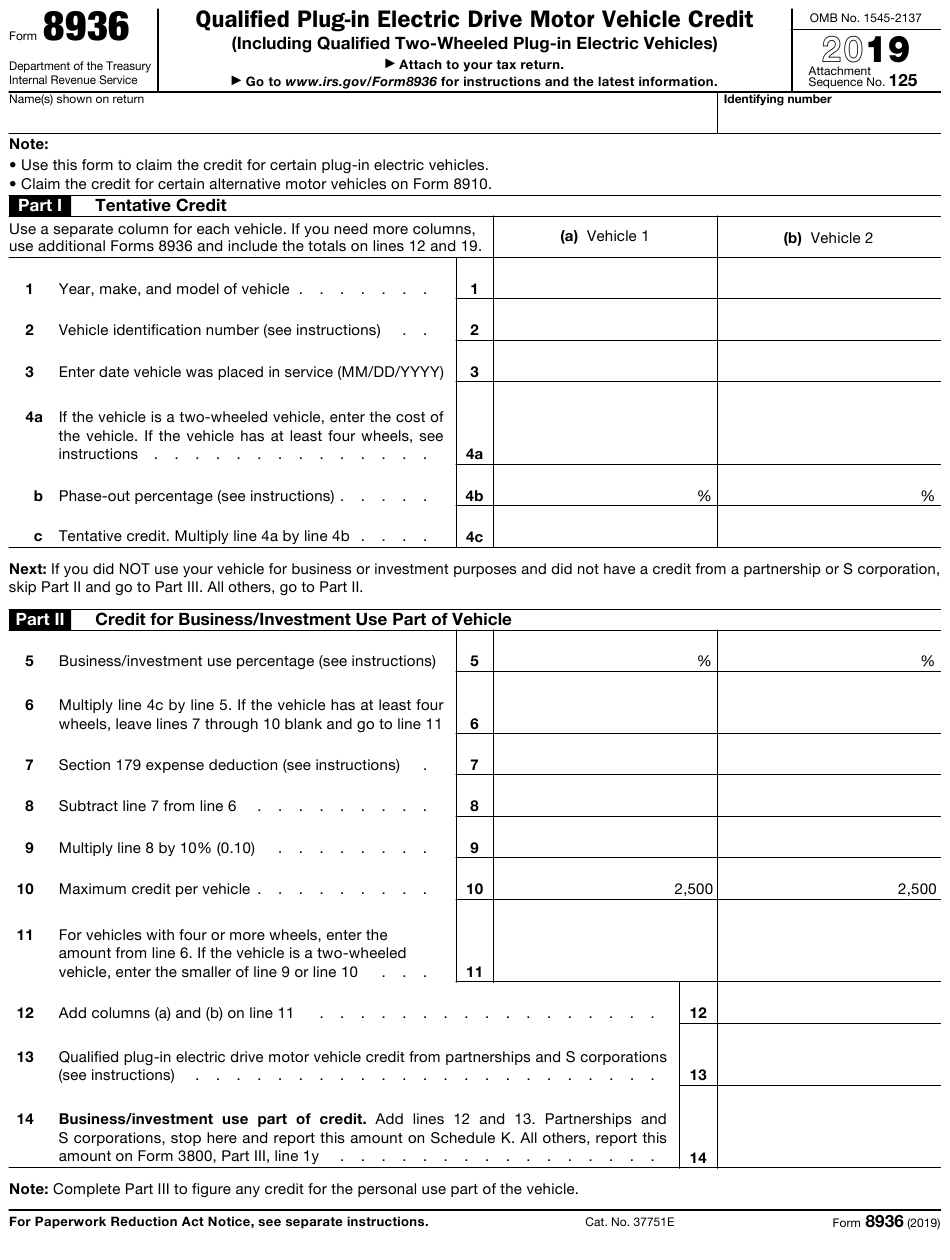

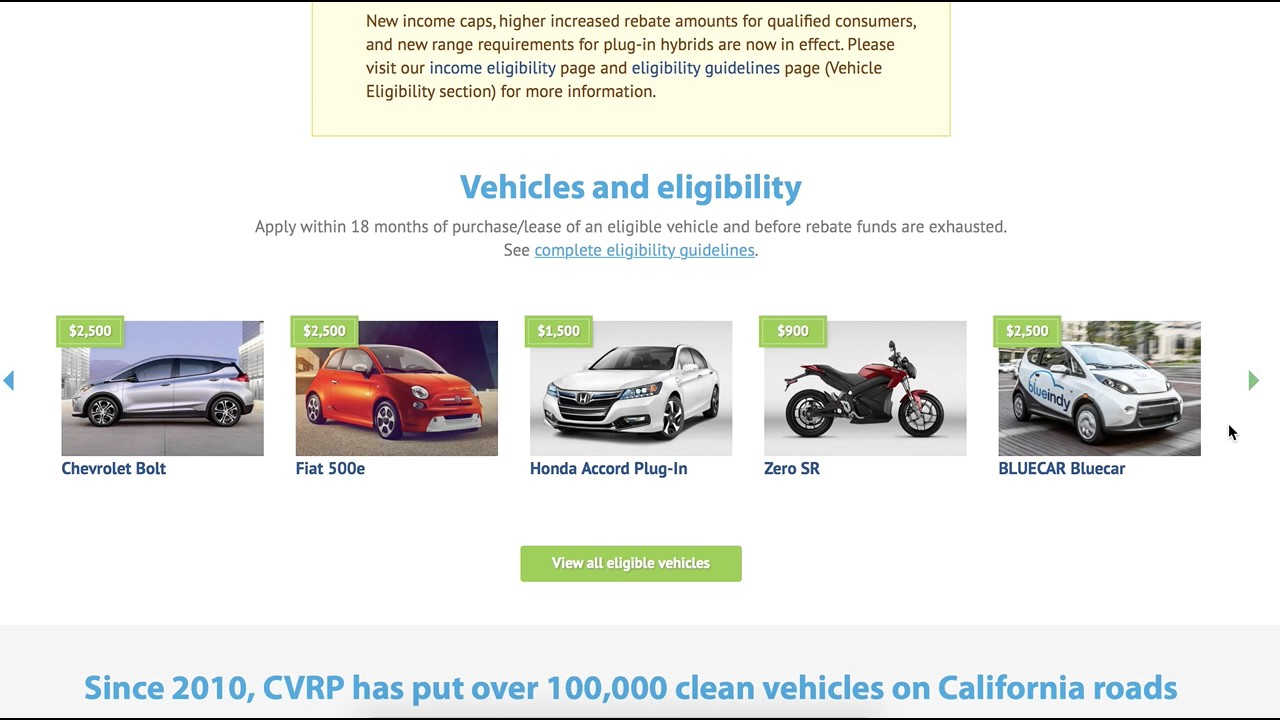

Plug In Car Tax Rebate Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act Web All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 The availability of the credit will depend on several factors including the vehicle s MSRP its final assembly location battery component and or critical minerals sourcing and your

Plug In Car Tax Rebate

Plug In Car Tax Rebate

https://www.carrebate.net/wp-content/uploads/2022/06/irs-form-8936-download-fillable-pdf-or-fill-online-qualified-plug-in-1.png

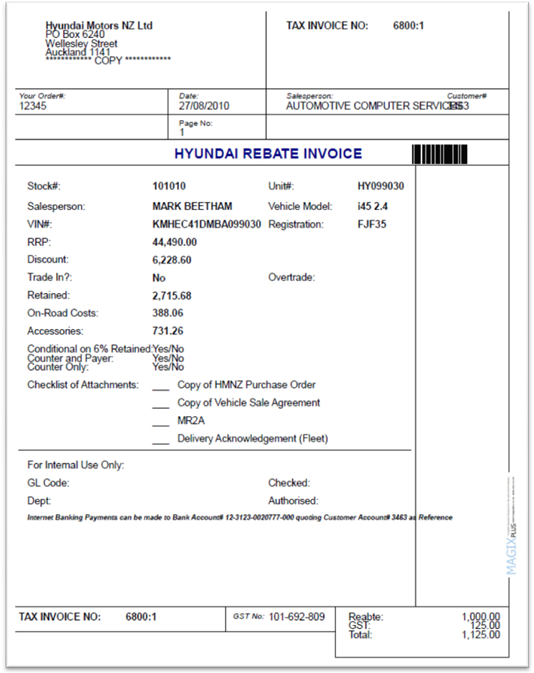

California Electric Car Tax Rebate ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/ev-car-tax-rebate-calculator-2022-carrebate-net.png

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used clean vehicles qualified commercial clean vehicles and new plug in Web 1 janv 2023 nbsp 0183 32 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Web Complete Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles and file it with your tax return for the year you took possession of Web 5 sept 2023 nbsp 0183 32 As of Aug 28 2023 the following fully electric and plug in hybrid vehicles are eligible for either a full or partial tax credit if delivered on or after April 18 2023 per FuelEconomy Car

Download Plug In Car Tax Rebate

More picture related to Plug In Car Tax Rebate

Ma Tax Rebates Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/2-500-massachusetts-electric-rebate-ma-electric-plug-in-rebate-details-2.jpg

Delaware Electric Car Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Delaware-Tax-Rebate-2023-768x679.png

Electric Car Rebates Washington State 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ma-tax-rebates-electric-cars-2022-carrebate-2.jpg?w=358&h=537&ssl=1

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed once in a Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

Web 12 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a Web 25 janv 2022 nbsp 0183 32 The future of subsidies for buying or leasing plug in vehicles remains uncertain but in the meantime here are all the models Uncle Sam will still help subsidize with tax credits

Tax Rebates Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/21-biggest-us-tax-incentives-for-electric-cars.png

Tax Rebates For Electric Cars Michigan 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/electric-vehicle-rebate-available-until-3-31-mcleod-cooperative-power-11.png

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

https://www.consumerreports.org/cars/hybrids-evs/electric-cars-plug-in...

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Tax Form For Federal Tax Rebate For Plug in Car 2023 Carrebate

Tax Rebates Electric Cars 2023 Carrebate

Tax Rebate Lease Electric Car 2022 2023 Carrebate

Nys Charges Tax On Car Rebates 2023 Carrebate

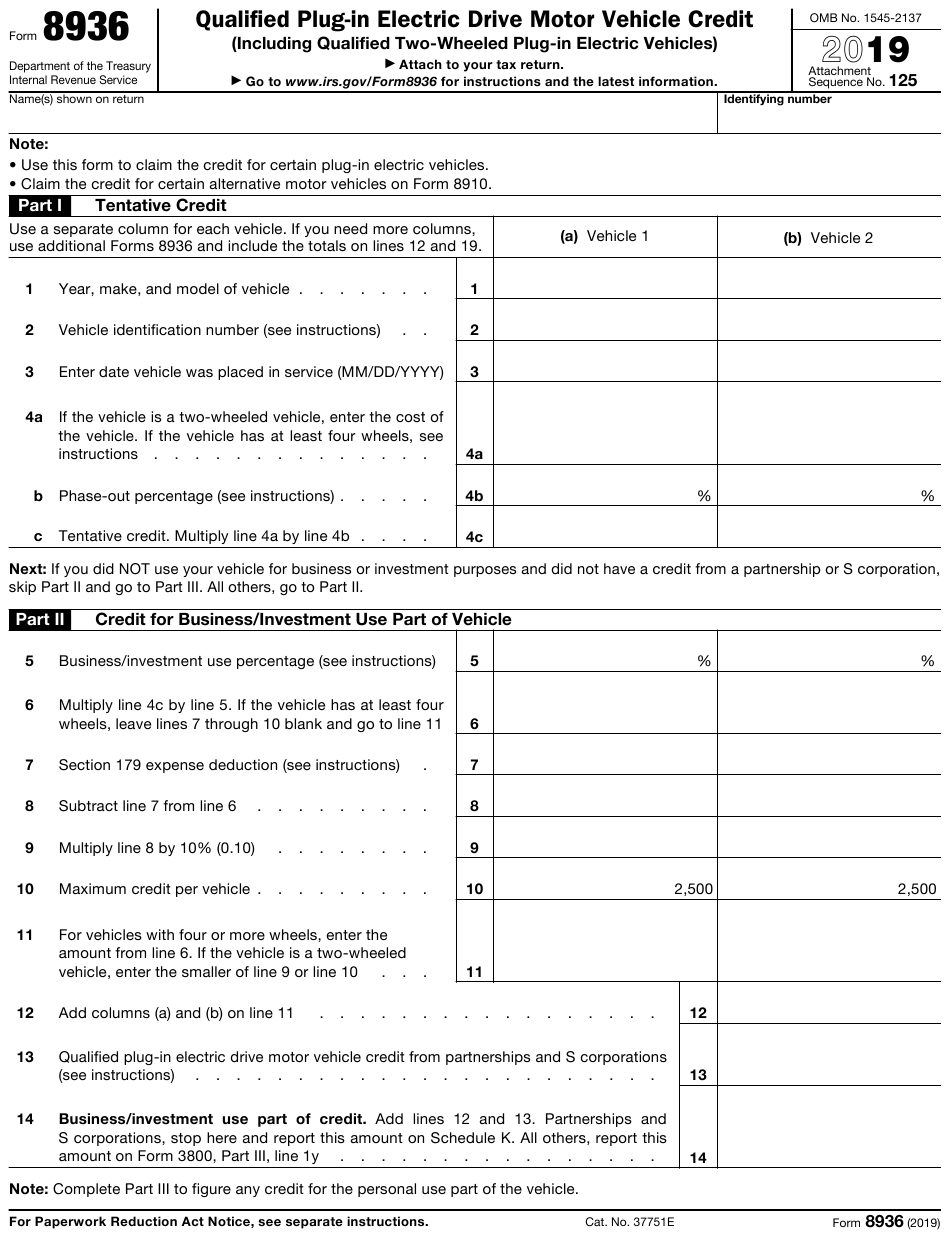

Hyundai Rebate Invoices

Tax Rebates For Electric Car 2023 Carrebate

Tax Rebates For Electric Car 2023 Carrebate

Tax Rebates For Electric Cars Michigan 2023 Carrebate

Is There A Rebate For Hybrid Cars 2023 Carrebate

Government Tax Rebates For Hybrid Cars 2023 Carrebate

Plug In Car Tax Rebate - Web 9 ao 251 t 2021 nbsp 0183 32 Posted on August 9 2021 Dozens of electric cars and trucks still qualify for a federal tax credit of up to 7 500 for buyers purchasing new plug in electric vehicles President Joe Biden