Pge Ev Rebate Income Tax Deductions Web Empower EV open for enrollment PG amp E s Empower EV Program offers income eligible households up to 2 500 in financial incentives The program extends to qualifying

Web 1 f 233 vr 2023 nbsp 0183 32 Current PG amp E electric customers may qualify to receive a 1 000 or 4 000 rebate based on household income when purchasing or leasing an eligible pre owned Web Customers who meet the PG amp E Pre Owned EV Rebate program requirements and are income qualified may be eligible for the Rebate Plus option of 4 000 If an applicant

Pge Ev Rebate Income Tax Deductions

Pge Ev Rebate Income Tax Deductions

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

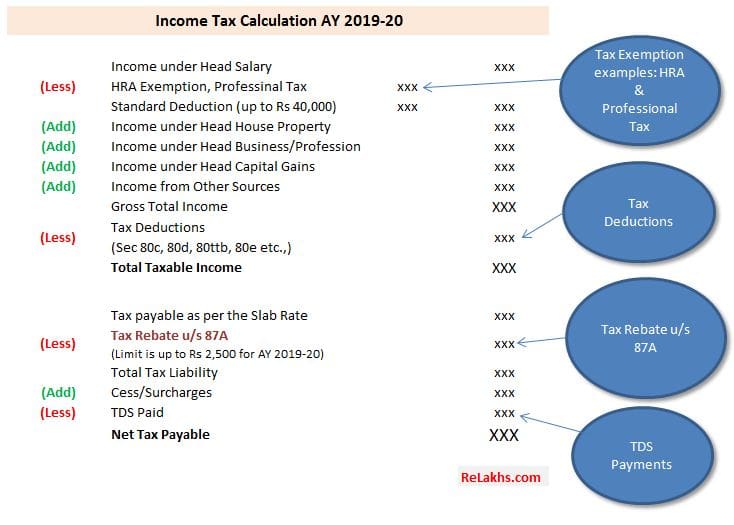

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Pge Incentives For Electric Cars ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/pg-e-500-ev-rebate-priuschat.jpeg

Web If there are two names on the vehicle registration card choose one vehicle owner or lessee to apply for the rebate only one owner or lessee as applicable may receive the rebate Web Once applications are submitted for three separate vehicles an applicant is not eligible to receive any additional rebates through the PG amp E Pre Owned EV Rebate program The

Web Standard Option 1 000 Eligible applicants may receive 1 000 for the purchase or lease of a pre owned EV Rebate Plus Option 4 000 Income qualified applicants may receive Web PG amp E will offer incentives of up to 2 500 per income eligible single family household to help cover the cost of purchasing and installing EV charging equipment Learn about

Download Pge Ev Rebate Income Tax Deductions

More picture related to Pge Ev Rebate Income Tax Deductions

Pg e Compressed Air Rebates AirRebate

https://www.airrebate.net/wp-content/uploads/2022/10/pge-compressed-air-rebates.png

Top 18 Ev Pge Rebate En Iyi 2022

https://cleantechnica.com/files/2018/07/PGE-EV-Rebate-heading-copy.png

80C TO 80U DEDUCTIONS LIST PDF

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Web Up to two EVs that you own are eligible to receive a rebate from one of our two offers either 500 toward the purchase of a qualifying charger or 1 000 for income eligible Web in his or her household to apply for more than one PG amp E used EV rebate for the same EV even if there is a transfer of ownership within the same household 7 In addition to the

Web 1 f 233 vr 2023 nbsp 0183 32 Pre Owned EV Rebate Terms and Conditions The following Terms and Conditions apply to all Pacific Gas and Electric Company PG amp E Pre O wned EV Web If you re a PGE customer earning up to 120 median income for your household size you can qualify for higher rebates through the PGE Residential EV Smart Charging Program

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?resize=1200%2C769&ssl=1

https://www.pge.com/.../clean-vehicles/electric/empower-ev-program.page

Web Empower EV open for enrollment PG amp E s Empower EV Program offers income eligible households up to 2 500 in financial incentives The program extends to qualifying

https://investor.pgecorp.com/news-events/press-releases/press-release...

Web 1 f 233 vr 2023 nbsp 0183 32 Current PG amp E electric customers may qualify to receive a 1 000 or 4 000 rebate based on household income when purchasing or leasing an eligible pre owned

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Pge ev full charge rate schedule peak periods residential charging

EV Rebates Valley Clean Energy

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Income Tax Deductions Financial Year 2020 21 WealthTech Speaks

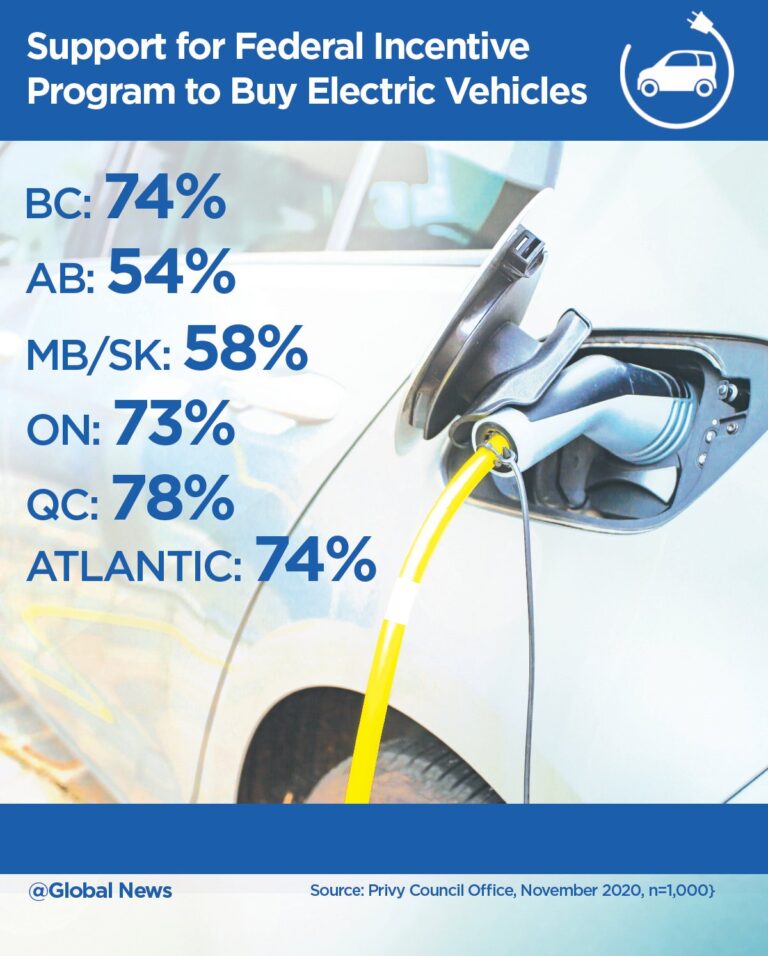

Canadians Support Federal EV Rebates Shows Internal Govt Poll

Income Tax Deduction Malaysia Joseph Randall

Pge Ev Rebate Income Tax Deductions - Web 20 f 233 vr 2020 nbsp 0183 32 Feb 19 2020 1 oddhack Member There s zero information about tax status of the 800 rebate on the PG amp E website AFAICT so I m unsure whether to report is as