Pool Heat Pump Tax Credit The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000 applies to electric or natural gas heat pump water heaters electric or The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum

Pool Heat Pump Tax Credit

Pool Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/QX3ShkFit/1600x837/heat-pump-1-1660837497727.jpg?position=top

How To Take Advantage Of The Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/bjAd12-bt/1024x536/heat-pump-2-1660837533114.jpg

Tax Credits Offered For Heat Pump Installation YouTube

https://i.ytimg.com/vi/j5EODeZMn-0/maxresdefault.jpg

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Heat pumps that are ENERGY STAR certified meet the requirements for this tax credit Tax Credit Amount 300 Requirements Split Systems HSPF 8 5 EER

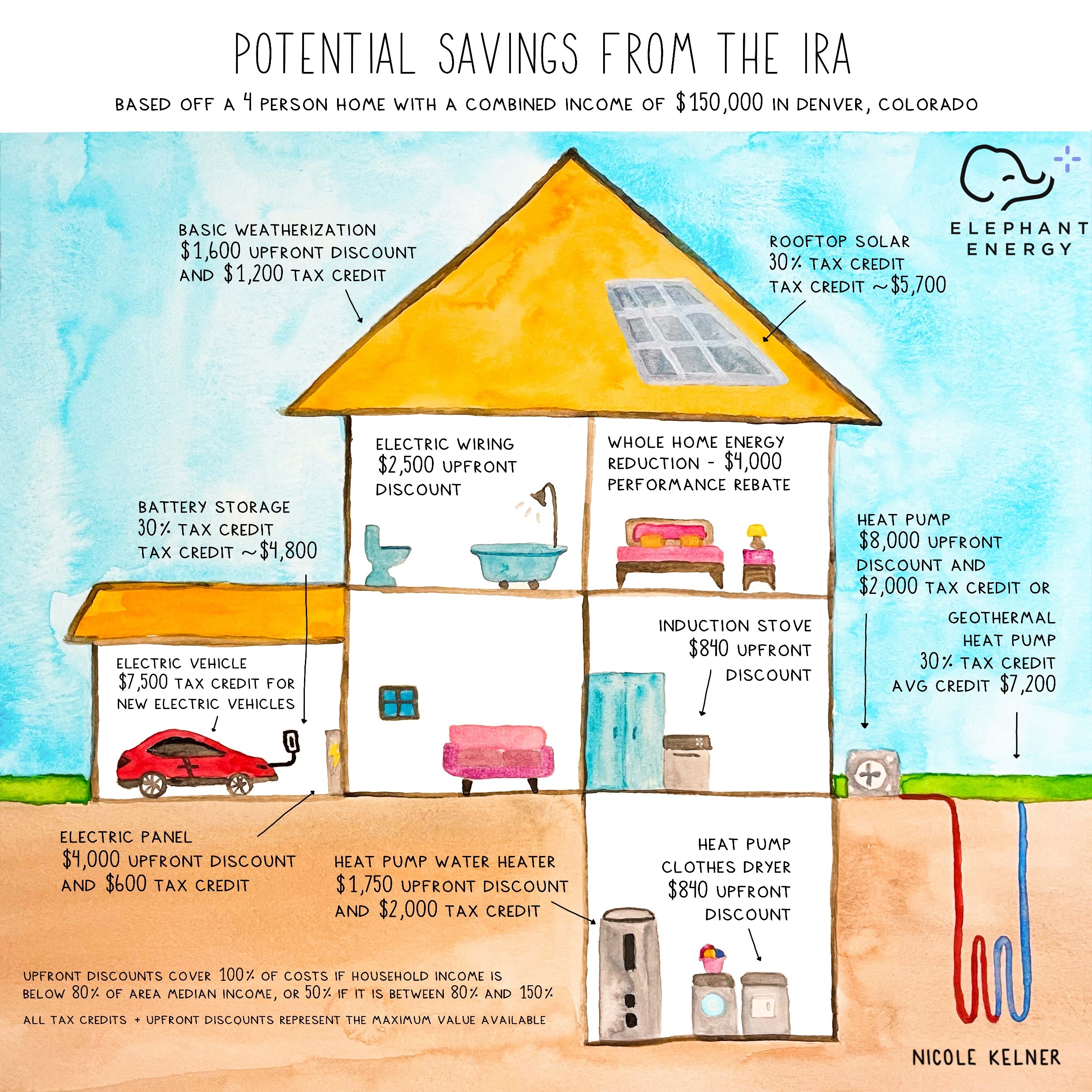

These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades Equipment type Tax Credit Available for 2022 Tax Year Home Clean Electricity Products Solar electricity Fuel Cells Wind Turbine Battery Storage Heating Cooling and

Download Pool Heat Pump Tax Credit

More picture related to Pool Heat Pump Tax Credit

Heat Pump Tax Credit

https://aspireheatingcooling.com/wp-content/uploads/2023/05/amn-3-5ton-lftqtr-hr42014777073d629eabb1ff0300454ea0-1024x1024.png

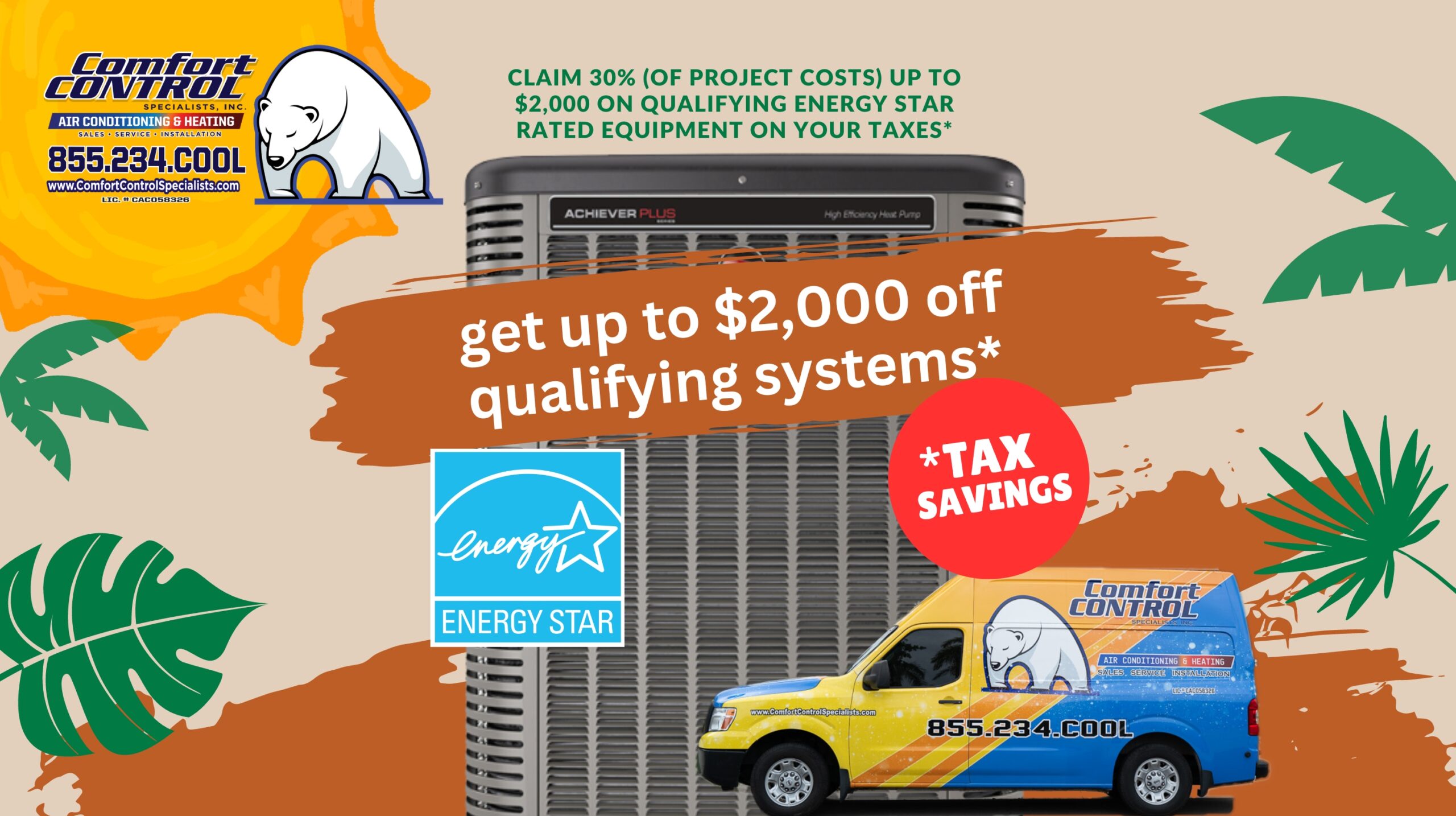

Air Source Heat Pump Tax Credit 2023 Comfort Control

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-scaled.jpg

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

https://www.rescueairtx.com/images/blog/iStock-1444118278.jpg

This tax credit is good for 30 percent of the total cost of what you paid for your heat pump including the cost of labor up to 2 000 and it would be available Tax credits are applied to the tax year you install the heat pump For example if your heat pump is deployed in 2023 you can redeem your credit when you

What SEER heat pump qualifies for a tax credit A SEER of 15 is the requirement for the 2022 tax credit of 300 the Inflation Reduction Act revitalized an existing program for Heat pump federal tax credit 2024 Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit

Heat Pump Tax Credit 2023 All You Need To Know Clover Contracting

https://www.cloverco.com/wp-content/uploads/2023/05/close-up-heat-pump-outside-home-1024x731.jpg

Inflation Reduction Act IRA The Ultimate Guide To Saving

https://elephantenergy.com/wp-content/uploads/2022/09/IRA-Summary-Image-by-Nicole-Kelner-Made-Exclusively-for-Elephant-Energy.jpg

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

https://turbotax.intuit.com/tax-tips/home...

In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000 applies to electric or natural gas heat pump water heaters electric or

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

Heat Pump Tax Credit 2023 All You Need To Know Clover Contracting

From Cold To Comfortable How A Pool Heat Pump Can Transform Your

Heating A Pool With A Heat Pump The Complete Guide TTI FAB

The Inflation Reduction Act pumps Up Heat Pumps Hvac

Heat Pump Tax Credit Oregon 2024 Tested And Reviewed

Heat Pump Tax Credit Oregon 2024 Tested And Reviewed

Heat Pumps How Federal Tax Credits Can Help You Get One

R410A Reverse Cycle Heat Pump For Swimming Pool From China Manufacturer

Heat Pump Tax Credits Get Rewarded For Sustainable Heating And Cooling

Pool Heat Pump Tax Credit - The maximum heat pump tax credit is 2 000 Homeowners can take advantage of the heat pump tax credit through at least 2032 Also buying a heat pump