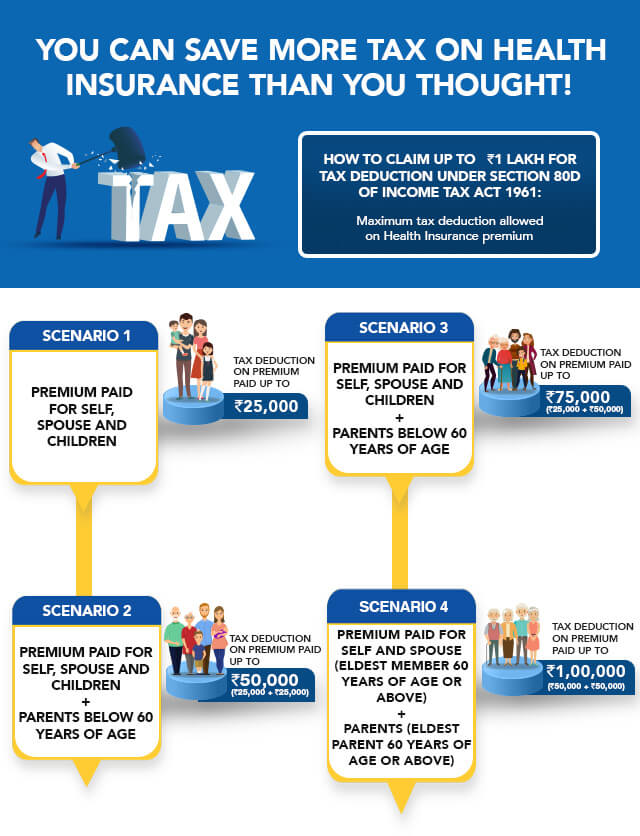

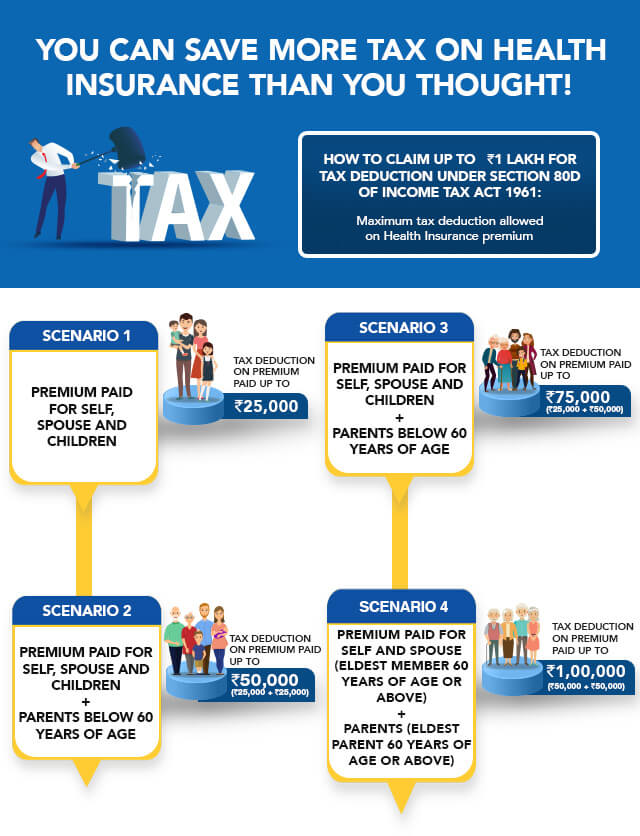

Preventive Health Check Up Income Tax Exemption Under Section 80D of the Income Tax India Act individuals who undergo preventive health check ups can enjoy tax deductions of up to INR 5000 per financial year You can also

Under Section 80D individuals can claim a deduction of up to 5 000 for payments made towards preventive health check ups This deduction can be availed by the taxpayer for The deduction limit under Section 80D for individuals below the age of 60 years is INR 25 000 The 25 000 limit includes a Rs 5 000 preventive health examination If the

Preventive Health Check Up Income Tax Exemption

Preventive Health Check Up Income Tax Exemption

https://img.etimg.com/thumb/msid-96729952,width-1070,height-580,imgsize-790413,overlay-etwealth/photo.jpg

5 Reasons Why You Should Be Scheduling Your Preventive Care Now

https://www.motivationalliance.org/wp-content/uploads/2023/01/low_Preventive-Care_TGC-Infographic_11x17-scaled.jpg

Preventive Health Check Up Benefits Tax Deductions

https://images.ctfassets.net/uwf0n1j71a7j/76knwryILCxFdd8oQGiTDt/79062fd764146f15917f323f9e066289/preventive-health-check-up.png?w=3840&q=75

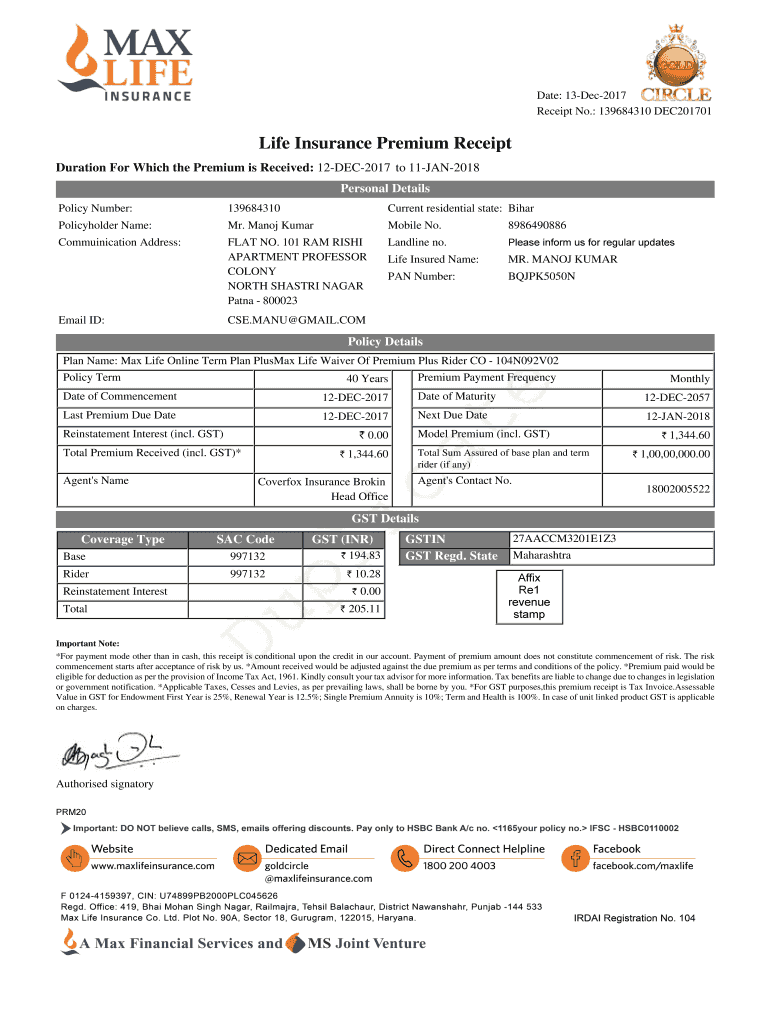

Tax benefits A part of the expenses incurred for preventive healthcare checkup limit is eligible for tax deduction under Section 80D of the Income Tax Act Therefore health Section 80D of income tax act provides a tax deduction benefit for expenses related to preventive medical checkups health insurance premiums and other medical

The aggregate payment on account of preventive health check up of self spouse dependent children father and mother cannot exceed Rs 5 000 4 The above Under Section 80D of the Income Tax Act a tax deduction of Rs 5 000 per financial year is allowed towards preventive health check ups within the overall limit of Rs 25 000 for

Download Preventive Health Check Up Income Tax Exemption

More picture related to Preventive Health Check Up Income Tax Exemption

Big Update For Income Tax Exemption Increased From 5 Lakh To 7 Lakh

https://i0.wp.com/taxconcept.net/wp-content/uploads/2023/02/20230201_122248.jpg?fit=2966%2C1189&ssl=1

Medical Insurance Premium Receipt PDF Complete With Ease AirSlate

https://www.signnow.com/preview/470/590/470590793/large.png

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

If you have bought a health insurance plan for yourself 34 paying a premium below INR 25 000 the taxpayer can claim a preventive health check up claim up to INR 5 000 under Section 80D You can claim a maximum tax deduction worth Rs 5 000 on expenses related to preventative health check ups This comes under the overall limit of Rs 25 000 under

You can avail of preventive health checkup tax benefits up to Rs 5000 for medical expenses incurred for regular health check ups You are eligible for preventive health Section 80D of the IT Act allows a deduction of up to 5 000 in respect of payment made towards preventive health check up of self spouse dependent children or parents made

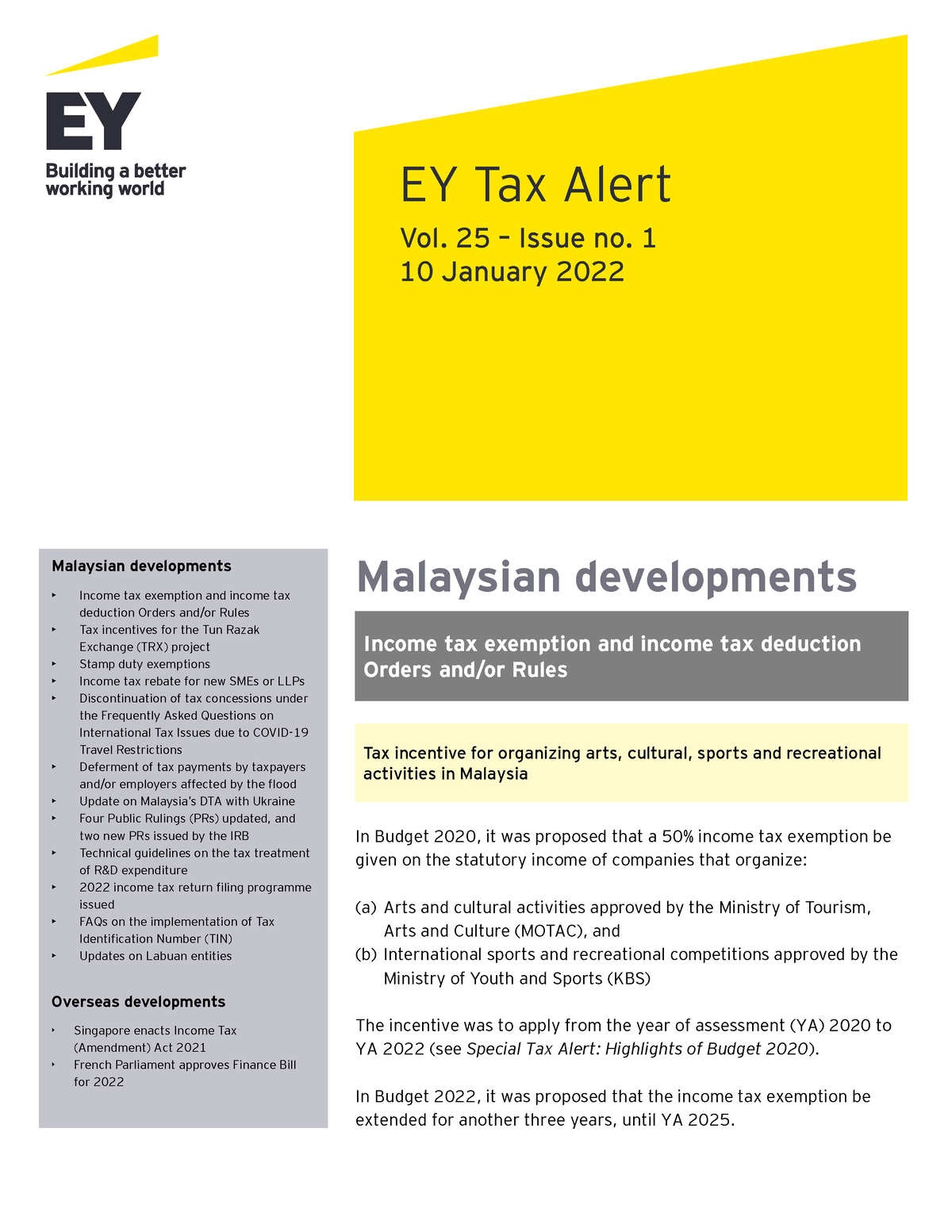

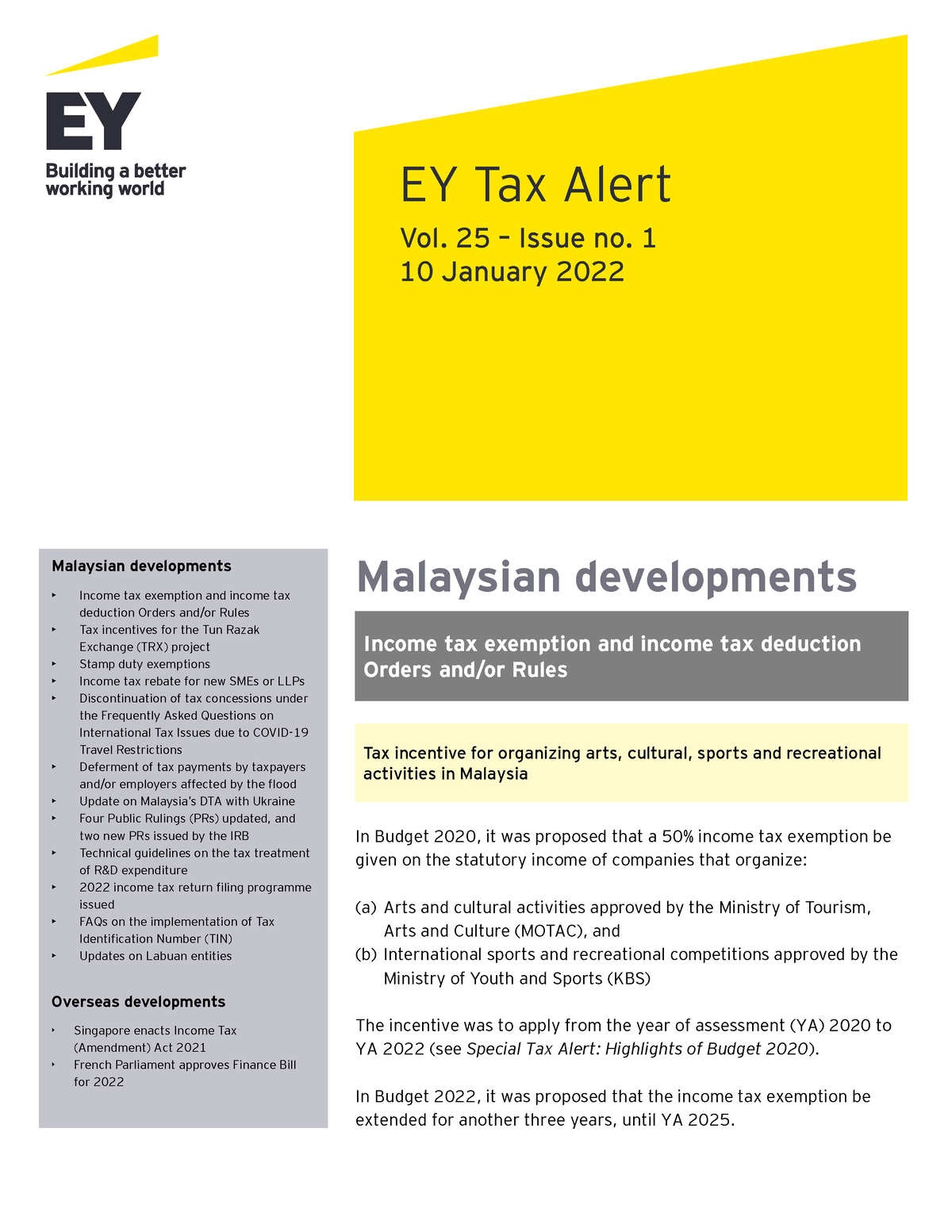

Ey Tax Alert Vol 25 No 1 10 January 2022 Malaysian Developments

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d7692cada732a57068f5ad0a600ad9be/thumb_1200_1553.png

Income Tax Exemption On Gifts Are The Gifts Above Rs 50 000 Taxable

https://i.ytimg.com/vi/poiiLhFa5Fw/maxresdefault.jpg

https://www.hdfcergo.com/blogs/health-insurance/...

Under Section 80D of the Income Tax India Act individuals who undergo preventive health check ups can enjoy tax deductions of up to INR 5000 per financial year You can also

https://www.iciciprulife.com/insurance-library/...

Under Section 80D individuals can claim a deduction of up to 5 000 for payments made towards preventive health check ups This deduction can be availed by the taxpayer for

Income Tax

Ey Tax Alert Vol 25 No 1 10 January 2022 Malaysian Developments

Income Tax

Request For Income Tax Exemption PDF Nonprofit Organization Tithe

Annual Check Up PULSE CLINIC Asia s Leading Sexual Healthcare Network

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

Preventive Health Checkup 80d Proof Deduction And Income Tax Benefits

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

Get More Tax Exemptions For Income Tax In Malaysia IMoney

Preventive Health Check Up Income Tax Exemption - Tax benefits A part of the expenses incurred for preventive healthcare checkup limit is eligible for tax deduction under Section 80D of the Income Tax Act Therefore health