Plug In Hybrid Tax Credit 2023 California Federal tax credits are available for the purchase of all electric and plug in hybrid vehicles The tax credits are up to dollar 7 500 Please note Sales or use tax is due on the total selling price of the vehicle

In this article we re going to take a quick look at California s state and local incentives We ll discuss the terms of the California Clean Vehicle Rebate how to find local incentives for EV buyers and what to do if you don t qualify for EV rebates in California California s EV Tax Credit Clean Vehicle Goals You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Plug In Hybrid Tax Credit 2023 California

Plug In Hybrid Tax Credit 2023 California

https://i.ytimg.com/vi/EWi3PmOSET0/maxresdefault.jpg

EVs And Plug In Hybrids That Qualify For Tax Credits Consumer Reports

https://i.pinimg.com/originals/86/b7/bd/86b7bd3f4eb13684f847788f38a73b62.jpg

Kia Niro Plug in Hybrid 2022 EV Chargers USA

https://evchargersusa.com/wp-content/uploads/2022/10/Kia-Niro-Plug-in-Hybrid-2022.png

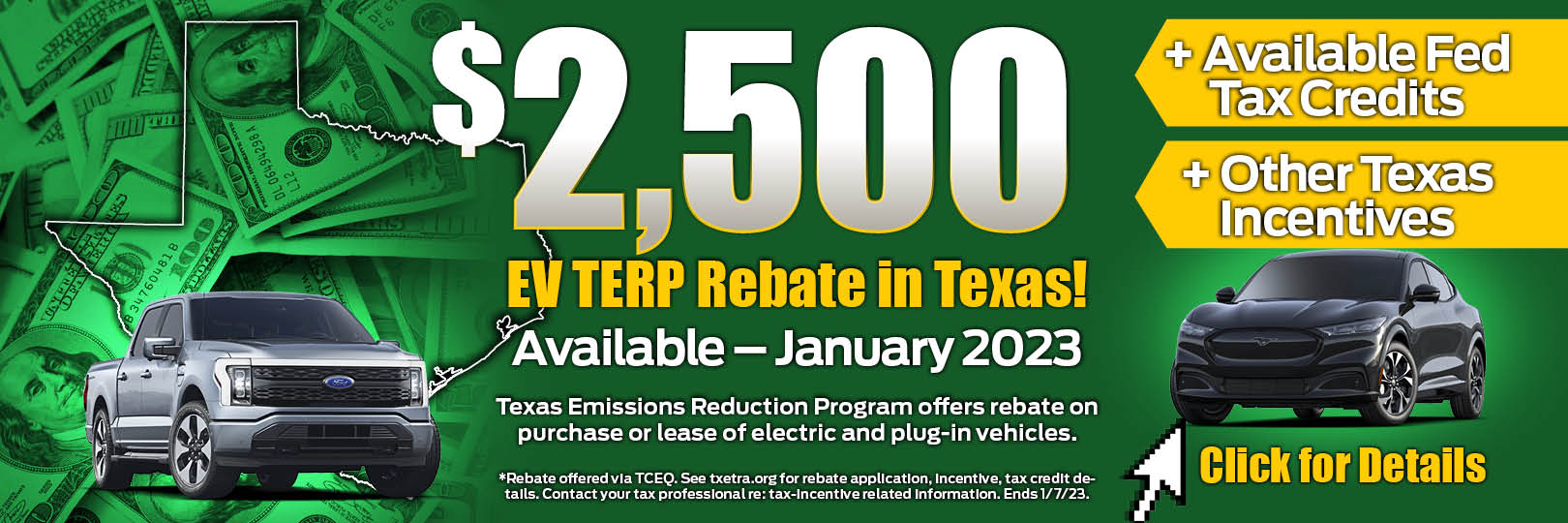

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000 As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround Car shoppers are increasingly aware of electric vehicles on the market

The Clean Vehicle Rebate Project CVRP promoted clean vehicle adoption in California by offering rebates from 1 000 to 7 500 for the purchase or lease of new eligible zero emission vehicles including electric plug in hybrid electric and fuel cell vehicles All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Download Plug In Hybrid Tax Credit 2023 California

More picture related to Plug In Hybrid Tax Credit 2023 California

2022 EV Tax Credit How To Get A Tax Refund On A New EV Or PHEV

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/41cce697d02567f472ac5922c1f0db93.jpg

Crosstrek Plug In Hybrid 2023 Review Jandaweb

https://file.kelleybluebookimages.com/kbb/base/evox/CP/14797/2023-Subaru-Crosstrek-front_14797_032_2400x1800_K1X.png

Obrovsk Rana Pre Plug in Hybridy E Chce Spr sni V po et Emisi

https://www.techbyte.sk/wp-content/uploads/2022/06/eu-plug-in-hybrid-vystraha.png

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act The Clean Vehicle Rebate Project CVRP is closed effective November 8 2023 What did it fund Rebates for the purchase or lease of new eligible light duty vehicles including electric fuel cell and plug in hybrid electric vehicles

In addition to federal tax credits California has also implemented several incentive programs to kick start the popularity of EVs These include rebates and tax credits from the state CARB has developed two implementation manuals that fully describe vehicle eligibility criteria and the application process for manufacturers of 1 light duty zero emission and plug in hybrid electric vehicles and 2 zero emission motorcycles

Prius Plug In Hybrid IV

https://images.impresa.pt/expresso/2017-02-23-2017_Prius_Plug_in_Hybrid_TECH_10.jpg/original/mw-1920

Buy BETTER AUTOMOTIVE Bull Bar Fit 2018 2023 Wrangler JL Exclude Plug

https://images-na.ssl-images-amazon.com/images/I/61-aNpMFTIL.jpg

https://www.cdtfa.ca.gov › industry › green-technology › vehicles.htm

Federal tax credits are available for the purchase of all electric and plug in hybrid vehicles The tax credits are up to dollar 7 500 Please note Sales or use tax is due on the total selling price of the vehicle

https://www.findmyelectric.com › blog

In this article we re going to take a quick look at California s state and local incentives We ll discuss the terms of the California Clean Vehicle Rebate how to find local incentives for EV buyers and what to do if you don t qualify for EV rebates in California California s EV Tax Credit Clean Vehicle Goals

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

Prius Plug In Hybrid IV

2024 Lexus NX PHEV

US Kia Introduces 2022 Niro PHEV

Toyota Rav4 Plug In Hybrid Tax Credit

2022 Lexus NX 450h AWD F Sport Plug In Hybrid Front Three Quarter

2022 Lexus NX 450h AWD F Sport Plug In Hybrid Front Three Quarter

Plug In Hybrid A Toyota Prius Plug in Hybrid Plugged In An Flickr

Video What Does It Cost To Own An EV

Planet Ford EV Plug in Hybrid Vehicle Rebate Program Randall Reed s

Plug In Hybrid Tax Credit 2023 California - The Clean Vehicle Rebate Project CVRP promoted clean vehicle adoption in California by offering rebates from 1 000 to 7 500 for the purchase or lease of new eligible zero emission vehicles including electric plug in hybrid electric and fuel cell vehicles