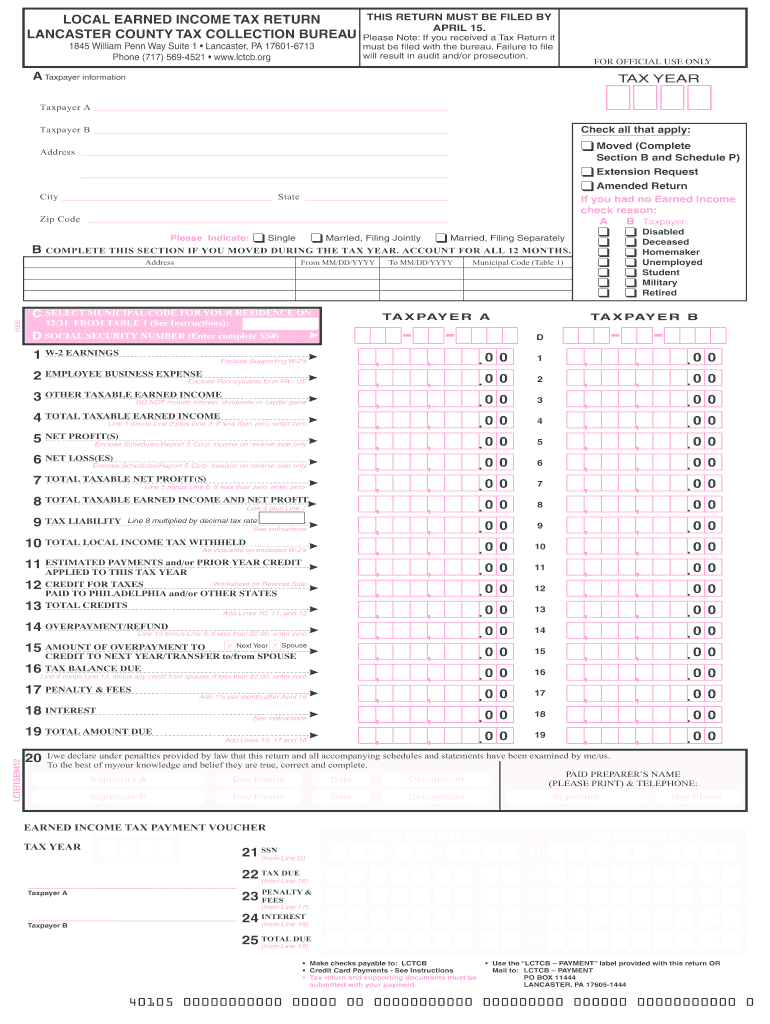

Philadelphia Earned Income Tax Rate Earnings Tax employees Due date Quarterly plus an annual reconciliation For specific deadlines see important dates below Tax rate 3 75 for residents and 3 44 for non residents To complete quarterly returns and payments for

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non resident taxpayers as of July 1 2021 Here are the new rates The new Wage Tax rate for residents is 3 8398 The Earnings Tax rate for residents is also decreasing from 3 8712 to 3 8398 Residents of Philadelphia pay a flat city income tax of 3 93 on earned income in addition to the Pennsylvania income tax and the Federal income tax Nonresidents who work in Philadelphia pay a local income tax of 3 50 which is 0 43 lower than the local income tax paid by residents

Philadelphia Earned Income Tax Rate

Philadelphia Earned Income Tax Rate

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_comparehero/income-tax-how-much-featured-image.png#keepProtocol

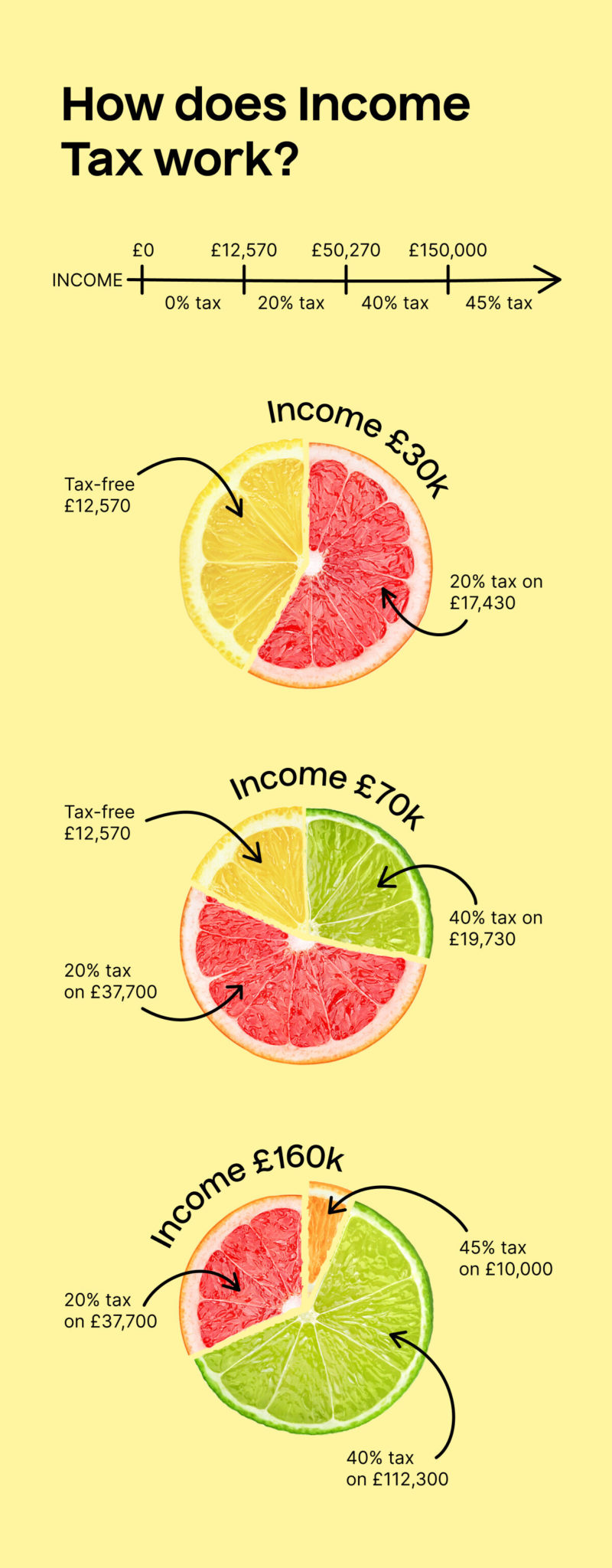

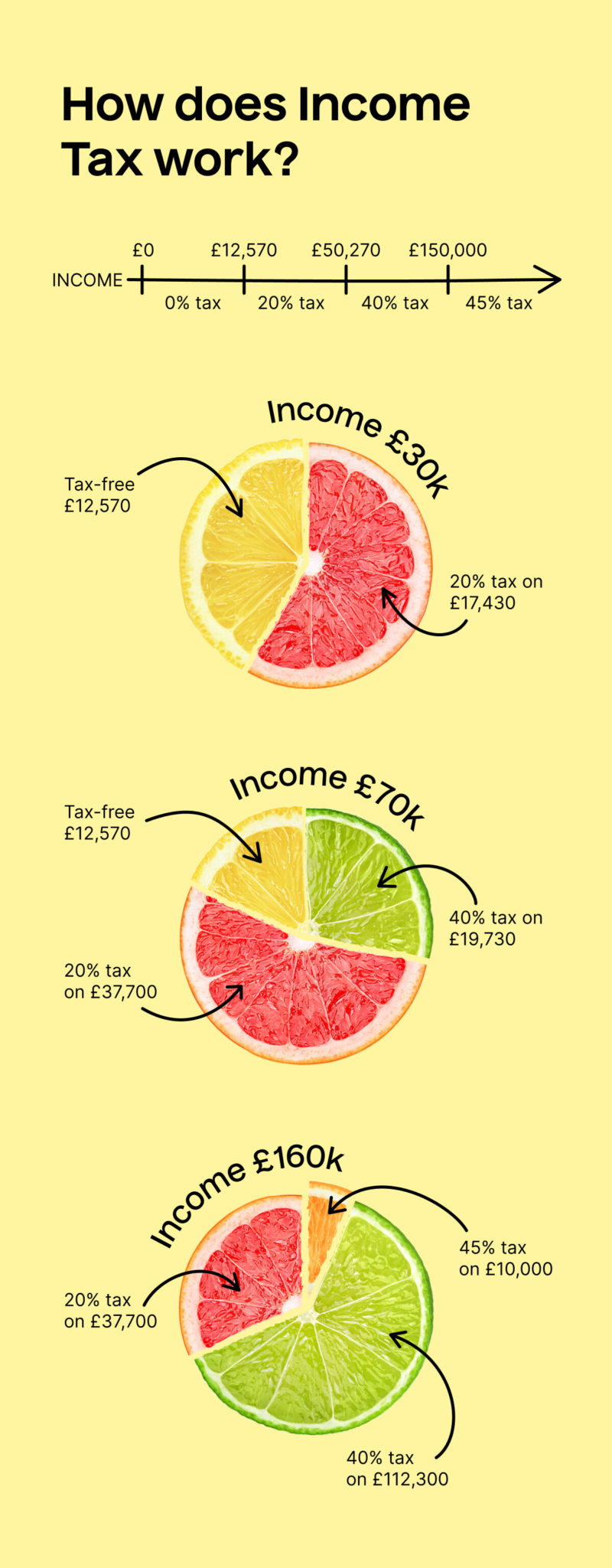

Income Tax Rates In The UK TaxScouts

https://taxscouts.com/wp-content/uploads/Infographic-1-800x2048.jpg

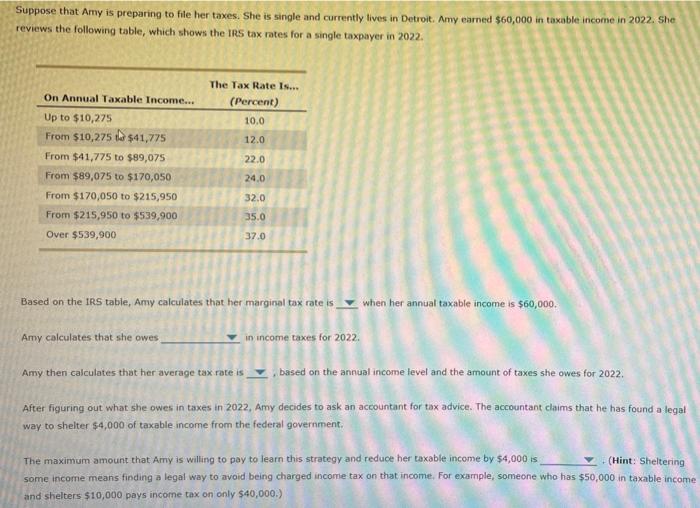

Solved Suppose That Amy Is Preparing To File Her Taxes She Chegg

https://media.cheggcdn.com/study/aa1/aa12bbe8-0642-426b-b066-38dfded02bf1/image

Many cities in Pennsylvania collect a Local Earned Income Tax which is typically 1 but can be as high as almost 3 9 In smaller municipalities this tax is capped by state law at 2 However in many larger cities including Pittsburgh and Philadelphia you ll encounter higher rates Residents The earned income tax rate for residents of Philadelphia is 3 75 This means that residents who earn income within the city are taxed at this rate on their gross earnings Non Residents Non residents who work in Philadelphia but live outside the city are subject to a slightly lower tax rate of 3 44

All Philadelphia residents owe the City Wage Tax regardless of where they work Non residents who work in Philadelphia must also pay the Wage Tax Effective July 1 2021 the rate for residents is 3 8398 percent and the rate for non residents is 3 4481 percent Current Tax Rates For detailed and historic tax information please see the Tax Compendium

Download Philadelphia Earned Income Tax Rate

More picture related to Philadelphia Earned Income Tax Rate

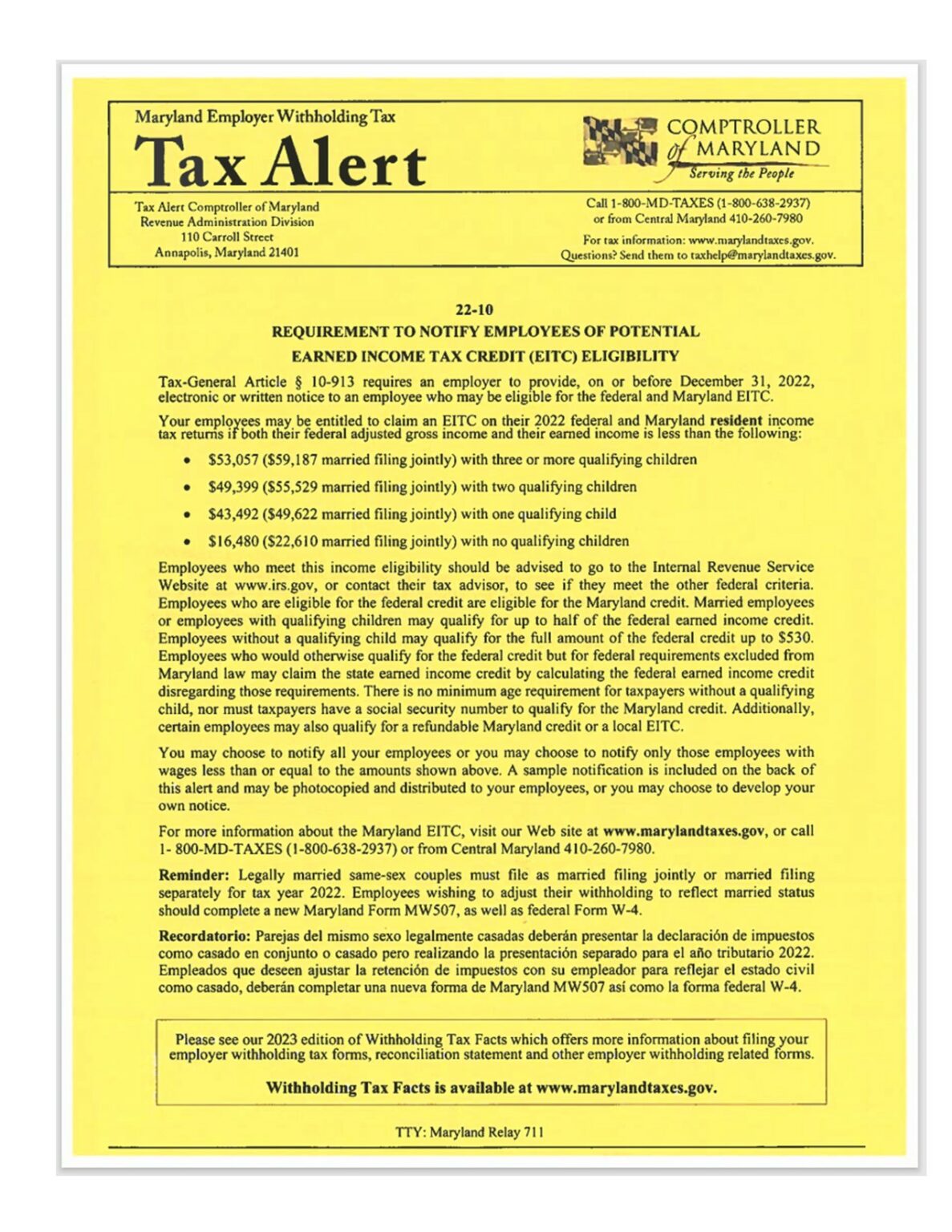

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Earned Income Tax Credit Horizon Goodwill Industries

https://horizongoodwill.org/wp-content/uploads/2022/12/tax-1-1-1187x1536.jpg

Pennsylvania will tax paychecks at a flat state income tax rate of 3 07 Depending on your location some cities have local income taxes There is also a 0 07 State Unemployment Insurance payroll tax for income up to 10 000 The City of Philadelphia has announced reduced tax rates for its School Income Tax SIT Changes to the Wage and Earnings tax rates become effective July 1 2022 The new NPT and SIT rates are applicable to income earned in Tax Year 2022 for returns due and taxes owed in 2023

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in PA This analysis focused on four of the biggest local taxes imposed on residents a 3 79 city tax on wages a 1 3998 tax on real estate the 2 local portion of the sales tax and a 3 79 school tax on unearned income such as dividends some forms of interest and rent received by landlords

Behind The Numbers On Income Tax News Bright Grahame Murray

https://bgm.imgix.net/uploads/insight/teaser/Income-Tax-Numbers.jpg?auto=compress

A State Earned Income Tax Credit Would Aid Pa Working Families

https://www.goerie.com/gcdn/presto/2022/02/07/NETN/fea7d07e-330c-4d39-a52b-f73203782a0f-MarybelleMartin.jpg?crop=5503,3095,x0,y1651&width=3200&height=1800&format=pjpg&auto=webp

https://www.phila.gov › ... › earnings-tax-employees

Earnings Tax employees Due date Quarterly plus an annual reconciliation For specific deadlines see important dates below Tax rate 3 75 for residents and 3 44 for non residents To complete quarterly returns and payments for

https://www.phila.gov

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non resident taxpayers as of July 1 2021 Here are the new rates The new Wage Tax rate for residents is 3 8398 The Earnings Tax rate for residents is also decreasing from 3 8712 to 3 8398

South Carolina s 2021 Agenda Why Income Tax Cuts Matter

Behind The Numbers On Income Tax News Bright Grahame Murray

Do I Qualify For The Earned Income Tax Credit The Motley Fool

Which States Have The Highest And Lowest Income Tax USAFacts

Lctcb Fast And Secure AirSlate SignNow

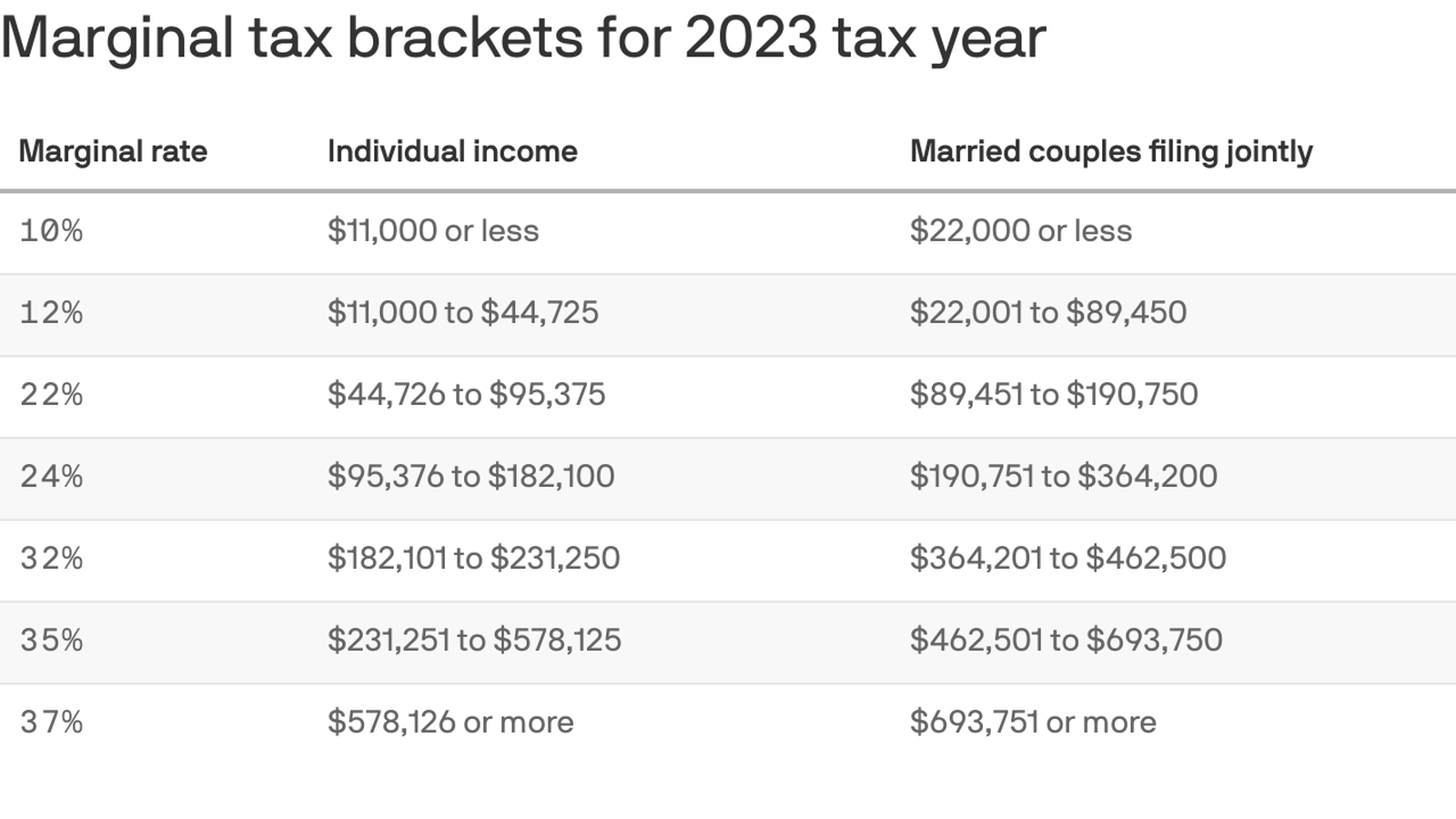

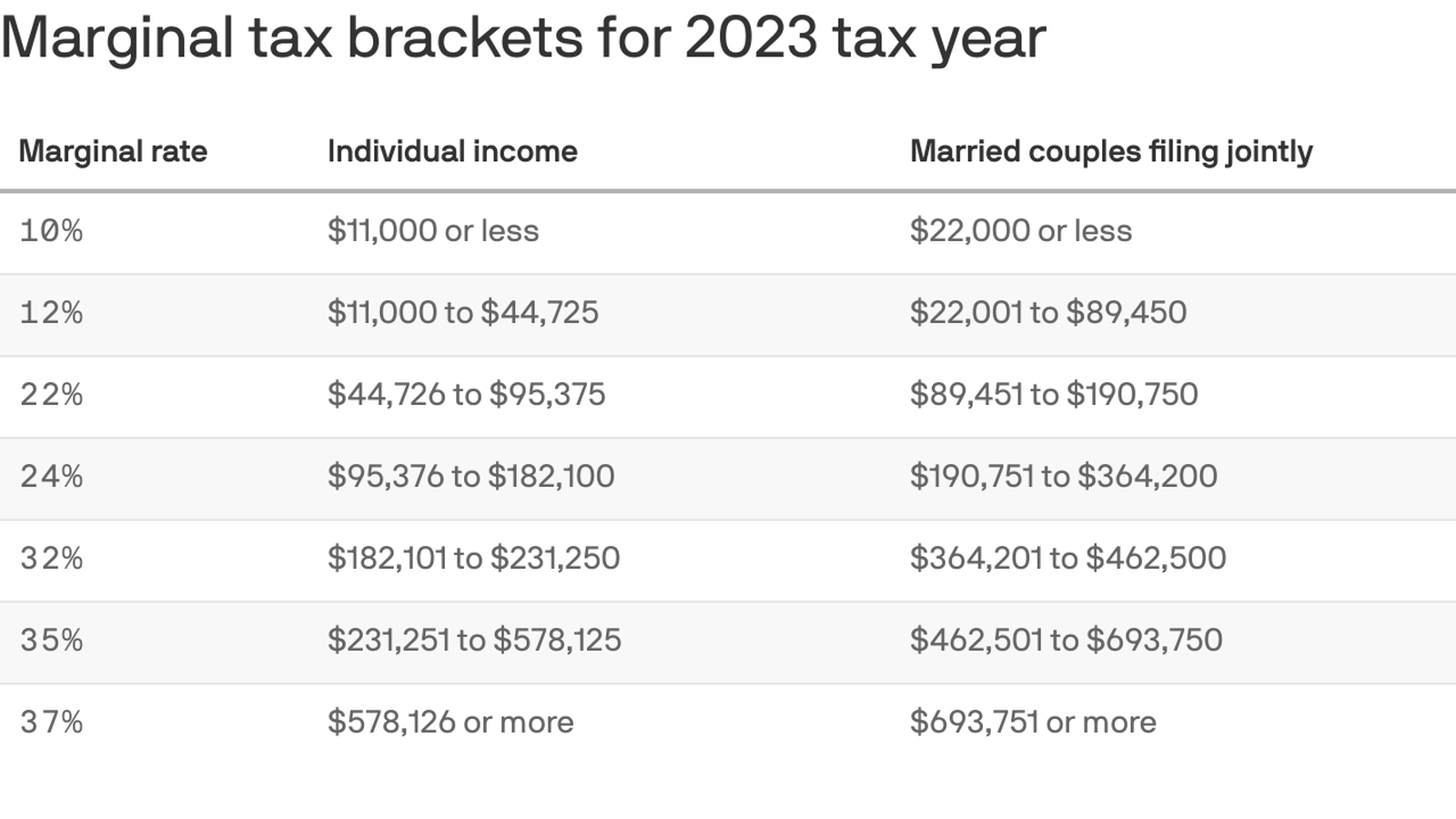

Federal Income Tax Table Cabinets Matttroy

Federal Income Tax Table Cabinets Matttroy

Earned Income Credit The Only Things You Need To Know Income

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

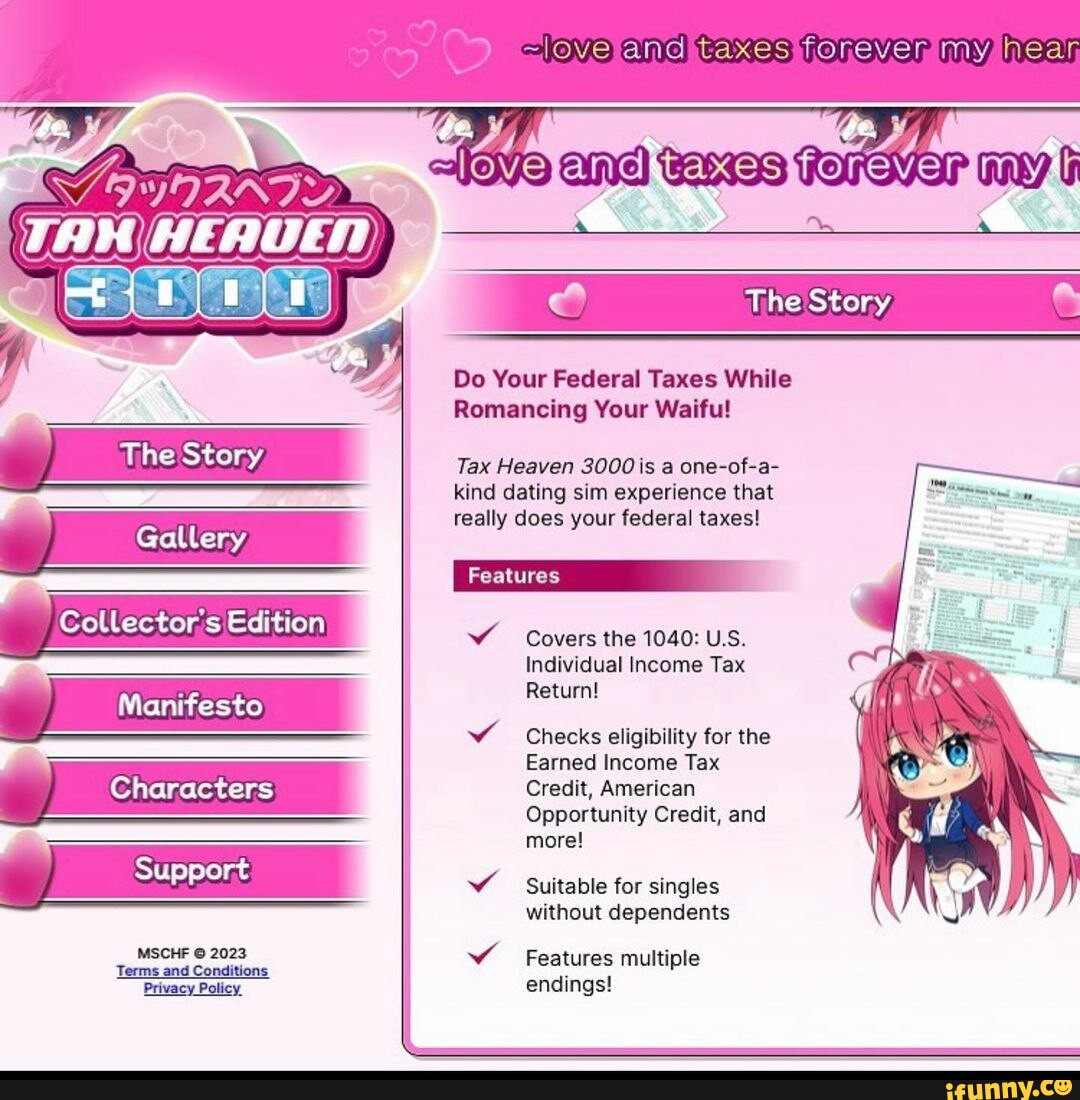

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

Philadelphia Earned Income Tax Rate - Current Tax Rates For detailed and historic tax information please see the Tax Compendium