Plug In Hybrid Tax Credit Income Limit The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Plug In Hybrid Tax Credit Income Limit

Plug In Hybrid Tax Credit Income Limit

https://i.ytimg.com/vi/EWi3PmOSET0/maxresdefault.jpg

EVs And Plug In Hybrids That Qualify For Tax Credits Consumer Reports

https://i.pinimg.com/originals/86/b7/bd/86b7bd3f4eb13684f847788f38a73b62.jpg

2022 EV Tax Credit How To Get A Tax Refund On A New EV Or PHEV

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/41cce697d02567f472ac5922c1f0db93.jpg

If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D Credits apply to plug in electric vehicles which include plug in hybrid EVs and battery electric vehicles BEVs Do used electric cars qualify for federal tax credits Yes

There are also income caps though they re fairly generous starting at 150 000 for single filers and 300 000 for married couples filing jointly To claim the tax credit the buyer must All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements

Download Plug In Hybrid Tax Credit Income Limit

More picture related to Plug In Hybrid Tax Credit Income Limit

Plug in hybrid

https://www.mercedes-benz.co.th/en/passengercars/content-pool/marketing-pool/stage-homepage/plug-in-hybrid/_jcr_content/par/stagepushablecampaig_1774769512.MQ6.12.20210825043729.jpeg

What Does The EV Tax Credit Overhaul Mean For Car Shoppers Cars

https://images.cars.com/cldstatic/wp-content/uploads/toyota-bz4x-2023-18-charging-cable-charging-port-exterior-red-suv-scaled.jpg

Toyota Rav4 Plug In Hybrid Tax Credit

https://editorials.autotrader.ca/media/151282/2018-toyota-rav4-hybrid-limited-23-gw.jpg?anchor=center&mode=crop&width=1920&height=1080&rnd=131686015292970000

Comprehensive 2024 EV tax credit guide Learn about income limits eligible vehicles point of sale rebates and how to claim up to 7 500 on your tax return The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as chargers

As of September 2024 the following fully electric and plug in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan 1 2024 Our experts show you how to qualify for a federal tax credit of up to 7 500 by leasing an electric vehicle or plug in hybrid

Video What Does It Cost To Own An EV

https://d2q5yj3kkcfw7v.cloudfront.net/posts/0003/45/ff82026cfc68f5381ef8ca310dc2c106870e3c3d.jpeg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.irs.gov/newsroom/topic-b-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the section 30D tax credit

https://www.consumerreports.org/cars/hybrids-evs/...

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Bmw Plug In Hybrid Tax Credit

Video What Does It Cost To Own An EV

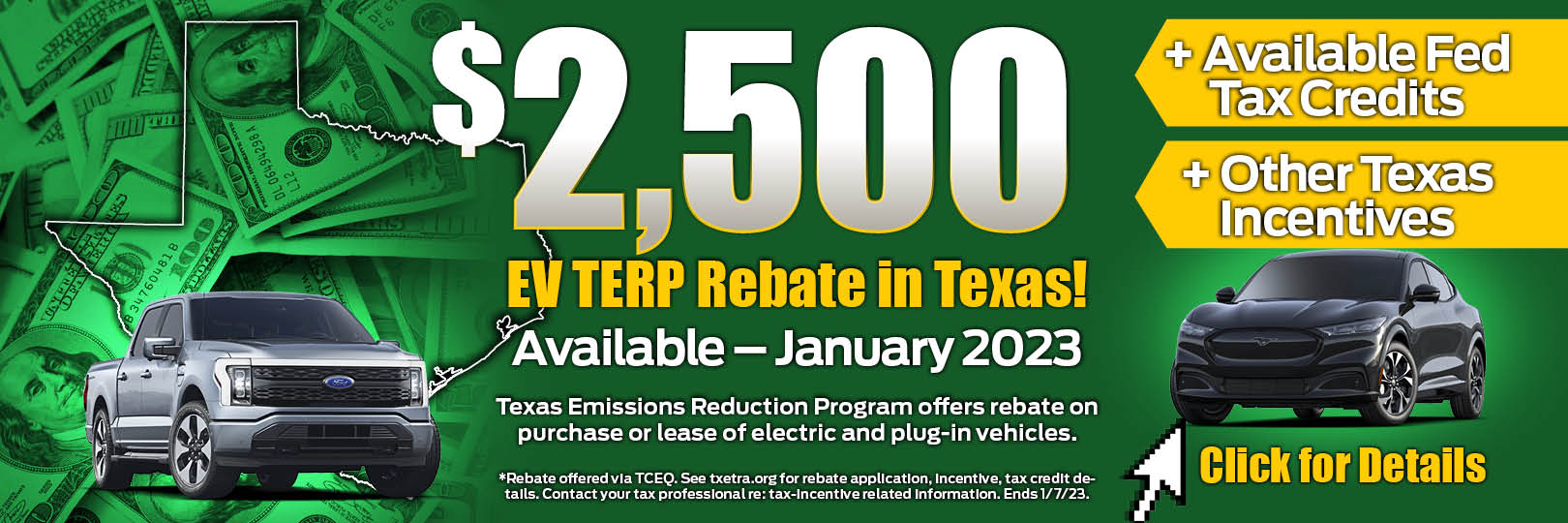

Planet Ford EV Plug in Hybrid Vehicle Rebate Program Randall Reed s

Has Irs Extended The Credit For Electric Cars OsVehicle

I Didn t Think I Could Afford An Electric Car But The 4 000 Used Plug

Earned Income Tax Credit EITC Who Qualifies

Earned Income Tax Credit EITC Who Qualifies

Auto Dealers Resist Plan To Pay Plug in Hybrid Tax Credit Torque News

2022 Kia Niro Plug In Hybrid Review Trims Specs Price New Interior

Earned Income Tax Credit For Households With One Child 2023 Center

Plug In Hybrid Tax Credit Income Limit - Commercial fleets and tax exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit per vehicle these include all electric plug in hybrid electric or fuel cell EVs The maximum credit is 7 500 for qualified commercial clean vehicles with gross vehicle weight ratings of under 14 000 pounds