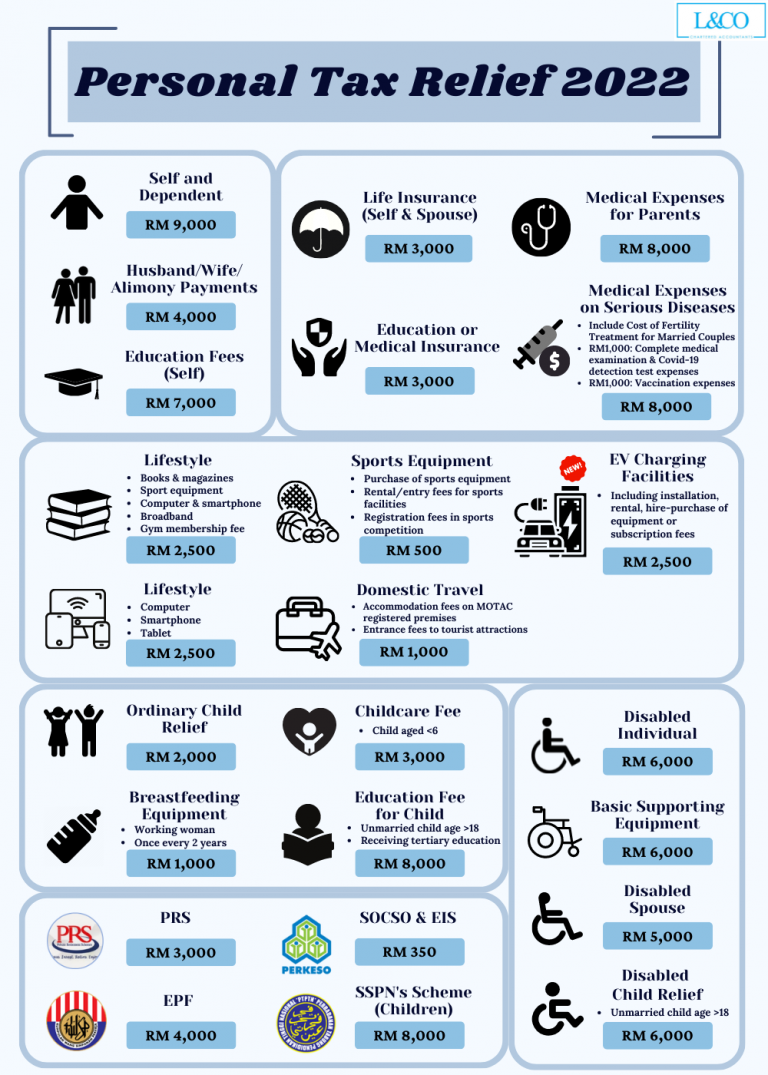

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/Personal-Tax-Relief-2022-1-768x1075.png

Application For Certificate Of Tax Exemption PDF

https://imgv2-1-f.scribdassets.com/img/document/299044763/original/f03bdb1a8b/1669836990?v=1

Web Tax Exemption Qualifications in the Philippines The Tax Code of the Philippines lists the following individuals or organizations that are qualified for tax exemption Individuals Web 11 Juli 2022 nbsp 0183 32 According to the Tax Reform for Acceleration and Inclusion TRAIN Law you are exempt from personal income tax if you are a compensation income earner self employed and professional taxpayer

Web May 26 2022 RR No 5 2022 Implements the Estate Tax Exemption under RA No 11597 An Act Providing for the Revised Charter of the Philippine Veterans Bank Repealing Web 2 February 2022 7 min read With vaccines and boosters being continuously administered borders are slowly re opening and airports are starting to be filled with travelers again In

Download Personal Tax Exemption Philippines 2022

More picture related to Personal Tax Exemption Philippines 2022

Tax Exemptions In The Philippines 2023

https://cdn-0.philpad.com/wp-content/uploads/2013/10/tax-exemption-philippines-2023-1536x864.jpg

E Filing Due Date 2022 Malaysia Tax Compliance And Statutory Due

https://soyacincau.com/wp-content/uploads/2022/03/220324-efiling-tax-relief-scaled.jpeg

Personal Tax Form Volution LLP

https://volutiontax.ca/wp-content/uploads/2021/02/lethbridge-accountant-volution-llp.jpg

Web 12 Juli 2022 nbsp 0183 32 MANILA Philippines A new tax reform package that would set the maximum individual income tax rate at 20 percent and spare from tax a person s first Web 8 Apr 2022 nbsp 0183 32 The Tax Code of the Philippines imposes tax exemption on certain incomes and transactions Likewise certain individuals and institutions are entirely exempted from paying taxes Equally important

Web 21 Jan 2023 nbsp 0183 32 Revenue Regulation RR No 5 2022 implements the Estate Tax Exemption under Republic Act RA No 11597 5 RR No 6 2022 removes the Five year Web 4 Jan 2023 nbsp 0183 32 Personal Income Tax Rates in the Philippines Income 2021 2022 tax rate 2023 tax rate 0 PHP 250 000 US 4 463 0 0 PHP 250 001 US 4 464

Tax Relief For Foreign Pension Contributions MGI Midgley Snelling LLP

https://www.nondomiciliaries.com/wp-content/uploads/2020/09/Personal-Tax-Advice.jpg

Deloitte Tax hand

https://www.taxathand.com/api/tax/v1/article/1536/image

https://www.icalculator.com/philippines/income-tax-rates/2022.html

Web This means that if you are aware of a 2022 tax exemption or 2022 tax allowance in Philippines that you are entitled too BUT it isn t listed here that we don t allow for it in

https://www.bir.gov.ph/index.php/tax-information/income-tax.html

Web Who are exempt from Income Tax a Income from abroad of a non resident citizen who is i A citizen of the Philippines who establishes to the satisfaction of the Commissioner

Window To Enjoy Tax Reliefs Closing CN Advisory

Tax Relief For Foreign Pension Contributions MGI Midgley Snelling LLP

Tax Relief 2022

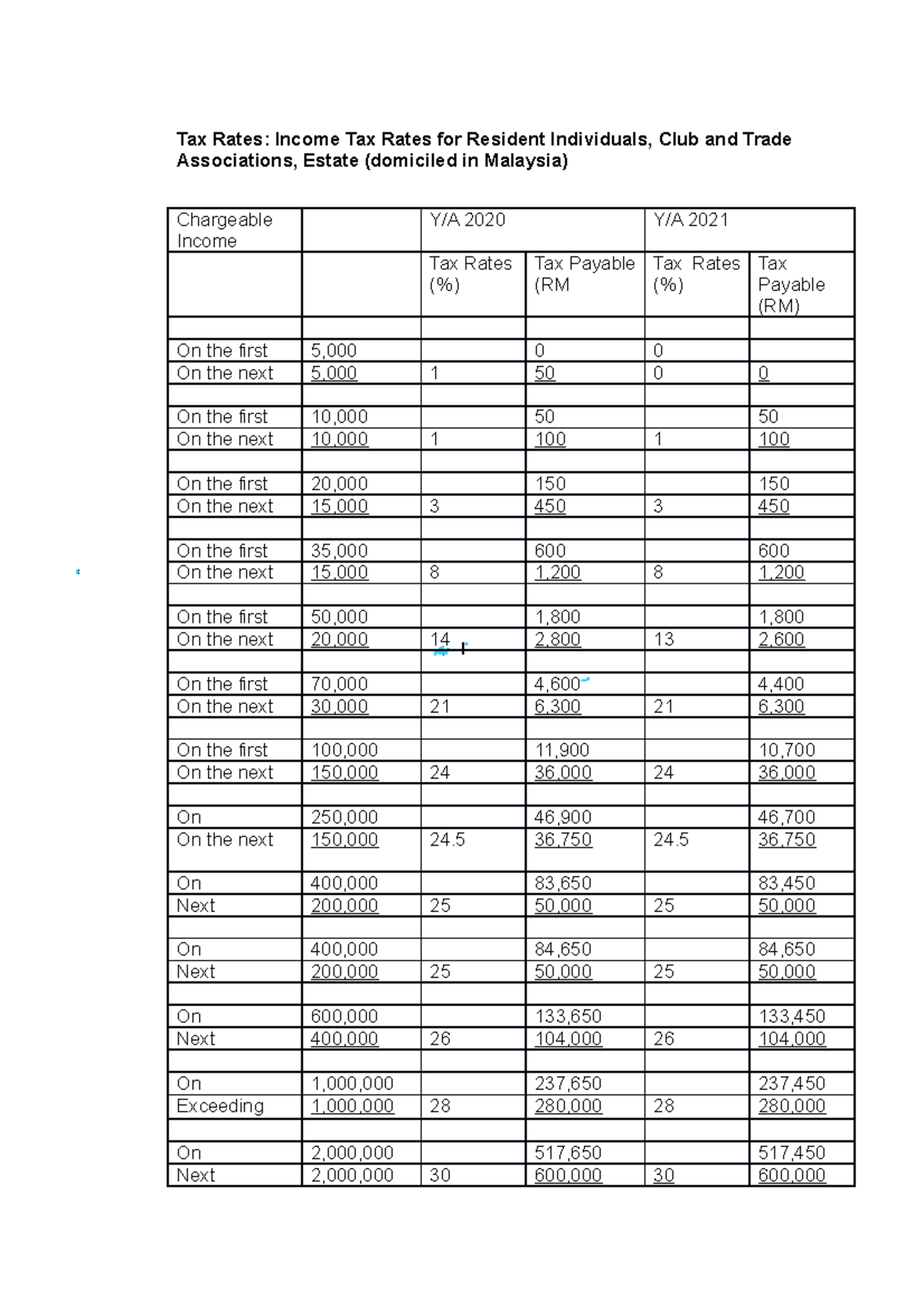

Individual Tax Rate Tax Rates Income Tax Rates For Resident

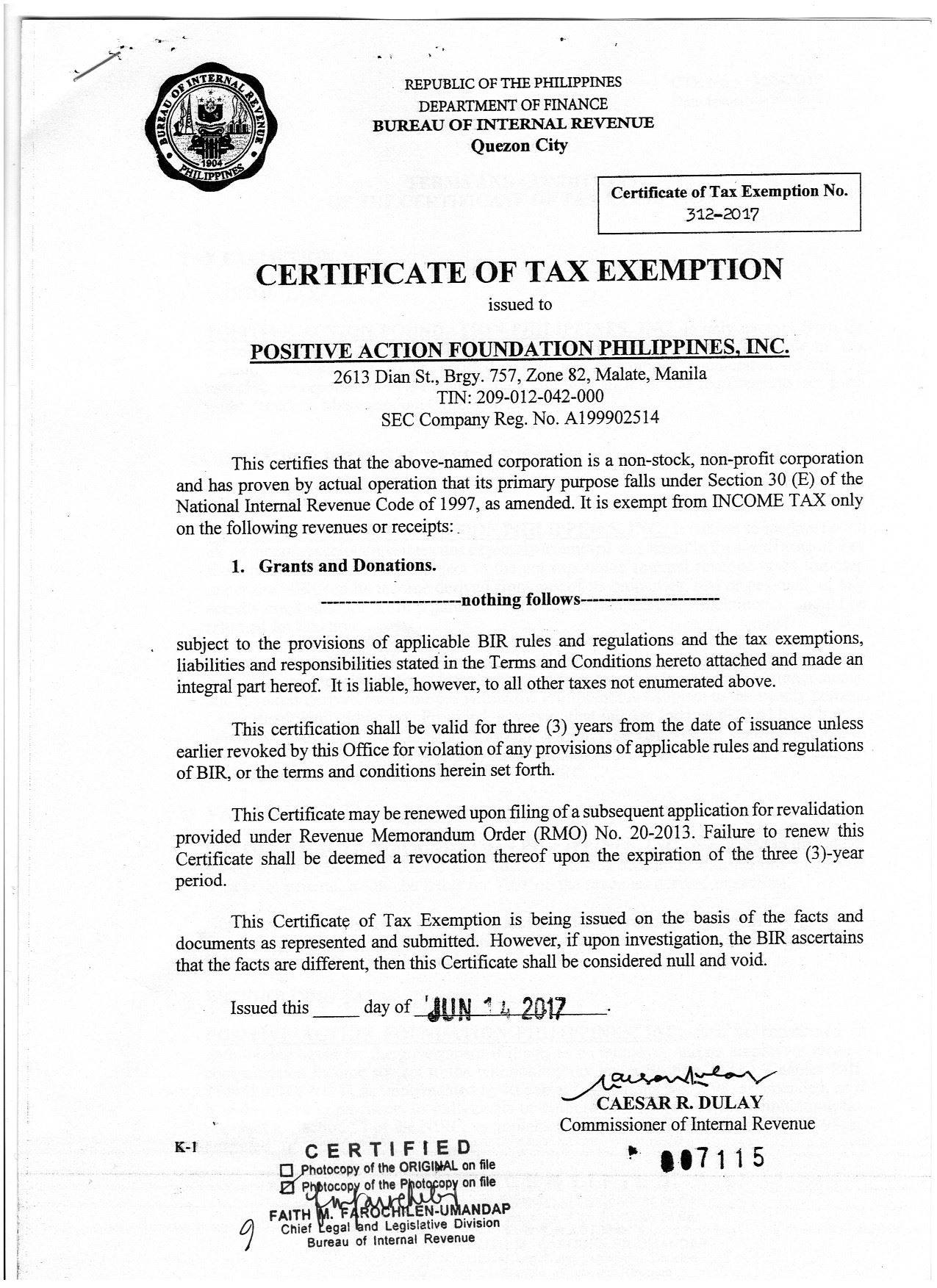

2017 PAFPI Certificate of TAX Exemption Certificate Of

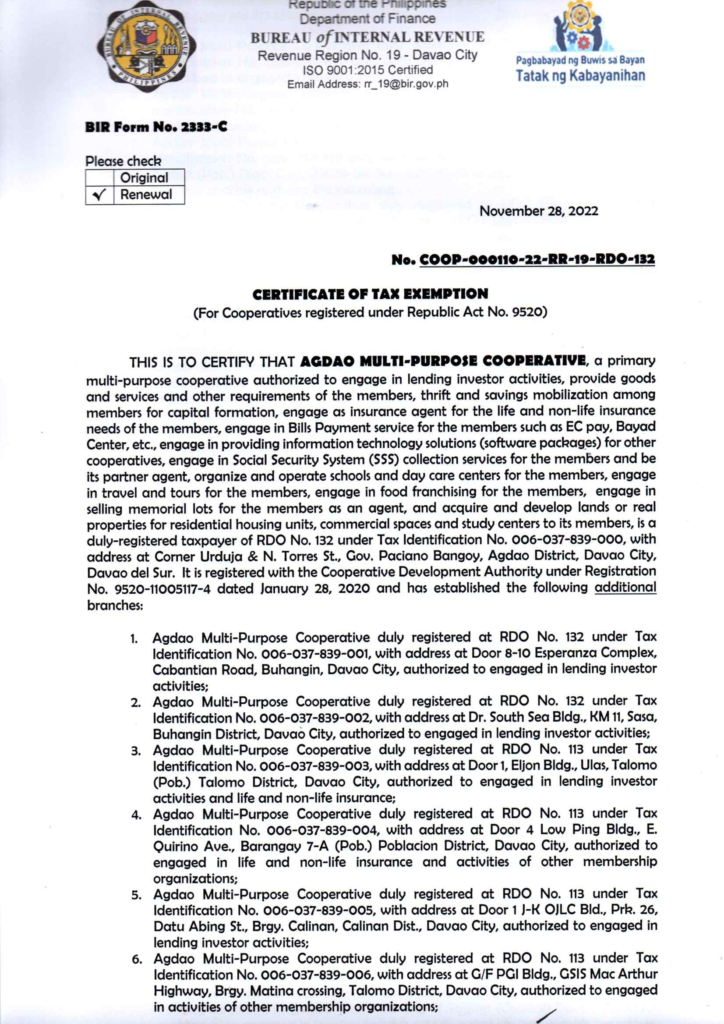

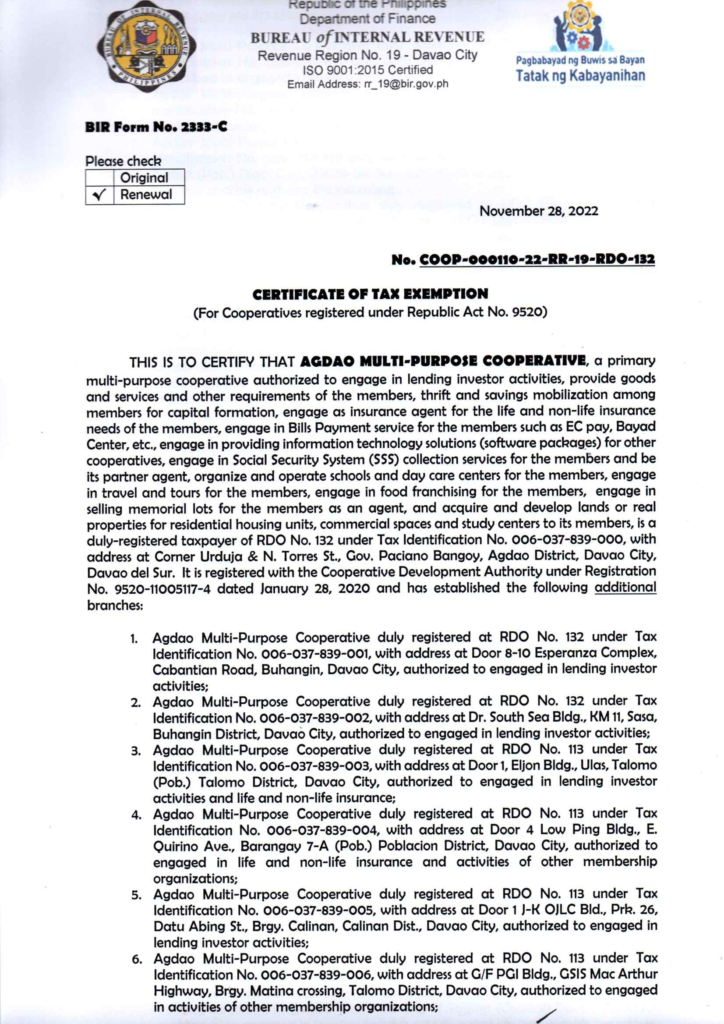

BIR Certificate Of Tax Exemption AMPC

BIR Certificate Of Tax Exemption AMPC

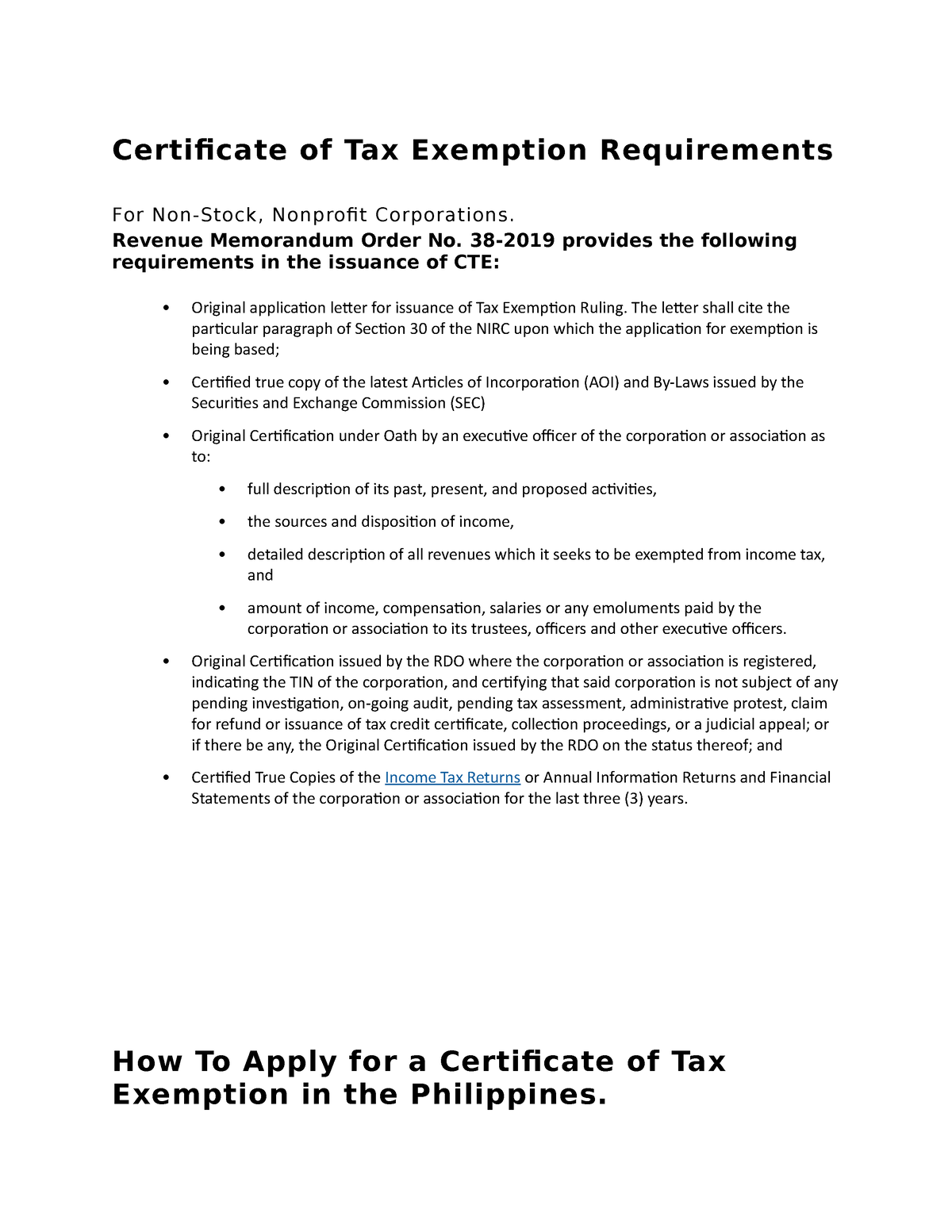

Tax Exemption Requirements And Process Certificate Of Tax Exemption

Tax Enquiry Protection Positive Accountants York

Singapore Tax Exemption Scheme AssemblyWorks

Personal Tax Exemption Philippines 2022 - Web 2 February 2022 7 min read With vaccines and boosters being continuously administered borders are slowly re opening and airports are starting to be filled with travelers again In