Premium Tax Credit Income Limits 2022 The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased

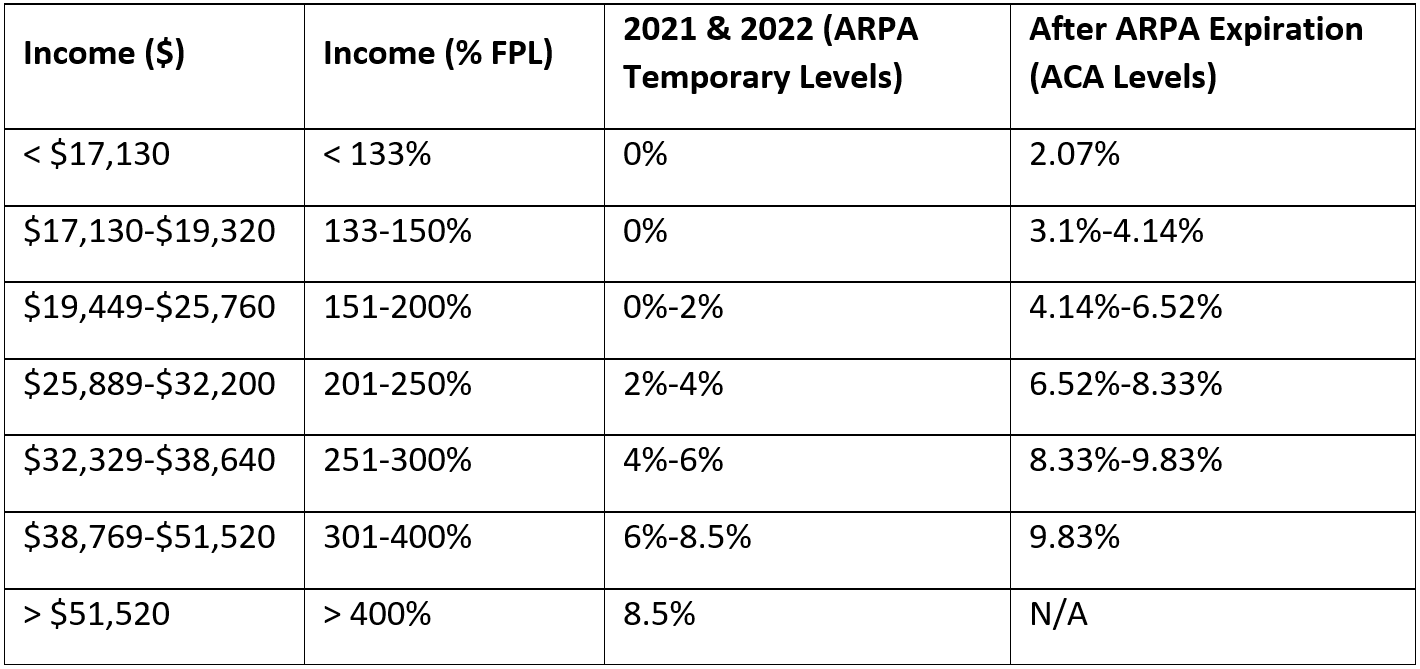

2021 and 2022 PTC Eligibility For tax years 2021 and 2022 the American Rescue Plan Act of 2021 ARPA temporarily expanded eligibility for the premium tax credit by Here are the details on the PTC its eligibility criteria the pros and cons of choosing the advance premium tax credit APTC and the tax forms you ll need to

Premium Tax Credit Income Limits 2022

Premium Tax Credit Income Limits 2022

https://i2.wp.com/www.peoplekeep.com/hs-fs/hub/149308/file-1041895891-jpg/Premium_Tax_Credit_Chart_2014.jpg

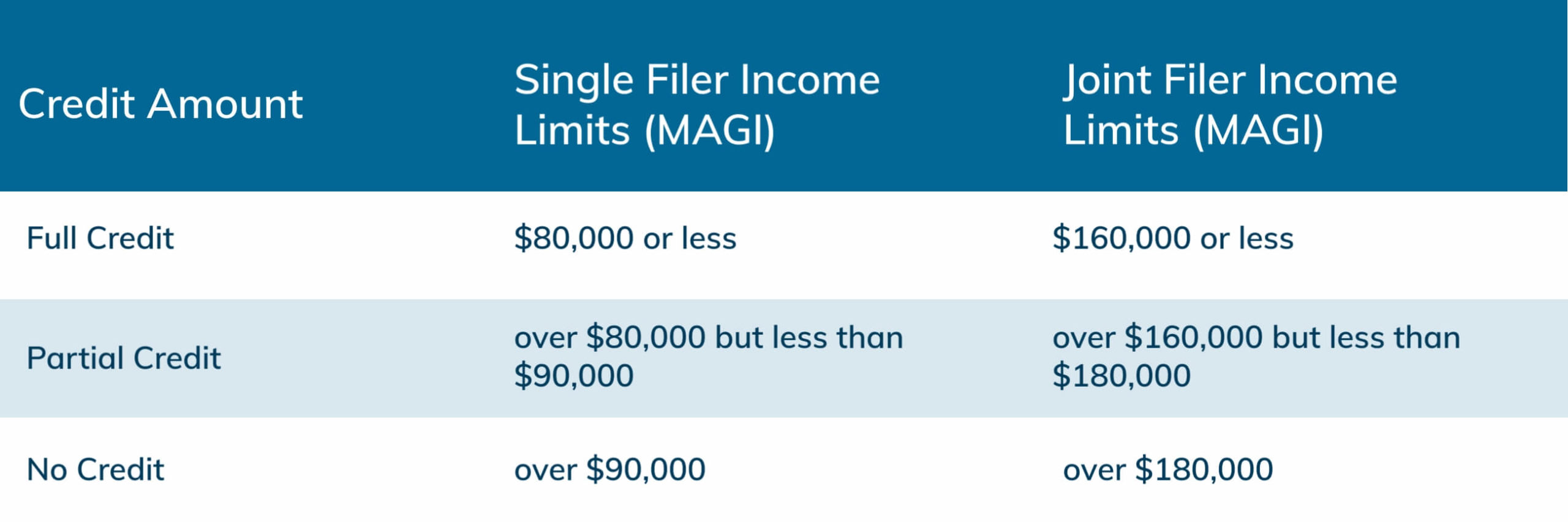

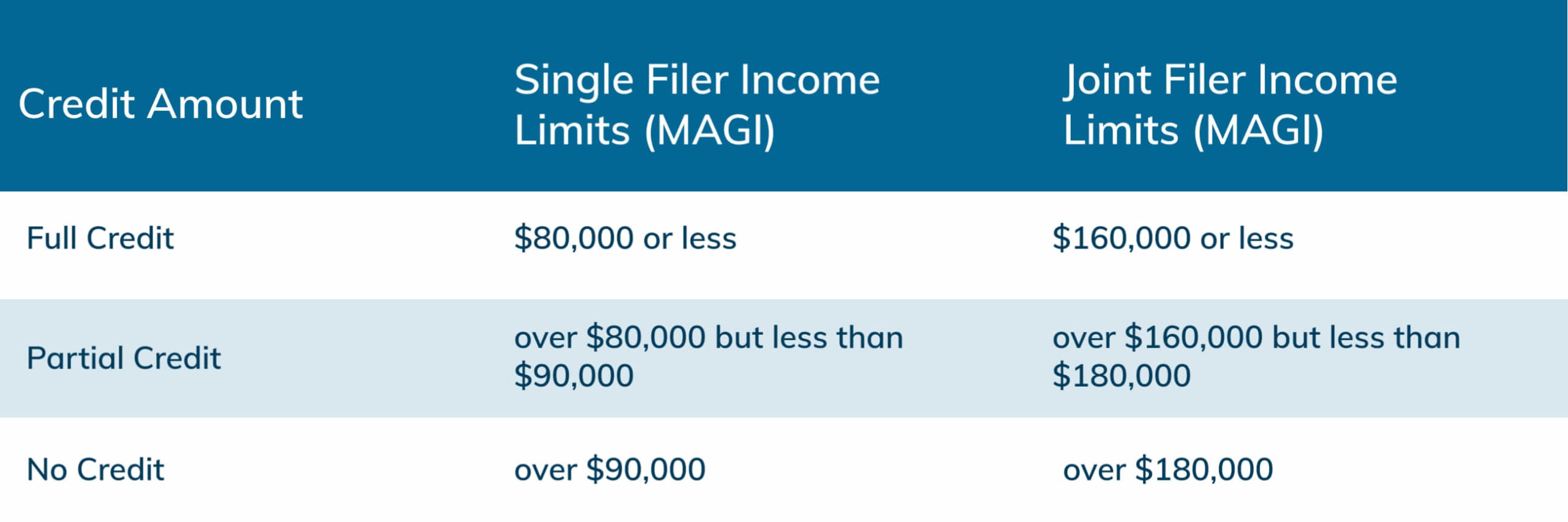

2022 Education Tax Credits Where s My Refund Tax News Information

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-AOTC-Income-Limits-scaled.jpg

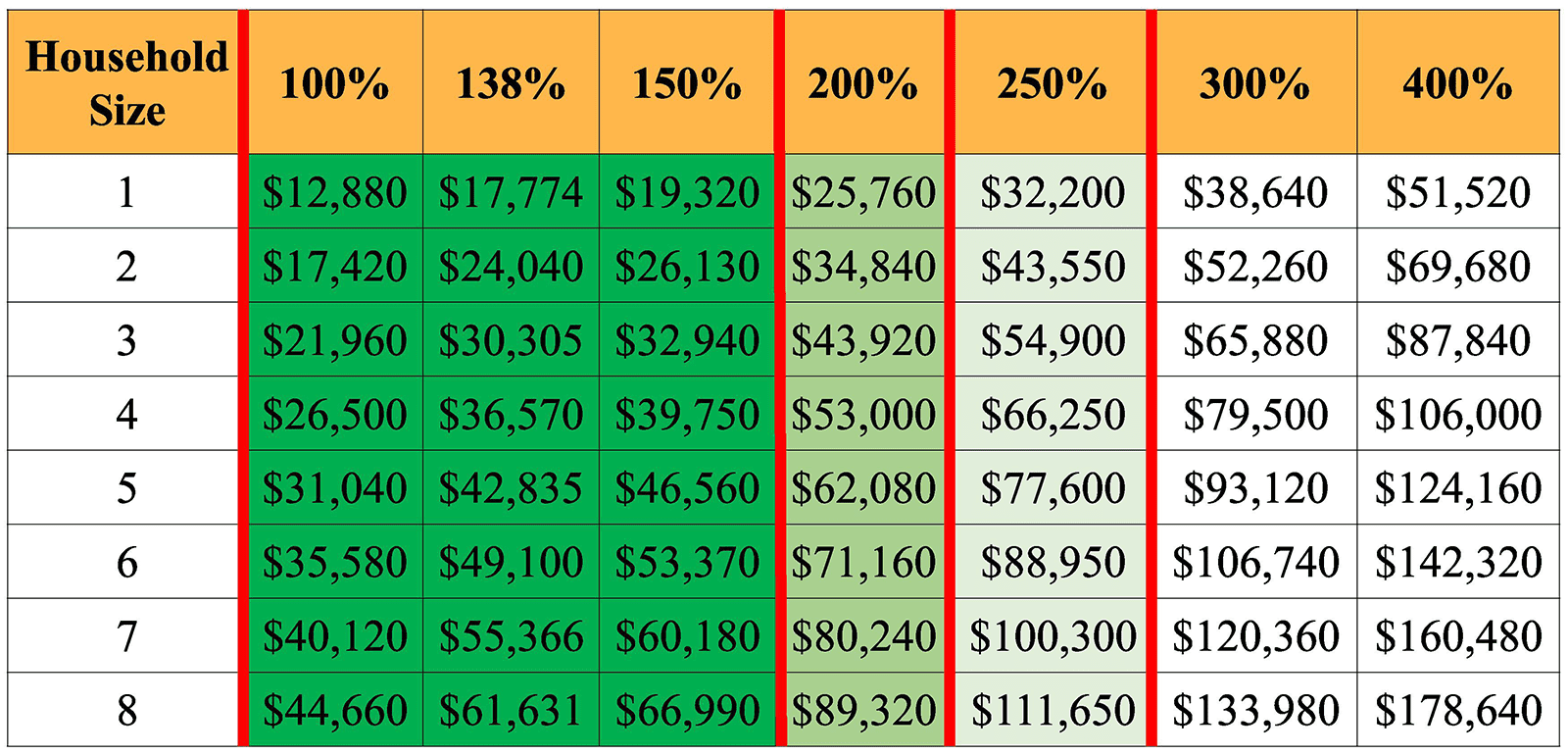

ACA Tax Credits To Help Pay Premiums White Insurance Agency

https://www.whiteinsuranceokc.com/wp-content/uploads/sites/4713/2021/11/2022-FPL-CHART_0001.png

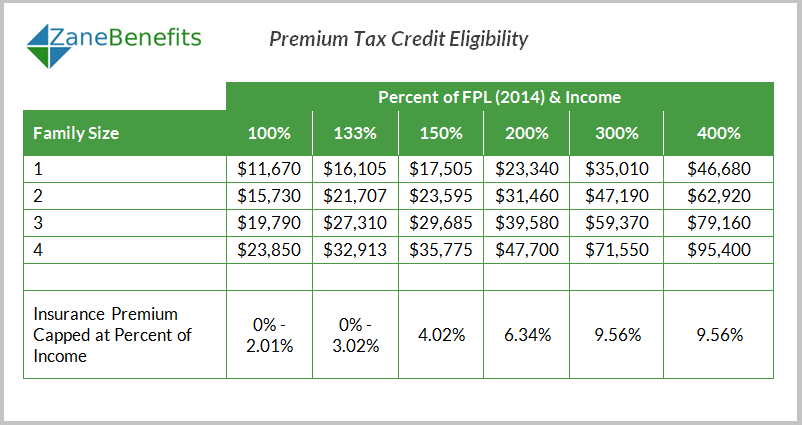

As part of the American Rescue Plan Act ARPA of 2021 the Biden administration s first tax base bill the premium tax credit was opened up to far more taxpayers via a temporary extension for individuals with 2021 and 2022 PTC Eligibility For tax years 2021 and 2022 the American Rescue Plan Act of 2021 ARPA temporarily expanded eligibility for the premium tax credit by eliminating

The premium tax credit is a refundable tax credit in the United States that s designed to help eligible individuals and families with low or moderate income afford Premium tax credit caps on 2022 marketplace coverage range from 0 8 5 of income based on the 2021 federal poverty level These caps were lowered and expanded by the

Download Premium Tax Credit Income Limits 2022

More picture related to Premium Tax Credit Income Limits 2022

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

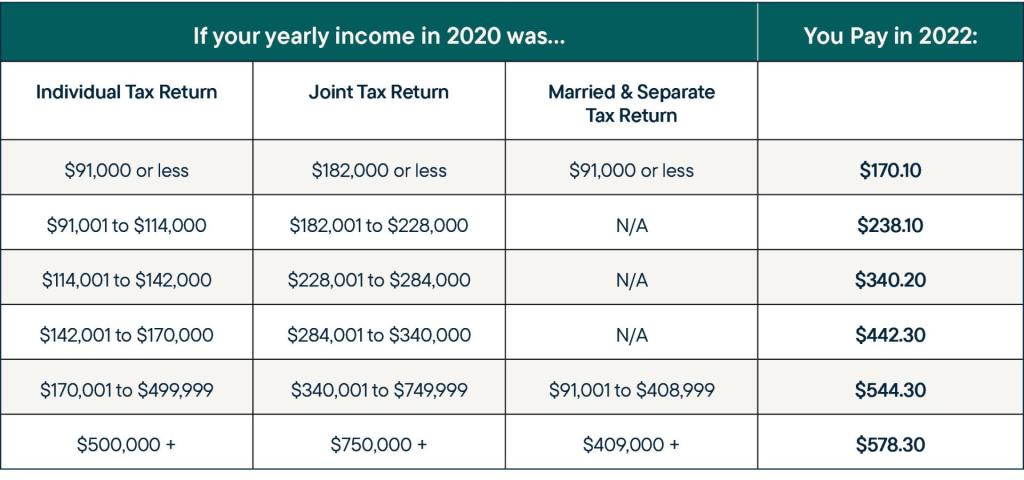

What Is Medicare Part B Your 2023 Costs Coverage Simplified RetireMed

https://www.retiremed.com/sites/default/files/styles/half/public/2022-11/RetireMed_New Brand_IRMAA Chart-Part B 2020 Income Chart.jpg?itok=ESfyJsFM

Premium Tax Credit Charts 2015

http://www.peoplekeep.com/hs-fs/hub/149308/file-1445968346-png/tax_credit_eligibility.png

For household incomes below 200 of the FPL the maximum required repayment is 600 if at least 200 but less than 300 of the FPL 1 500 and if at least 300 but less than 400 of the FPL What Are the Income Tax Brackets for 2022 vs 2023 However there are a number of requirements you must satisfy to be eligible for the credit For instance you normally can t claim the credit

Q7 What are the income limits Updated February 24 2022 A7 In general individuals and families may be eligible for the premium tax credit if their household income for the Premium tax credits are available to people who buy Marketplace coverage and whose income is at least as high as the federal poverty level For an individual that means an

Jps Eligibility Income Chart

https://i2.wp.com/insuremekevin.com/wp-content/uploads/2019/09/2020-Subsidy-Eligibility-Income-Chart-Covered-California-Medi_Cal-09_2019.jpg

Premium Tax Credit WhatTaxpayers Need To Know Tax Relief Center

https://i.pinimg.com/originals/d8/bf/5c/d8bf5c8f2a6724d32c86a120a90b5947.png

https://www.irs.gov/affordable-care-act/...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased

https://www.irs.gov/affordable-care-act/...

2021 and 2022 PTC Eligibility For tax years 2021 and 2022 the American Rescue Plan Act of 2021 ARPA temporarily expanded eligibility for the premium tax credit by

Income Tax Thresholds 2022 23 Latest News Update

Jps Eligibility Income Chart

After The American Rescue Plan s Enhanced Premium Tax Credits End AAF

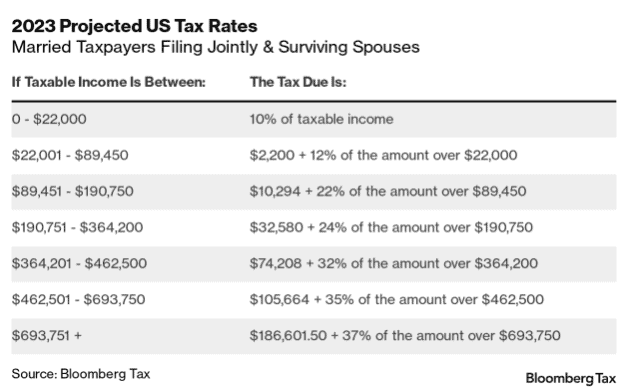

Tax Brackets 2022 Married Jointly Sustainablejulu

Premium Tax Credit Income Limits 2024

Irs Gov Printable Tax Forms TUTORE ORG Master Of Documents

Irs Gov Printable Tax Forms TUTORE ORG Master Of Documents

Premium Tax Credit 2023 2024

2023 Tax Brackets The Best Income To Live A Great Life

The Enhanced Premium Tax Credits Are Substantial

Premium Tax Credit Income Limits 2022 - The premium tax credit is available to individuals and families with incomes at or above the federal poverty level 1 who purchase coverage in the ACA marketplace in their state