Personal Tax Return Business Expenses You can deduct as a business expense excise taxes that are ordinary and necessary expenses of carrying on your trade or business Taxes on gasoline diesel fuel and

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent If you are a self employed professional own a home based business or are a shareholder in an S Corporation or partnership your business deductions can be listed directly on or passed through to your personal income tax return

Personal Tax Return Business Expenses

Personal Tax Return Business Expenses

https://i.pinimg.com/originals/e7/38/89/e738898e44f404f66db78550bc60bbe3.png

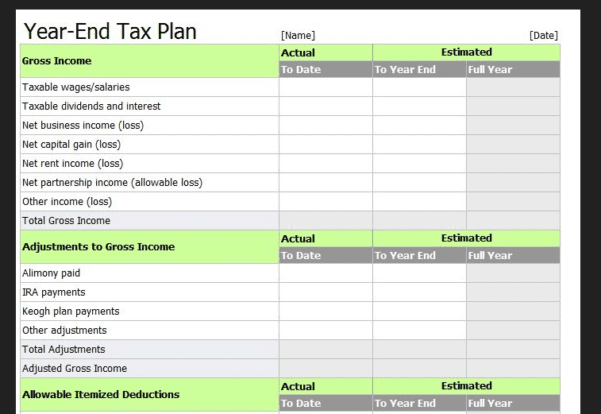

Personal Tax Return Workbook With Personal Tax Preparation Checklist

https://i.etsystatic.com/39231042/r/il/351cc2/4534958951/il_fullxfull.4534958951_m5bh.jpg

Small Business Printable Expense Report Template

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

Taxes on business property real estate taxes and excise taxes can be deducted on your business tax return 7 Legal and professional fees but there are several common challenges business owners face when it Business expenses are deductible and lower the amount of taxable income The total of business expenses is subtracted from revenue to arrive at a business total amount of taxable income

To know how to deduct business expenses from your tax return you must understand what is considered a business expense And it is important to not confuse personal expenses with If you deduct 100 of your personal vehicle as a business expense it s going to raise a flag Greene Lewis said If you declare 20 000 in income on your tax return but

Download Personal Tax Return Business Expenses

More picture related to Personal Tax Return Business Expenses

Tax Return Spreadsheet Template Spreadsheets Bank2home

https://excelxo.com/wp-content/uploads/2017/03/tax-return-spreadsheet-template-uk-601x414.png

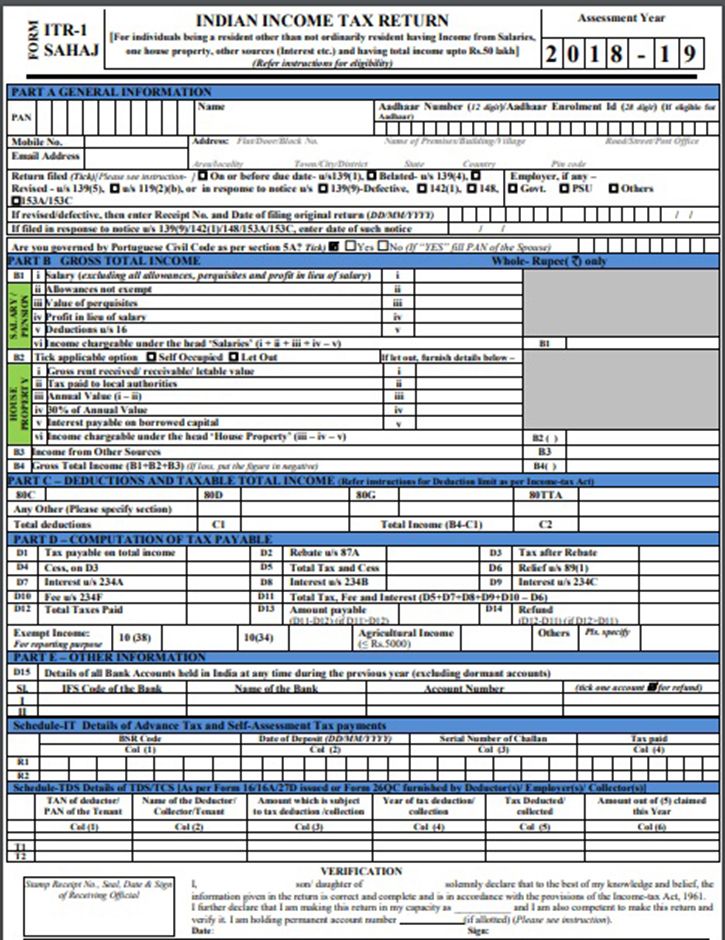

Income Tax Return

https://im.indiatimes.in/content/2018/Apr/income_tax_return_form_1522998544.jpg

Personal Tax Return Workbook With Personal Tax Preparation Checklist

https://i.etsystatic.com/39231042/r/il/7c661c/4487589086/il_fullxfull.4487589086_7090.jpg

Business expenses are tax deductible so they can lower your taxable income and reduce the amount of tax you owe However personal expenses generally aren t considered tax write offs against business income You can either 1 pay from a personal account and have your business reimburse you 2 pay just the business portion of the bill from the business account or 3 pay the bill from a business

Also known as a tax write off the tax law defines a tax deduction as any ordinary and necessary expense incurred to carry on any trade or business Eligible expenses are deducted from the If you are self employed or operate as a sole trader you can claim business expenses deductions on your individual tax return This allows you to offset the costs of

Personal Tax Return Workbook With Personal Tax Preparation Checklist

https://i.etsystatic.com/39231042/r/il/4cfec6/5187007848/il_1080xN.5187007848_e8p1.jpg

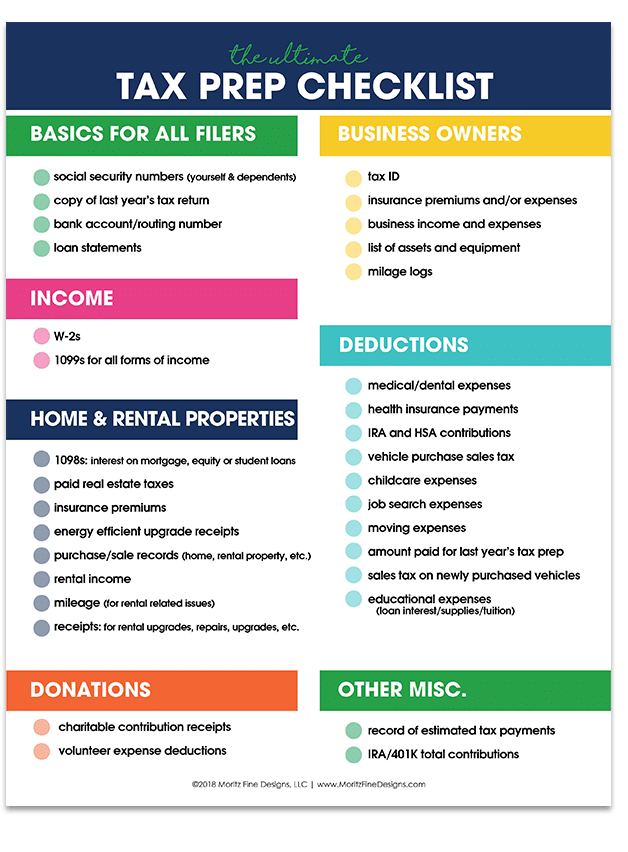

Tax Form Checklist 2023 Printable Forms Free Online

https://www.moritzfinedesigns.com/wp-content/uploads/2018/01/tax-prep-checklist.png

https://www.irs.gov › faqs › small-business-self...

You can deduct as a business expense excise taxes that are ordinary and necessary expenses of carrying on your trade or business Taxes on gasoline diesel fuel and

https://www.irs.gov › forms-pubs

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent

Tax Return Preparation Complete Guide 2022 Jasim Uddin Rasel

Personal Tax Return Workbook With Personal Tax Preparation Checklist

Bx91as 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

How Does The Medical Expense Tax Credit Work In Canada

Your Guide To The Annual Self assessed Tax Return Business Post

Don t Forget To Budget For These Things or It Will Cost You

Don t Forget To Budget For These Things or It Will Cost You

Personal Capital Taxes Chartered Accountants UK International

Printable Pdf Tax Form Printable Forms Free Online

Navigating Income Tax Returns For Businesses Strategies For Compliance

Personal Tax Return Business Expenses - Business expenses are deductible and lower the amount of taxable income The total of business expenses is subtracted from revenue to arrive at a business total amount of taxable income