Pre Tax Health Insurance Rebate Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income thresholds and rebate percentage rates Find out what Lifetime health cover LHC is

Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return we will then calculate his rebate entitlement based on his income for surcharge purposes Web What Are Tax Rebates for Private Health Insurance Select who you would like private health cover for to compare and get a quote Taking out private health insurance may entitle you to a tax rebate Earn a tax rebate if you have a taxable income of under

Pre Tax Health Insurance Rebate

Pre Tax Health Insurance Rebate

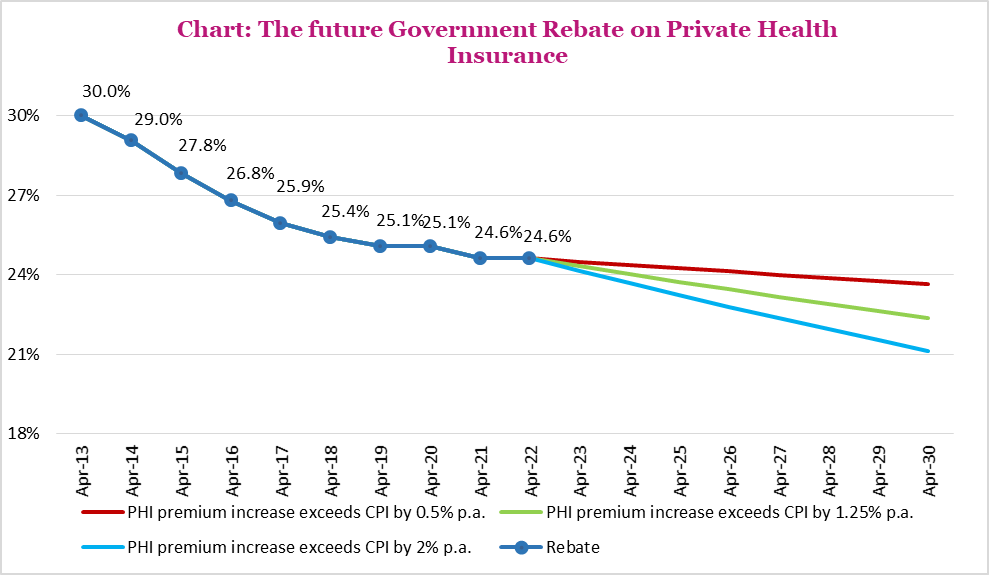

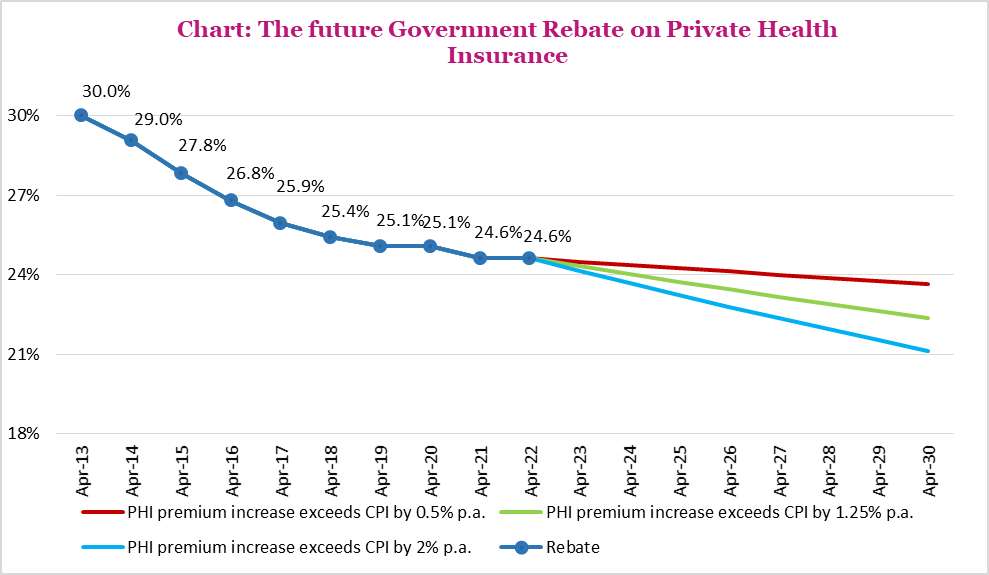

https://membershealth.com.au/wp-content/uploads/2022/05/Chart-The-future-Government-Rebate-on-Private-Health-Insurance.png

What Should Happen To The Private Health Insurance Rebate This Election

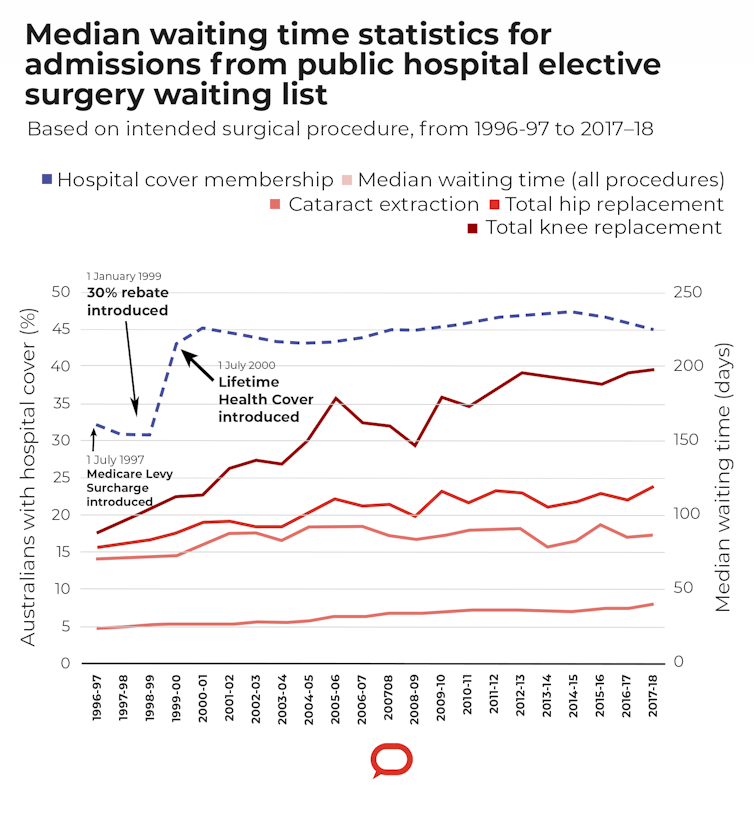

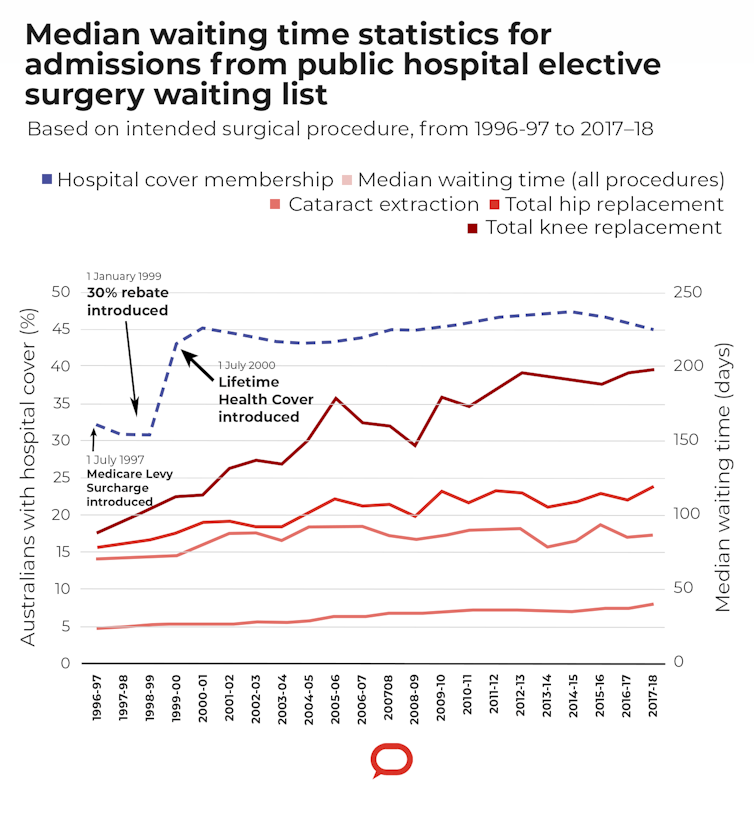

https://images.theconversation.com/files/458508/original/file-20220419-24-8c9jju.png?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

What Should Happen To The Private Health Insurance Rebate This Election

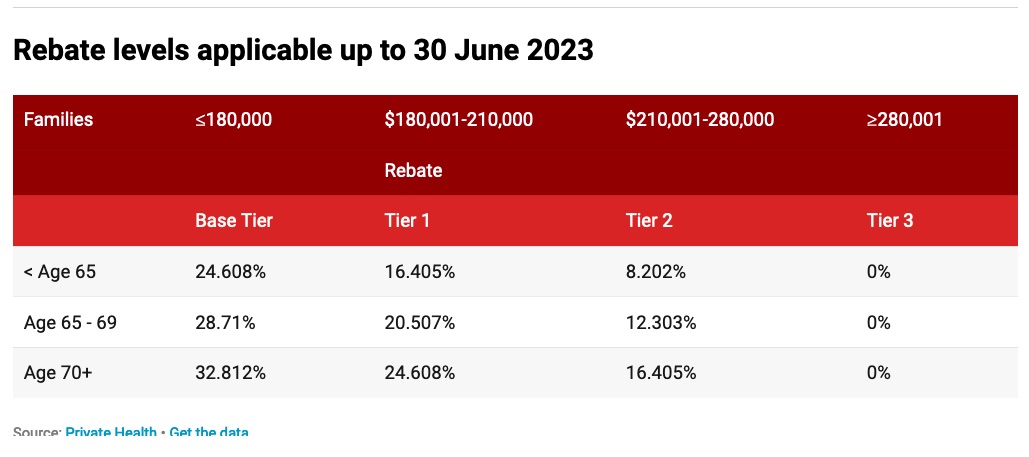

https://www.croakey.org/wp-content/uploads/2022/04/REBATELEVELS.jpg

Web 19 avr 2022 nbsp 0183 32 The private health insurance rebate costs Australian taxpayers nearly A 7 billion per year and has cost over 100 billion since its introduction Yet the rebate s return on investment has Web If you are an Australian Citizen or Permanent Resident and hold a full Medicare Card when you take out private health insurance with a registered fund you ll eligible for the tax rebate The percentage of your rebate will then depend on your income age of the

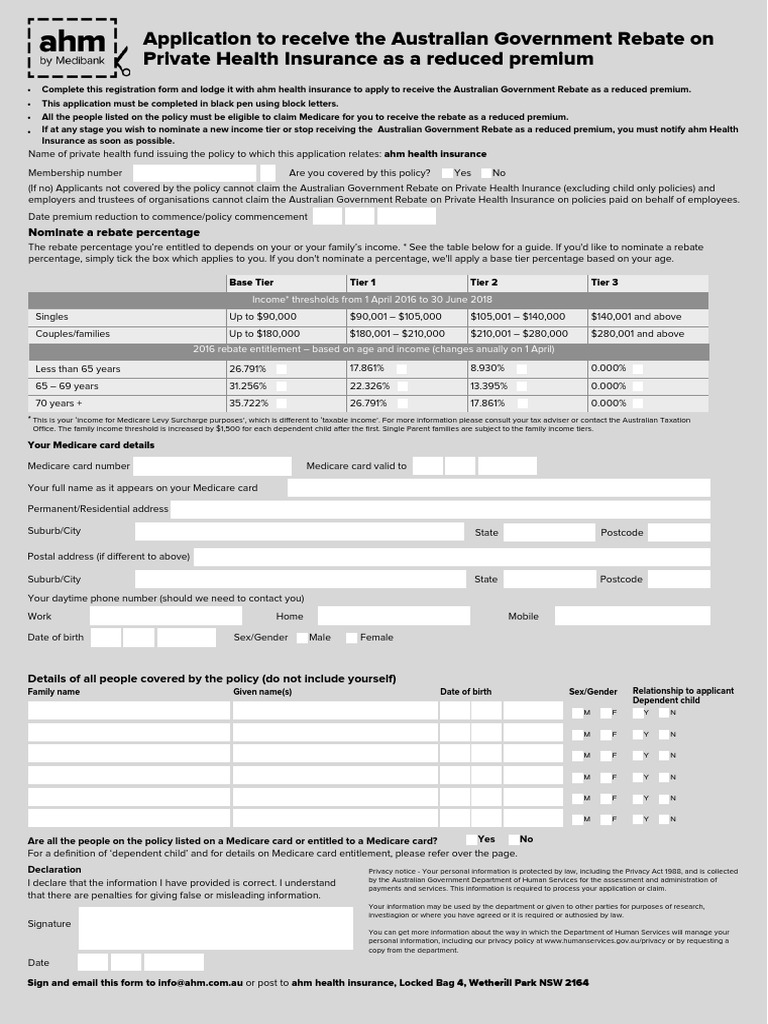

Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained unchanged for 8 years from 2015 16 to 2022 23 The thresholds remained at the Web 7 ao 251 t 2020 nbsp 0183 32 The Private Health Insurance Rebate reduces the premium you pay for having private health insurance You can receive the rebate or quot refund quot as either a direct reduction of the cost of your private health insurance through the year and this is a

Download Pre Tax Health Insurance Rebate

More picture related to Pre Tax Health Insurance Rebate

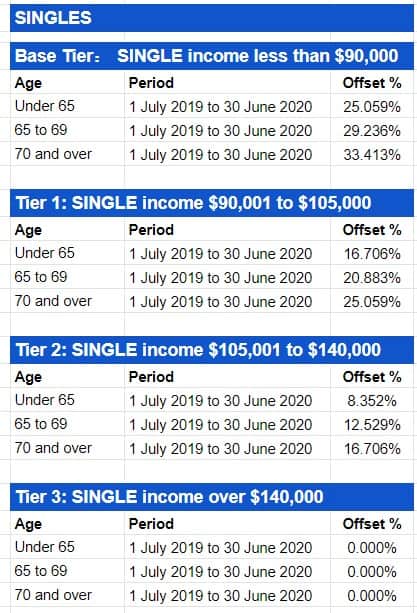

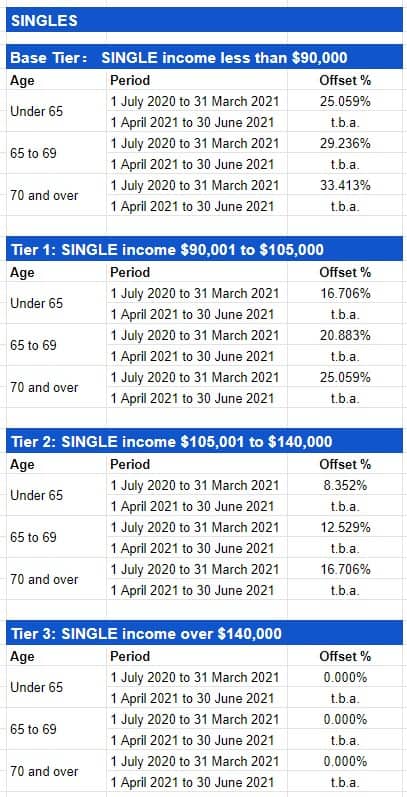

Private Health Insurance Tax Offset Atotaxrates info

http://atotaxrates.info/wp-content/uploads/2020/05/Private-Health-Insurance-Rebate-Percentages-SINGLES-2019-20.jpg

Are Payroll Deductions For Health Insurance Pre Tax Details More

https://www.patriotsoftware.com/wp-content/uploads/2022/12/health-insurance-pre-tax-1.png

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2023/05/currentable-e1685500762509.png

Web To claim the private health insurance rebate depends on your circumstances regardless of your residency status in Australia You must have a Complying health insurance policy with an Australian registered health insurer be eligible for Medicare be a Private health Web Ensure you complete your tax return and enter your private health insurance details correctly to avoid delays in receiving the rebate How do I calculate my rebate entitlement The private health insurance rebate

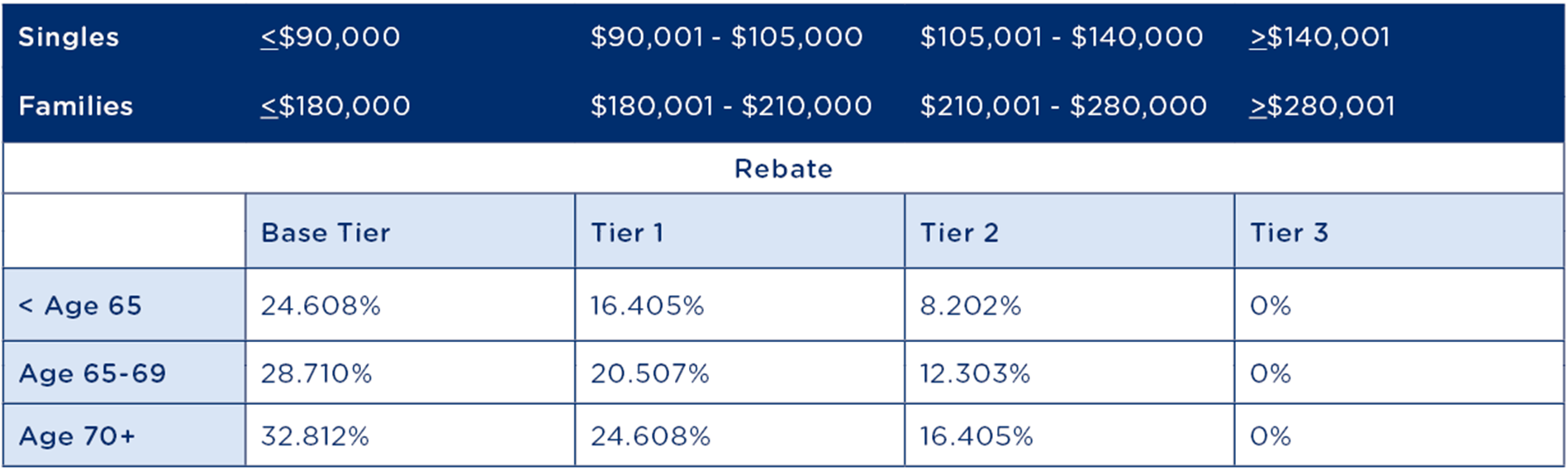

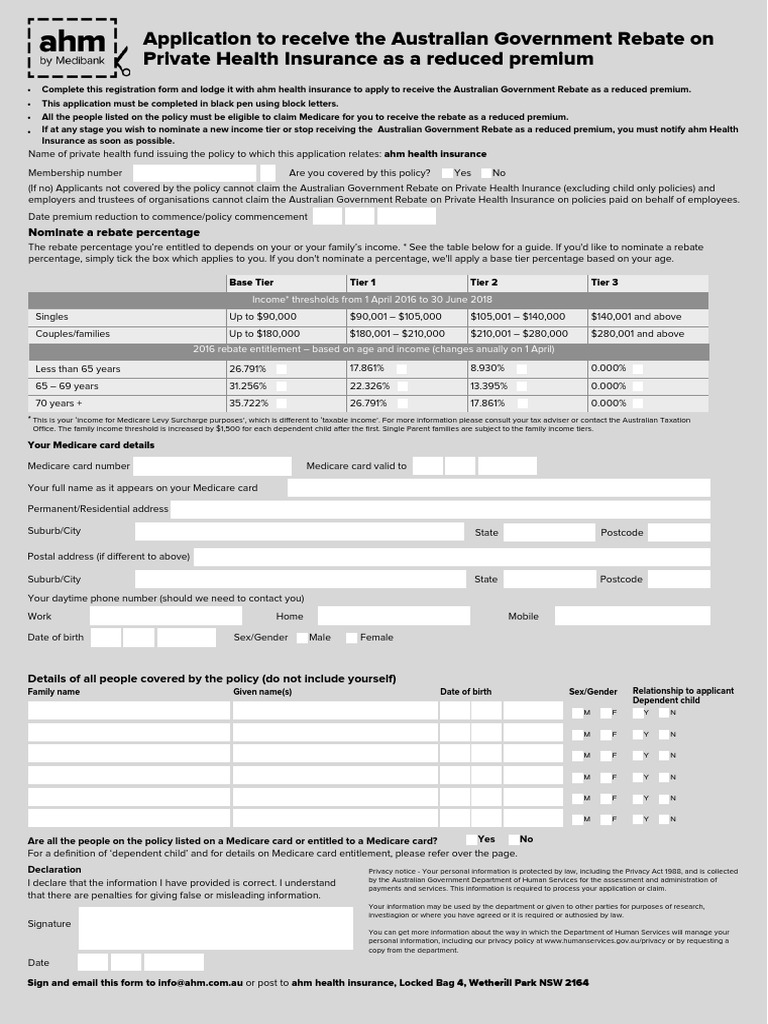

Web Private Health Insurance Rebate effective from 01 April 2022 31 March 2023 Less than 65 years 24 608 16 405 8 202 0 65 69 years 28 710 20 507 12 303 0 70 years 32 812 24 608 16 405 0 Private Health Insurance Rebate Web 1 avr 2021 nbsp 0183 32 If you are eligible for the rebate there are two ways you can claim through a reduced premium or through your tax return at the end of the financial year If you choose to receive your rebate through your insurer you will be asked to nominate the tier you

What Is Australian Government Rebate On Private Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/ISEL0021-Article-35-PrivateHealthInsuranceTax_v2_3.png

Exploring Pre Tax Health Insurance Benefits Risks How To Choose

https://www.lihpao.com/wp-content/uploads/2023/01/is-health-insurance-pre-tax.jpg

https://www.ato.gov.au/.../Private-health-insurance-rebate

Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income thresholds and rebate percentage rates Find out what Lifetime health cover LHC is

https://www.ato.gov.au/.../Claiming-the-private-health-insurance-rebate

Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return we will then calculate his rebate entitlement based on his income for surcharge purposes

Is Health Insurance Deducted Pre Tax Cares Healthy

What Is Australian Government Rebate On Private Health Insurance

Private Health Insurance Rebate Navy Health

How Does Private Health Insurance Affect My Tax Return Compare Club

Pre Tax Health Insurance Premiums Ppt Powerpoint Presentation Show

Australian Government Rebate On Private Health Insurance Form

Australian Government Rebate On Private Health Insurance Form

Tax Time And Private Health Insurance Teachers Health

Private Health Insurance Tax Offset AtoTaxRates info

How Does Private Health Insurance Affect My Tax Return Compare Club

Pre Tax Health Insurance Rebate - Web 27 sept 2012 nbsp 0183 32 If you have a fully insured group health plan through your employer and paid the premium with pre tax dollars as most employees do the rebate will generally be taxable If you happen to have paid your insurance premium with after tax dollars you