Point Of Sale Rebate Canada This info sheet explains the point of sale rebate rebate available for the provincial part of the harmonized sales tax HST payable on qualifying books

This info sheet explains the point of sale rebate rebate available for the provincial part of the harmonized sales tax HST payable on qualifying children s goods First Nation individuals with a status card bands and band councils of an Ontario First Nations reserve are eligible for a point of sale rebate from paying the 8 provincial portion of the Harmonized Sales Tax HST for qualifying off reserve purchases

Point Of Sale Rebate Canada

Point Of Sale Rebate Canada

https://media.blogto.com/articles/20230512-grocery-rebate-canada.jpg?w=2048&cmd=resize_then_crop&height=1365&quality=70

Drug Channels Improve Access Affordability And Brand Performance

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEip5DSM0JEcKO0vEfGBiejISAFSDNNnh_SoikhVcJz34GVy_EEZXVjNqKSG3STg58INxl8AYo9IBeLqDHwEC-JMPMoYW9bM2egx1bcOfY54V-NPpg4zAP0abOAFZODYj0qYCvBHH3pZ7gLkeW4gl1pz8pn5hywTaZzxaTY72HT1fd-j-DaXwA4/s1600/IMAGE B_Price affects printouts.png

Budget 2023 Grocery Rebate Coming To Help Canadians Fight Food

https://images.dailyhive.com/20230327084157/savedd.jpg

Currently the Harmonized Sales Tax is 13 in Ontario However Ontario provides a rebate on the 8 provincial portion of the HST on specific items through a point of sale rebate Administration The Canada Revenue Agency CRA administers and collects the HST on behalf of the Government of Ontario Ontario point of sale rebate Ontario also provides a rebate of the 8 provincial portion of the HST for all Ontarians on specific items such as print newspapers qualifying prepared food and beverages printed books children s goods feminine hygiene products The Canada Revenue Agency administers these other rebates on behalf of the

On November 12 2009 the Ontario government announced it will provide a point of sale rebate of the provincial component of the HST for qualifying prepared food and beverages sold for a total price of 4 00 or less This information will help consumers and retailers understand what goods will be eligible for the Harmonized Sales Tax HST point of sale rebate Consumers will not be required to pay the Ontario component of the HST 8 per cent on goods that qualify for the point of sale rebates The qualifying goods are Print newspapers

Download Point Of Sale Rebate Canada

More picture related to Point Of Sale Rebate Canada

Grocery Rebate Canada ShaunyColeby

https://globalnews.ca/wp-content/uploads/2023/03/grocery-receipt-errors-chart.png?w=1200

Grocery Rebate Canada ShaunyColeby

https://www.vmcdn.ca/f/files/glaciermedia/images/getty-images/grocerystorecart.jpg

CHEAPR How To Submit Point Of Sale Rebate Applications YouTube

https://i.ytimg.com/vi/Poeq0wENwdc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBcgZSg7MA8=&rs=AOn4CLCyBs1syoVkjJgUZG-WLUlZ4U5D7A

For point of sale rebates in Ontario there are a number of specific tax forms that can be used to report the sale of these items These include GI 060 Point of Sale Rebate on Newspapers GI 064 Point of Sale Rebate on Prepared Food and Beverages GI 065 Point of Sale Rebate on Books Some provinces such as Ontario have agreements that First Nations people can use their status card to receive point of sale rebates on the provincial sales tax portion of the HST when

Rebate for books 2 A book is qualifying property for the purposes of section 51 of the Act if it is property that is described in paragraph 1 2 3 or 4 of Schedule 1 to the Federal regulations The new regulation under the Retail Sales Tax Act implements the definitions of the following qualifying property for the purposes of the Harmonized Sales Tax HST point of sale rebates effective July 1 2010 Books Children s clothing footwear and diapers Feminine hygiene products

Grocery Rebate MarilenaCalym

https://media.blogto.com/articles/20230329-CanadaGroceryRebate.jpg?w=2048&cmd=resize_then_crop&height=1365&quality=70

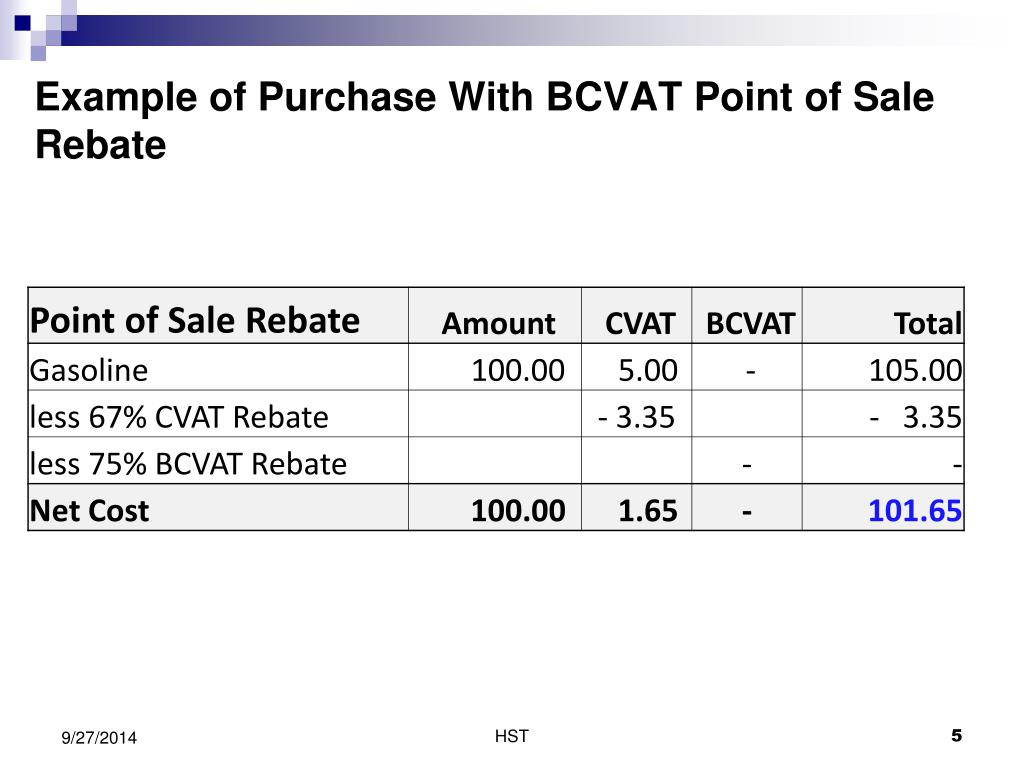

PPT HST On SFU Purchases And Sales PowerPoint Presentation Free

https://image2.slideserve.com/4853449/example-of-purchase-with-bcvat-point-of-sale-rebate-l.jpg

https://www.canada.ca › en › revenue-agency › services › ...

This info sheet explains the point of sale rebate rebate available for the provincial part of the harmonized sales tax HST payable on qualifying books

https://www.canada.ca › en › revenue-agency › services › ...

This info sheet explains the point of sale rebate rebate available for the provincial part of the harmonized sales tax HST payable on qualifying children s goods

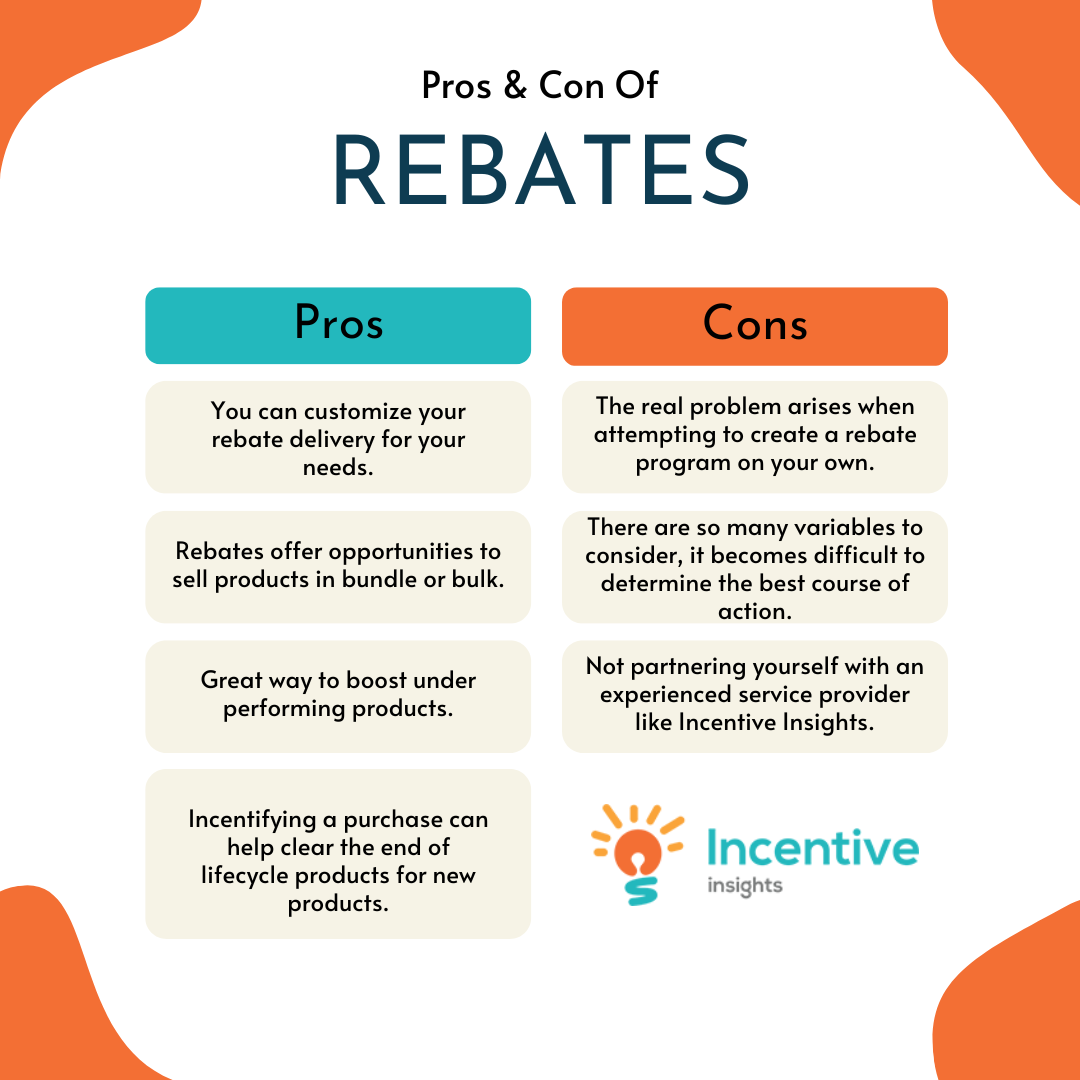

Pros And Cons Of Rebates For Companies Incentive Insights

Grocery Rebate MarilenaCalym

A Simple Guide To Point Of Sale Software Success Systems

Point Of Sale Rebate Analysis In The Commercial Market PhRMA

Grocery Rebate Canada ShaunyColeby

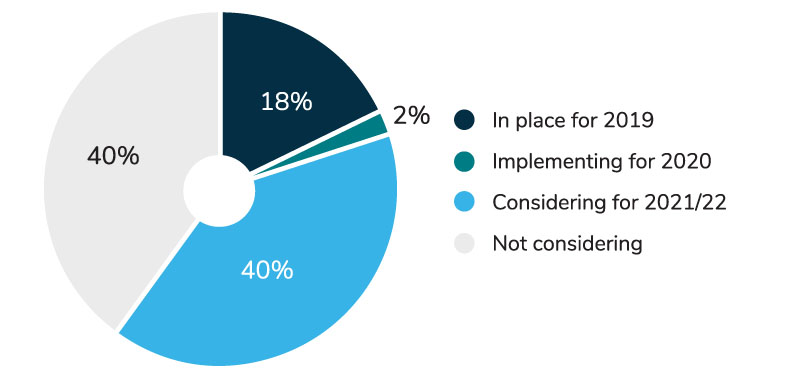

Point Of Sale Rebate Changes Will Help More Consumers Buy Electric

Point Of Sale Rebate Changes Will Help More Consumers Buy Electric

Use Rebates To Build Brand Advocacy All Digital Rewards

Uml Case Study Online Shopping PDF Point Of Sale Rebate Marketing

Prescription Drug Rebates Employer Considerations Business Group On

Point Of Sale Rebate Canada - The Government of Ontario provides a point of sale rebate of the provincial part of the HST payable on qualifying prepared food and beverages The Canada Revenue Agency CRA administers the rebate on behalf of the Government of Ontario