Philadelphia Real Estate Taxes Rebate Due Home Homeowners Web 21 avr 2020 nbsp 0183 32 The City of Philadelphia offers a number of abatement and exemption programs that may reduce a property s real estate tax bill Tax abatements reduce taxes

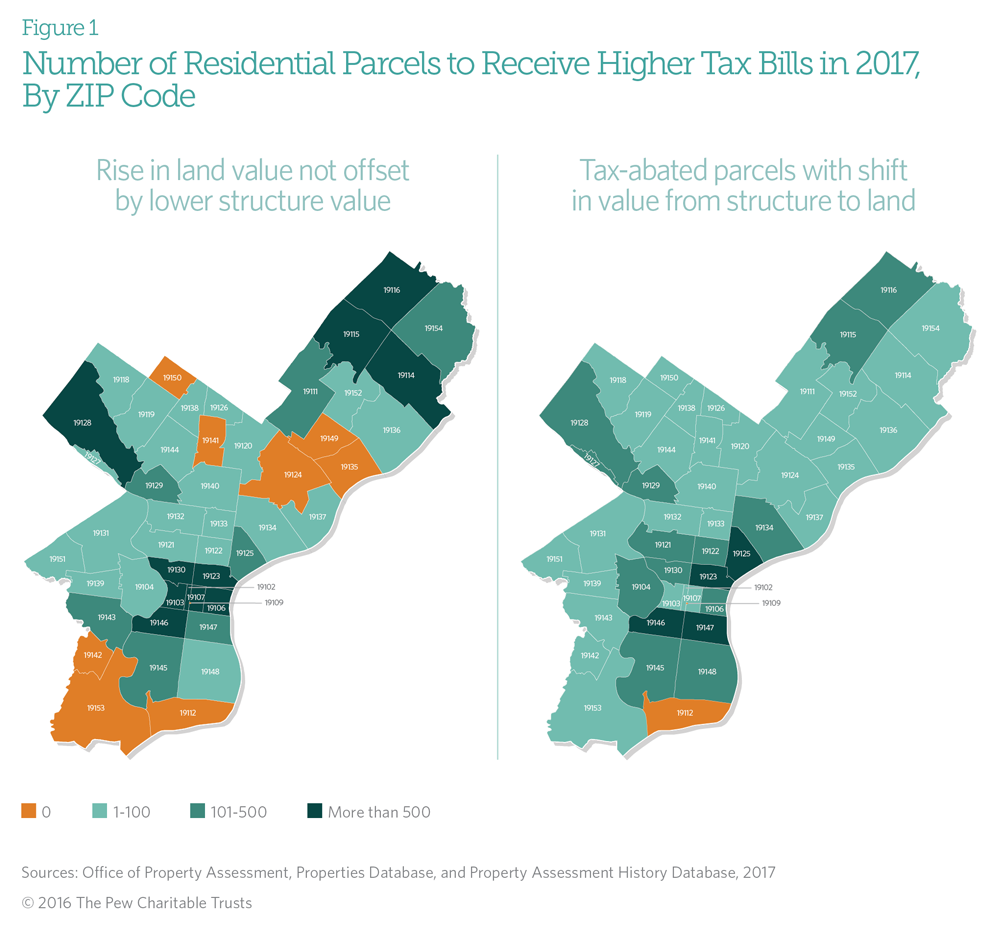

Web 27 juil 2022 nbsp 0183 32 This change will be reflected in Real Estate Tax bills for 2023 For a Philadelphia homeowner the increase in the Homestead Exemption to 80 000 means Web 29 nov 2022 nbsp 0183 32 One in five of the city s 324 000 owner occupied homes isn t enrolled in any of its tax relief programs meaning those homeowners collectively pay 73 million more in taxes than they should

Philadelphia Real Estate Taxes Rebate Due Home Homeowners

Philadelphia Real Estate Taxes Rebate Due Home Homeowners

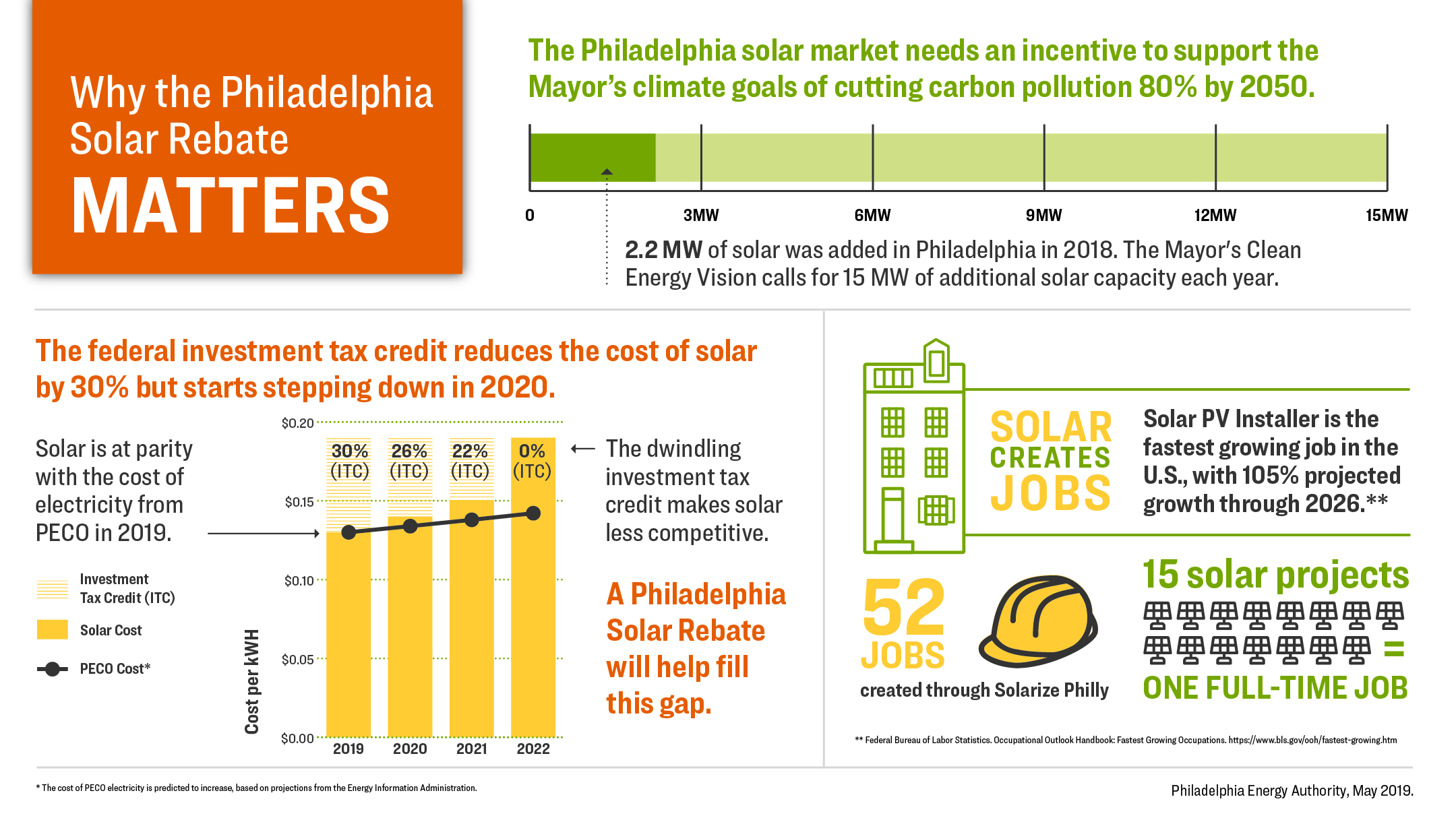

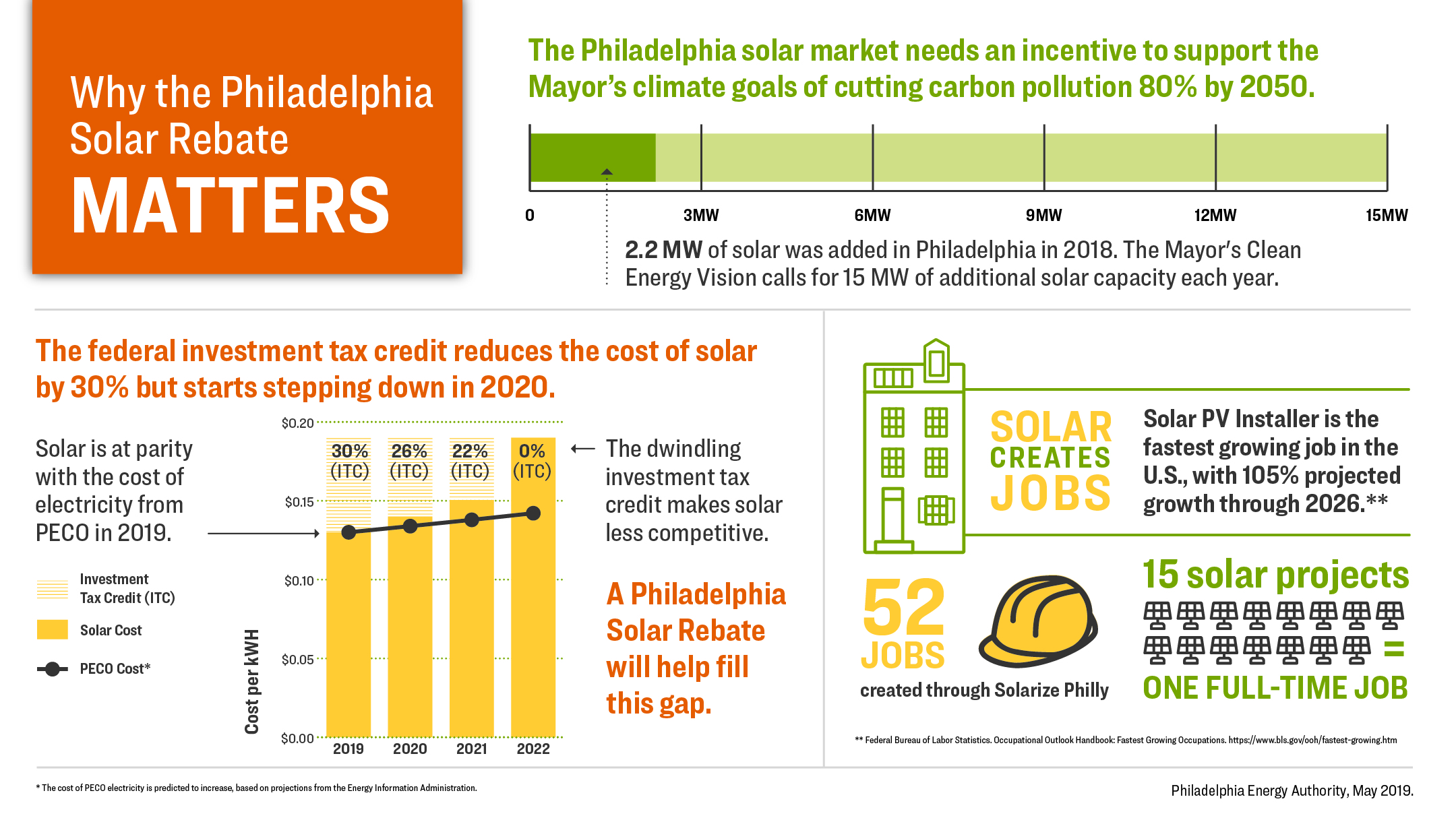

https://philaenergy.org/wp-content/uploads/2019/05/SOLARINFOGRAPHIC-V11-1.jpg

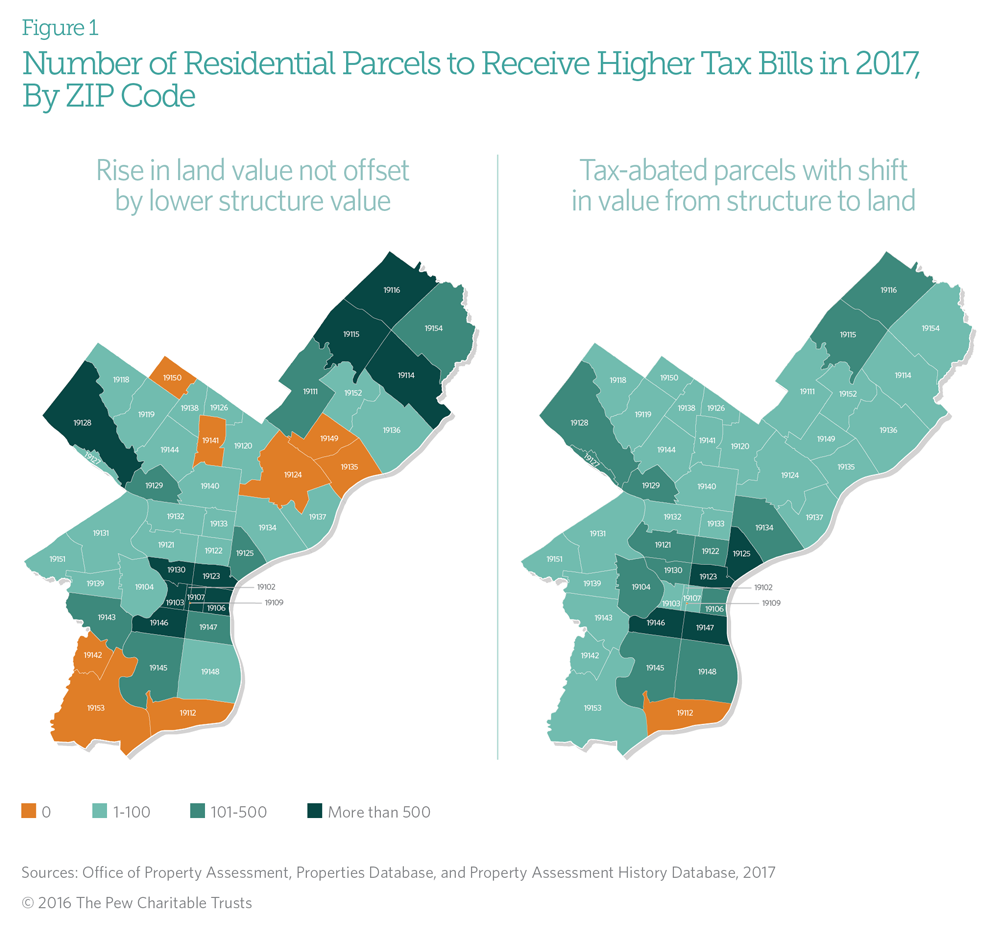

Change In Philadelphia Land Tax Value Raises Taxes For Many Properties

https://www.pewtrusts.org/-/media/post-launch-images/2016/06/philadelphia/landtaxvaluegraphicsfig1.png

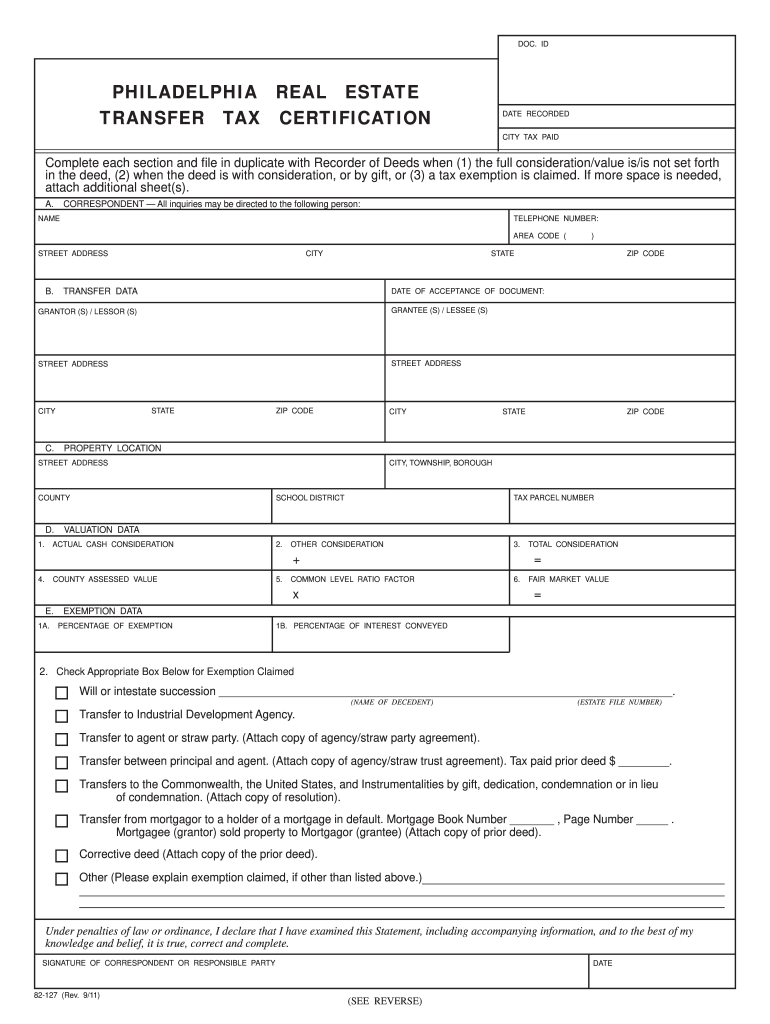

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Web 13 juil 2022 nbsp 0183 32 The Homestead Exemption offers Real Estate Tax savings to all Philadelphia homeowners by reducing the taxable assessment of their primary Web Owner occupied Real time Estate Ta Payment Agreement OOPA This download allows homeowners to make affordable monthly services on property taxes that are past due

Web 25 mai 2023 nbsp 0183 32 The City offers a number of abatement and exemption programs for Real Estate Taxes These programs include Homestead Exemption for all Philadelphia Web 21 nov 2022 nbsp 0183 32 March 28 2023 Press Release Don t wait until the last day to pay your property tax taxpayers still have time to enroll in programs to reduce their bill

Download Philadelphia Real Estate Taxes Rebate Due Home Homeowners

More picture related to Philadelphia Real Estate Taxes Rebate Due Home Homeowners

Are Citizens To Support America Or The Government

http://www.cityofmadison.com/epayment/images/TaxBillReal.gif

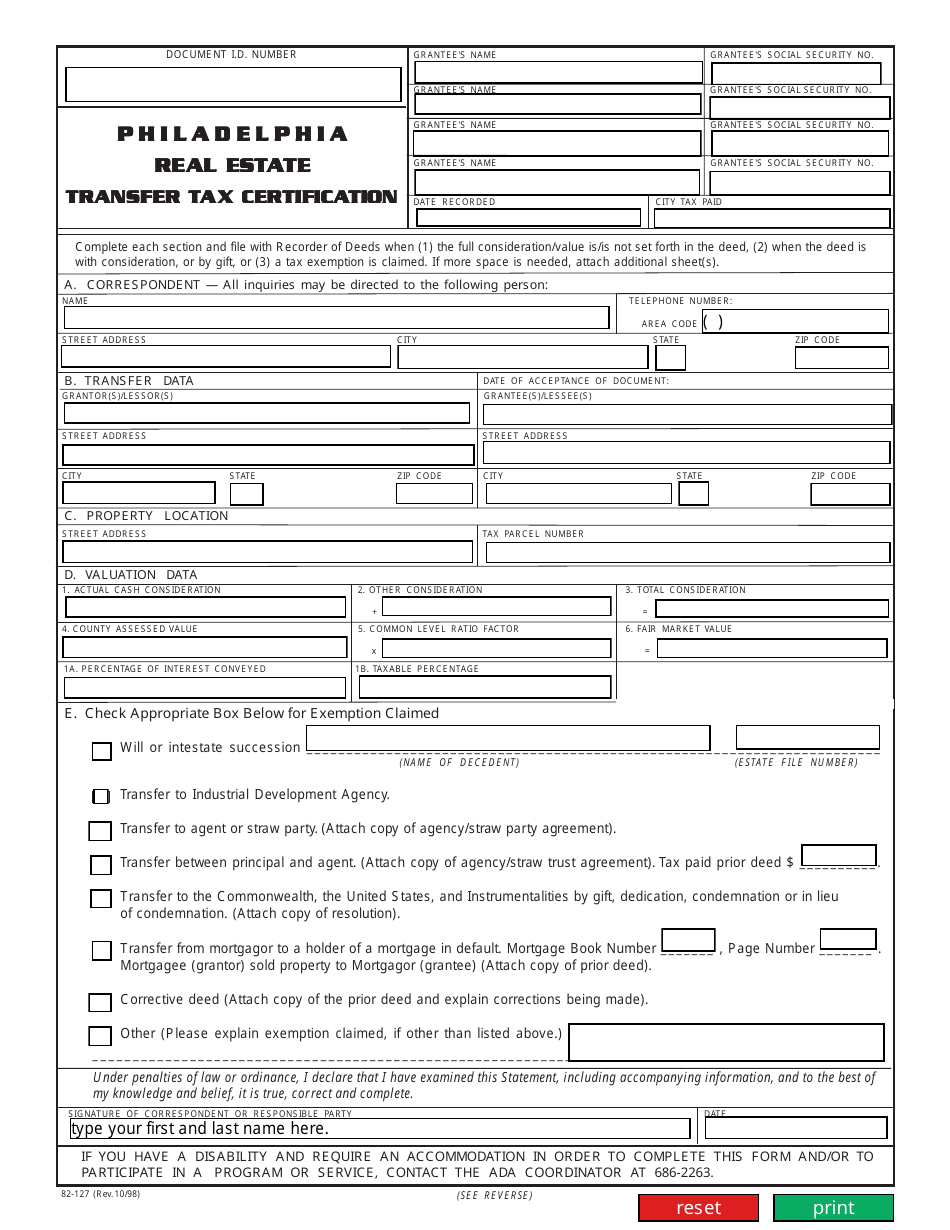

Philadelphia Deed Transfer Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/421/12/421012776/large.png

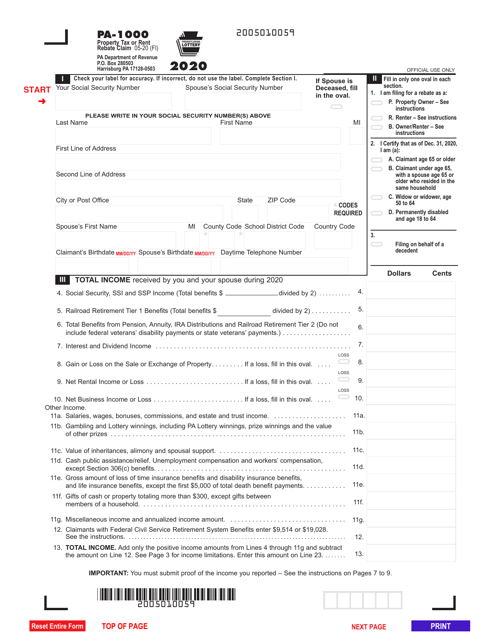

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

https://data.templateroller.com/pdf_docs_html/2130/21300/2130045/form-pa-1000-property-tax-or-rent-rebate-claim-pennsylvania_big.png

Web 14 f 233 vr 2017 nbsp 0183 32 Every Philadelphian who owns the home where they reside can qualify for the Homestead Real Estate Tax Exemption which reduces the taxable portion of their property assessment by 30 000 The Web 26 janv 2023 nbsp 0183 32 Complete all sections on the Property refund petition screen and follow the onscreen instructions to submit your refund request Refunds are usually processed in

Web 30 juin 2023 nbsp 0183 32 PROPERTY TAX or PA 1000 Booklet 05 22 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 Web Supplemental rebates are still automatically calculated for property owners with 30 000 or less in income who live in Philadelphia Scranton or Pittsburgh Property taxes are

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

https://townsquare.media/site/704/files/2022/07/attachment-Untitled-design-4.jpg?w=980&q=75

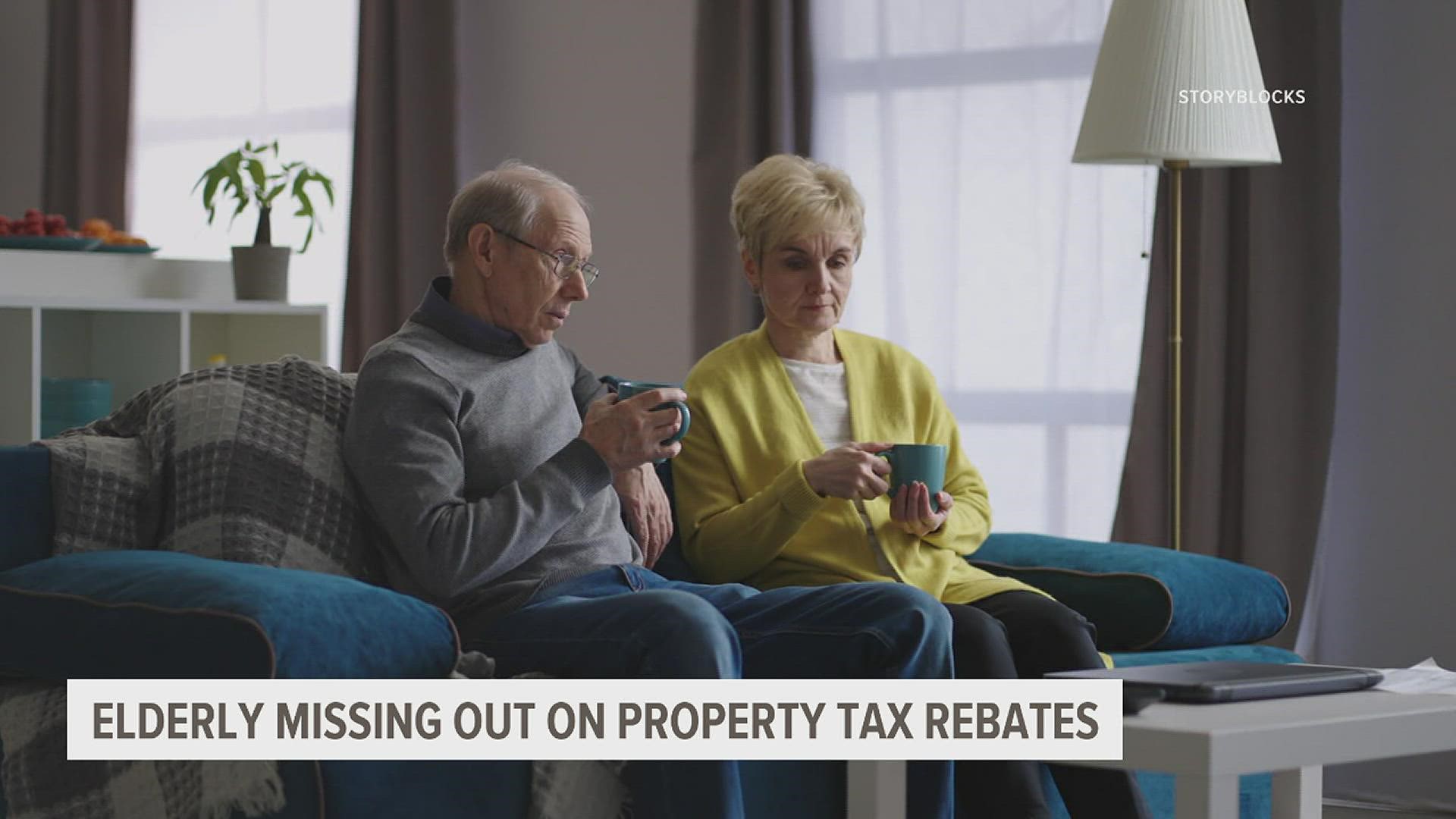

More Pa Seniors Would Qualify For The Property Tax Rent Rebate

https://media.tegna-media.com/assets/WPMT/images/72e83dba-d2e9-4880-9eb6-3d504f17872f/72e83dba-d2e9-4880-9eb6-3d504f17872f_1920x1080.jpg

https://www.phila.gov/departments/office-of-property-assessment/tax...

Web 21 avr 2020 nbsp 0183 32 The City of Philadelphia offers a number of abatement and exemption programs that may reduce a property s real estate tax bill Tax abatements reduce taxes

https://www.phila.gov/2022-07-27-mayor-kenney-signs-property-tax...

Web 27 juil 2022 nbsp 0183 32 This change will be reflected in Real Estate Tax bills for 2023 For a Philadelphia homeowner the increase in the Homestead Exemption to 80 000 means

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

When Will The Hudson Valley Receive Their Homeowners Tax Rebate

New York Property Owners Getting Rebate Checks Months Early

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Michigan Homeowners Can Expect Property Taxes To Rise In 2023 Due To

Rev 1220 Fill Out Sign Online DocHub

Rev 1220 Fill Out Sign Online DocHub

2012 Form PA 83 T 5Fill Online Printable Fillable Blank PdfFiller

Philadelphia Transfer Tax Exemption

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Philadelphia Real Estate Taxes Rebate Due Home Homeowners - Web 25 mai 2023 nbsp 0183 32 The City offers a number of abatement and exemption programs for Real Estate Taxes These programs include Homestead Exemption for all Philadelphia