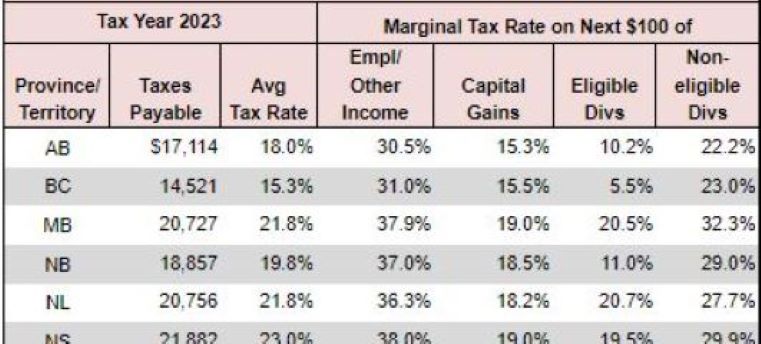

Personal Tax Rates 2023 Alberta Capital gains4 0 00 7 50 12 50 15 25 18 00 19 00 20 66 21 16 21 66 23 50 24 00 The tax rates reflect budget proposals and news

Indexing the personal income tax system Alberta has resumed indexation of the provincial personal income tax system for inflation beginning for the 2022 tax year Tax bracket Alberta Non Refundable Tax Credits 15 000 21 003 Basic exemption 15 000 21 003 Spousal eligible dependent exemption less their income 8 396 5 853 Age

Personal Tax Rates 2023 Alberta

Personal Tax Rates 2023 Alberta

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

State Corporate Income Tax Rates And Brackets For 2023 CashReview

https://files.taxfoundation.org/20230123172533/2023-state-corporate-income-tax-rates-and-brackets-see-state-corporate-tax-rates-by-state.png

TaxTips ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

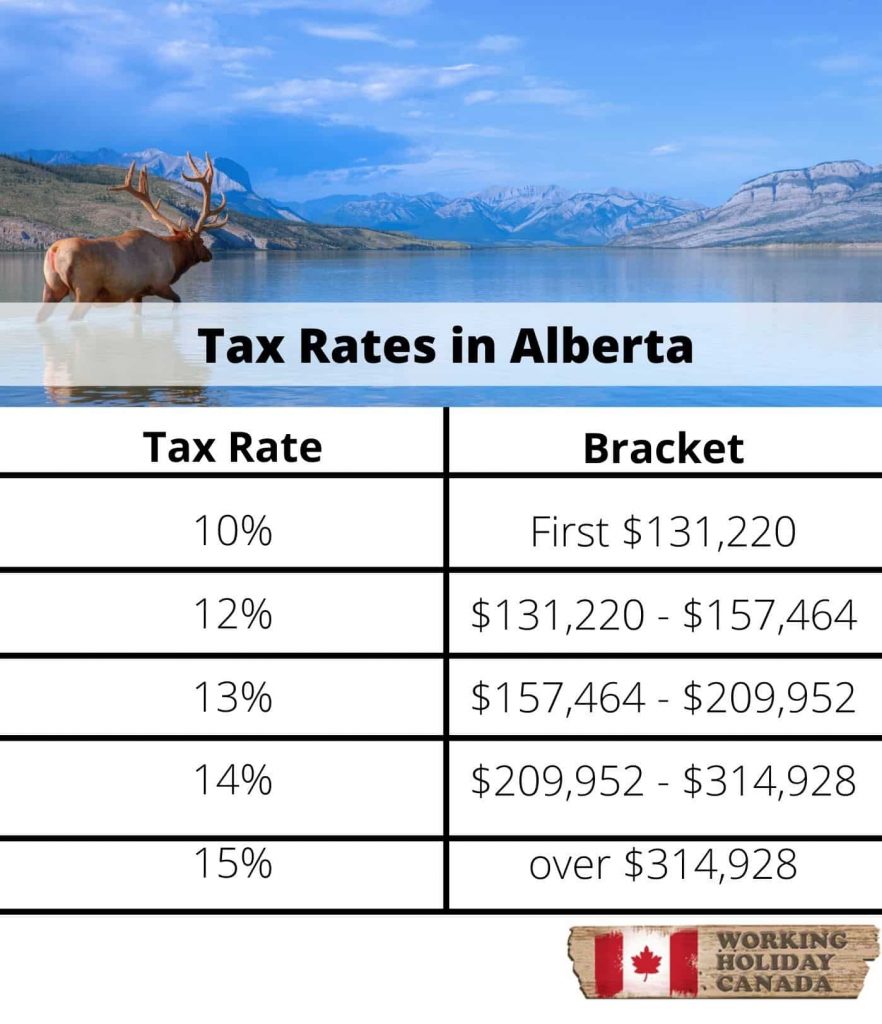

Alberta Personal Income Tax Tables in 2023 The Income tax rates and personal allowances in Alberta are updated annually with new tax tables published for Resident Federal income tax rates in 2023 range from 15 to 33 Alberta income tax rates in 2023 range from 10 to 15 The amount of income tax that was deducted from your

2023 Alberta income tax brackets 2023 Alberta income tax rates 142 292 or less 10 142 292 to 170 751 12 170 751 to 227 668 13 227 668 to The personal income tax rates in Alberta are as follows 10 for amounts up to 142 292 12 for amounts between 142 292 01 to 170 751 13 for amounts

Download Personal Tax Rates 2023 Alberta

More picture related to Personal Tax Rates 2023 Alberta

TaxTips ca Business 2022 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

2021 Nc Standard Deduction Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

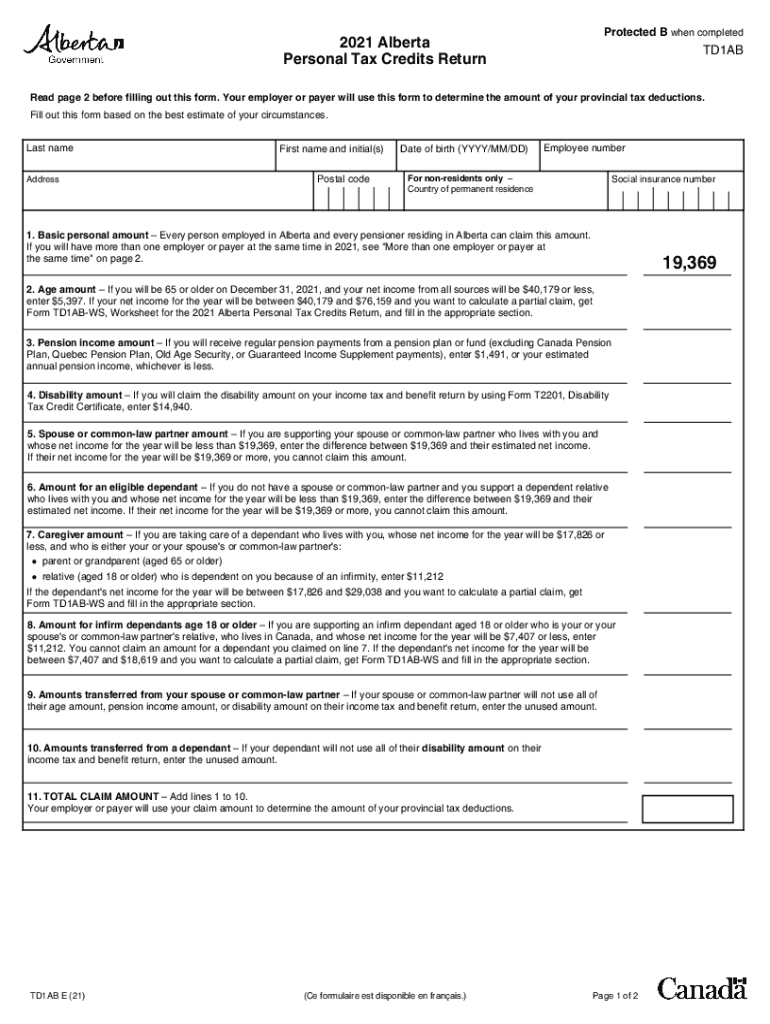

Alberta Tax Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/544/703/544703983/large.png

2023 personal tax rates Taxes calculated on Canadian dividend amounts assume that the dividends are generated from Canadian public corporations and as such are Alberta has resumed indexation of the provincial personal income tax system for inflation beginning for the 2022 tax year Tax bracket thresholds and credit amounts increased by

For the 2023 tax year the Alberta basic personal amount is 21 003 while the federal basic personal amount is 15 000 Moreover the first tax bracket in Alberta Federal tax Income Tax and Benefit Return This is the main form you need to complete your taxes Optional Federal income tax and benefit information Find out what s new

Alberta Tax Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/633/753/633753558/large.png

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth

https://cardinalpointwealth.com/wp-content/uploads/2021/12/Winter_2021_Canadian_Income_Tax_Table.jpg

https://assets.ey.com/content/dam/ey-sites/ey-com/...

Capital gains4 0 00 7 50 12 50 15 25 18 00 19 00 20 66 21 16 21 66 23 50 24 00 The tax rates reflect budget proposals and news

https://www.alberta.ca/personal-income-tax

Indexing the personal income tax system Alberta has resumed indexation of the provincial personal income tax system for inflation beginning for the 2022 tax year Tax bracket

Ca Tax Brackets Chart Jokeragri

Alberta Tax Form 2023 Printable Forms Free Online

The Basics Of Tax In Canada Workingholidayincanada

Solved Recall That In Class We Discussed How Personal Tax Chegg

2023 Federal Tax Rates Cra Printable Forms Free Online

2022 Tax Brackets PersiaKiylah

2022 Tax Brackets PersiaKiylah

Highlights Of Tax Reform Law TRAIN See The Tax Rates For 2019

2023 Federal Tax Brackets 2023

Canadian Income Tax Form 2023 Printable Forms Free Online

Personal Tax Rates 2023 Alberta - For 2023 the maximum allowable expenses for the credit will be increased to 18 210 The tax credit provides a non refundable tax credit equal to 10 per cent of