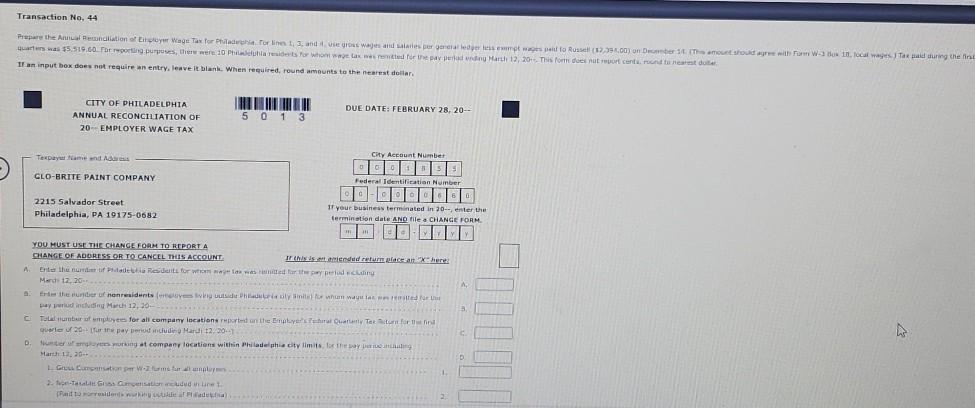

Philadelphia Wage Tax Reporting Web All Philadelphia residents owe the Wage Tax regardless of where they work Non residents who work in Philadelphia must also pay the Wage Tax Each year the Department of Revenue publishes a schedule of specific due dates for the Wage Tax Your first filing due date for 2022 is May 2 See Reconciliation and Schedules below

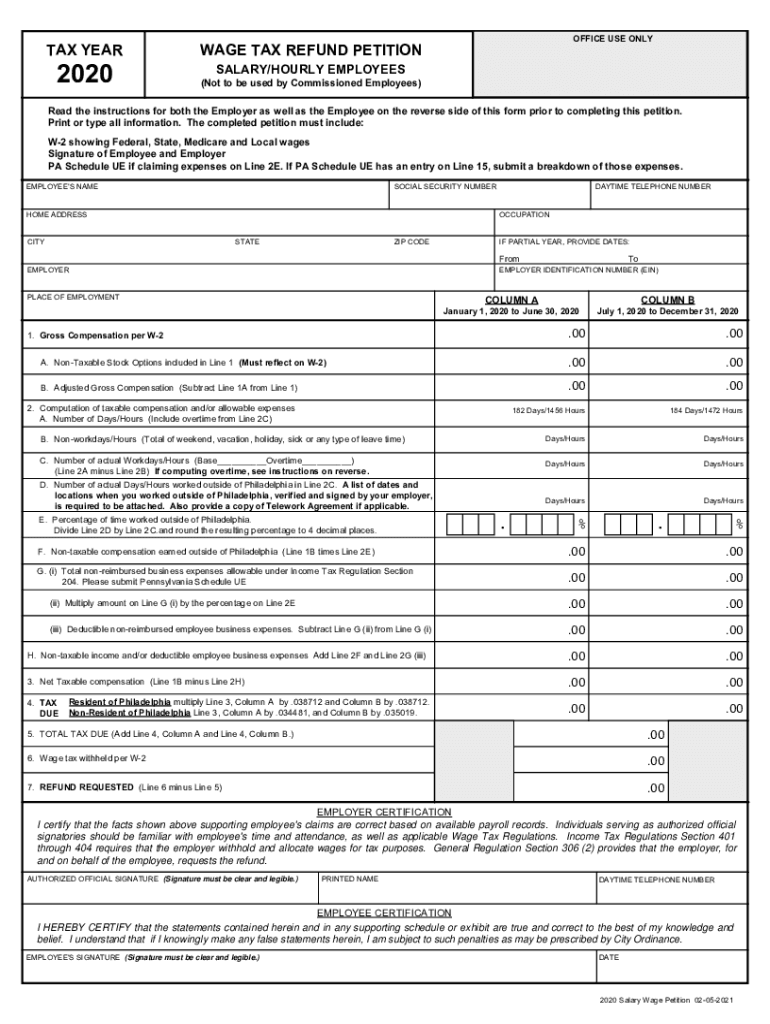

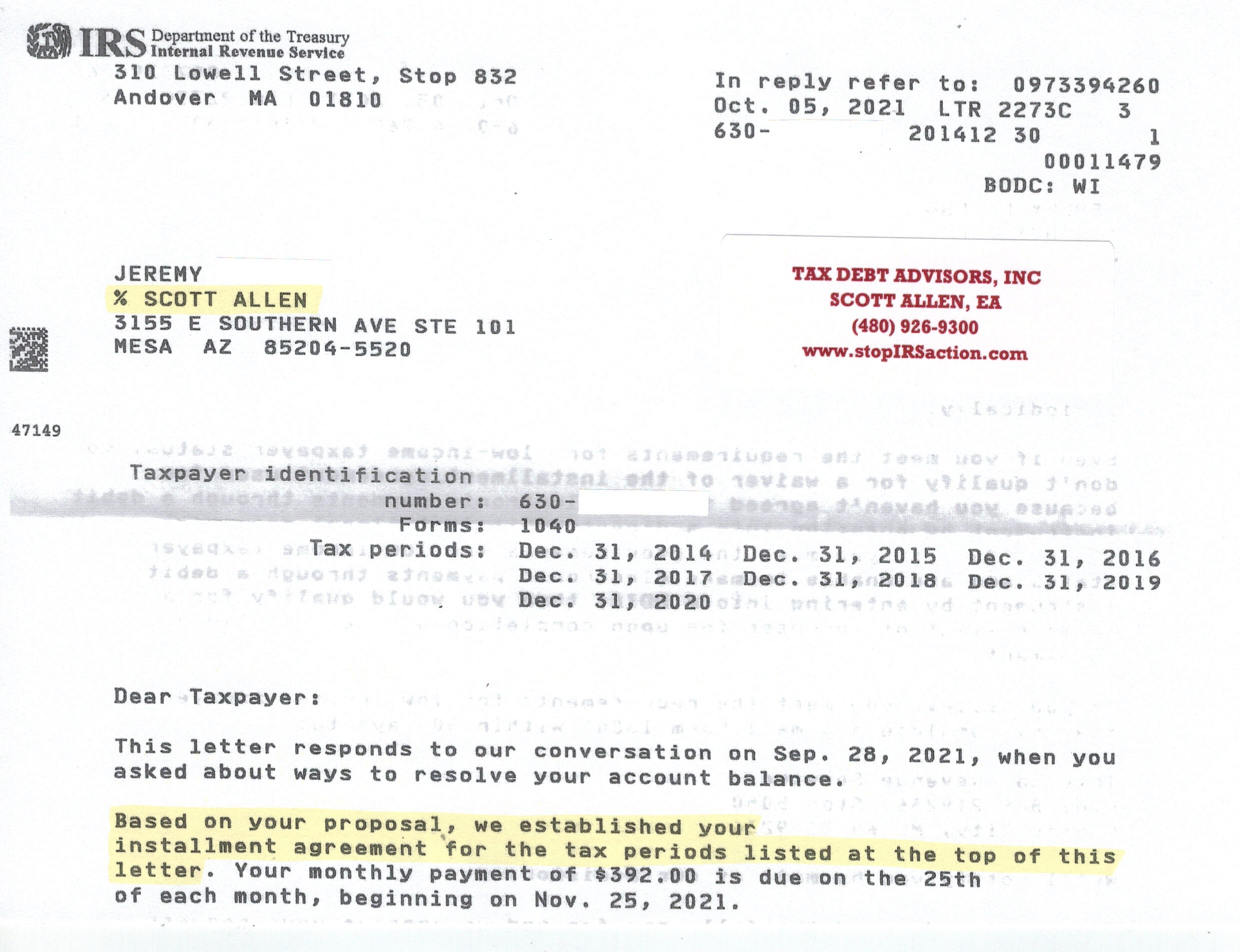

Web All employers who paid taxable compensation to residents of Philadelphia even if earned outside of Philadelphia and to non residents for services performed within Philadelphia When To File The Annual Reconciliation of Employer Wage Tax for the calendar year 2021 is due on or before February 28 2022 Web Wages earned for work performed at the home outside of Philadelphia are exempt from the Philadelphia wage tax if the employee 1 is merely assigned to the Philadelphia office and there is no other connection to the Philadelphia based employer 2 reports to work in the Philadelphia office no more than two times per year 3 does not have a d

Philadelphia Wage Tax Reporting

/cloudfront-us-east-1.images.arcpublishing.com/pmn/Z7LPYQ4DGJGUVDDQBBFZNP7KTY.jpg)

Philadelphia Wage Tax Reporting

https://www.inquirer.com/resizer/-7bqDwgkg3eo0u8ISscYTxlU-mY=/500x333/smart/filters:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/pmn/Z7LPYQ4DGJGUVDDQBBFZNP7KTY.jpg

/cloudfront-us-east-1.images.arcpublishing.com/pmn/4W4LTZTBOVDSRMZALBHJ3Z43HE.jpg)

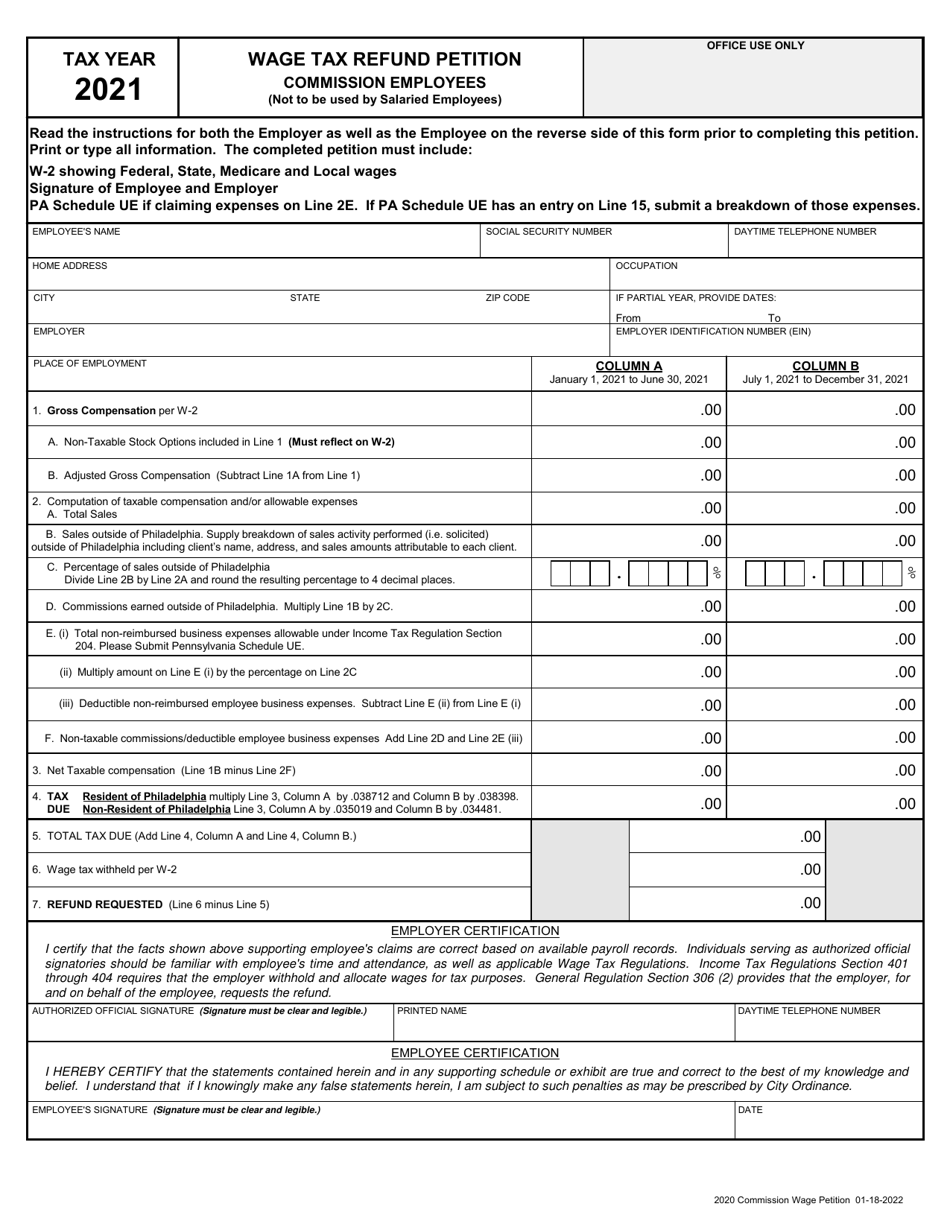

How To Get Your 2021 Philadelphia City Wage Tax Refund

https://www.inquirer.com/resizer/aIzI7o0tOe85U5xrh1oeixbKMNI=/500x333/smart/filters:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/pmn/4W4LTZTBOVDSRMZALBHJ3Z43HE.jpg

Philadelphia Wage Tax Calculator Imposing Logbook Lightbox

https://i.pinimg.com/originals/e7/29/4b/e7294b175e52b2413fe01977eecfc619.png

Web 2021 0957 Philadelphia Department of Revenue issues frequently asked questions concerning compliance with the Wage Tax requirements under its COVID 19 policies Web 3 Juli 2023 nbsp 0183 32 This year trimming Philadelphia s wage tax rate and the corresponding rate for the school income tax from 3 79 to 3 75 will reduce the tax burdens by less than one tenth of one percentage point according to Pew s model

Web 1 Apr 2022 nbsp 0183 32 1 st Quarter Filing Due Date May 2 2022 2 nd Quarter Filing Due Date August 1 2022 3 rd Quarter Filing Due Date October 31 2022 4 th Quarter Filing Due Date January 31 2023 What To Do Now Existing Philadelphia Taxpayers Web 10 M 228 rz 2022 nbsp 0183 32 Commentary On Jan 7 2022 the Pennsylvania Commonwealth Court ruled that a Philadelphia resident taxpayer who worked for a Wilmington Delaware based employer was not entitled to a credit against her Philadelphia Wage Tax City Wage Tax liability for state income tax paid to Delaware for the 2013 2016 tax years 1 The Court

Download Philadelphia Wage Tax Reporting

More picture related to Philadelphia Wage Tax Reporting

Philadelphia Wage Tax Petition Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/549/697/549697988/large.png

OFFICIAL NOTICE Philadelphia Wage Tax Rate Changes Start July 1 2022

https://files.constantcontact.com/414cc94e401/d396f5ff-470f-452d-bac3-e2d65ec122ba.jpg?rdr=true

Philadelphia City Wage Tax Refund Form 2021 Veche

https://i2.wp.com/data.formsbank.com/pdf_docs_html/276/2765/276534/page_1_thumb_big.png

Web Earnings Tax employees Due date Quarterly plus an annual reconciliation For specific deadlines see important dates below Tax rate 3 75 for residents and 3 44 for non residents To complete quarterly returns and payments for Web Also known as the Wage Tax it is typically withheld and remitted by employers with nexus in Philadelphia and employees working for employers who withhold and remit 100 of the tax due do not need to file an annual return

Web 4 Mai 2023 nbsp 0183 32 The Philadelphia wage tax is 3 79 for residents and 3 44 for non residents including those who work remotely for companies based in Philadelphia Most forms of income are subject to the tax Web 18 Mai 2022 nbsp 0183 32 Philadelphia s wage tax puts a levy on all employees who work or live in the city It taxes all Philadelphia residents at a rate of 3 84 regardless of where they work and non residents who work

City Officials Say Philadelphia Wage Tax Refunds Are Delayed 6abc

https://cdn.abcotvs.com/dip/images/788731_061615-wpvi-wage-tax-checks-430pm-video.jpg?w=1600

Philadelphia Wage Tax Coupon Brinda Oswald

https://media.cheggcdn.com/study/33d/33d92311-e7fe-4f06-8e87-6f50580e6fee/image

/cloudfront-us-east-1.images.arcpublishing.com/pmn/Z7LPYQ4DGJGUVDDQBBFZNP7KTY.jpg?w=186)

https://www.phila.gov/documents/2022-wage-tax-forms

Web All Philadelphia residents owe the Wage Tax regardless of where they work Non residents who work in Philadelphia must also pay the Wage Tax Each year the Department of Revenue publishes a schedule of specific due dates for the Wage Tax Your first filing due date for 2022 is May 2 See Reconciliation and Schedules below

/cloudfront-us-east-1.images.arcpublishing.com/pmn/4W4LTZTBOVDSRMZALBHJ3Z43HE.jpg?w=186)

https://www.phila.gov/media/20220414112558/Wage-Ta…

Web All employers who paid taxable compensation to residents of Philadelphia even if earned outside of Philadelphia and to non residents for services performed within Philadelphia When To File The Annual Reconciliation of Employer Wage Tax for the calendar year 2021 is due on or before February 28 2022

2021 City Of Philadelphia Pennsylvania Wage Tax Refund Petition

City Officials Say Philadelphia Wage Tax Refunds Are Delayed 6abc

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue

Democratic Plan Would Close Tax Break On Exchange traded Funds

New Tax Reporting Law For Platforms Within The Sharing Economy Pherrus

Philadelphia Wage Tax Coupon Brinda Oswald

Philadelphia Wage Tax Coupon Brinda Oswald

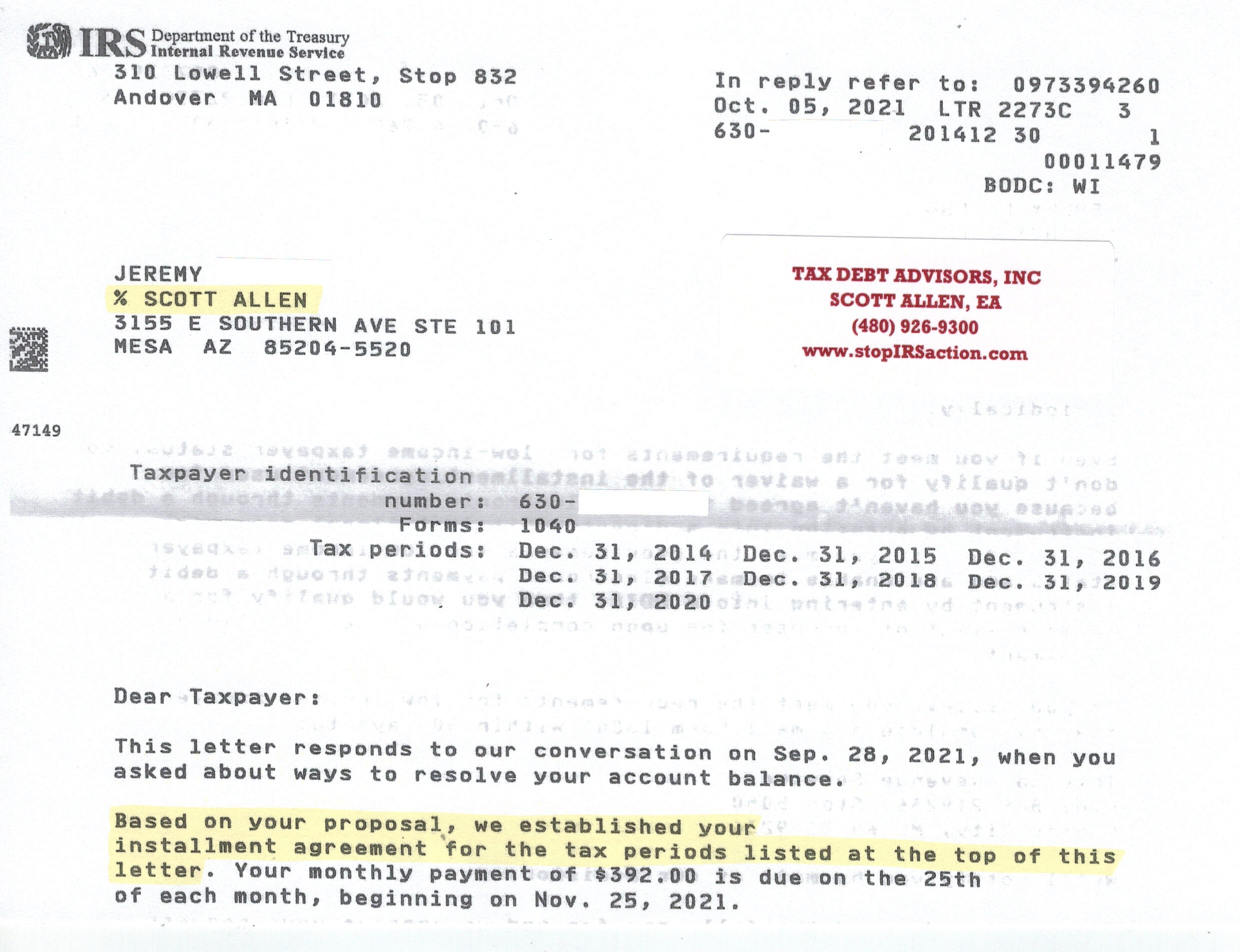

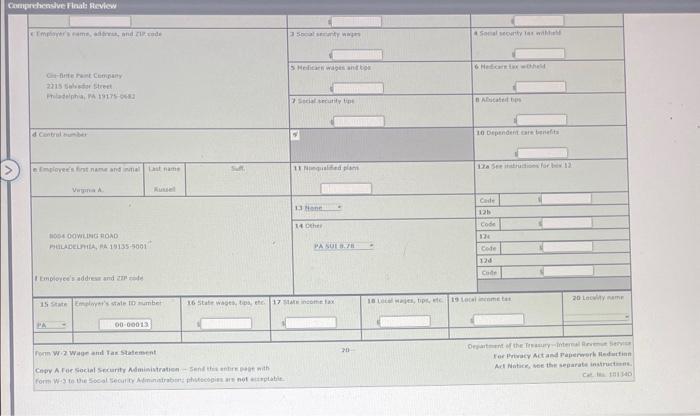

Transaction No 41 Prepure The Annual Reconoliation Chegg

Philadelphia Wage Tax For Non residents Increases On July 1

Transaction No 41 Prepure The Annual Reconoliation Chegg

Philadelphia Wage Tax Reporting - Web Vor einem Tag nbsp 0183 32 Corporate Transparency Act regulations took effect Jan 1 Small business owners have a new reporting requirement in 2024 although most have until the end of the year to get it done The